No Dependents Templates

Are you looking for legal documents and forms related to situations where there are no dependents involved? Our collection of documents, known as "No Dependents" or "No Dependent" documents, offers a variety of forms and instructions specifically designed for such cases.

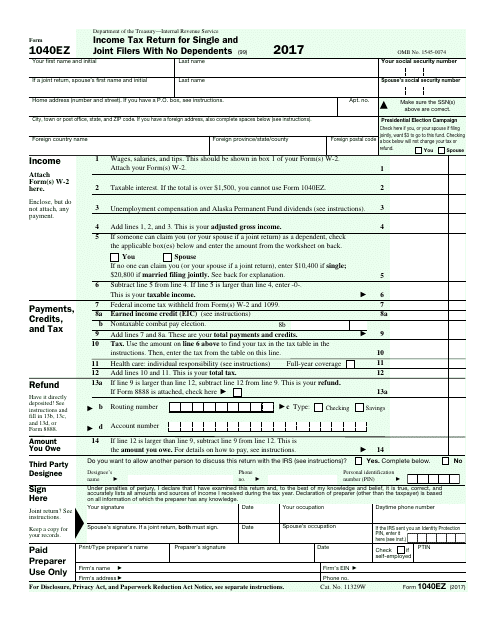

Whether you are going through a divorce without any dependent or minor children, seeking support unconnected with the dissolution of marriage, or filing your income tax return as a nonresident alien with no dependents, our comprehensive collection of documents covers all your needs.

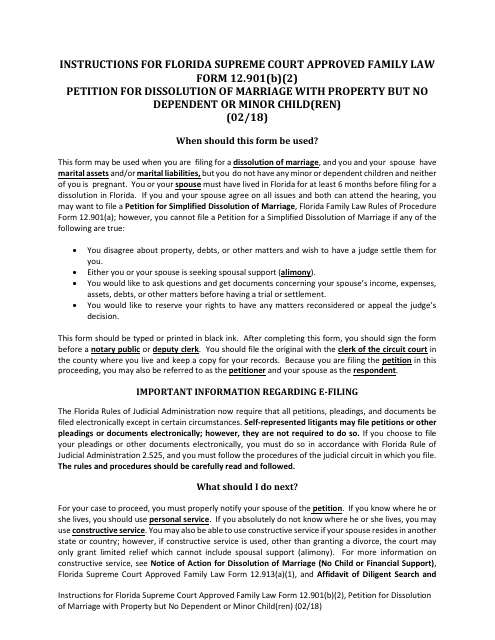

For example, our "Form 12.901(B)(2) Petition for Dissolution of Marriage With Property but No Dependent or Minor Child(Ren)" is specifically crafted for individuals seeking a divorce while having no dependent child or minor children. This form provides a clear structure for filing your petition and initiating the dissolution process.

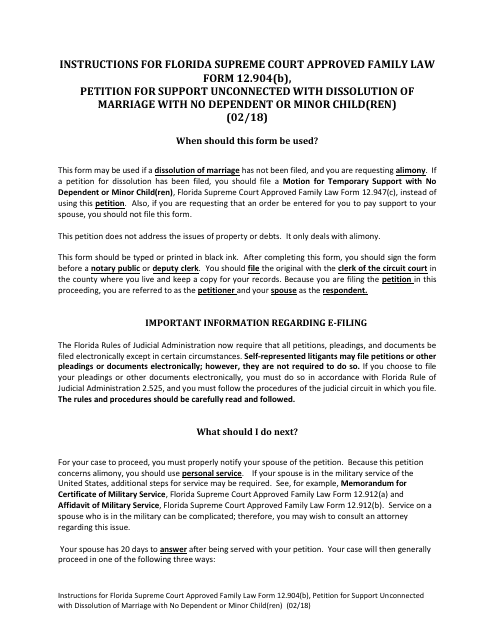

Similarly, our "Form 12.904(B) Petition for Support Unconnected With Dissolution of Marriage With No Dependent or Minor Child(Ren)" is designed for individuals who require support unrelated to divorce and child custody matters. This form enables you to request financial assistance without involving any dependent or minor child.

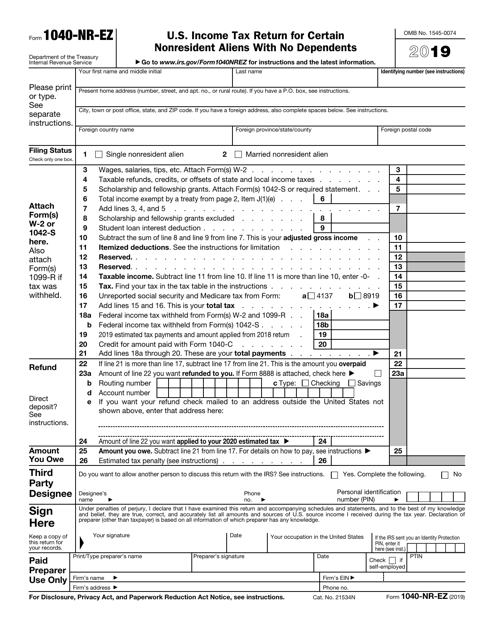

If you are a nonresident alien and looking to file your income tax return, our "IRS Form 1040-NR-EZ U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents" is an essential document to fulfill your tax obligations. This form simplifies the tax reporting process for nonresident aliens without any dependents.

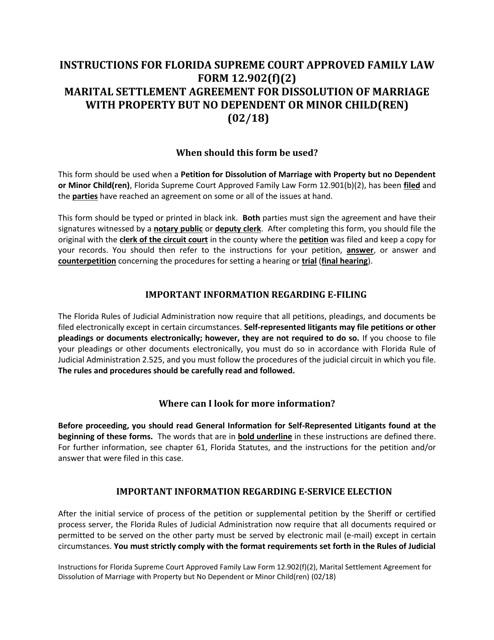

Additionally, we offer the "Form 12.902(F)(2) Marital Settlement Agreement for Dissolution of Marriage With Property but No Dependent or Minor Child(Ren)" which serves as a legal contract detailing the division of assets and obligations when going through a divorce without any dependent or minor children.

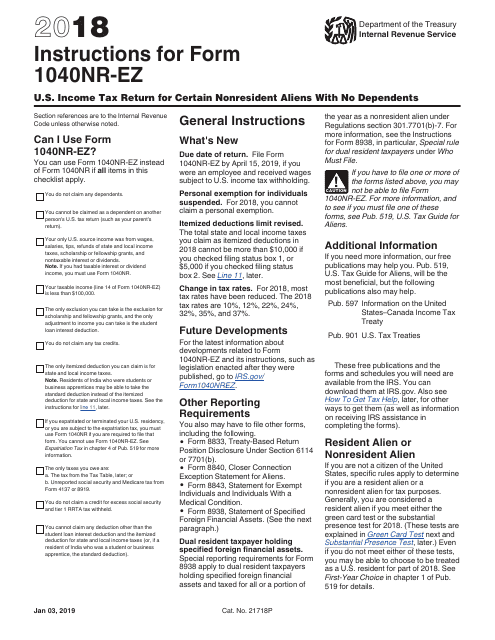

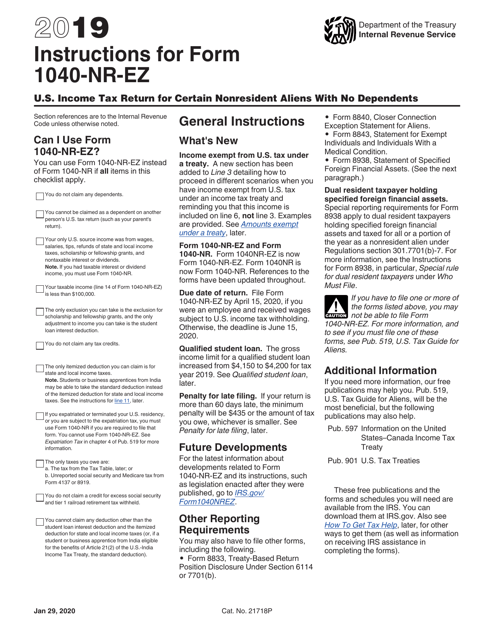

Our collection also includes detailed instructions for completing the "IRS Form 1040-NR-EZ U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents". These instructions provide step-by-step guidance on accurately reporting your income, deductions, and credits as a nonresident alien without dependents.

No matter your legal situation, our "No Dependents" document collection has you covered. With our comprehensive forms and instructions, you can navigate through various scenarios involving no dependents with ease and confidence. Save time and stress by accessing the necessary documents conveniently in one place.

Please note that the availability of these documents may vary by jurisdiction. Be sure to check the specific requirements and regulations in your state or country to ensure compliance and accuracy.

Documents:

10

This Form is used for filing a divorce petition in Florida when there is property involved but no dependent or minor child.

This form is used for filing a petition for support that is not related to the end of a marriage in Florida when there are no dependent or minor children involved.

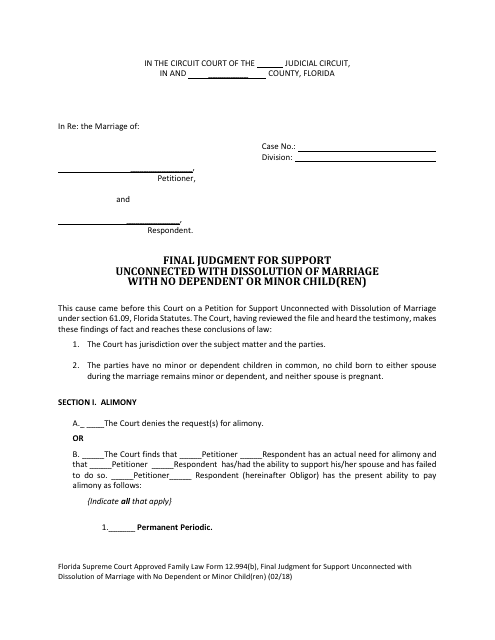

This form is used for obtaining a final judgment for support that is not connected to a divorce and does not involve any dependent or minor child in the state of Florida.

Use this form if you are a non-resident alien (non-United States citizen who has not passed the green card or the substantial presence test) and claim no dependents. This form was issued by the Internal Revenue Service (IRS).

This document is for nonresident aliens with no dependents who need to file their U.S. income tax return. It provides instructions on how to complete IRS Form 1040NR-EZ.

This document is a Marital Settlement Agreement form specifically for divorce cases in Florida where there is property involved but no dependent or minor children. It helps outline the division of assets and property between the couple.

This Form is used for filing U.S. income tax return by nonresident aliens with no dependents. It provides instructions on how to report income, deductions, and credits for the tax year.

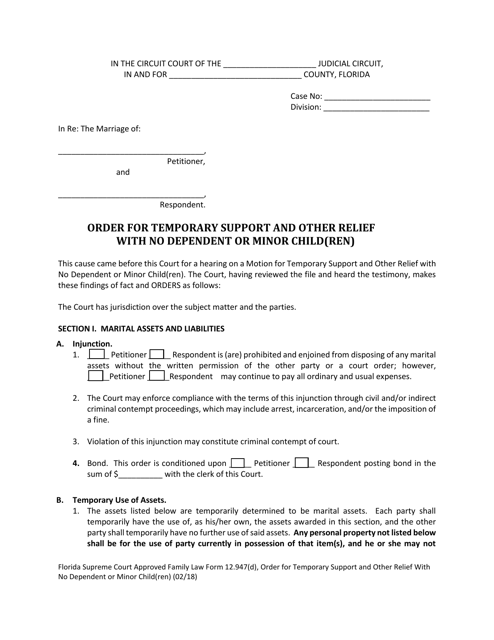

This document is used in Florida for obtaining a court order for temporary support and other relief when there are no dependent or minor children involved.