Energy Tax Credit Templates

Are you looking to save money on your energy costs? Take advantage of the energy tax credit program for eligible businesses and individuals. With this program, you can receive tax credits for using clean and alternative energy sources.

The energy tax credit, also known as energy tax credits or energy-related tax incentives, provides financial incentives to encourage the use of renewable energy and the reduction of carbon emissions. By implementing energy-efficient solutions and making environmentally conscious choices, you not only contribute to a greener future but also benefit from potential tax savings.

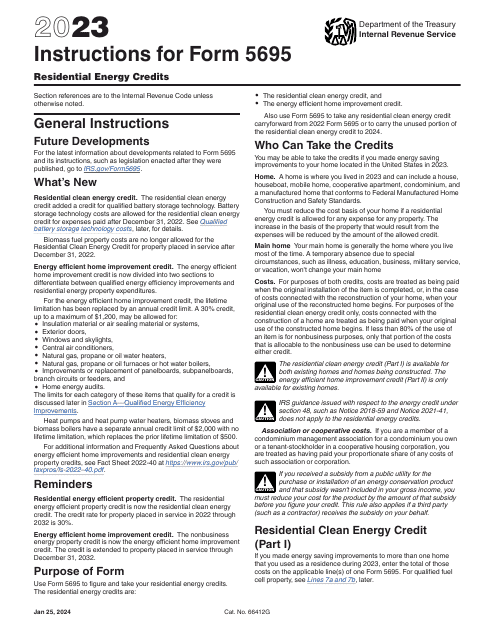

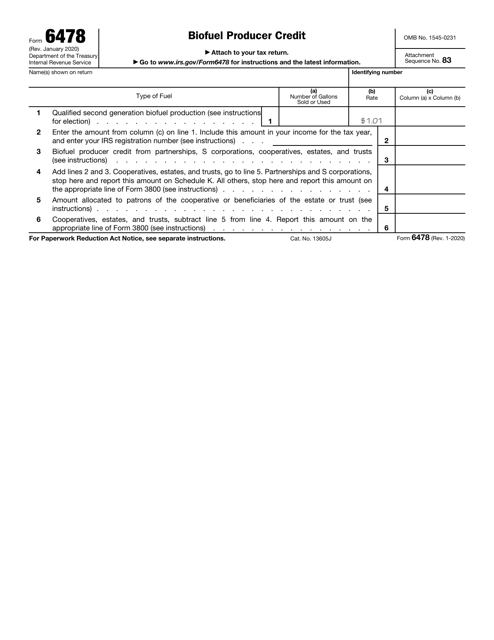

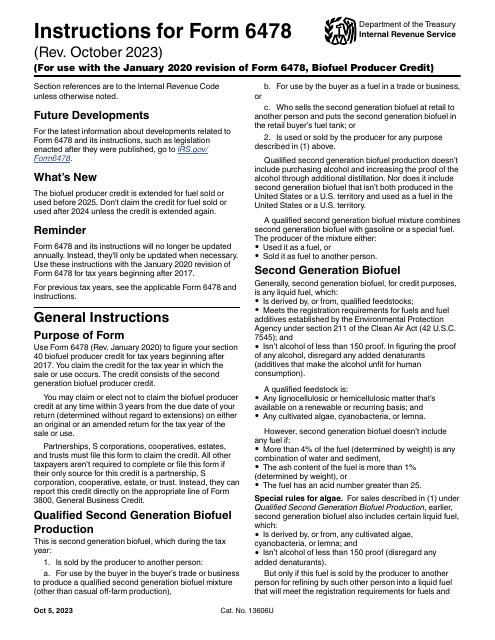

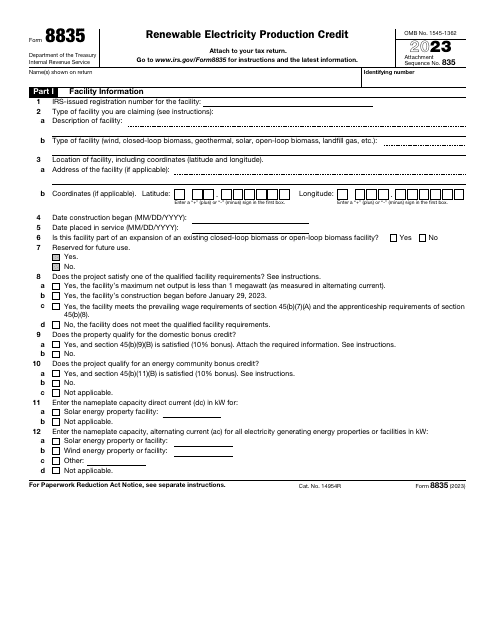

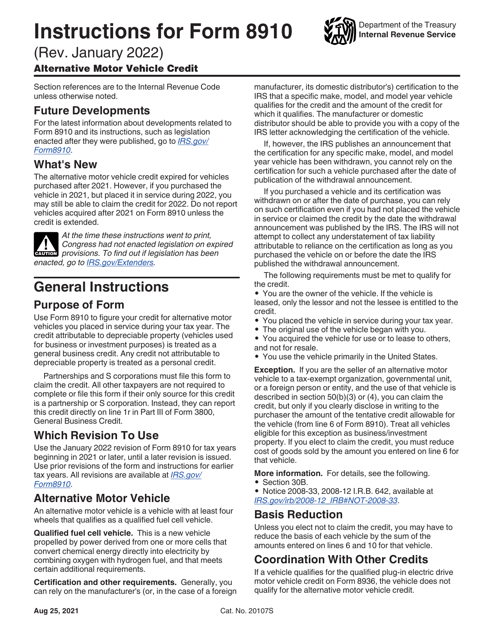

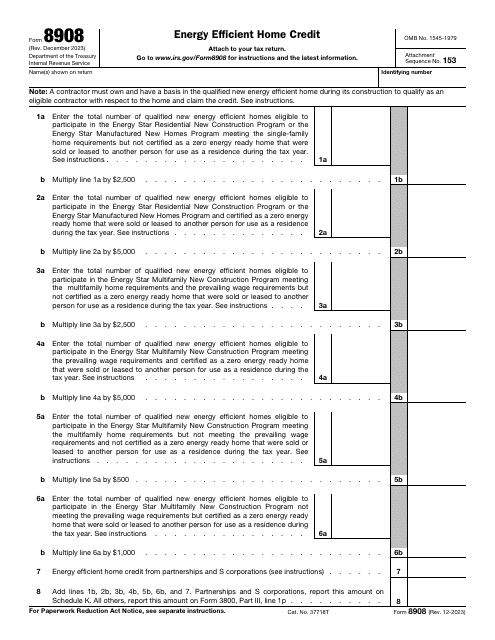

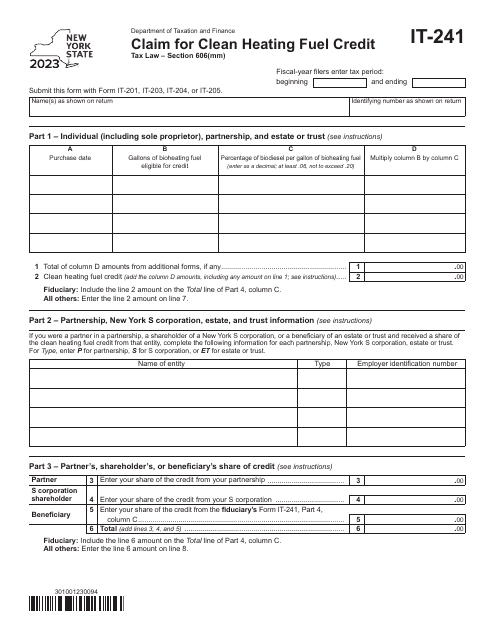

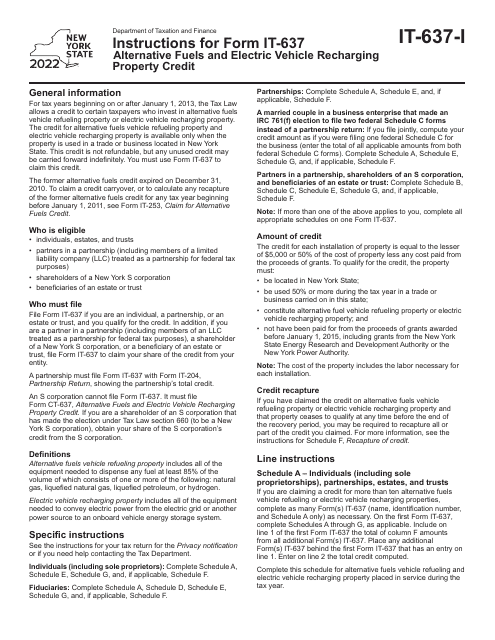

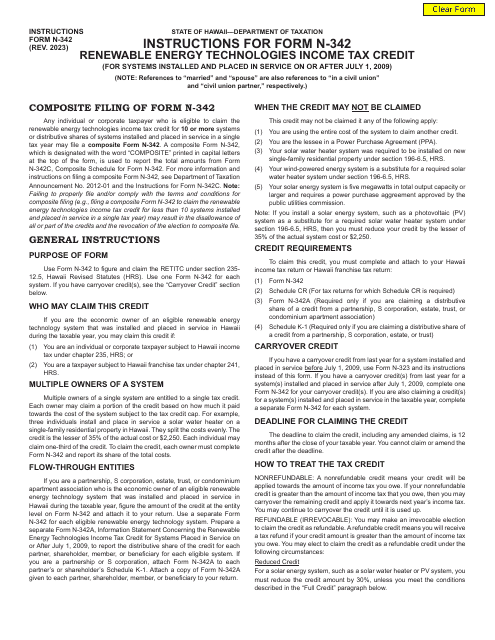

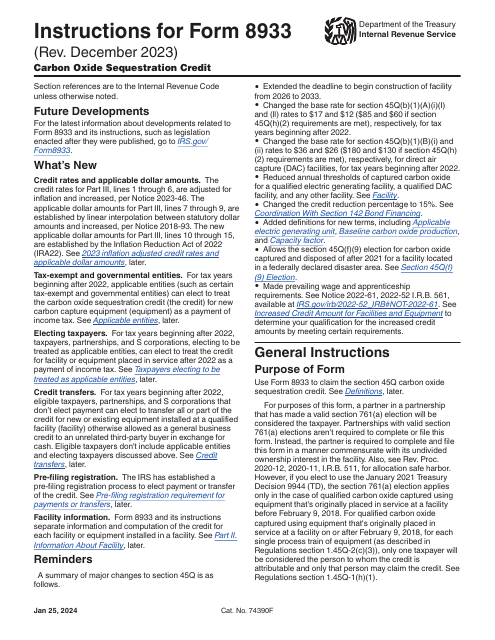

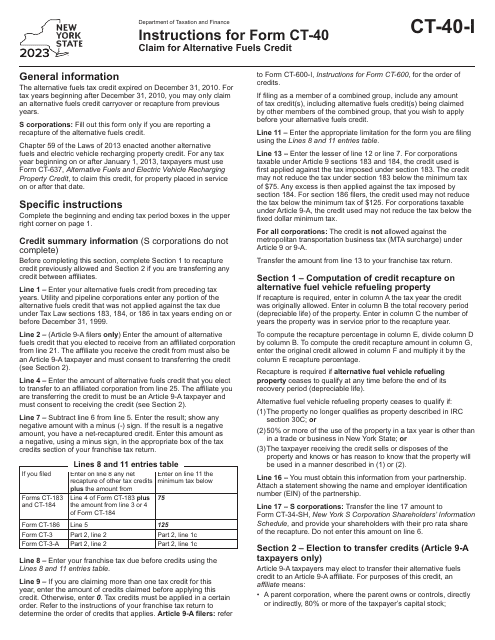

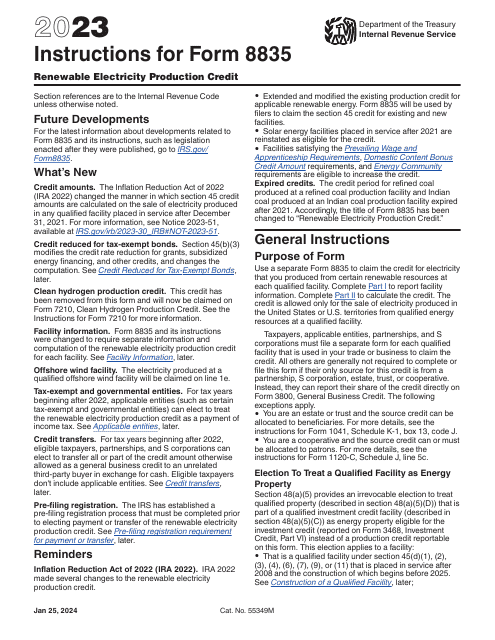

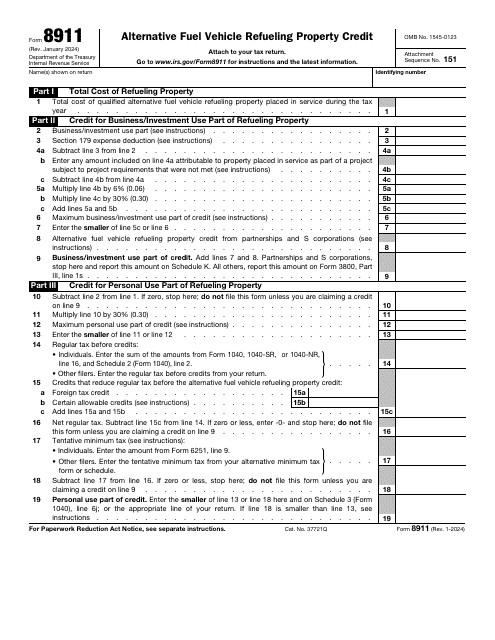

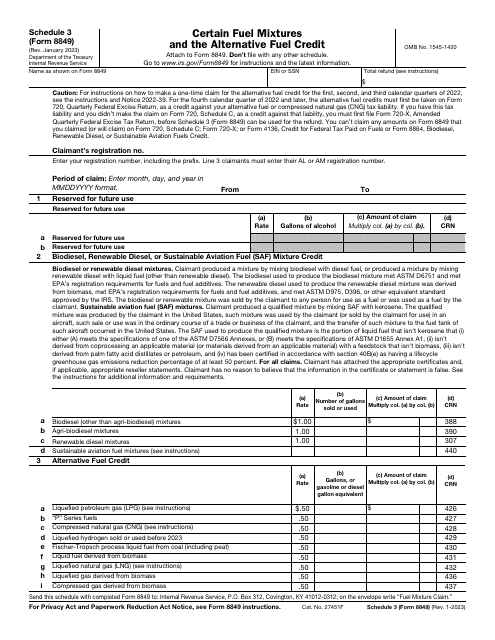

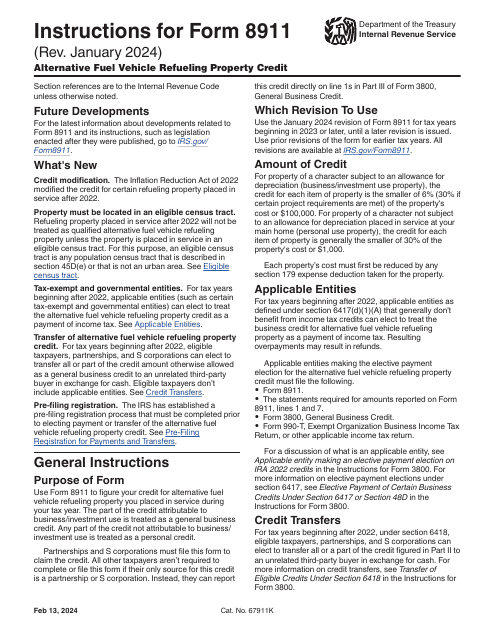

Several documents are associated with the energy tax credit program. These include forms and instructions for claiming specific credits, such as the IRS Form 6478 Biofuel Producer Credit, Form IT-241 for claiming the Clean Heating Fuel Credit in New York, and Instructions for Form CT-40 to claim the Alternative Fuels Credit in New York. Additionally, the IRS Form 8911 allows you to claim the Alternative Fuel Vehicle Refueling Property Credit.

Whether you are a biofuel producer, interested in clean heating fuel credits, or want to take advantage of alternative fuels for your vehicles, these energy tax credit documents provide you with the necessary information and guidance to maximize your tax savings.

Don't miss out on the opportunity to reduce your tax liability through energy tax credits. Explore these valuable documents, learn about the eligibility criteria, and take advantage of the financial benefits while contributing to a sustainable future. Start your journey towards energy efficiency and enjoy the rewards that come with it.

Documents:

23

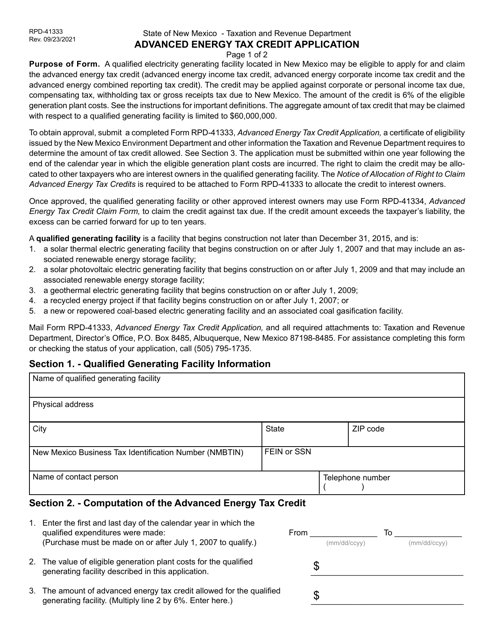

This form is used for applying for the Advanced Energy Tax Credit in the state of New Mexico.