Disposition of Property Templates

Are you looking for information on how to handle the disposition of property? Whether you're in the USA, Canada, or other countries, it's important to understand the rules and regulations surrounding the disposition of properties. In some cases, you may need to file specific forms or elections to report the disposition of property for tax purposes.

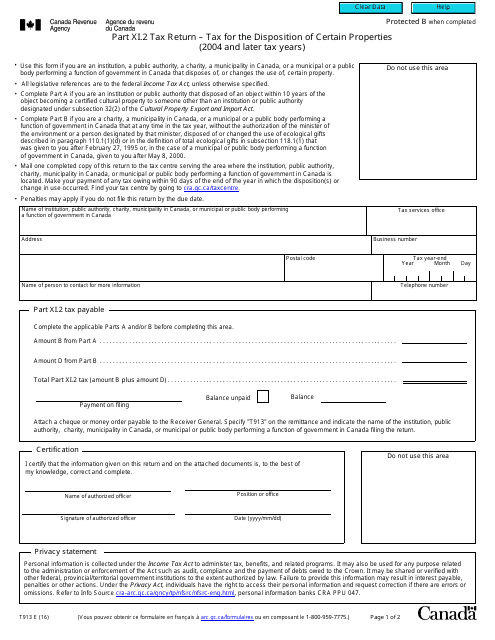

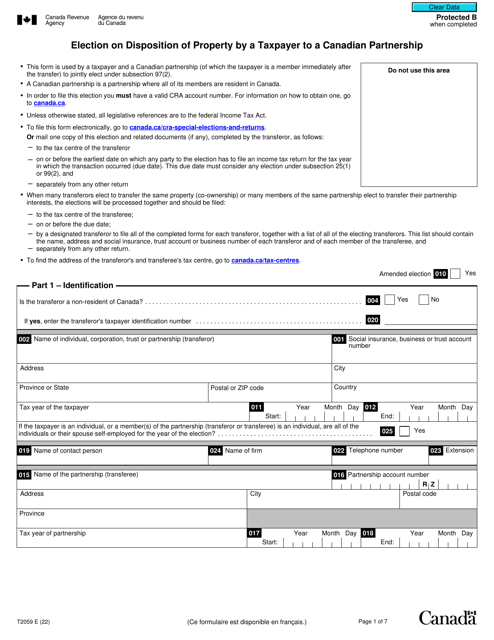

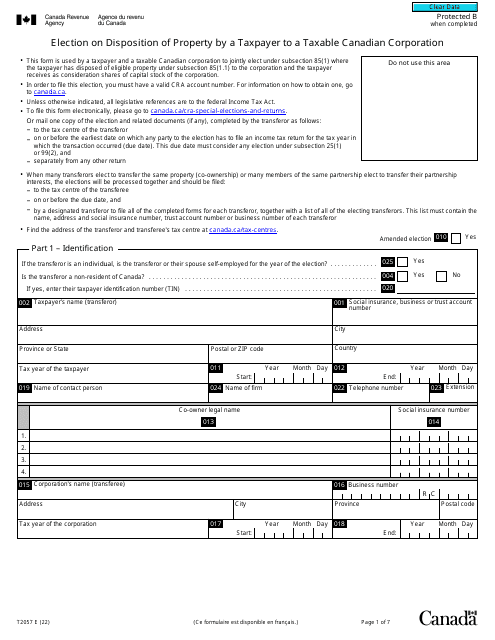

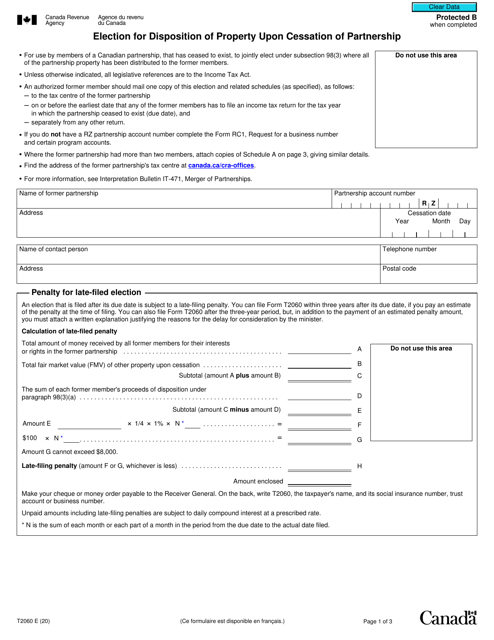

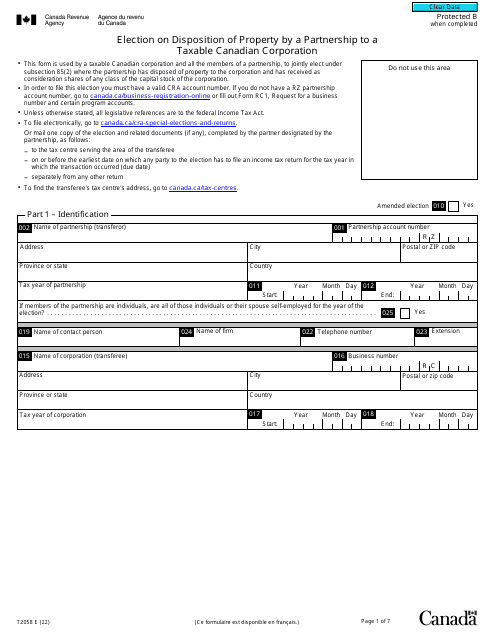

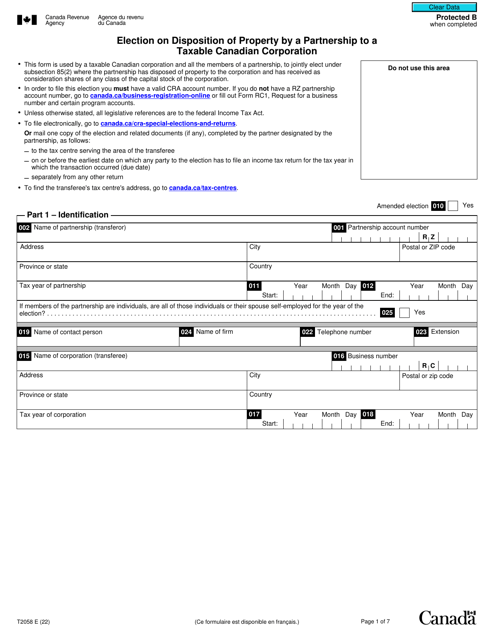

One example of a document related to the disposition of property is the "Form T913 Part XI.2 Tax Return - Tax for the Disposition of Certain Properties (2004 and Later Tax Years)" offered in Canada. This form is used to report the tax owed on the disposition of certain properties. In addition, Canada also has other forms such as the "Form T2059 Election on Disposition of Property by a Taxpayer to a Canadian Partnership" and the "Form T2057 Election on Disposition of Property by a Taxpayer to a Taxable Canadian Corporation" used for specific types of property dispositions.

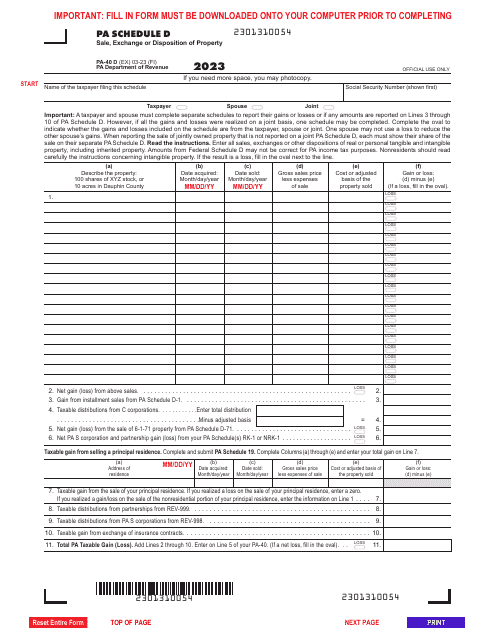

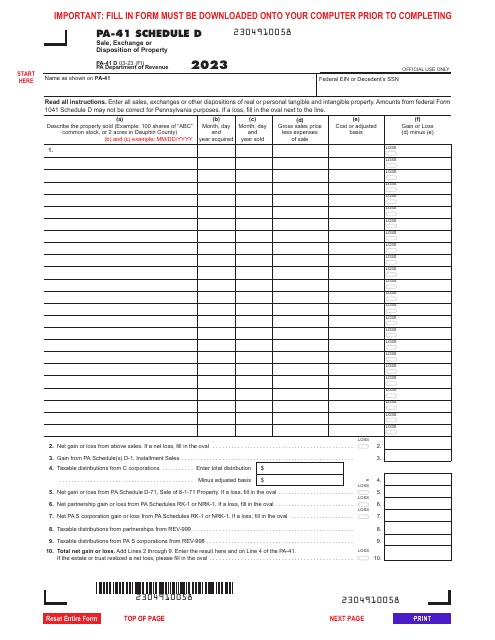

If you're in Pennsylvania, the "Form PA-40 Schedule D Sale, Exchange or Disposition of Property" is used to report the sale or disposition of property for state tax purposes.

Properly managing and reporting the disposition of property is crucial to ensure compliance with tax laws and regulations. Whether you're an individual, partnership, or corporation, it's essential to understand the requirements and obligations related to the disposition of properties. If you're unsure about how to navigate this process, it may be beneficial to seek professional advice or consult the appropriate resources to ensure proper compliance.

Documents:

15

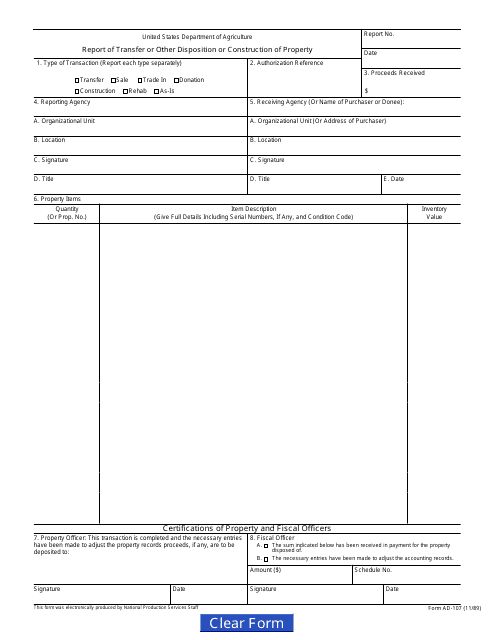

This form is used for reporting the transfer, disposal, or construction of property.

This Form is used for reporting tax on the sale of certain properties in Canada for the tax years 2004 and later.

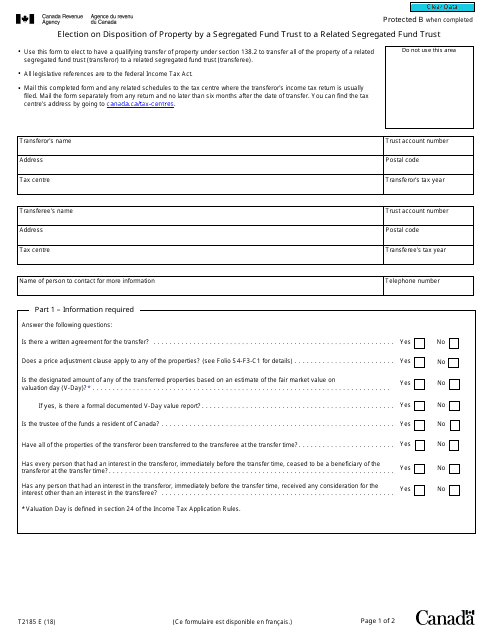

This Form is used for electing the disposition of property by a segregated fund trust to a related segregated fund trust in Canada.

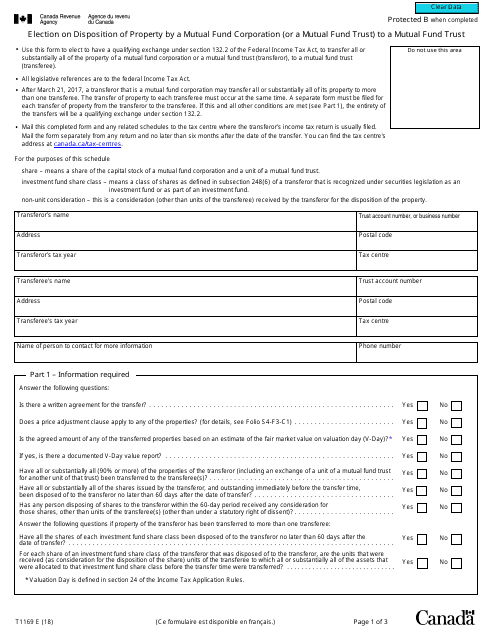

This Form is used for electing the disposition of property by a mutual fund corporation or a mutual fund trust to a mutual fund trust in Canada.

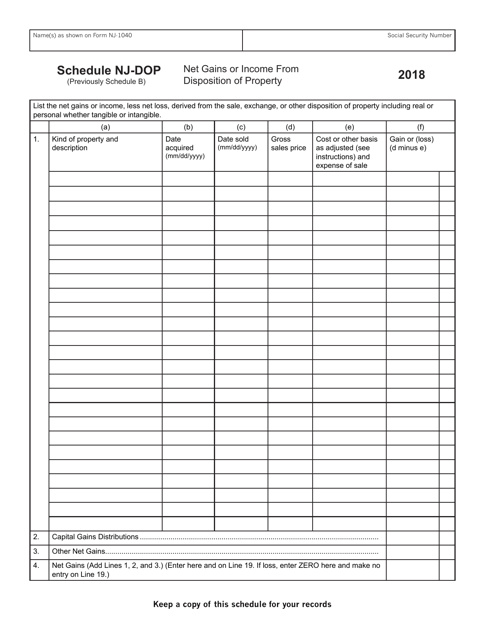

This form is used for reporting any net gains or income obtained from the sale or disposal of property in the state of New Jersey.

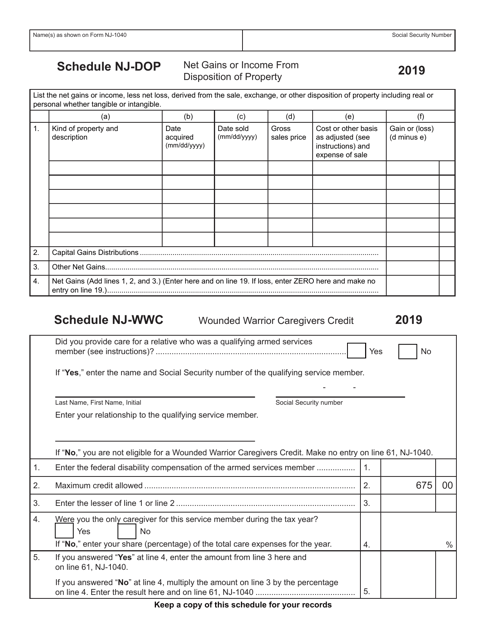

This form is used to report net gains or income from the disposition of property and claim the Wounded Warrior Caregivers Credit in New Jersey.

This form is used for electing the disposition of property by a partnership to a taxable Canadian corporation in Canada.