Use Tax Templates

If you are a business owner or individual who sells goods or services, then you may be familiar with the concept of use tax. Use tax, also known as use taxes or use tax forms, is a tax that is imposed on the use, consumption, or possession of taxable items that were not taxed at the time of purchase. This tax is typically levied by state or local governments.

Filing and reporting use tax can sometimes be a complex process, especially when it comes to understanding which forms to use and how to accurately report your transactions. To help simplify this process, we have put together a comprehensive collection of use tax forms and instructions from various states across the country.

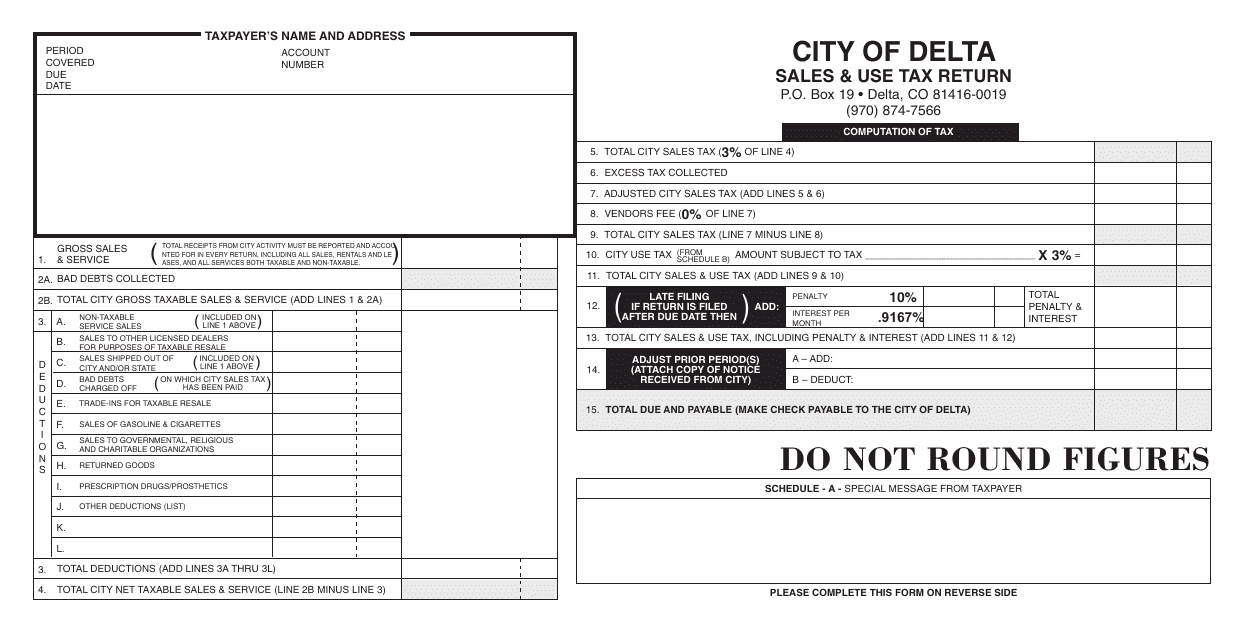

For instance, if you are a business owner in the City of Delta, Colorado, you may need to use the Sales & Use Tax Return Form provided by the local government. Similarly, if you are located in LaSalle Parish, Louisiana, you will need to submit the Sales and Use Tax Report. In Massachusetts, there is a specific form called Form MVU-23 Affidavit in Support of a Claim for Exemption From Sales or Use Tax for a Motor Vehicle, Trailer or Other Vehicle Transferred to an Insurer.

These are just a few examples of the many use tax forms available in our collection. Whether you are a distributor in Indiana and need to fill out Form GT-103DR (State Form 55500) Recap of Gasoline Use Tax by Distributors or a business owner in North Carolina filing the Form E-500 Sales and Use Tax Return, we have the resources you need to ensure compliance with state and local use tax regulations.

Don't let the complexities of use tax overwhelm you. Take advantage of our comprehensive collection of use tax forms and instructions to streamline your reporting process and avoid potential penalties. With our easy-to-use resources, you can efficiently fulfill your tax obligations and focus on growing your business.

Documents:

480

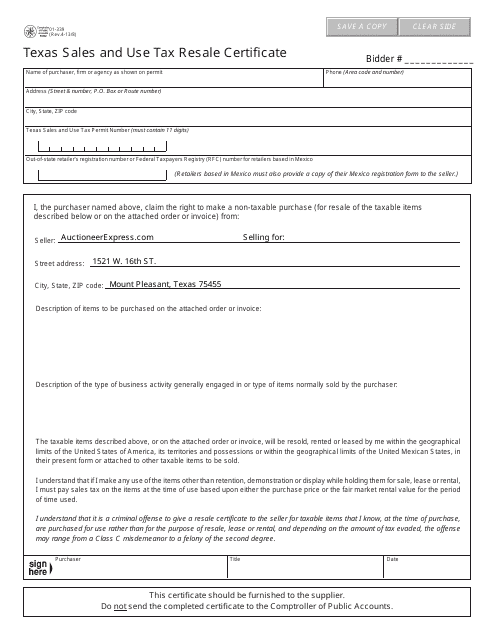

This is a legal form presented by a purchaser to a seller from whom the purchaser buys the goods with the purpose of resale in the state of Texas.

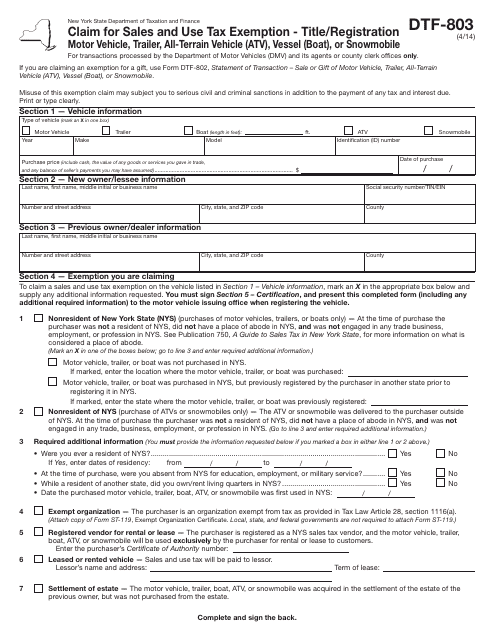

This form is used for claiming sales and use tax exemption when registering a title in New York.

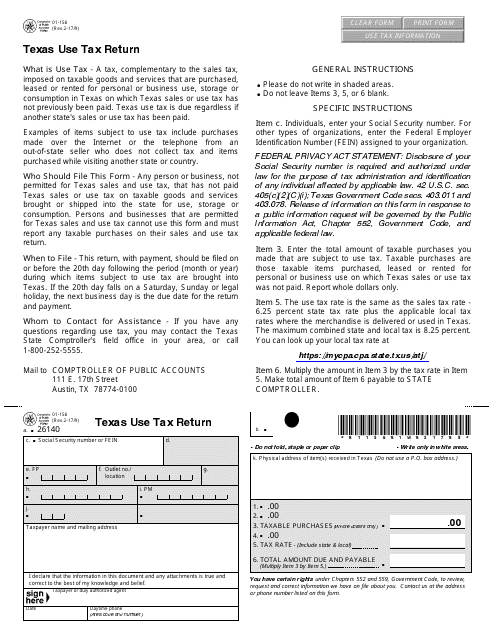

This form is used for reporting and filing use tax in the state of Texas. Use tax is a tax on purchases made out of state that would have been subject to sales tax if purchased within the state.

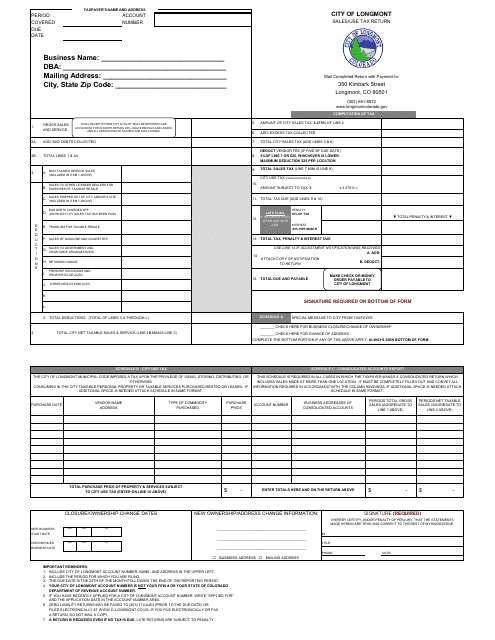

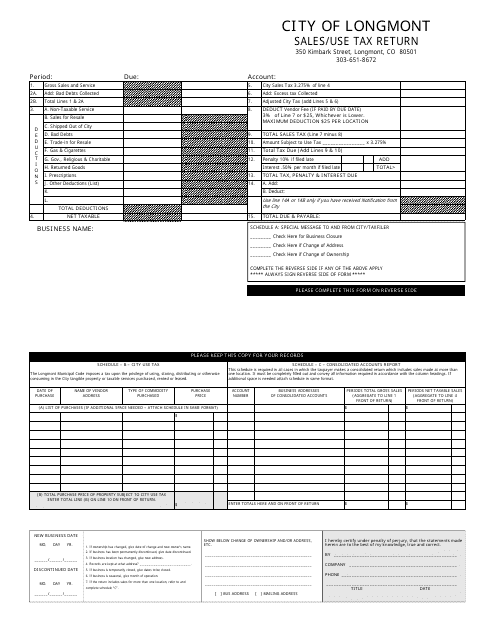

This form is used to report and pay sales and use taxes to the City of Longmont, Colorado. It is used by businesses and individuals who have made taxable sales or purchases within the city.

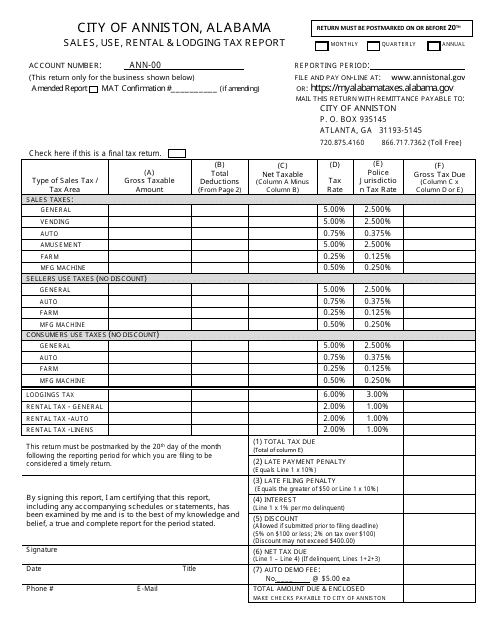

This document is used for reporting sales, use, rental, and lodging taxes in the City of Anniston, Alabama.

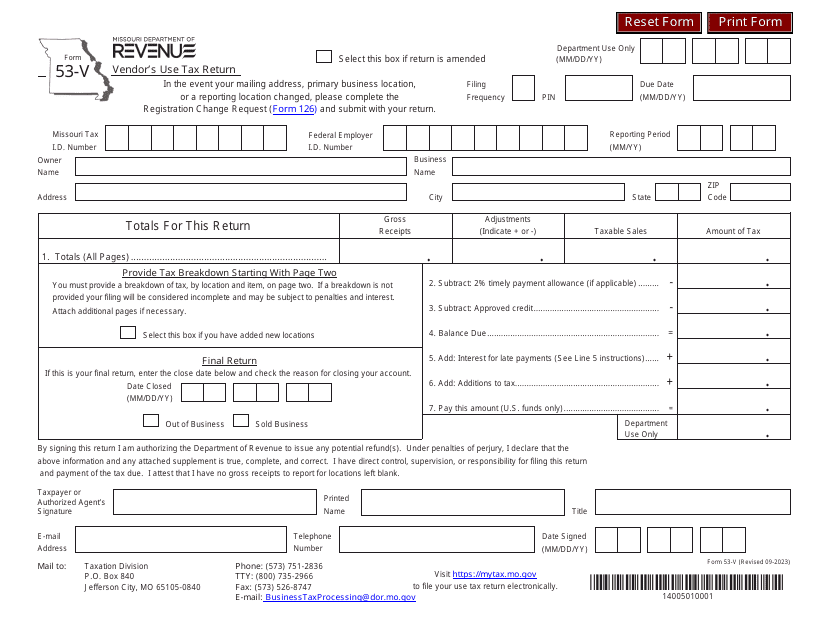

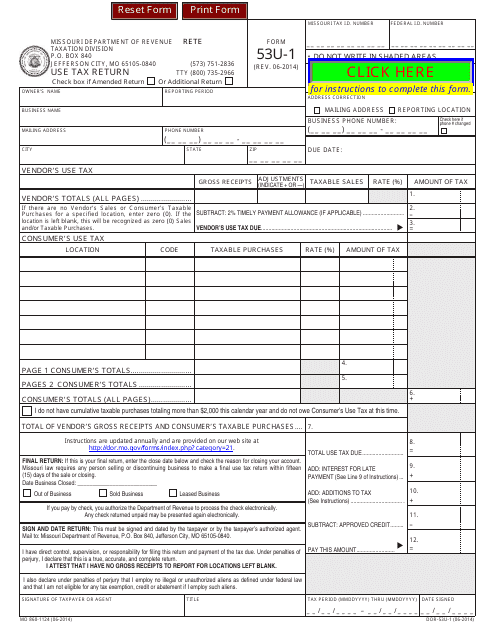

This Form is used for reporting and paying use tax in the state of Missouri. Use tax is owed on taxable items that were purchased tax-free and used in Missouri. The Form 53U-1 is used to calculate the use tax owed and submit it to the Missouri Department of Revenue.

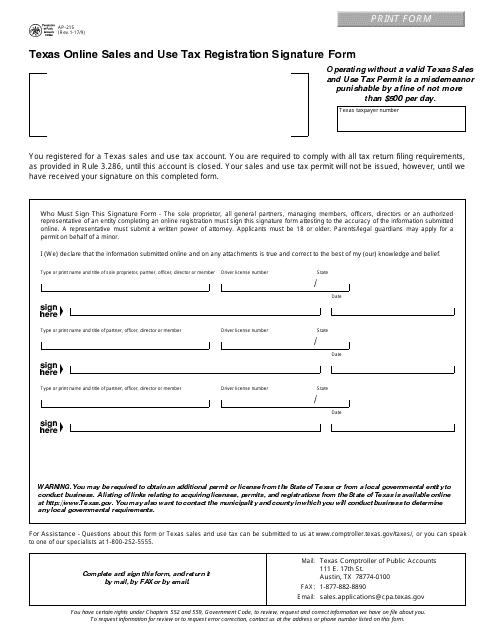

This document is used for registering for sales and use tax in Texas, and it requires your signature.

This Form is used for filing sales and use tax returns in LONGMONT, Colorado.

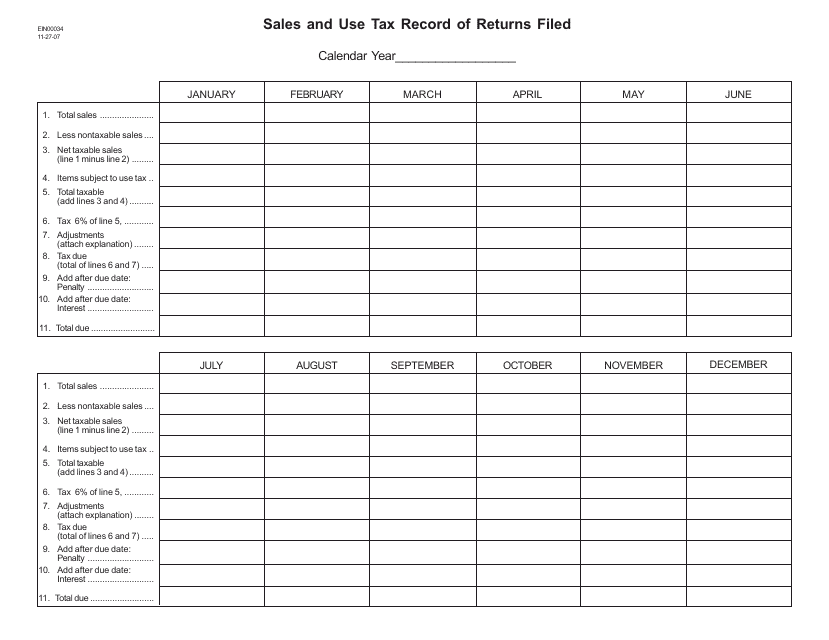

This form is used for recording sales and use tax returns filed in the state of Idaho.

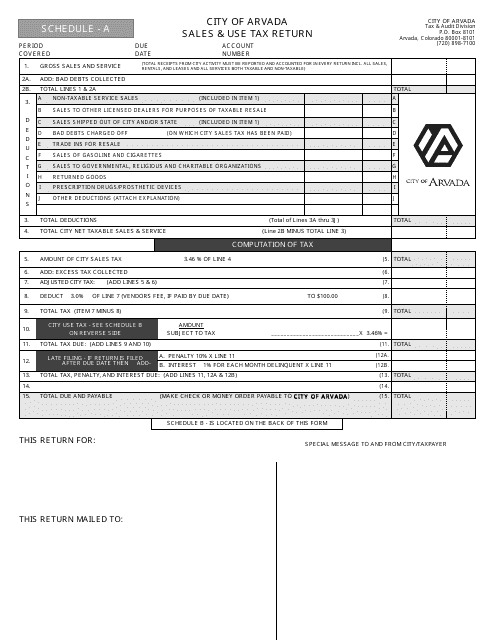

This document is used for filing Sales & Use Tax returns for businesses in the City of Arvada, Colorado.

This form is used for reporting and submitting sales and use tax to the City of Delta, Colorado.

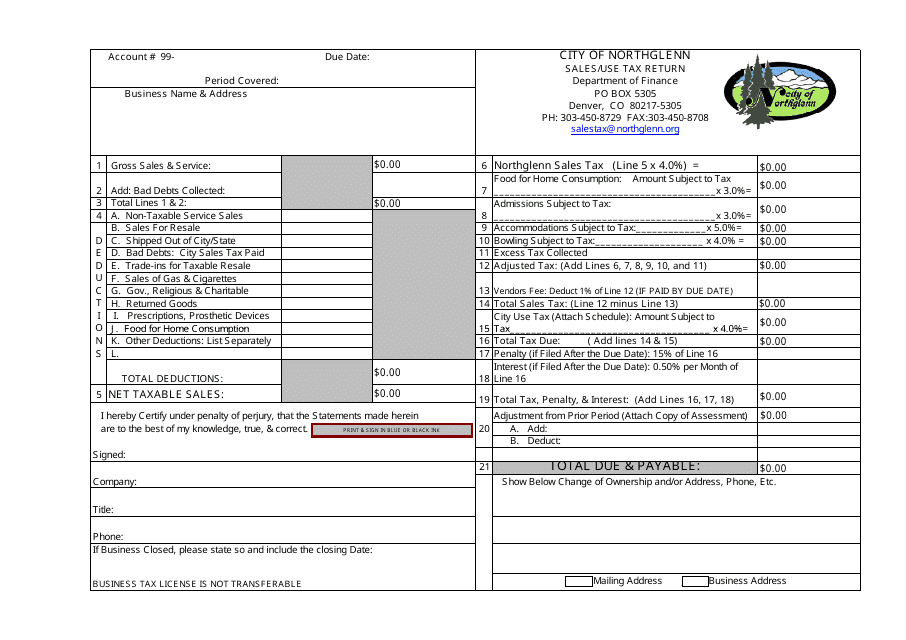

This form is used for reporting and remitting sales and use tax to the City of Northglenn, Colorado.

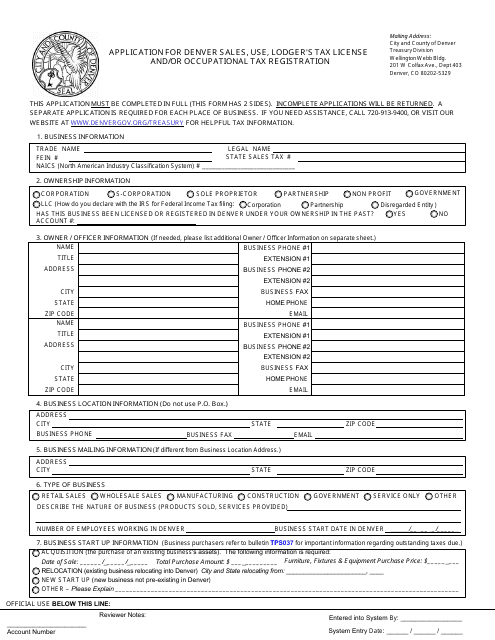

This form is used for applying for a sales, use, lodger's tax license, and/or occupational tax registration in the City and County of Denver, Colorado.

This form is used for reporting and remitting sales and use taxes to the City of Boulder, Colorado.

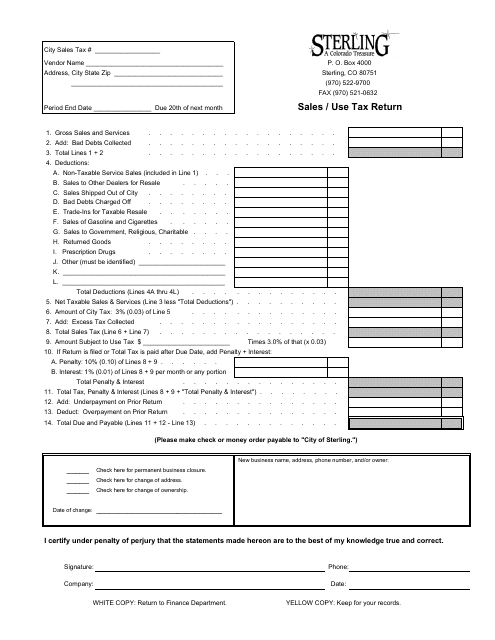

This form is used for reporting and remitting sales and use tax to the City of Sterling, Colorado. It is mandatory for businesses operating within the city limits to file this return on a regular basis.

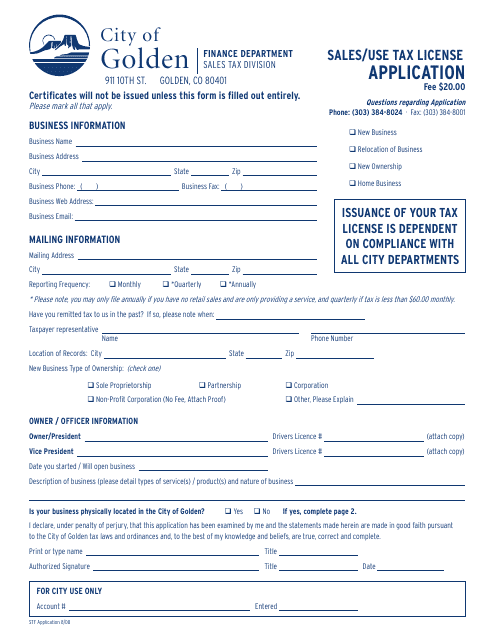

This form is used for applying for a sales/use tax license in the city of Golden, Colorado.

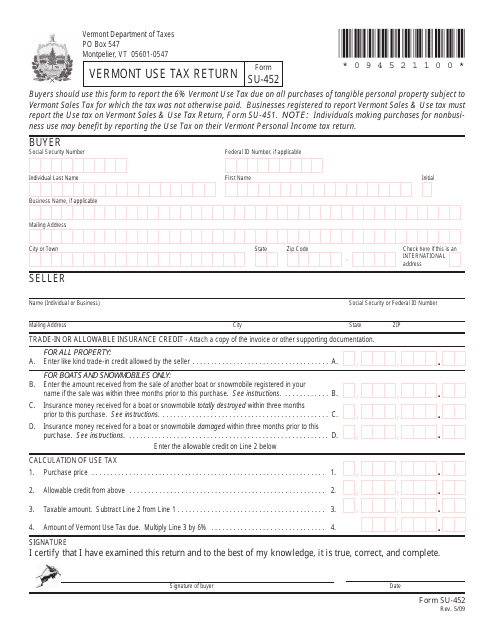

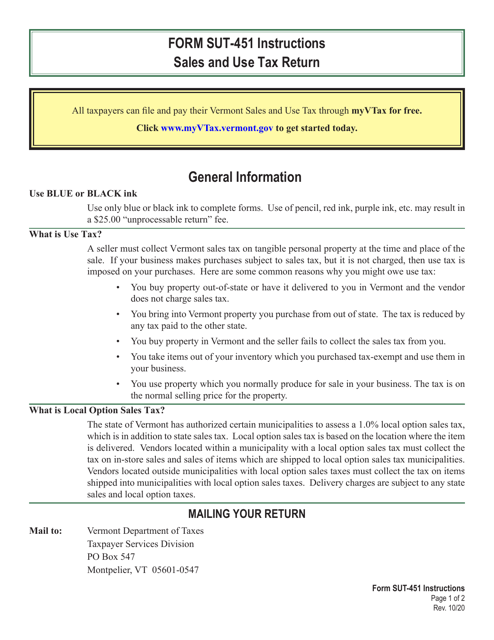

This Form is used for reporting and paying use tax owed to the state of Vermont. Use tax is typically due on items purchased out-of-state and brought into Vermont for use or consumption.

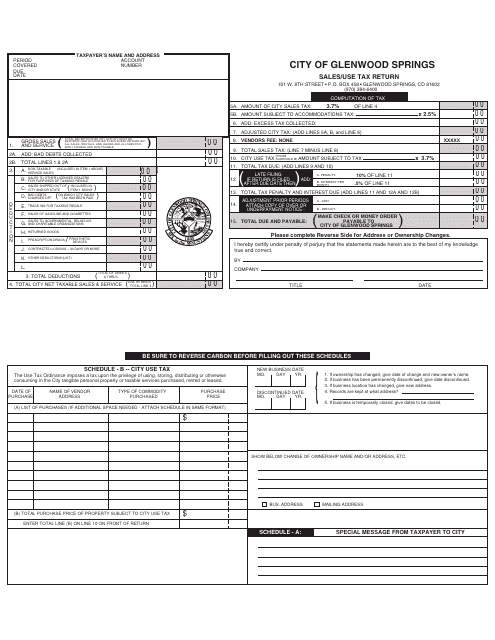

This Form is used for reporting and paying sales and use taxes to the City of Glenwood Springs, Colorado.

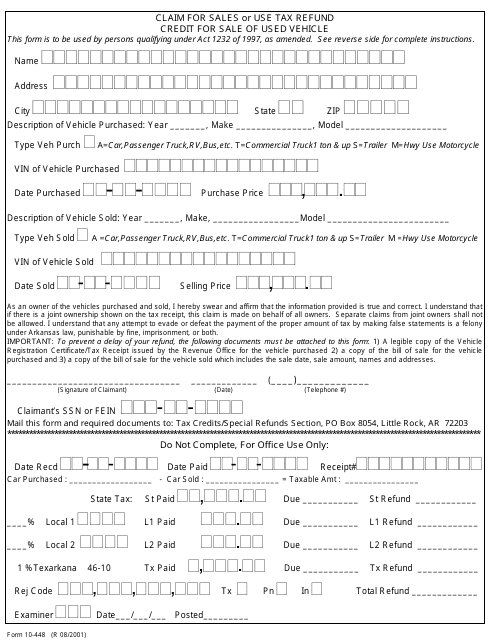

This form is used for claiming a sales or use tax refund in Arkansas when you have sold a used vehicle.

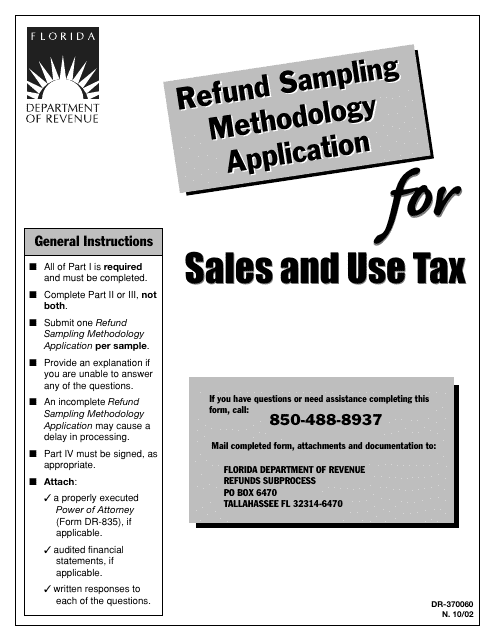

This Form is used for applying for a refund of sales and use tax in Florida. It specifically pertains to the sampling methodology that will be used to determine the amount of the refund.

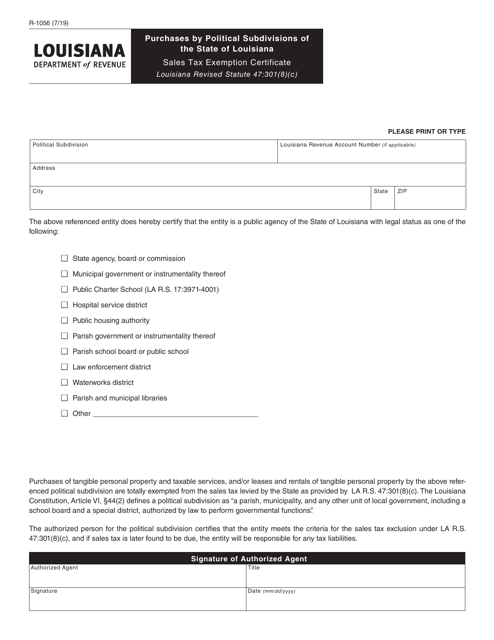

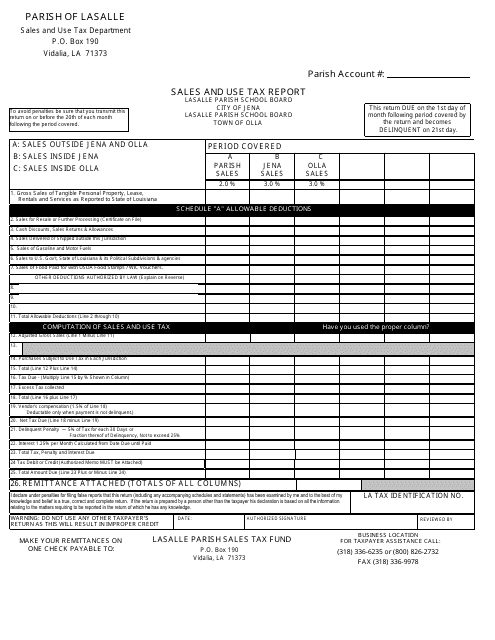

This document is used for reporting sales and use tax in LaSalle Parish, Louisiana.

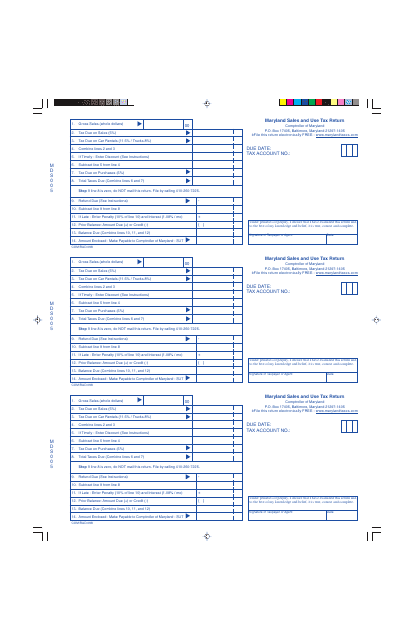

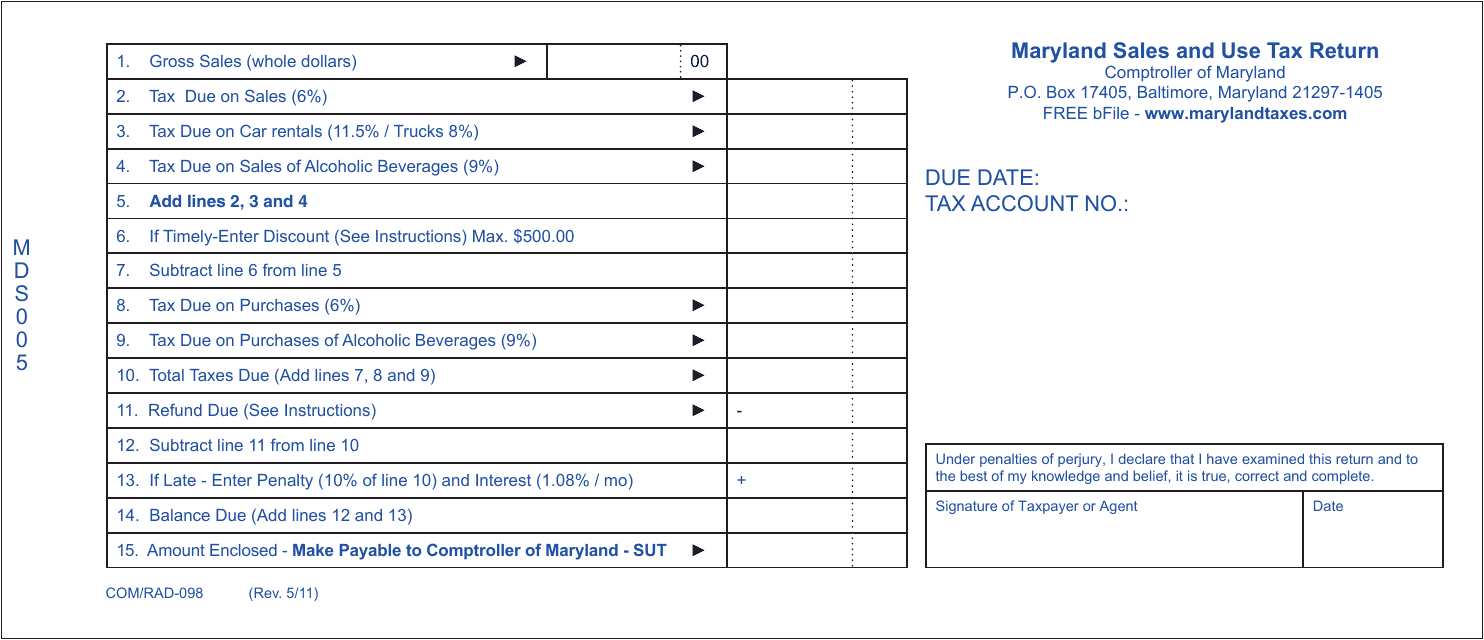

This document is used to report and remit sales and use tax in the state of Maryland. Businesses must submit this return to the Maryland Comptroller's Office to report the sales they have made and the corresponding sales tax collected.

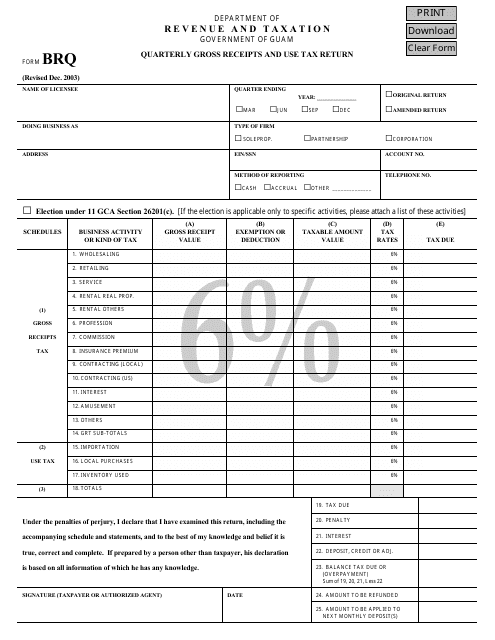

This form is used for reporting quarterly gross receipts and use tax in Guam.

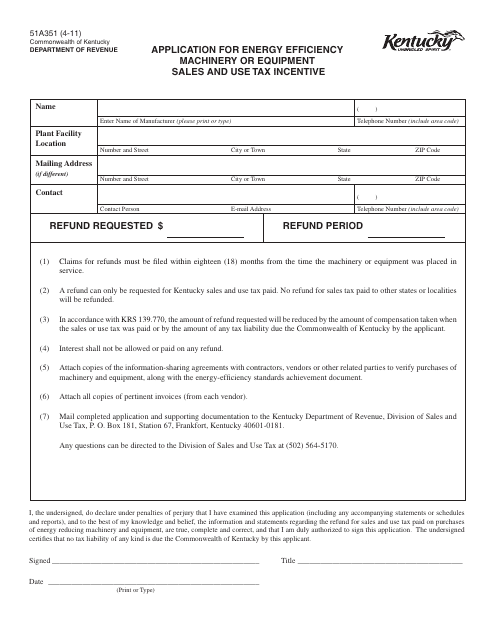

This form is used for applying for the Energy Efficiency Machinery or Equipment Sales and Use Tax Incentive in the state of Kentucky.

This form is used for reporting sales and use tax in the state of Maryland. It is used by businesses to calculate and pay their tax obligations related to sales of goods and services.

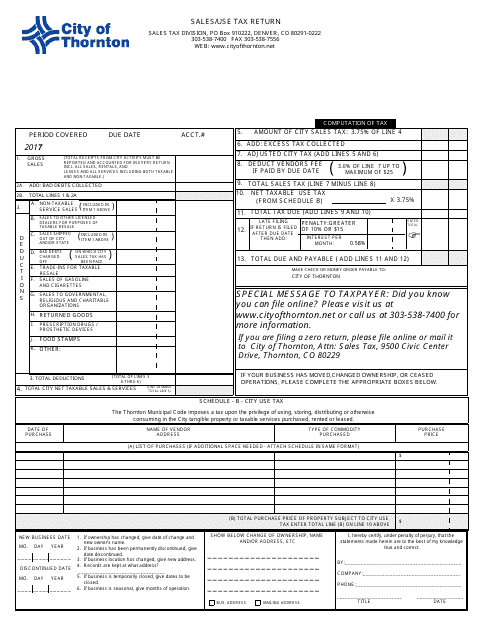

This form is used for reporting and remitting sales or use tax to the City of Thornton, Colorado.

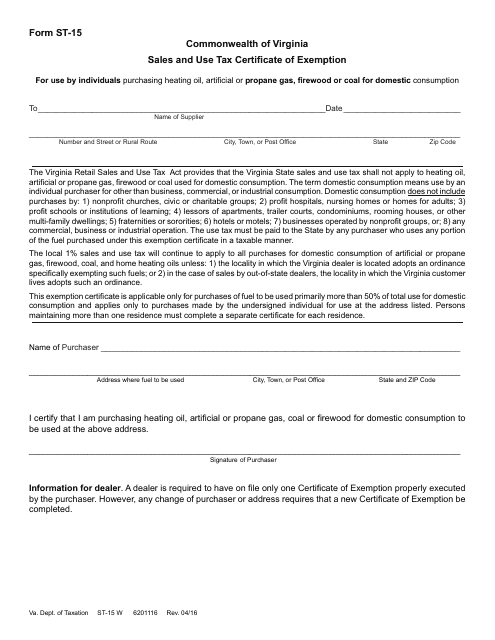

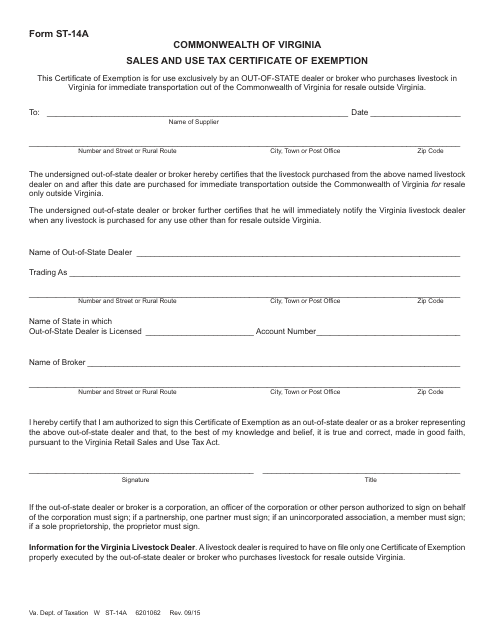

This form is used for claiming sales and use tax exemption in the state of Virginia.

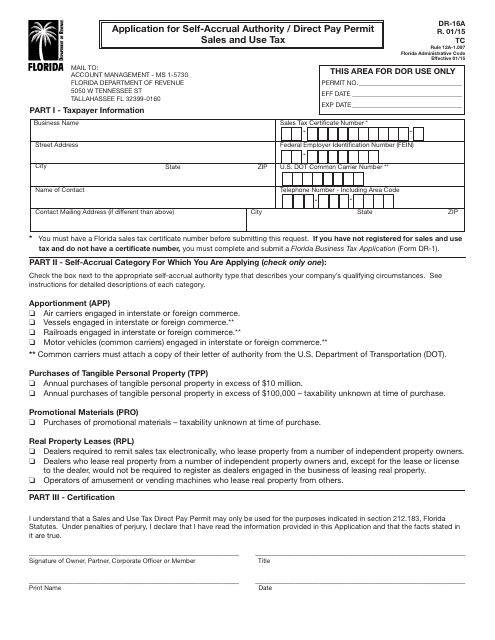

This Form is used for applying for self-accrual authority or a direct pay permit for sales and use tax in Florida.

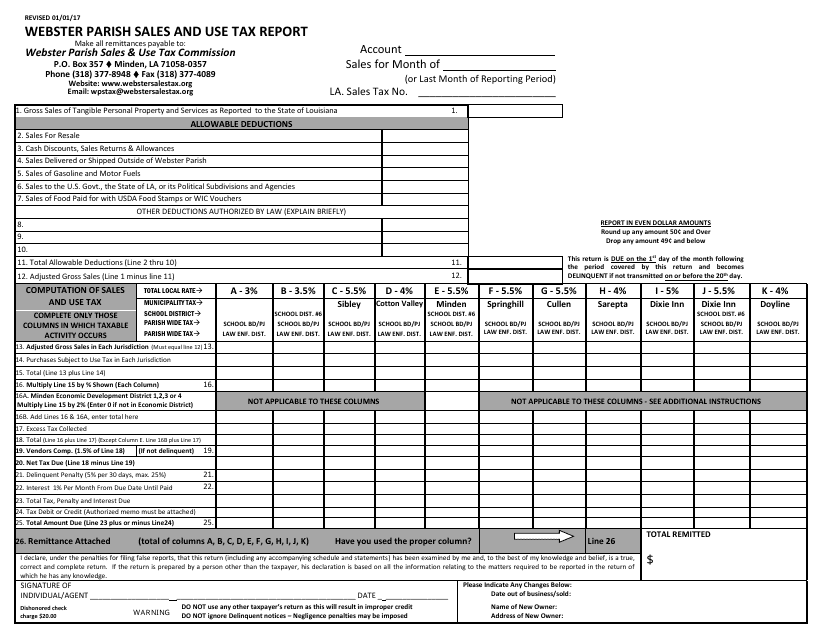

This document is used for reporting sales and use tax in Webster Parish, Louisiana.

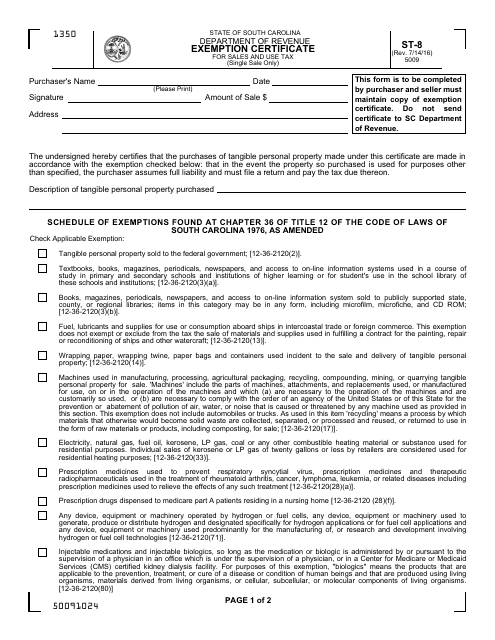

This form is used for requesting an exemption from sales and use tax in South Carolina. It is for individuals or businesses who qualify for certain exemptions.

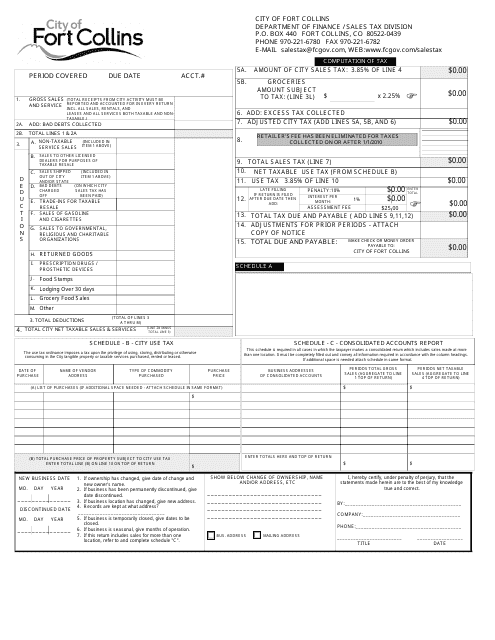

This form is used for reporting sales and use tax to the City of Fort Collins, Colorado. Businesses in the city are required to fill out this form to remit their tax obligations.

This Form is used for claiming exemption from sales and use tax in the state of Virginia.

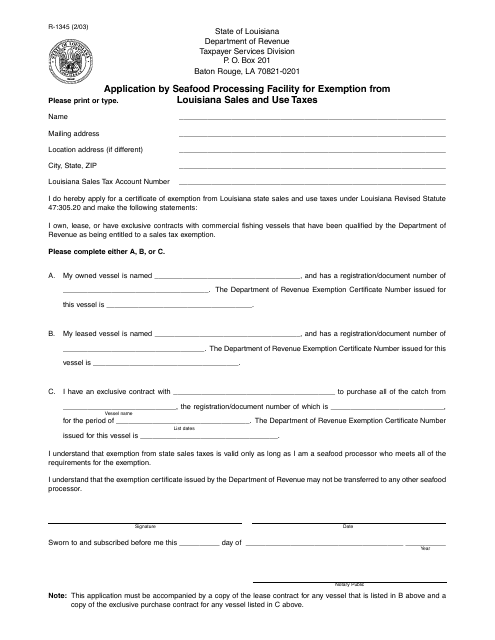

This form is used for seafood processing facilities in Louisiana to apply for an exemption from sales and use taxes. It helps these facilities save on taxes and streamline their business operations.

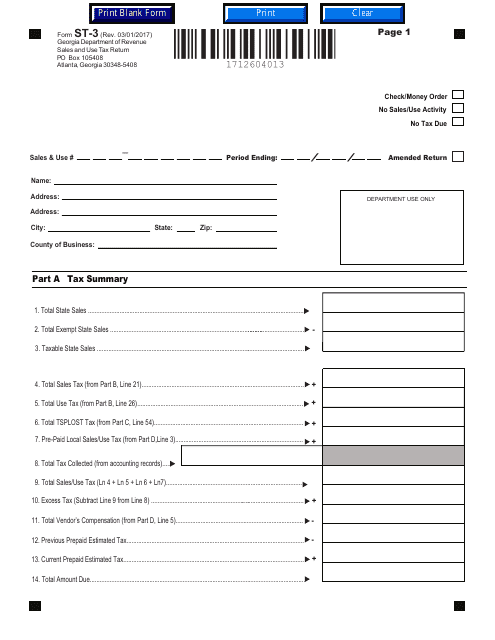

Georgia-registered organizations may use this form to report the sales and use tax they owe in the state of Georgia.

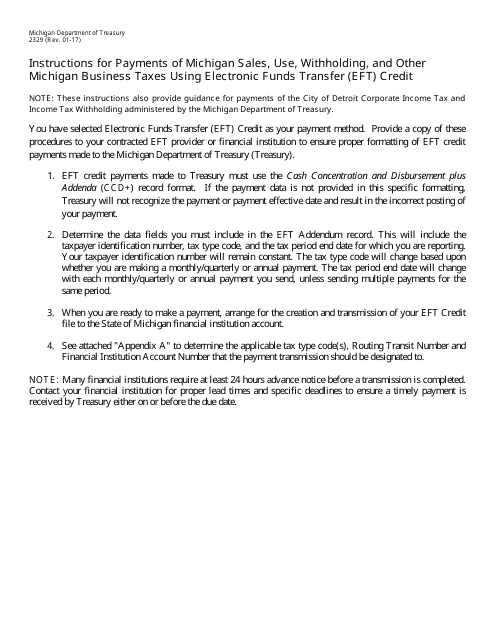

This form provides instructions for making electronic payments for various types of Michigan business taxes, including sales tax, use tax, withholding tax, and other taxes. It explains how to use the Electronic Funds Transfer (EFT) credit method for submitting these payments.