Pa Tax Templates

Are you a resident of Pennsylvania? Are you looking for information and resources related to taxes in the Keystone State? Look no further! Our website provides a comprehensive collection of documents and forms related to PA Tax. Whether you need to file your individual taxes, report gambling winnings, or claim an injured spouse allocation, we have the resources you need to navigate Pennsylvania's tax system.

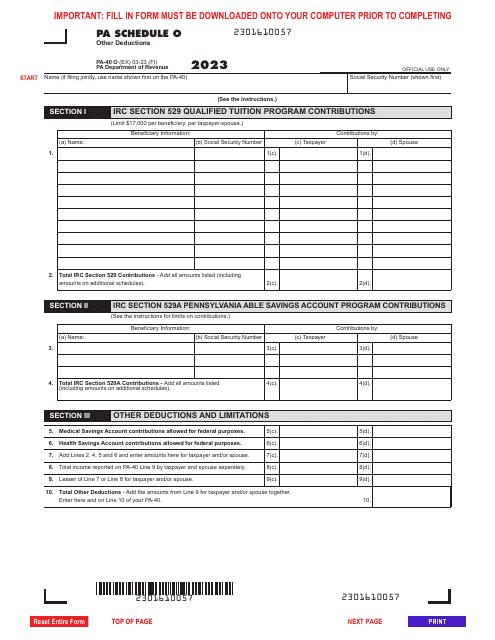

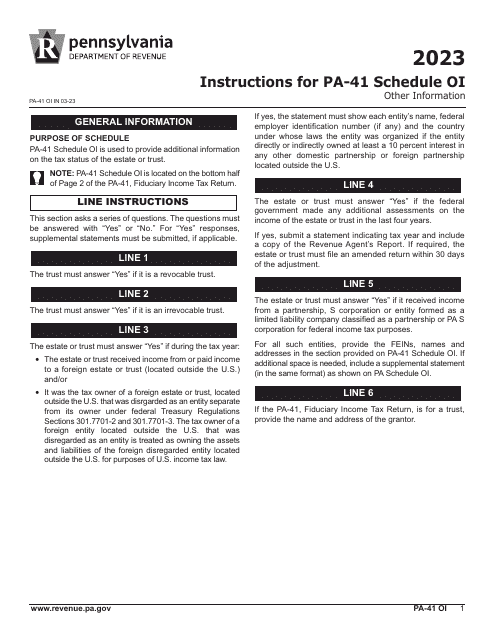

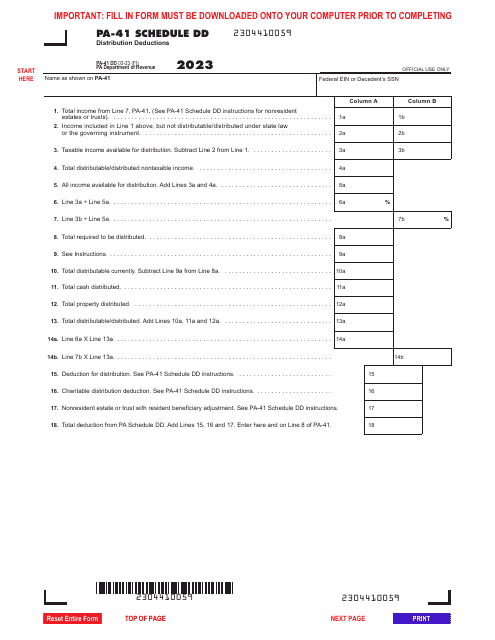

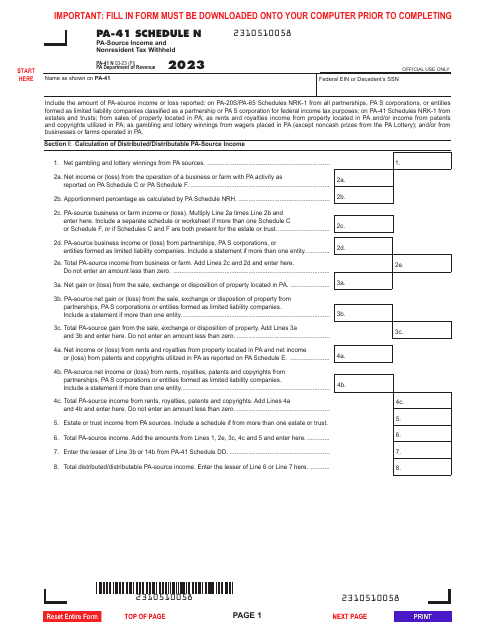

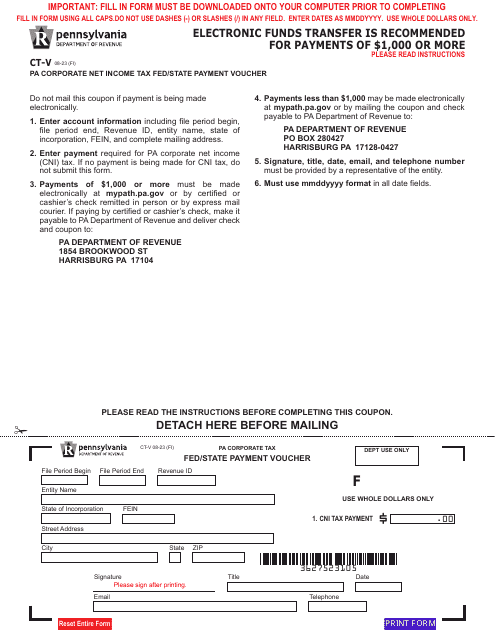

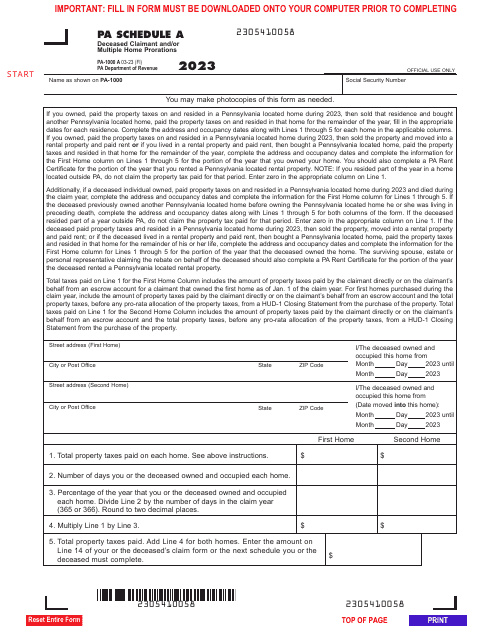

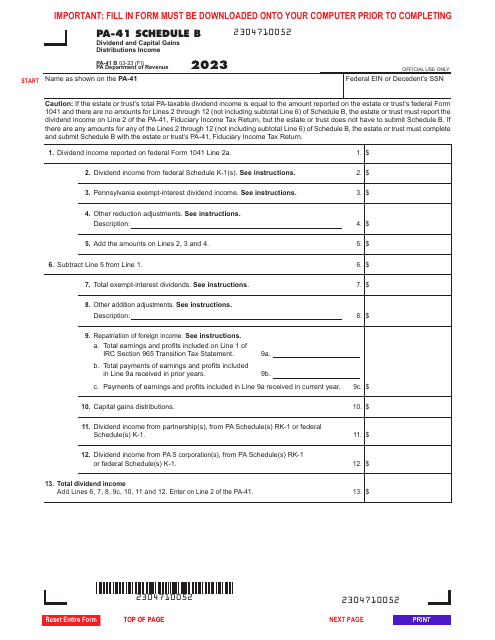

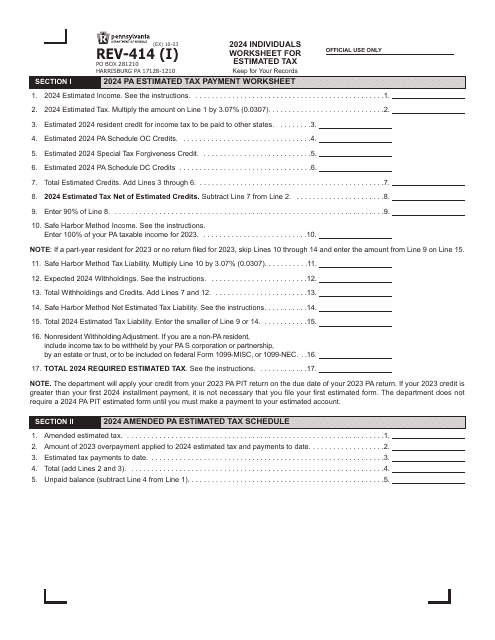

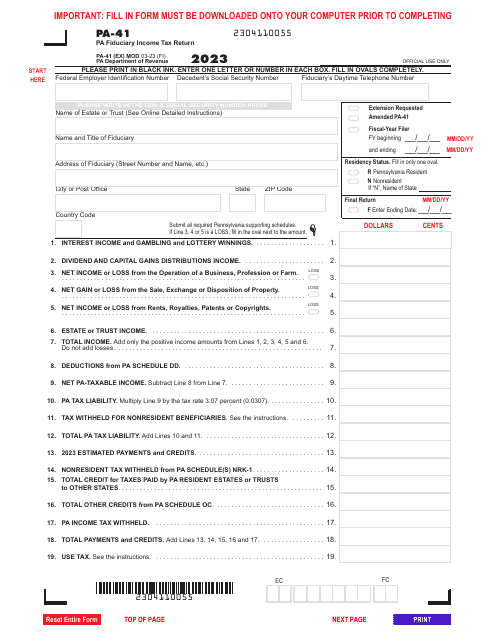

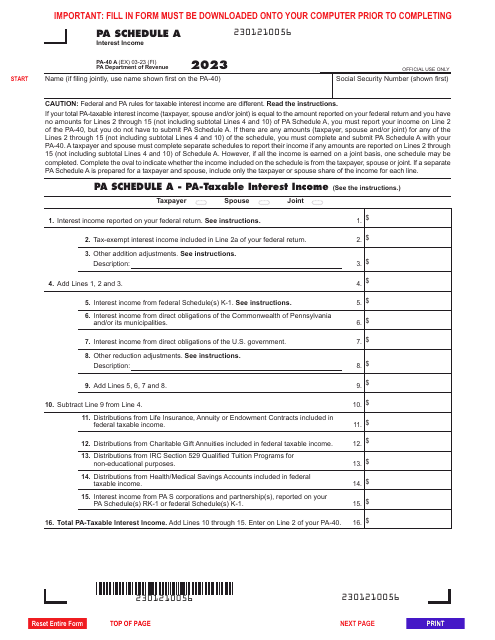

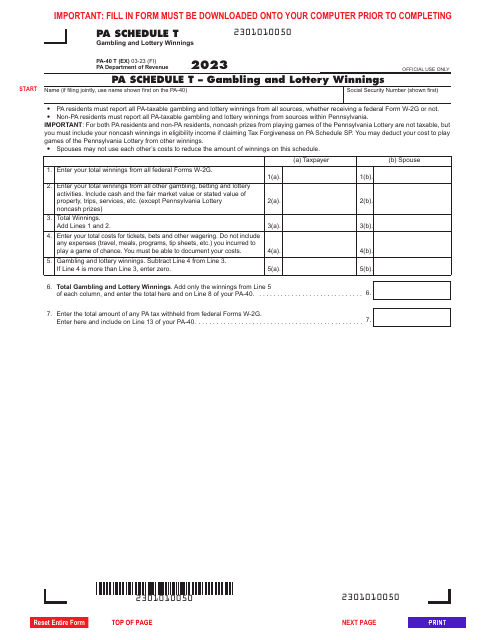

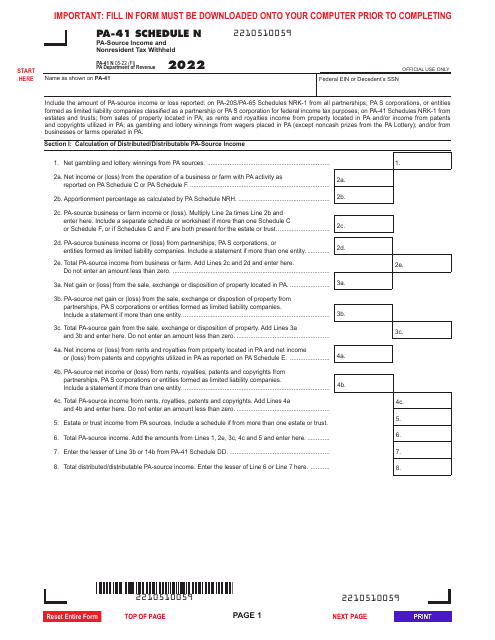

Our PA Tax collection includes a wide range of documents, such as the Form PA-8379 Injured Spouse Claim and Allocation, Form PA-41 Schedule N for reporting PA source income and nonresident tax withheld, Form REV-414 (I) Individuals Worksheet for Estimated Tax, and Form PA-40 Schedule T for reporting gambling and lottery winnings. These documents cover various aspects of PA Tax and are designed to help you meet your tax obligations accurately and efficiently.

At our website, we understand that taxes can be complex and sometimes overwhelming. That's why we've assembled an extensive collection of PA Tax forms and documentation, making it easier for you to find the information you need. Our user-friendly interface allows you to search for specific forms or browse through the entire collection, ensuring that you have access to the documents necessary to fulfill your tax responsibilities.

Whether you are an individual taxpayer or a tax professional, our website is a valuable resource for all your PA Tax needs. Our collection of PA Tax forms is constantly updated to reflect changes in the tax laws, ensuring that you have access to the most current and accurate documents. We are committed to providing you with the tools and information you need to navigate the complexities of the PA Tax system with ease.

So, if you are looking for PA Tax forms, documentation, or resources, look no further. Our website is your one-stop destination for all things related to PA Tax. Explore our collection today and take control of your tax obligations in Pennsylvania.

Other names for this document collection: PA Tax Forms, PA Taxes, PA Tax Documentation, PA Tax Documents, Tax Form PA, Tax Forms PA

Documents:

26

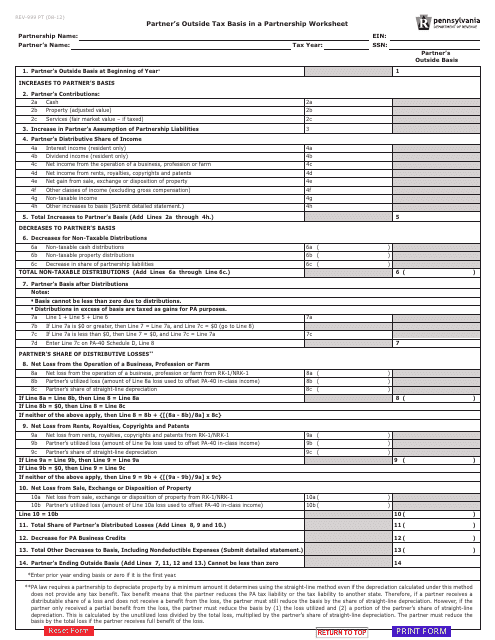

This form is used for calculating the partner's outside tax basis in a partnership in Pennsylvania.

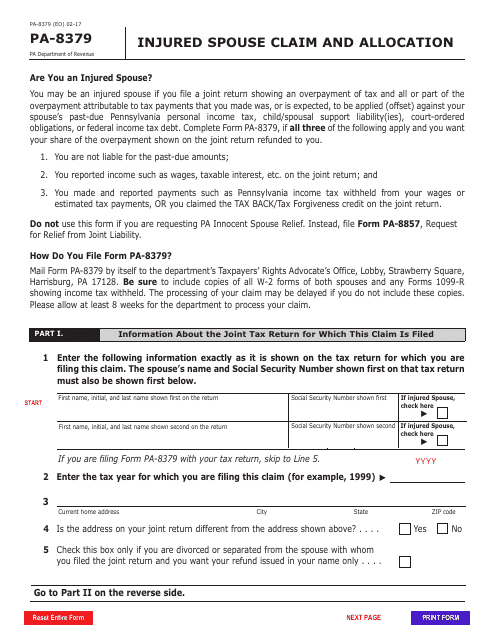

This form is used for spouses in Pennsylvania to file a claim and allocate any refunds due to them when their tax refund is being offset for their partner's debts.

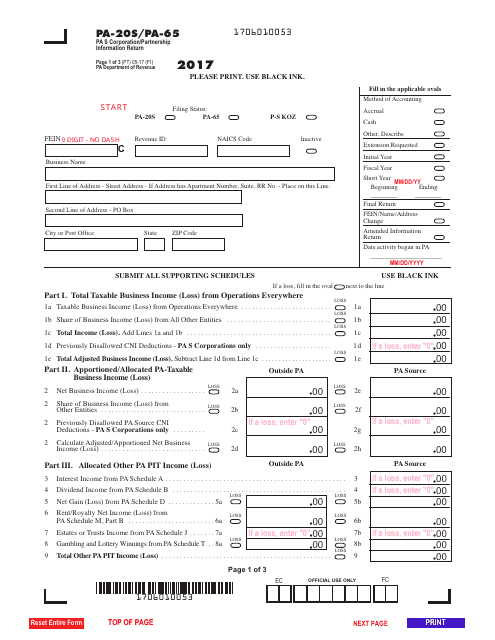

This Form is used for Pennsylvania S corporations and partnerships to file their annual information return.

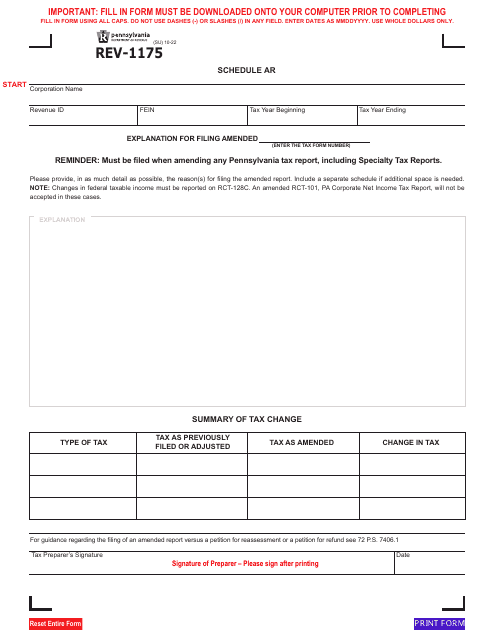

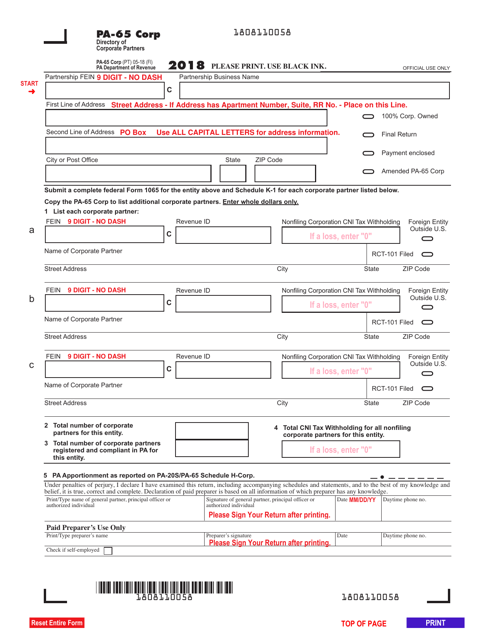

This document is used for submitting information about corporate partners in Pennsylvania.

This form is used for reporting Pennsylvania-source income and the nonresident tax withheld.