Tax Bonds Templates

Are you a business or individual needing to meet your tax obligations? Look no further than tax bonds, also known as bond tax or tax bond forms. These documents offer a streamlined solution for ensuring compliance with tax regulations while providing financial security to the government.

Tax bonds act as a guarantee that businesses and individuals will fulfill their tax responsibilities, protecting both taxpayers and the government. By obtaining these bonds, taxpayers demonstrate their commitment to meeting their obligations and provide an added layer of confidence to tax authorities.

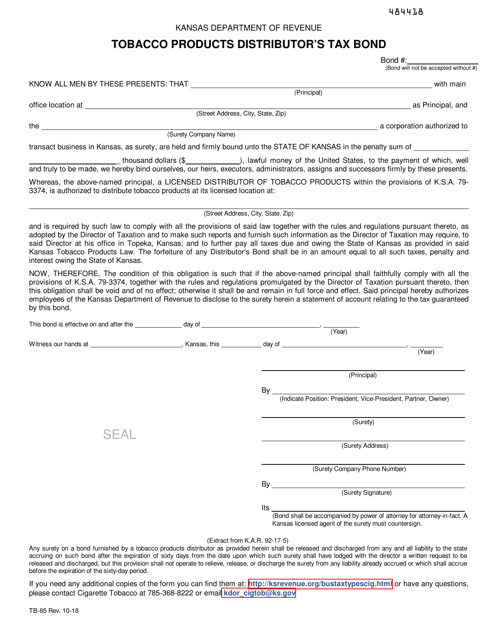

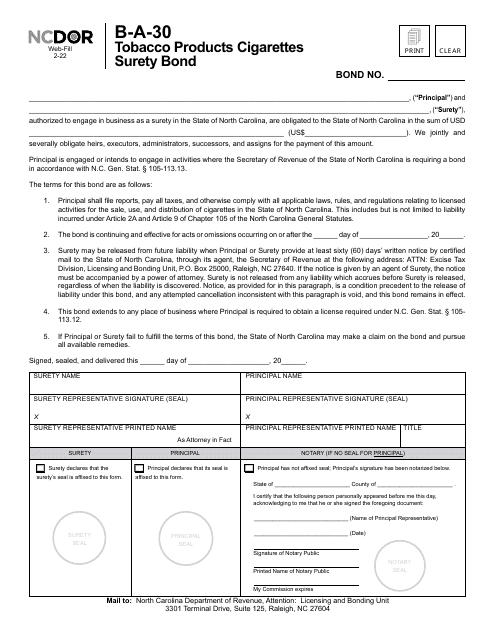

One example of a tax bond is the Form DMF-6 New Jersey Distributor of Motor Fuels Tax Bond in New Jersey. This document ensures that fuel distributors adhere to tax regulations, guaranteeing payment of taxes owed on motor fuels. Similarly, the Other Tobacco Products Tax Bond in Oregon ensures that businesses meet their tax obligations related to tobacco products.

If you operate in Louisiana, you may need to obtain the Form R-10100 Tobacco Tax Surety Bond. This bond guarantees payment of tobacco taxes in compliance with state regulations. On the other hand, the Form TC-763E Electronic Cigarette and Nicotine Products Tax Surety Bond in Utah provides assurance that businesses meet their tax obligations related to electronic cigarettes and nicotine products.

When it comes to managing your tax obligations, tax bonds offer peace of mind and security. Whether it's the Instructions for Form OR-131 Surety Tax Bond in Connecticut or other tax bond forms across the United States and Canada, these documents provide a safety net and help maintain tax compliance.

With these tax bonds, businesses and individuals can ensure they meet their tax responsibilities while avoiding penalties and potential legal consequences. So, if you're looking for a reliable way to demonstrate your commitment to tax compliance, consider obtaining tax bonds, also known as bond tax or tax bond forms.

Documents:

54

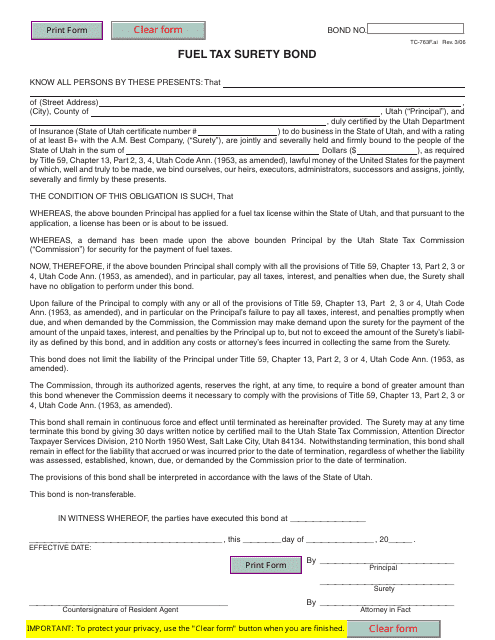

This form is used for filing a fuel tax surety bond in Utah.

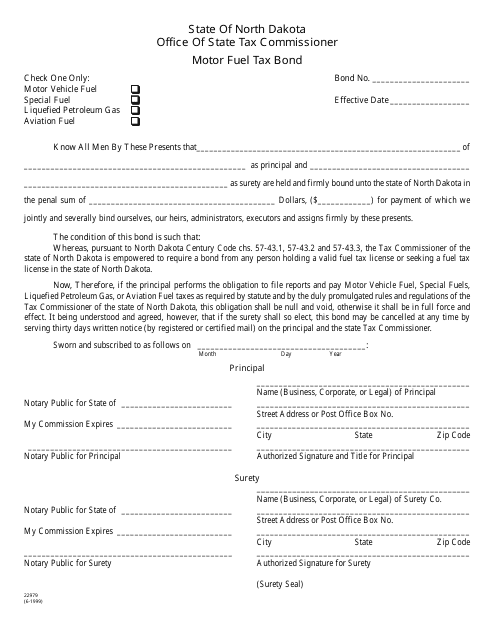

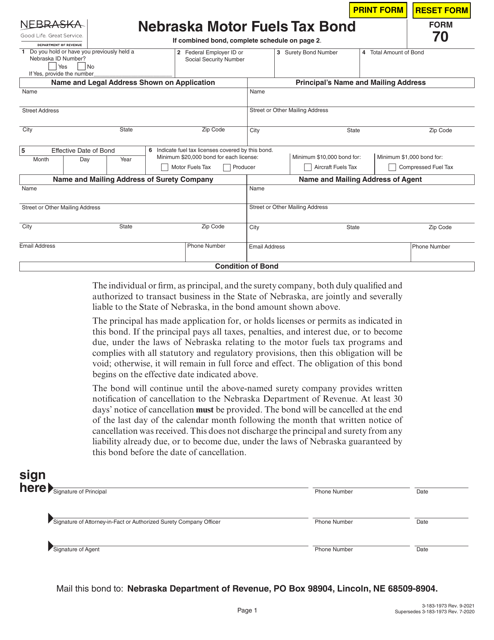

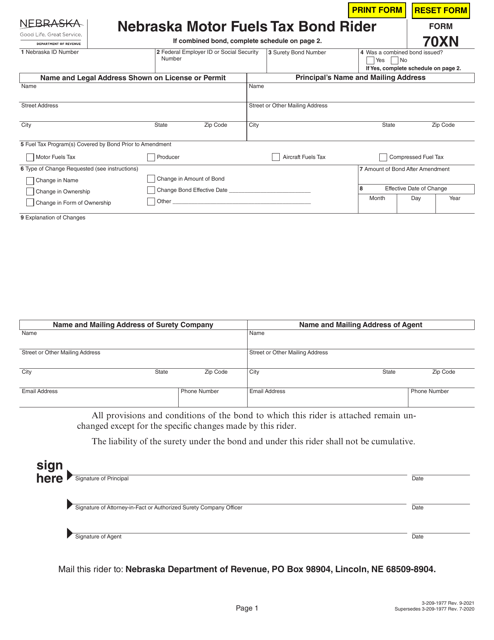

This Form is used for obtaining a motor fuel tax bond in North Dakota.

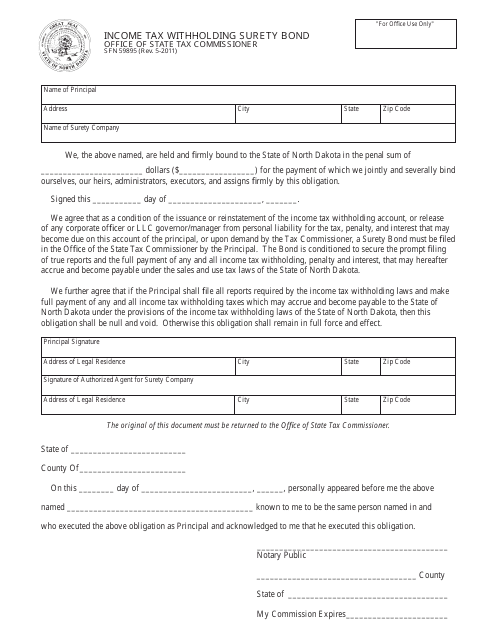

This form is used for obtaining a surety bond for income tax withholding in the state of North Dakota.

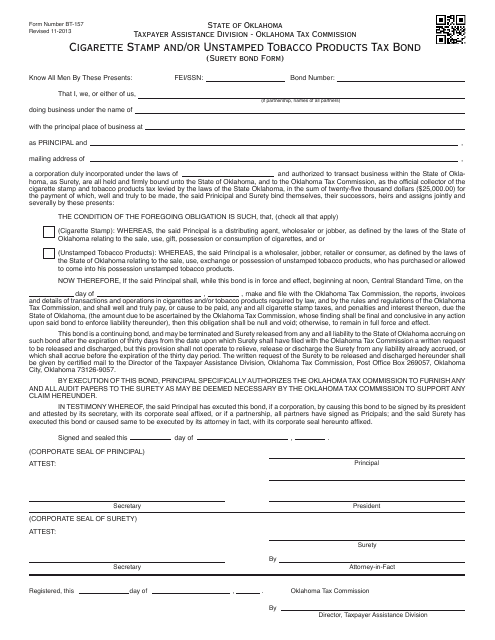

This form is used for a Cigarette Stamp and/or Unstamped Tobacco Products Tax Bond in Oklahoma. It is a surety bond form required for certain businesses selling cigarettes or tobacco products in the state.

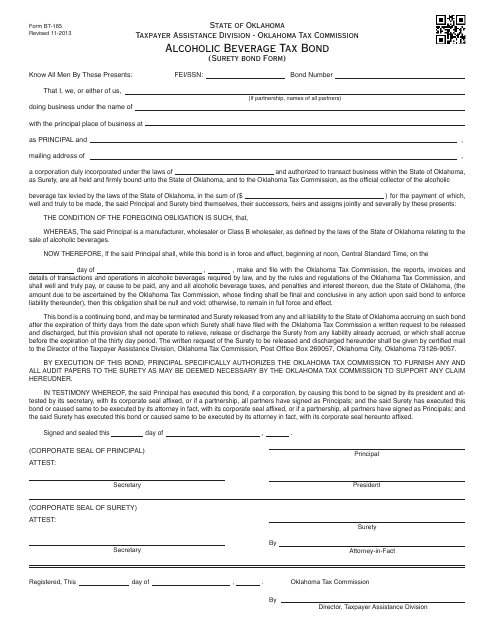

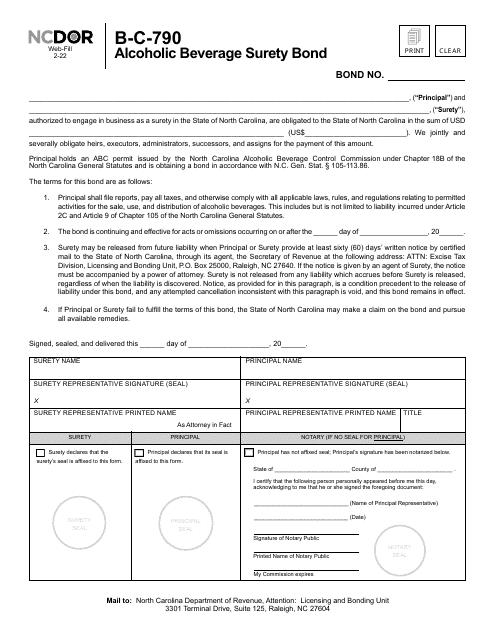

This Form is used for obtaining an Alcoholic Beverage Tax Bond (Surety Bond) in Oklahoma.

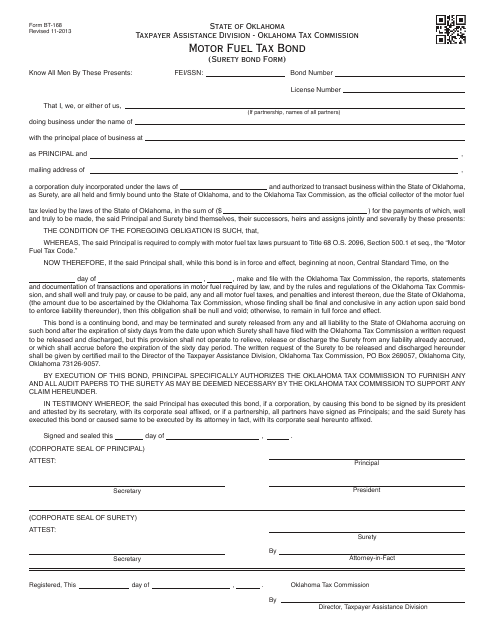

This Form is used for obtaining a Motor Fuel Tax Bond (Surety Bond) in Oklahoma for businesses that sell motor fuel over-the-counter. This bond ensures that the business complies with state laws and regulations regarding motor fuel taxes.

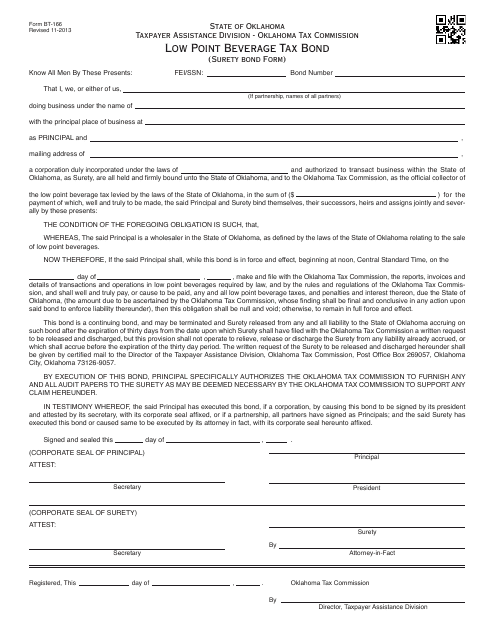

This document is for obtaining a surety bond for the Low Point Beverage Tax in Oklahoma.

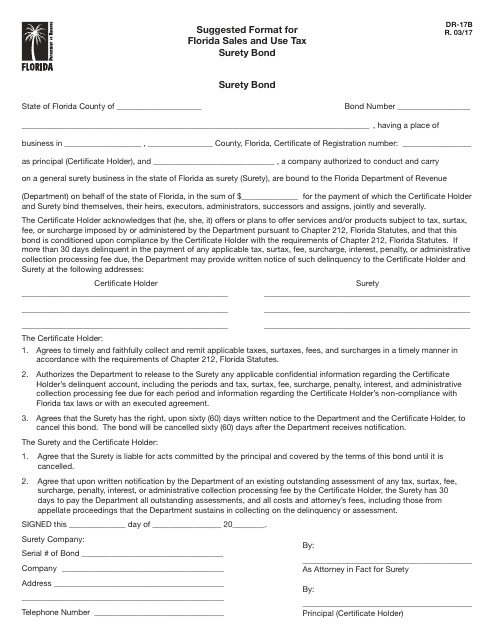

This form is used for obtaining a surety bond for Florida sales and use tax purposes. It provides a suggested format for the bond.

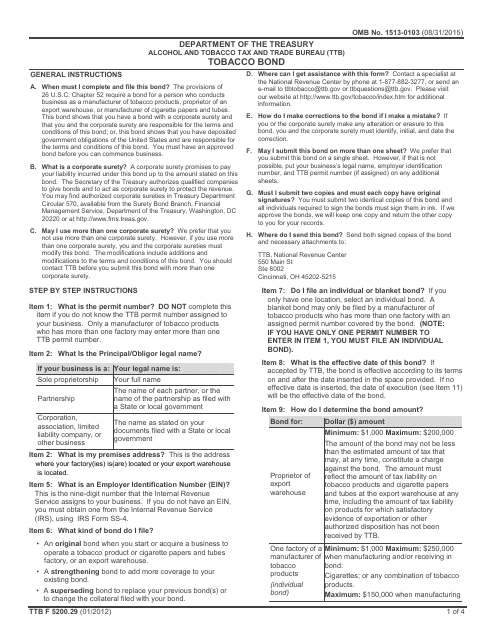

This document is a Tobacco Bond form used by the Alcohol and Tobacco Tax and Trade Bureau (TTB) to ensure compliance with regulations related to the production and distribution of tobacco products.

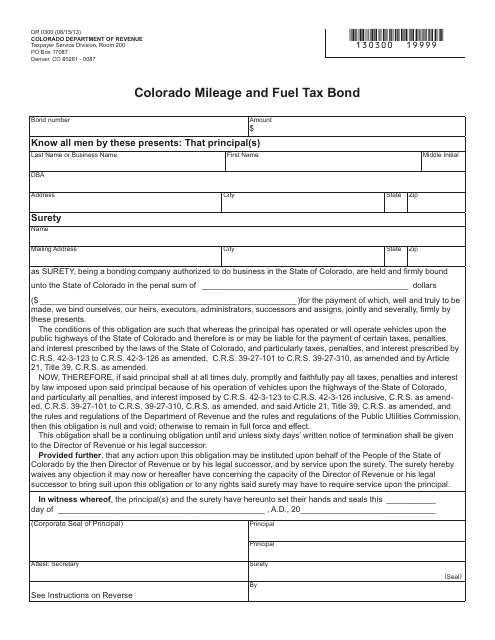

This form is used for obtaining a Mileage and Fuel Tax Bond in the state of Colorado.

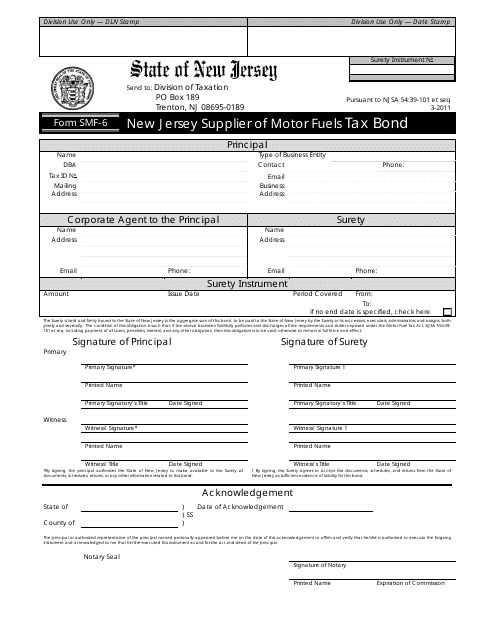

This form is used for applying for a tax bond in the state of New Jersey.

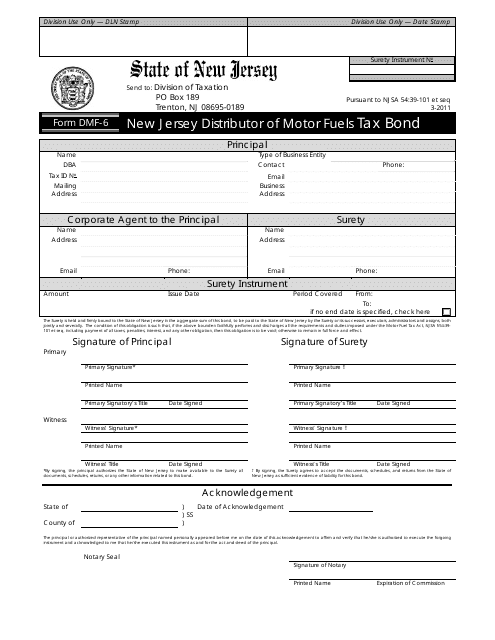

This form is used for obtaining a Distributor of Motor Fuels Tax Bond in the state of New Jersey. It is required for businesses that distribute motor fuels to ensure compliance with tax obligations.

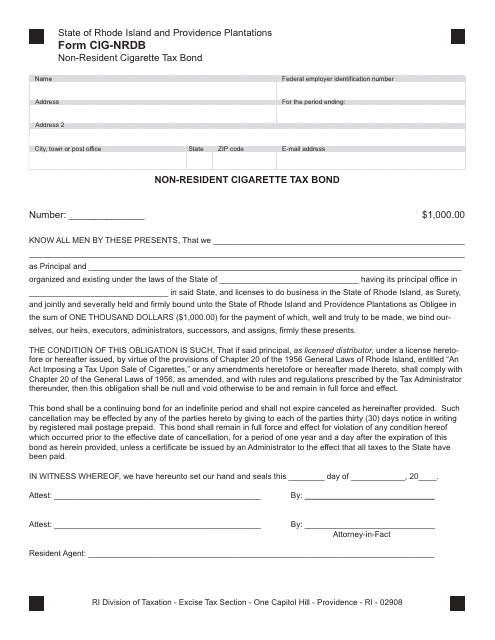

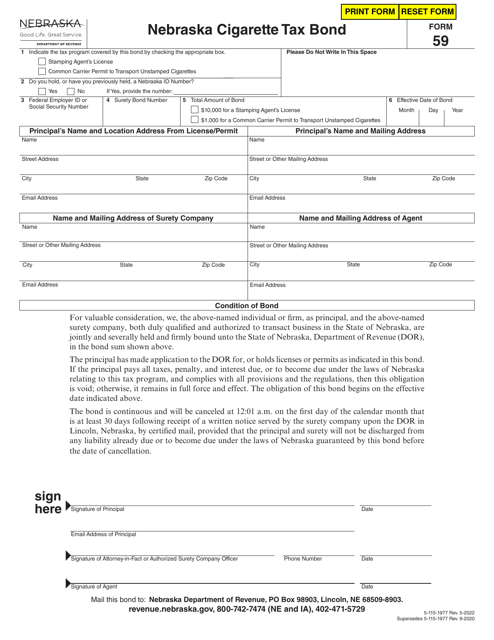

This type of document is used for obtaining a non-resident cigarette tax bond in Rhode Island.

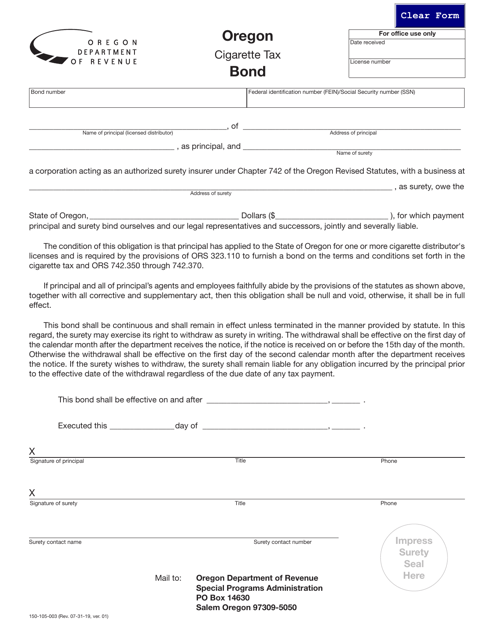

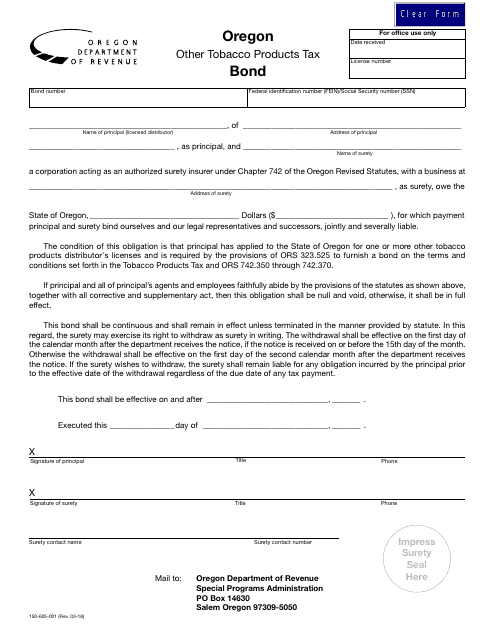

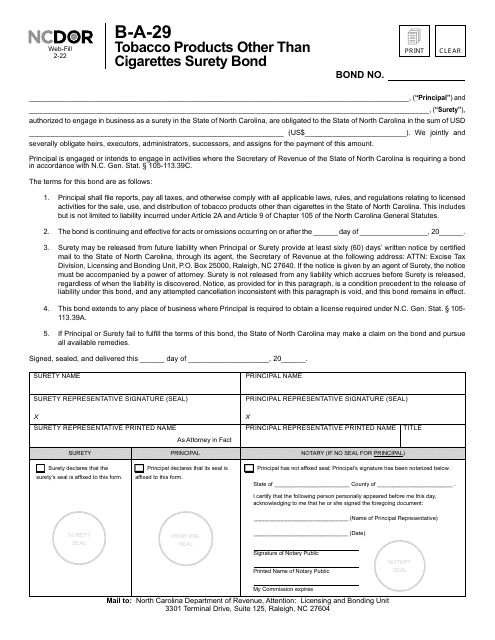

This document is for obtaining a bond for the taxation of other tobacco products in the state of Oregon.

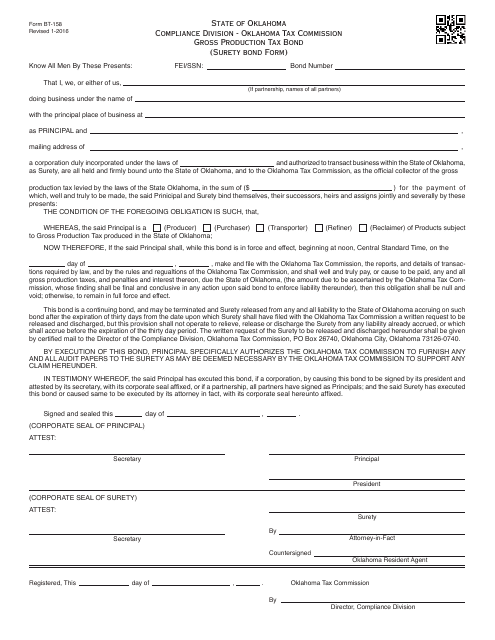

This Form is used for obtaining a Gross Production Tax Bond in Oklahoma.

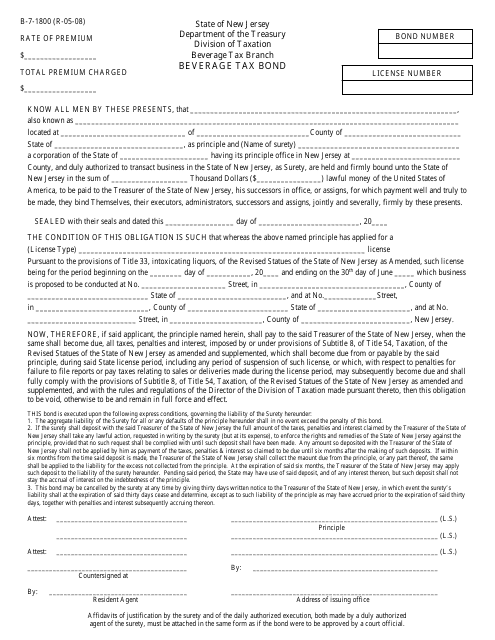

This form is used for obtaining a beverage tax bond in the state of New Jersey. The bond is required for businesses that sell or distribute beverages and ensures compliance with tax obligations.

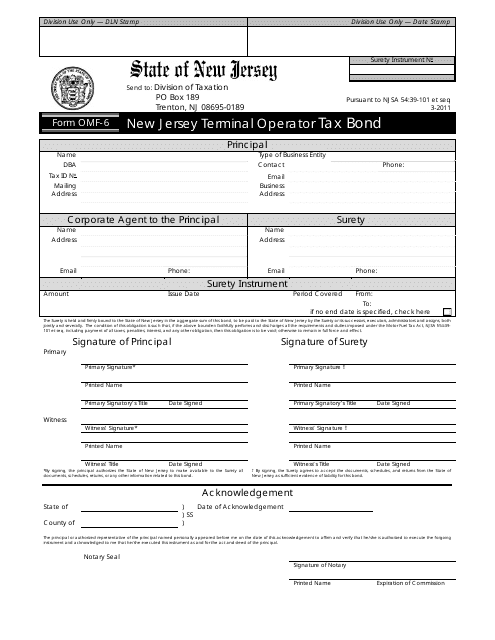

This form is used for obtaining a Terminal Operator Tax Bond in the state of New Jersey.

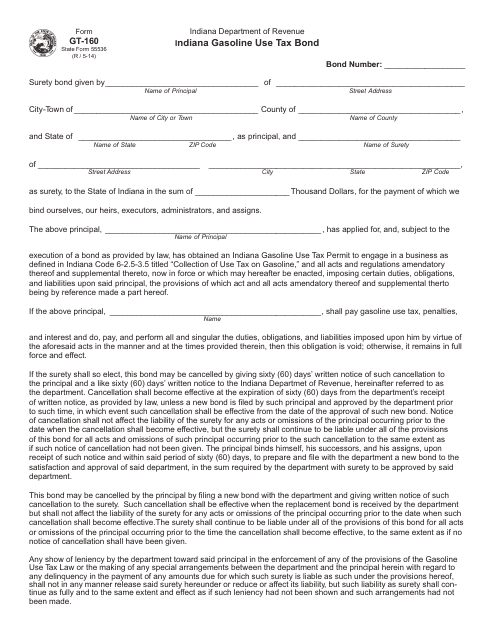

This form is used for obtaining a gasoline use tax bond in the state of Indiana. The bond is required for businesses that sell or distribute gasoline in Indiana.

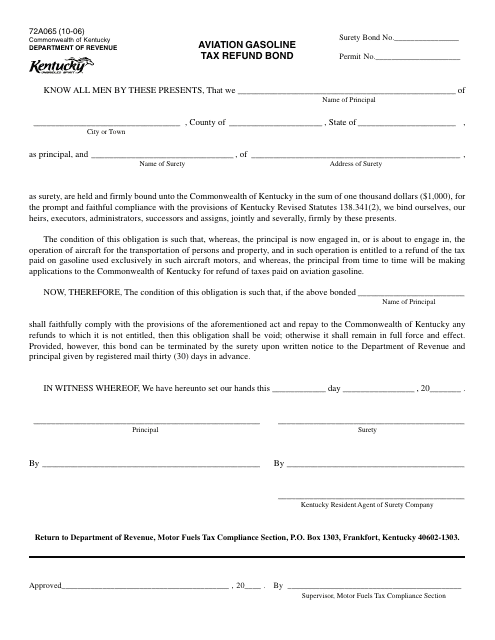

This form is used for obtaining a refund of aviation gasoline taxes paid in the state of Kentucky.

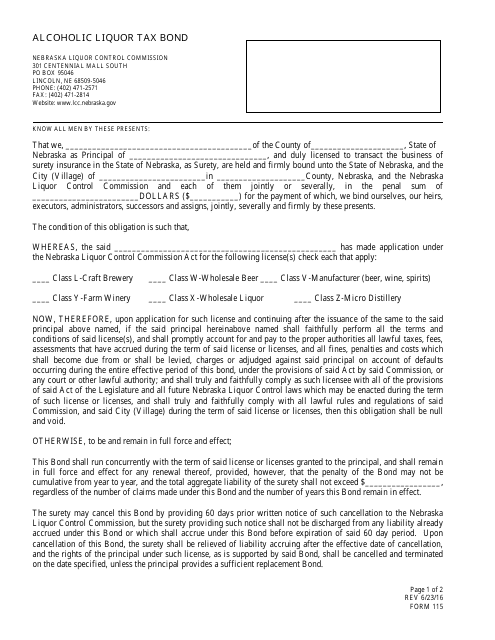

This form is used for obtaining an alcoholic liquor tax bond in the state of Nebraska. It is required for businesses that sell or distribute alcoholic beverages.

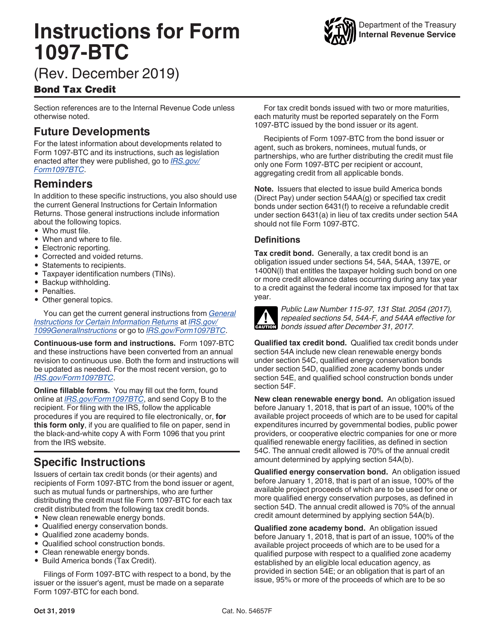

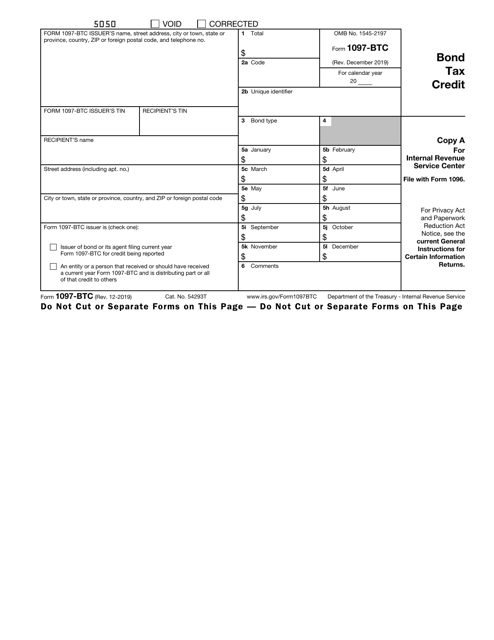

This is a formal IRS document prepared by tax credit bond issuers and taxpayers that distribute the credit in question.

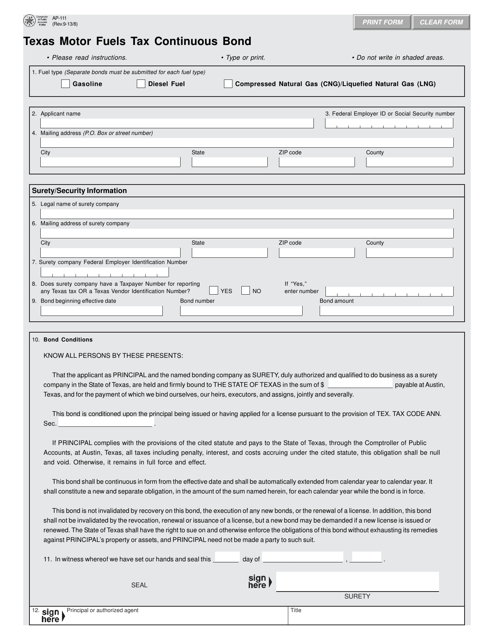

This form is used for Texas businesses to apply for a continuous bond required to comply with motor fuels tax regulations in the state.

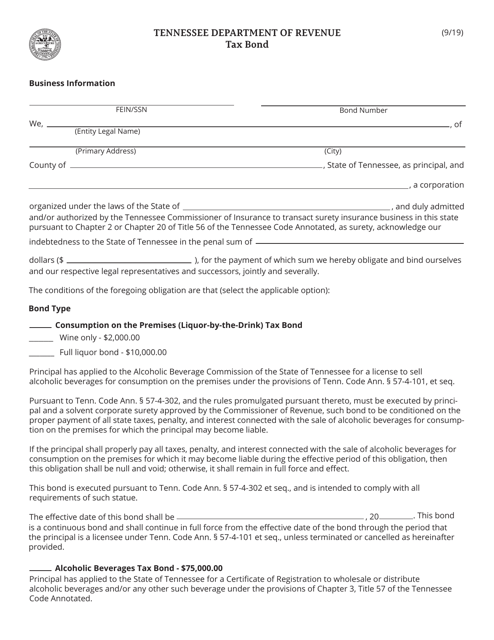

This document is a Tax Bond specific to the state of Tennessee. It is used to provide a guarantee of payment for any tax liabilities owed by an individual or business in Tennessee.

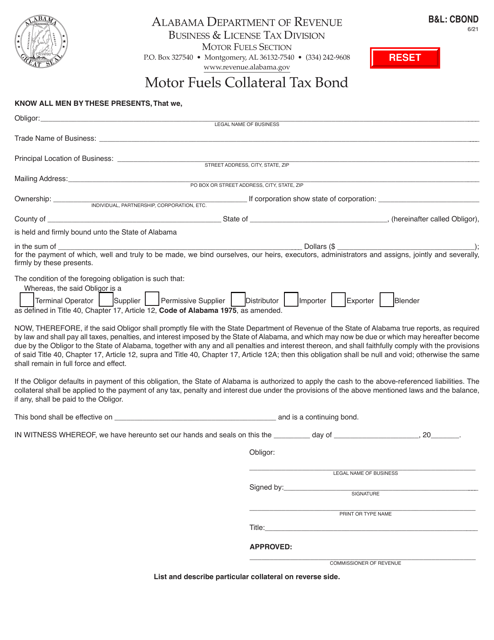

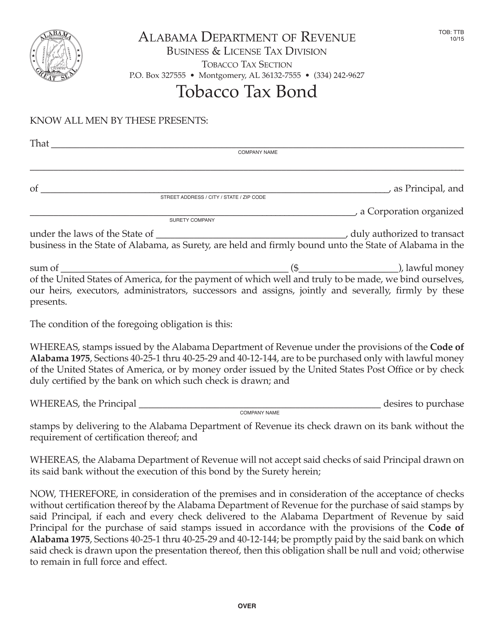

This form is used for obtaining a tobacco tax bond in Alabama.

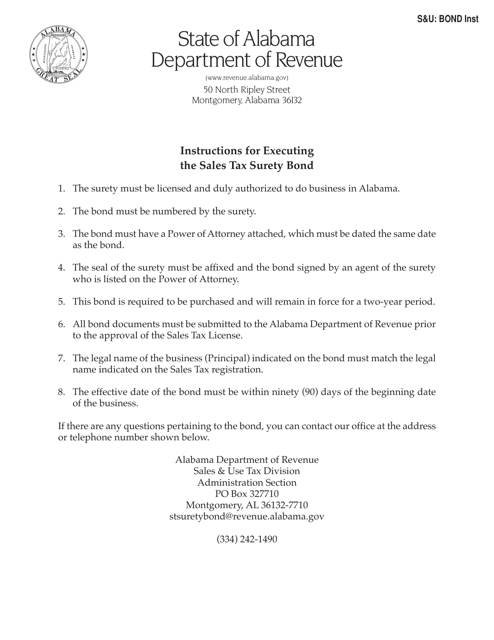

This Form is used for reporting and paying sales tax through a surety bond in the state of Alabama.

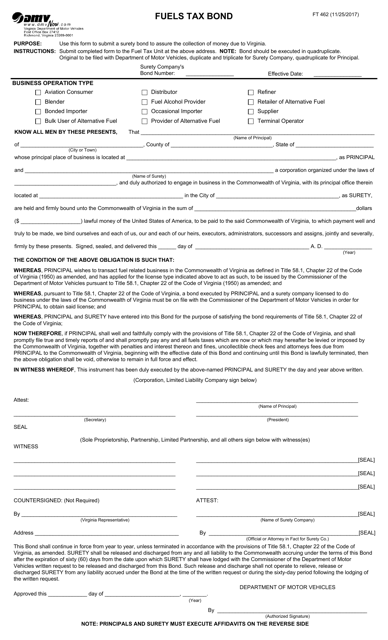

This form is used for applying for a fuels tax bond in the state of Virginia.