Waive Interest Templates

If you are facing financial difficulties and are unable to pay the penalties or interest related to the Goods and Services Tax/Harmonized Sales Tax (GST/HST) or Quebec Sales Tax (QST), there is a solution for you. The option to cancel or waive penalties and interest exists to provide relief to taxpayers in Canada.

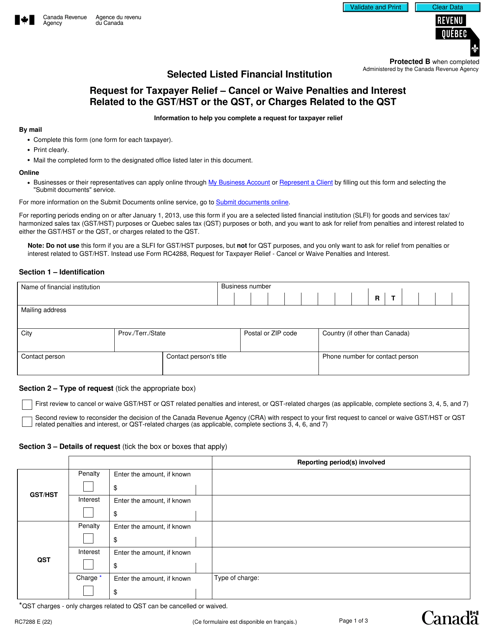

You can seek assistance through the official Request forTaxpayer Relief form (Form RC7288). This form enables you to apply for the cancellation or waiver of penalties or interest related to the GST/HST or QST, as well as charges related to the QST.

The Request for Taxpayer Relief form (Form RC7288) is just one of the options available to you. Through this form, you can request relief from penalties or interest that may have accumulated due to financial hardships or unforeseen circumstances.

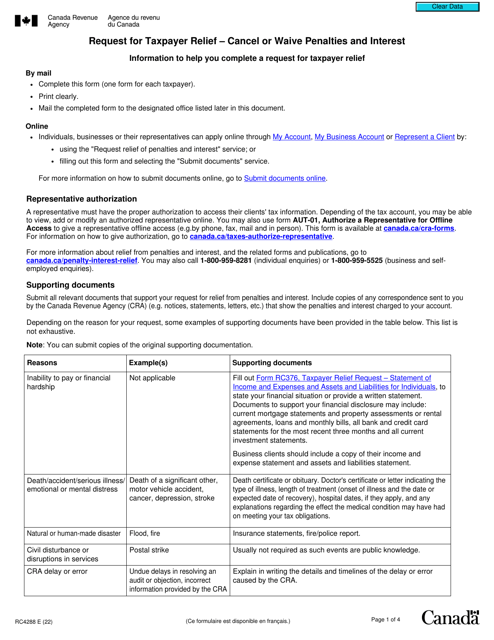

Alternatively, you can also utilize the Request for Taxpayer Relief form (Form RC4288) to request the cancellation or waiver of penalties or interest. These forms are designed to provide a means for taxpayers to seek relief from the financial burden posed by penalties and the accumulation of interest.

By completing the Request for Taxpayer Relief form (Form RC4288), you are making a formal request to the relevant authorities to review your case and consider the cancellation or waiver of penalties and interest that have been imposed upon you.

Remember that seeking relief through these forms requires a valid reason and supporting documentation to demonstrate your financial hardship. The Canada Revenue Agency understands that life circumstances can change, and they are here to help you navigate through these challenging times.

Take advantage of the opportunity to apply for relief from penalties and interest related to taxes in Canada. Explore the available forms, such as the Request for Taxpayer Relief forms (Form RC7288 and Form RC4288), to alleviate the financial strain caused by penalties and interest.

Apply for the cancellation or waiver of penalties and interest today, and take the first step towards regaining your financial stability. Seek relief from penalties and interest related to taxes in Canada by utilizing the appropriate Request for Taxpayer Relief form.

Documents:

5

This form acts as the supporting documentation a Canadian person will need to submit when they are unable to pay their annual taxes due to extenuating circumstances.