Group Term Life Insurance Templates

Group term life insurance, also known as group insurance, is a type of life insurance coverage that is typically offered through employers or organizations to provide financial protection for their employees or members. This type of insurance policy is designed to cover a group of individuals under a single policy, offering economical rates and simplified enrollment.

Group term life insurance provides a range of benefits and options to ensure that your loved ones are financially secure in the event of your passing. It offers flexibility in choosing beneficiaries, as well as the option to make changes to your beneficiaries as life circumstances evolve. The coverage amount can be tailored to meet your needs, giving you the peace of mind that your loved ones will be taken care of.

With group term life insurance, you can rest assured knowing that your beneficiaries will receive a lump sum payment upon your death, which can be used to cover expenses such as funeral costs, outstanding debts, mortgage payments, or even college tuition. This financial support can be invaluable during a difficult time, providing your loved ones with the means to maintain their quality of life.

By participating in a group term life insurance policy, you also benefit from the advantages of being part of a larger group. This includes the ability to secure coverage with minimal medical underwriting, making it accessible to individuals with pre-existing conditions or those who may have difficulty obtaining individual life insurance. Additionally, the cost of group term life insurance is often more affordable compared to purchasing an individual policy.

At our company, we understand the importance of protecting your loved ones and ensuring their financial security. That's why we offer a comprehensive range of group term life insurance options, allowing you to choose the coverage that best suits your needs. Our experienced team is dedicated to providing personalized assistance and guiding you through the process of selecting the right policy for you.

Disclaimer: The information provided here is not an exhaustive list of all available documents related to group term life insurance. The document titles mentioned are for illustrative purposes only and not an endorsement or recommendation. For more information, please refer to the specific documents provided by the insurance provider.

Documents:

7

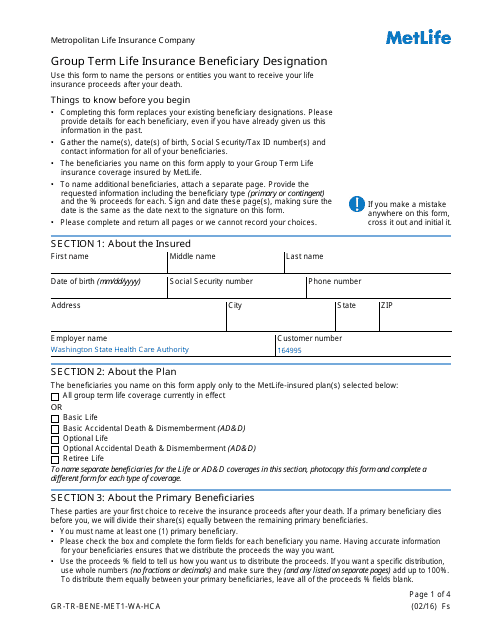

This Form is used for designating beneficiaries for group term life insurance with Metlife.

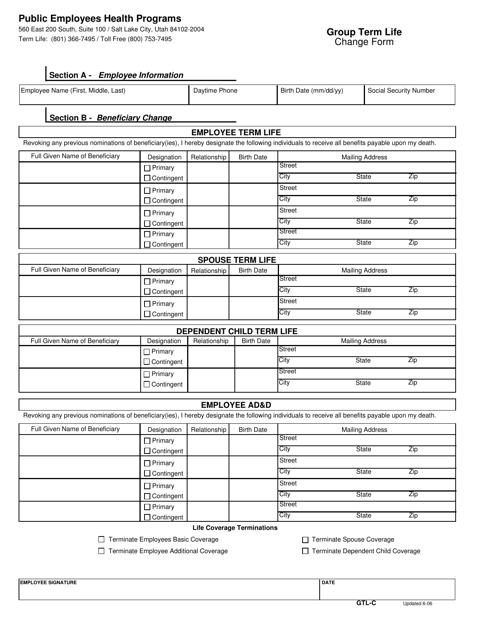

This Form is used for making changes to a Group Term Life insurance policy in the state of Utah.