Foreign Income Exclusion Templates

Are you a US citizen or resident earning income abroad? Are you wondering about the rules and regulations regarding the exclusion of foreign income? Look no further! Our comprehensive collection of documents, also known as the Foreign Income Exclusion, is the ultimate resource for everything you need to know.

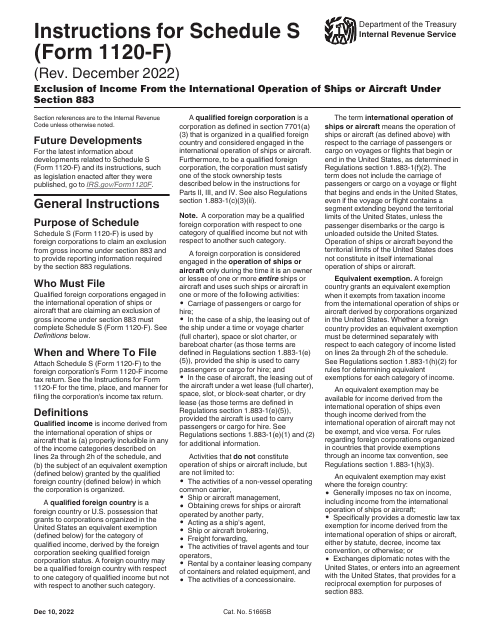

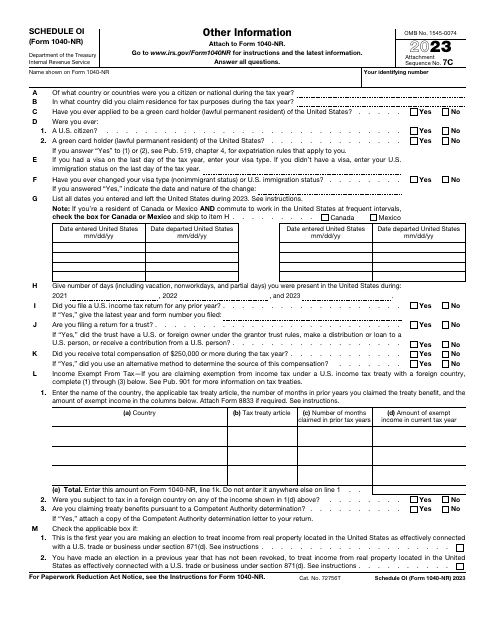

Our collection includes a variety of IRS forms and instructions, such as the Instructions for IRS Form 1120-F Schedule S Exclusion of Income From the International Operation of Ships or Aircraft Under Section 883, IRS Form 2555 Foreign Earned Income, IRS Form 1040-NR Schedule OI Other Information, and more. These documents provide step-by-step guidance on how to accurately report and exclude your foreign income and ensure compliance with tax laws.

With the Foreign Income Exclusion documents, you'll gain valuable insights and information on how to properly calculate your foreign income exclusion, learn about any limitations or restrictions, and understand the various requirements for qualifying for this exclusion. Whether you're a frequent traveler, an expat, or simply earning income from international sources, our documents will provide you with the necessary tools to navigate the complex world of foreign income exclusion.

Don't miss out on potential tax savings and avoid penalties by ensuring you have access to accurate and up-to-date information. Explore our Foreign Income Exclusion documents today and stay informed about the rules and regulations surrounding the exclusion of foreign income.