Assets Distribution Templates

Are you in need of a comprehensive guide on how to distribute assets? Look no further than our extensive collection of documents on assets distribution. Whether you refer to it as asset distribution, distributing assets, or even by its alternate names such as the distribute assets form or asset distribution forms, our wide range of resources has got you covered.

Within our assets distribution collection, you will find a variety of helpful documents to assist you in the process. From the Form AU-101-C Legacy, Succession and Estates Trust Report - New Hampshire to the Transfer on Death Deed Form - Montana, and the Small Estate Affidavit Forms for Iowa and Oklahoma, we have a diverse range of forms tailored to different states and scenarios. Additionally, if you are a married individual without children in Texas, we have a specific Will Form designed just for you.

Navigating the complexities of assets distribution can be a daunting task, but our documents are here to simplify the process for you. With easy-to-understand instructions and legally binding templates, our assets distribution collection ensures that you are well-equipped to handle the distribution of your assets efficiently and effectively.

Don't let the distribution of your assets become a source of stress or confusion. Trust in our assets distribution document collection to provide you with the guidance and resources you need. Explore our extensive selection today and gain peace of mind knowing that your assets distribution process is in capable hands.

Documents:

62

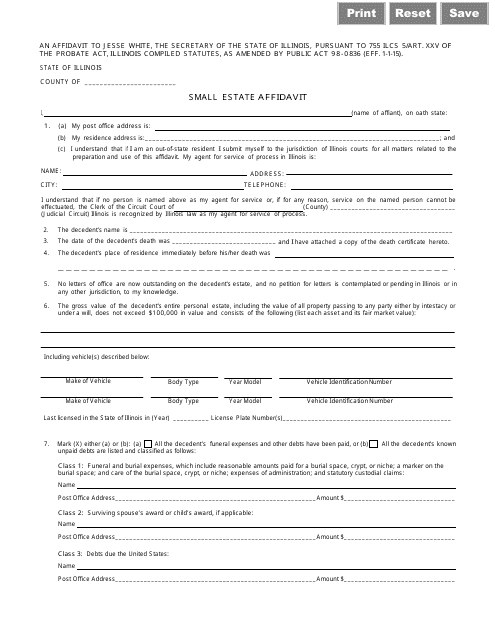

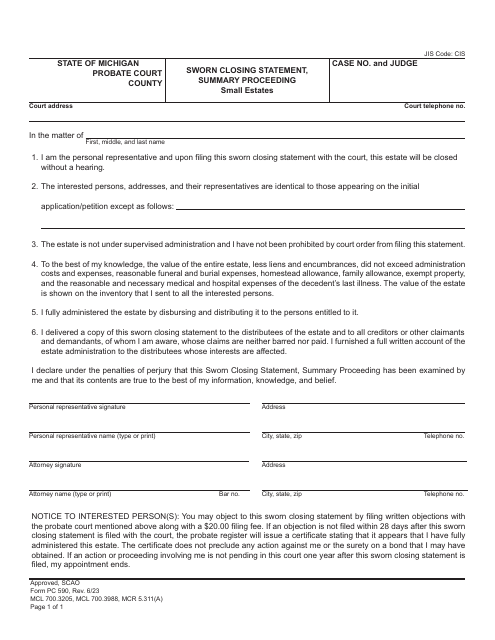

This type of form is used in Illinois and refers to a formal document that gives legal heirs of the deceased individual the right to distribute the latter's assets without having to appear in court.

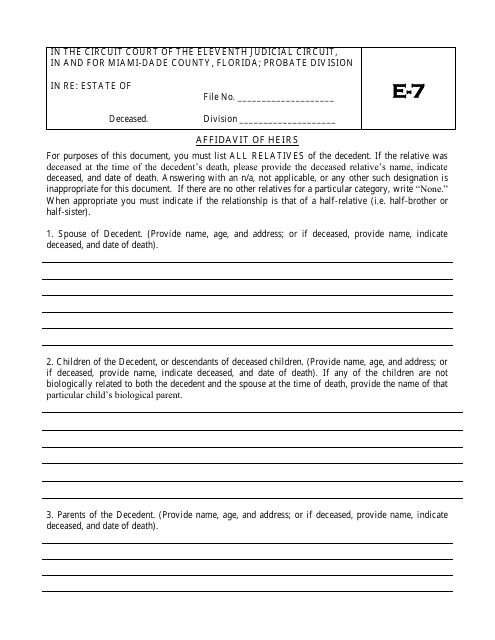

This form is used for declaring the legal heirs of a deceased person in the state of Florida. It helps establish the rightful beneficiaries of the estate.

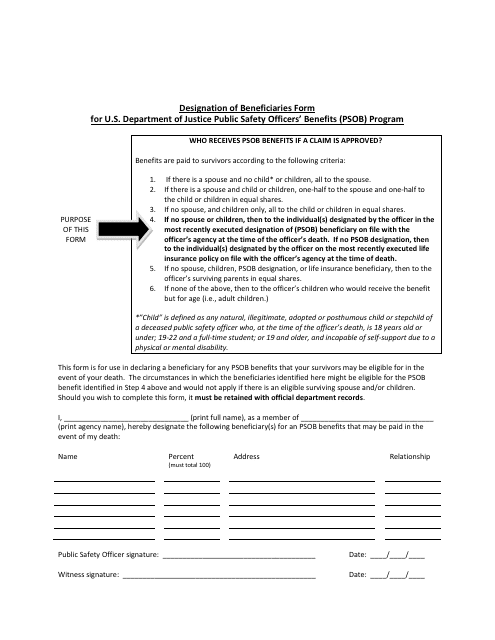

This form is used for designating beneficiaries for a retirement plan, life insurance policy, or other types of financial accounts.

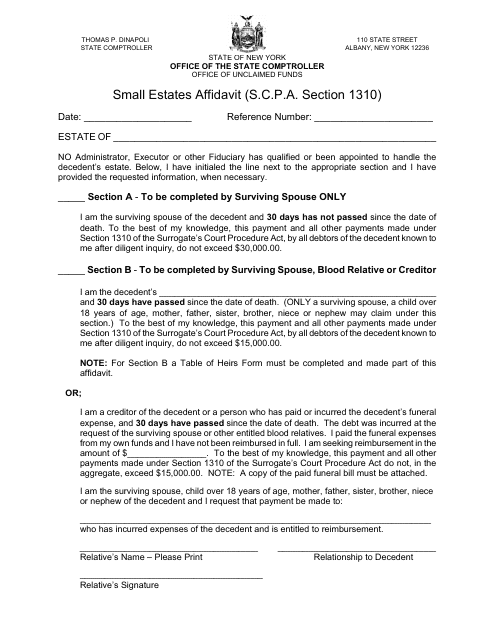

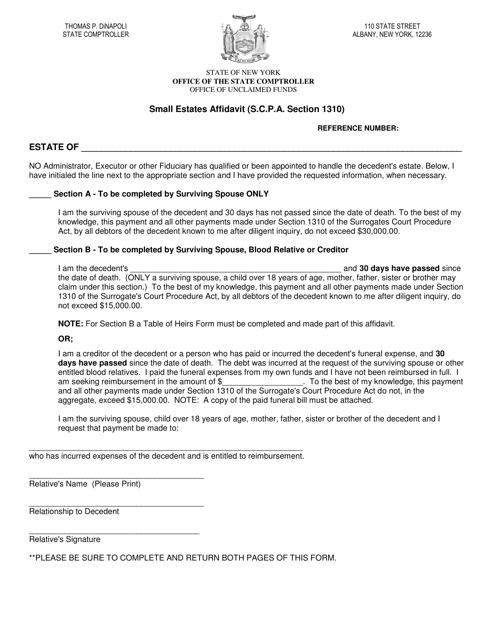

This form is used for declaring the assets and debts of a deceased individual in New York when their estate is small.

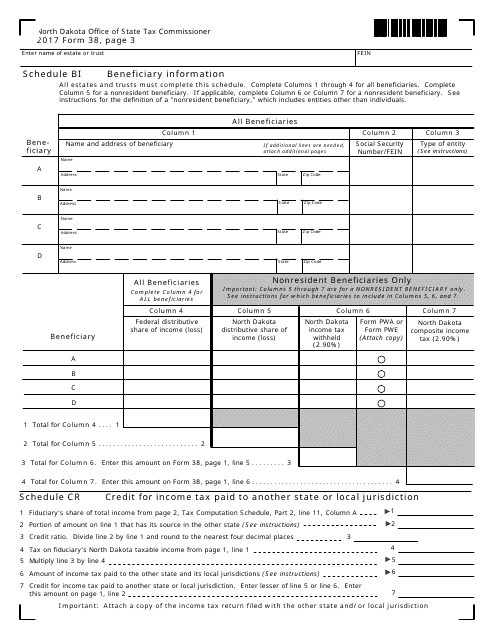

This form is used for providing beneficiary information in North Dakota.

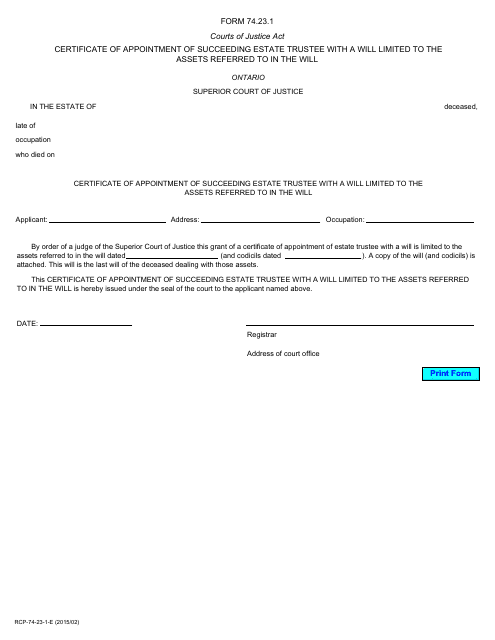

This type of document is used in Ontario, Canada to appoint a new estate trustee with a will, limited to the assets mentioned in the will.

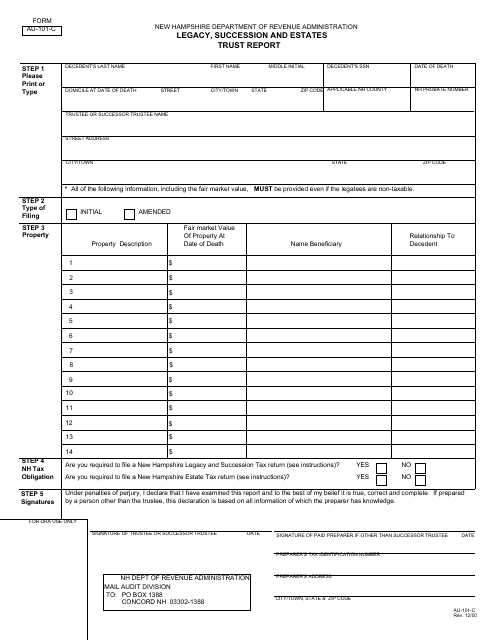

This form is used for reporting legacy, succession, and estate trusts in the state of New Hampshire.

For individuals that reside in the state of New York, this type of form is a legal document that allows an individual inheriting a small estate to become the new legal owner after the decedent has passed away.

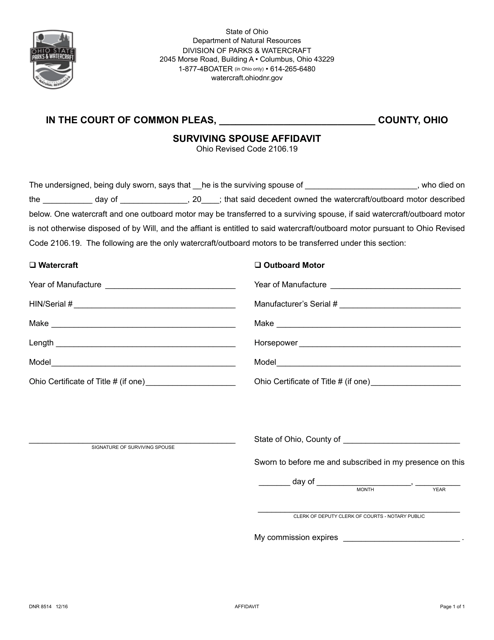

This form is used for filing an affidavit by a surviving spouse in Ohio.

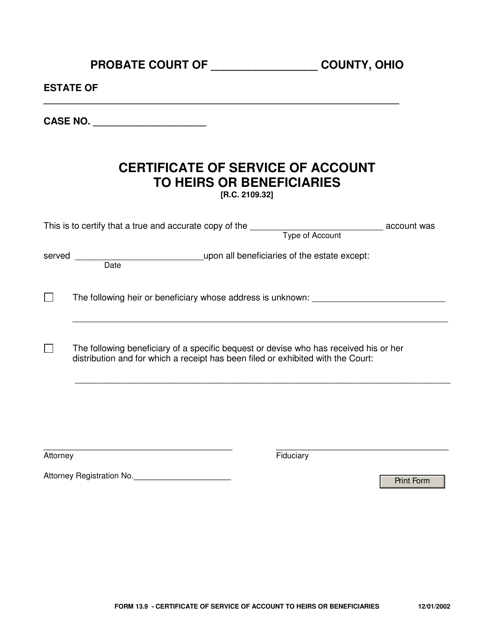

This form is used for certifying the service of an account to heirs or beneficiaries in the state of Ohio.

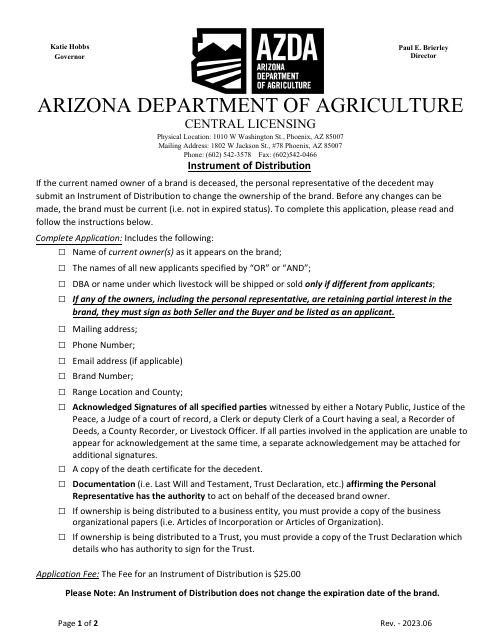

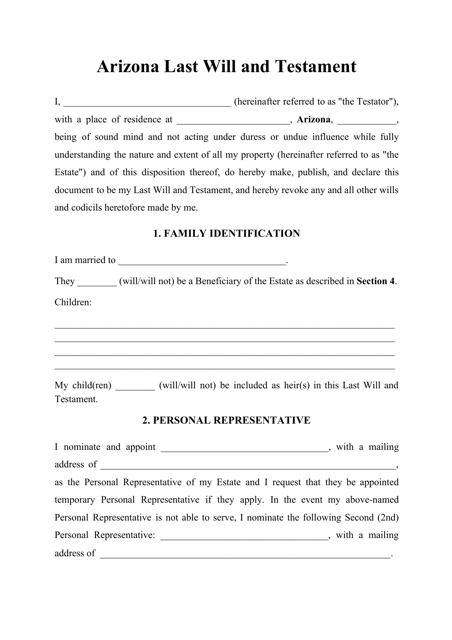

This Arizona-specific form lists the terms for distribution of the deceased person's property in the state.

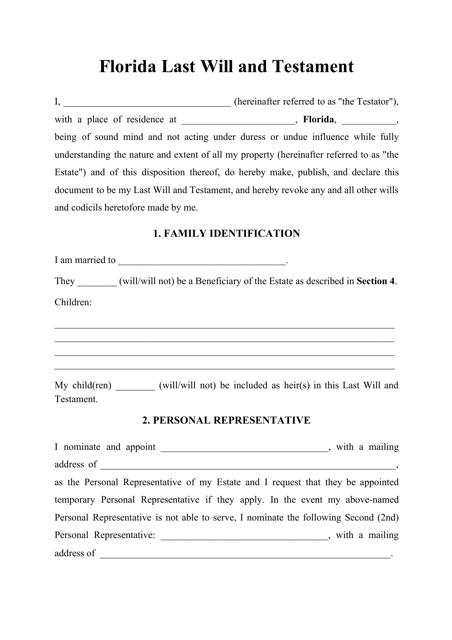

Download this Florida-specific form if you need to create a document that would outline the terms and conditions for the distribution of the deceased person's possessions and property.

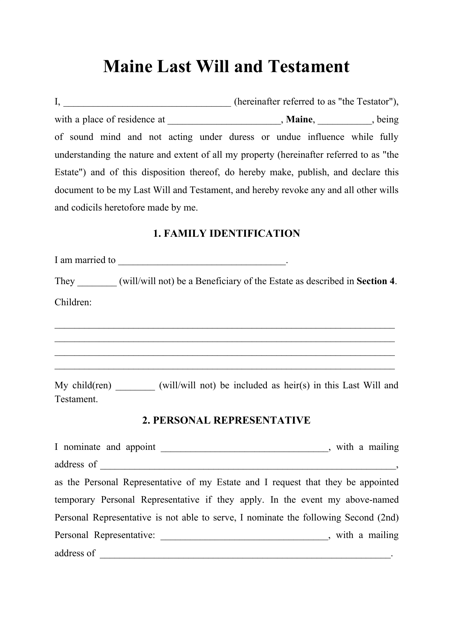

Download this Maine-specific document that is used for defining how a person's possessions and property should be distributed after their death.

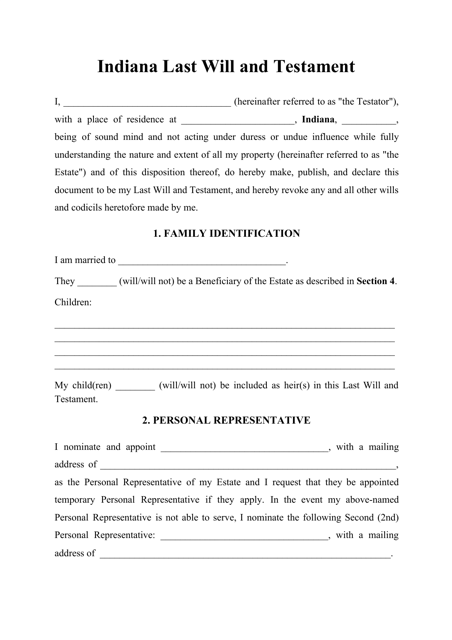

This Indiana-specific form lists the provisions for the distribution of the deceased person's property and belongings.

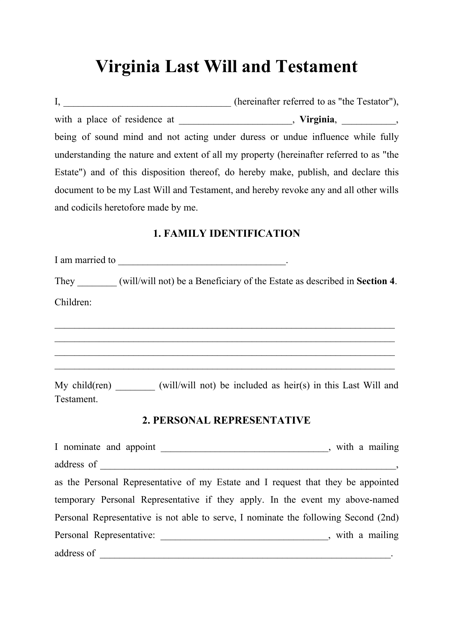

This Virginia-specific form lists the terms for distribution of the deceased person's property in the state.

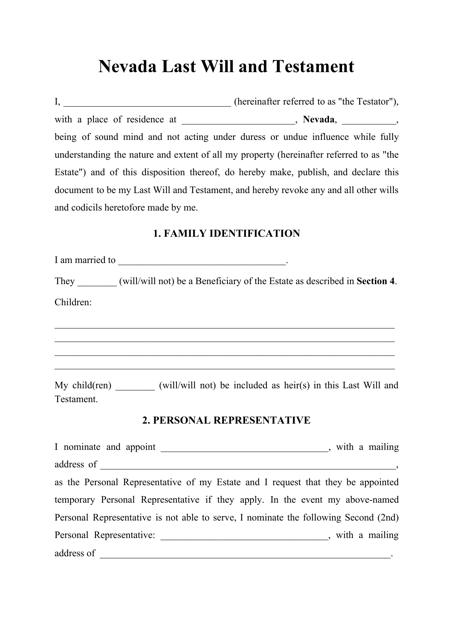

This Nevada-specific form lists the terms for distribution of the deceased person's property in the state.

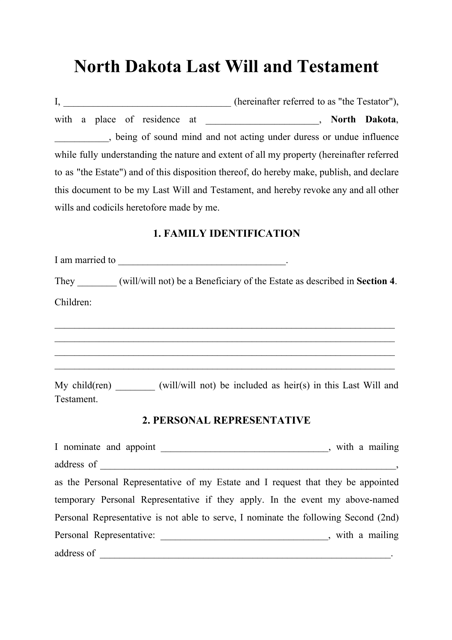

Download this North Dakota-specific form if you need to create a document that would outline the terms and conditions for the distribution of the deceased person's possessions and property.

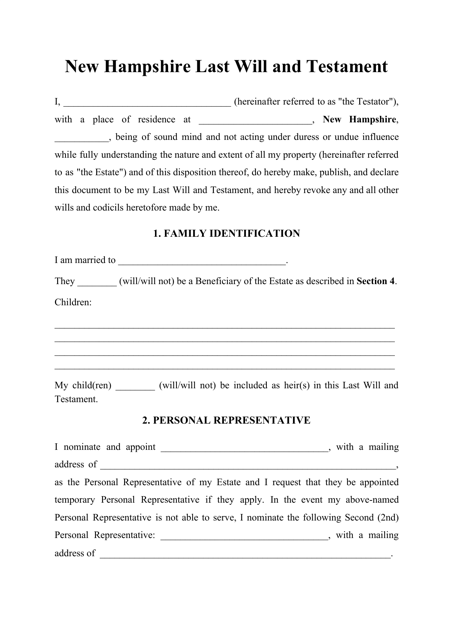

Download this New Hampshire-specific form that is used for determining how a person's possessions and property should be distributed after their death.

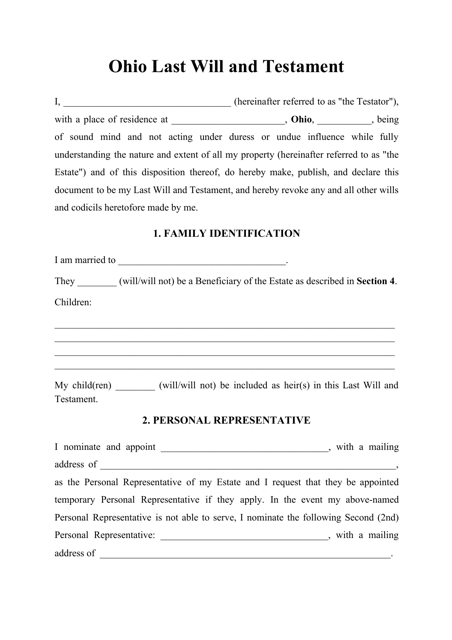

Download this Ohio-specific form if you need a document that determines the distribution of the deceased person's possessions and property.

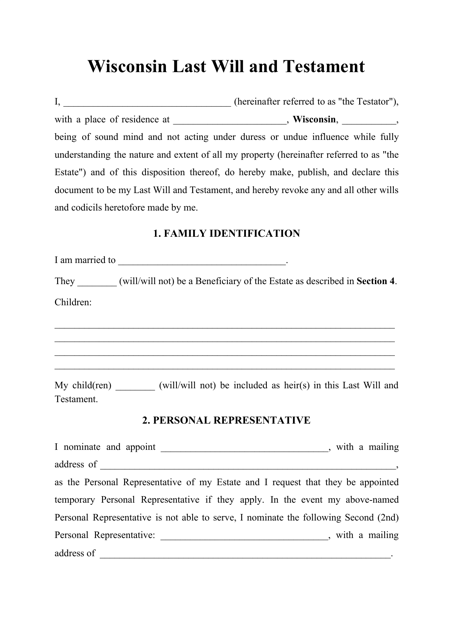

Download this Wisconsin-specific form that lists the terms and conditions for the distribution of the deceased person's property in the state.

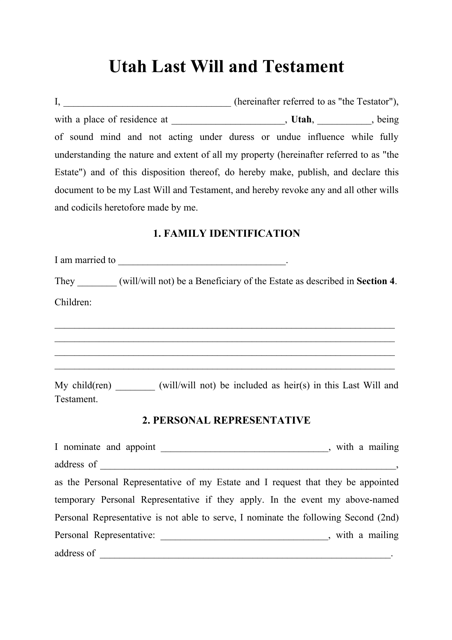

This document is used in the state of Utah and serves the purpose of determining the distribution of the property of the deceased person.

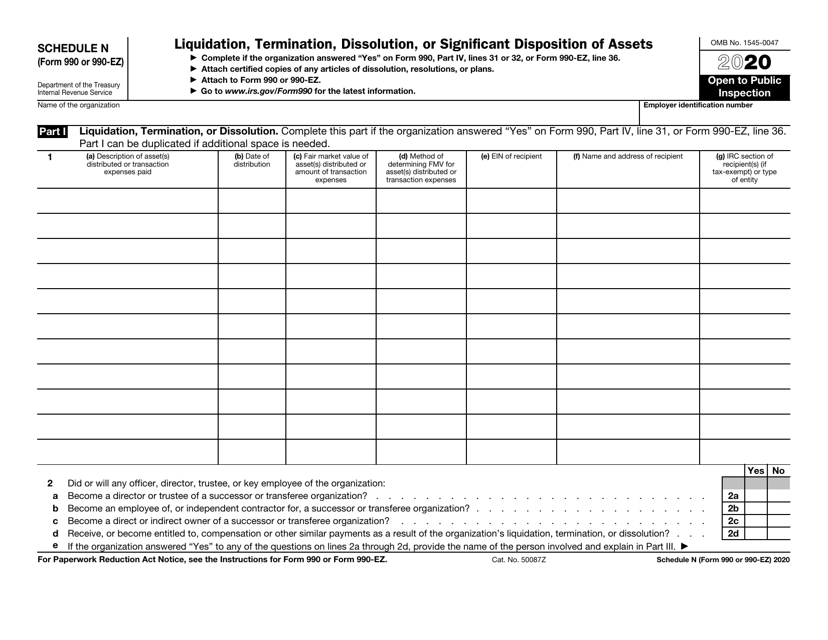

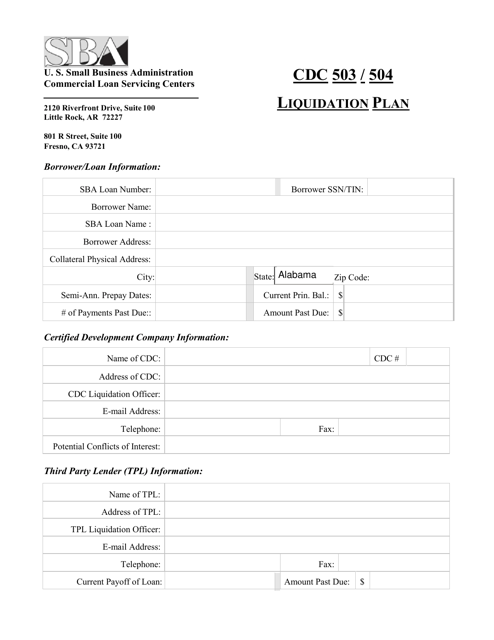

This document is a Liquidation Plan used by the CDC (Centers for Disease Control and Prevention). It outlines the process for liquidating assets or dissolving the organization.

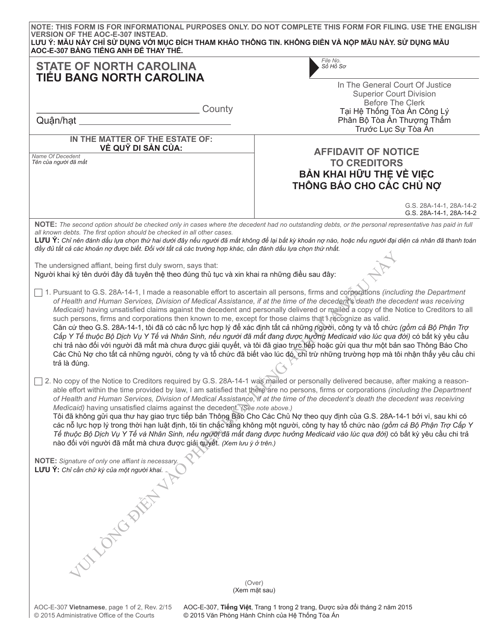

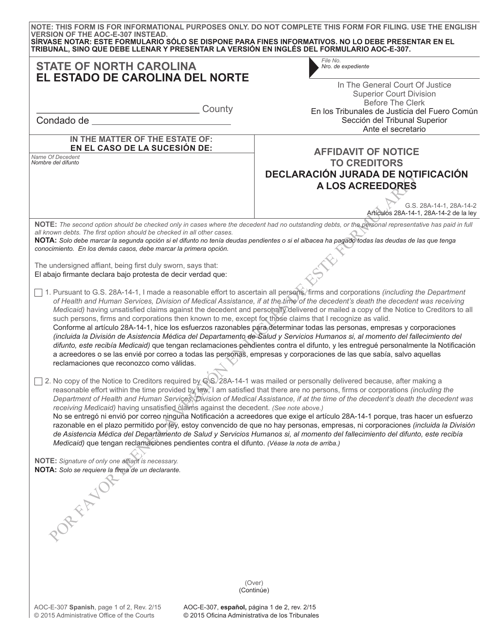

This document is used for filing an Affidavit of Notice to Creditors in North Carolina. It is available in both English and Vietnamese languages.

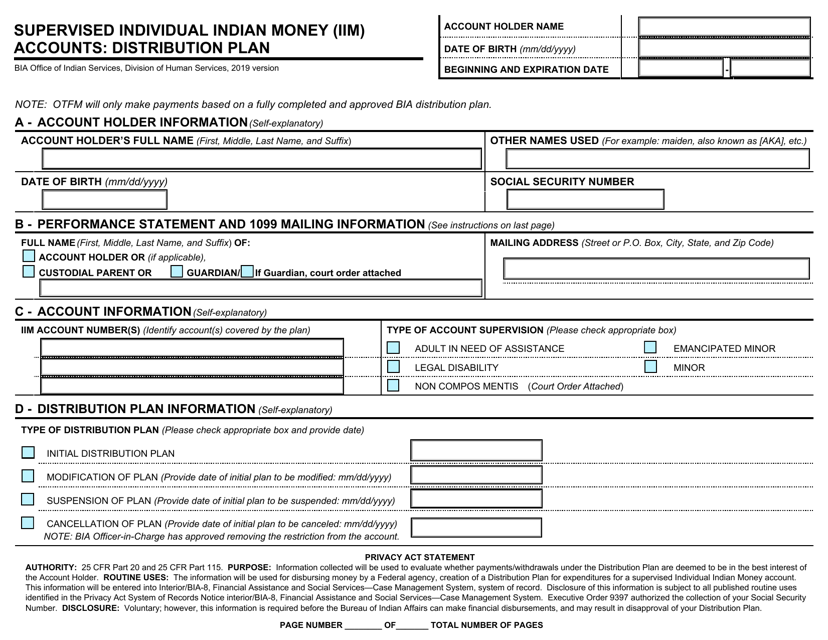

This document explains the distribution plan for Supervised Individual Indian Money (IIM) accounts. It outlines the process of allocating funds to eligible individuals.

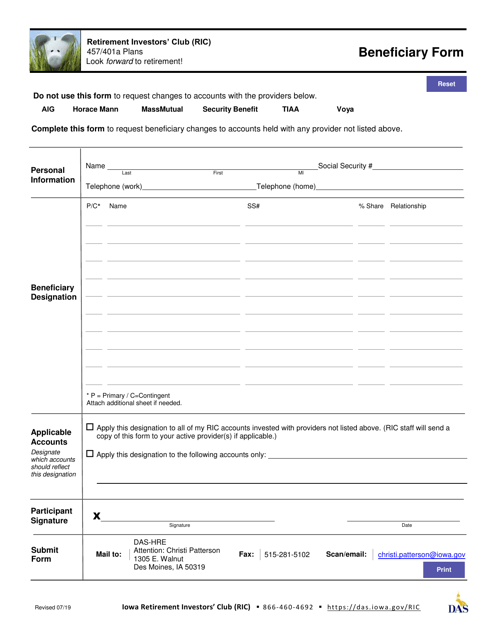

This Form is used for designating a beneficiary for certain assets or benefits in the state of Iowa.

This form is used for filing an affidavit of notice to creditors in North Carolina. It is available in both English and Spanish.

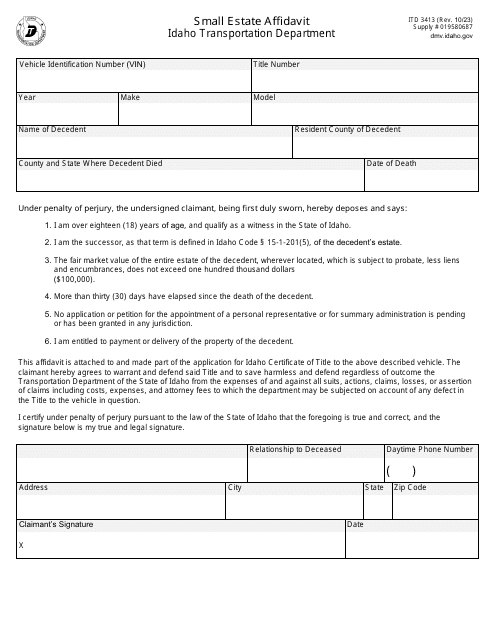

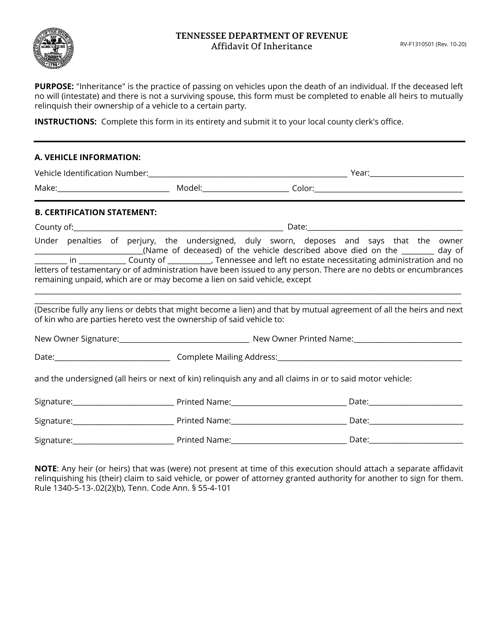

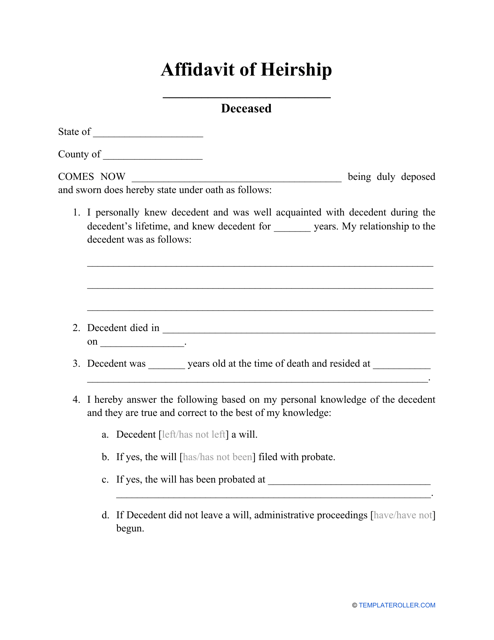

An Affidavit of Heirship defines the presenсe of the inheritors of a deceased person who has not left a will.

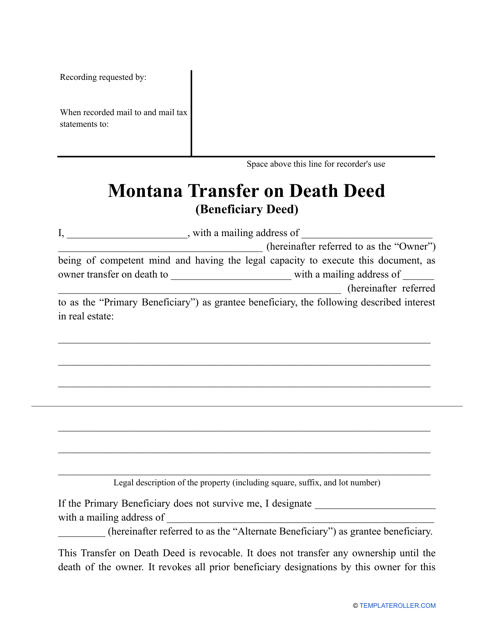

Complete this printable Transfer on Death Deed template when making your own Deed in the state of Montana.

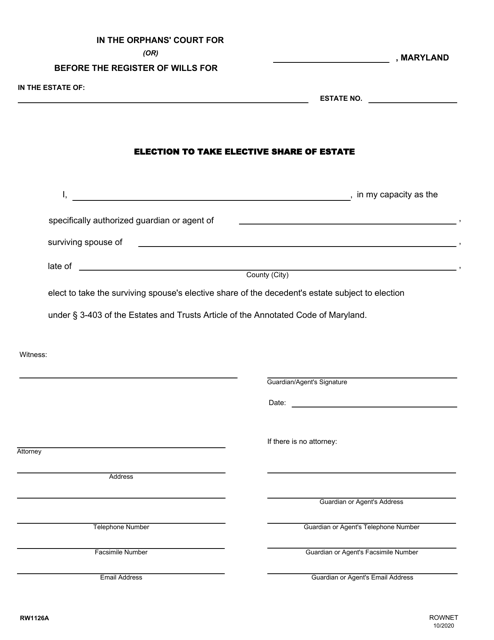

This form is used for electing to take the elective share of an estate in the state of Maryland. It is a legal document that allows a surviving spouse to claim a portion of the deceased spouse's estate, even if they were not included in the will.

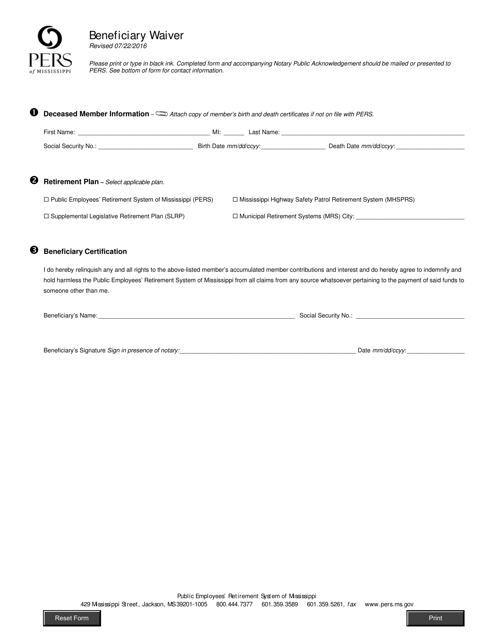

This document is used in Mississippi for a beneficiary to waive their rights or claims to certain benefits or assets.

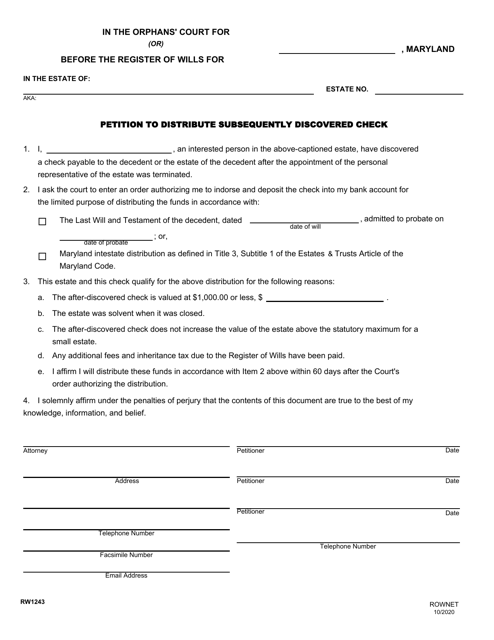

This Form is used for filing a petition in Maryland to distribute a subsequently discovered check.

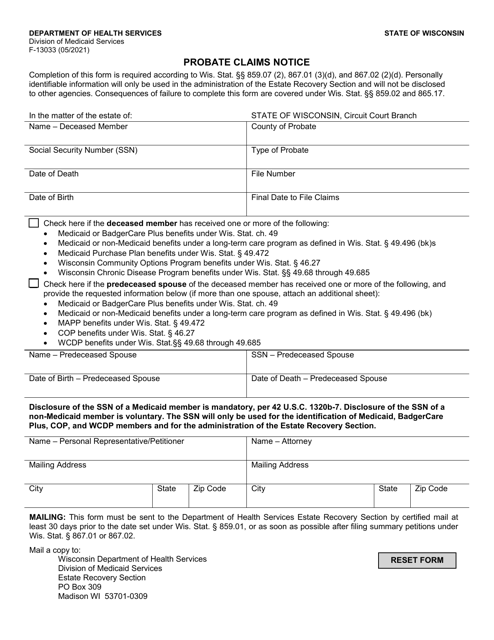

This form is used for submitting probate claims in the state of Wisconsin. It provides the necessary information and notice requirements for individuals to file claims against a deceased person's estate.

This document is used for transferring property in the state of Arizona when the estate is small. It allows for a simplified process when there is no need for probate court involvement.