Loan Disclosures Templates

Are you considering taking out a loan? Before you sign on the dotted line, it's important to be fully informed about the terms and conditions of your loan. That's where loan disclosures come in.

Loan disclosures, also known as loan disclosure forms or loan agreement documents, provide you with all the necessary information about your loan. These documents are designed to protect you as a borrower and ensure transparency between you and the lender. They outline key details such as the loan amount, interest rate, repayment terms, and any fees or penalties associated with the loan.

Loan disclosures serve as a legal and binding agreement between you and the lender. By reviewing these documents, you can make an informed decision about whether the loan is right for you. They give you the opportunity to fully understand the terms and conditions of the loan, including any potential risks or obligations.

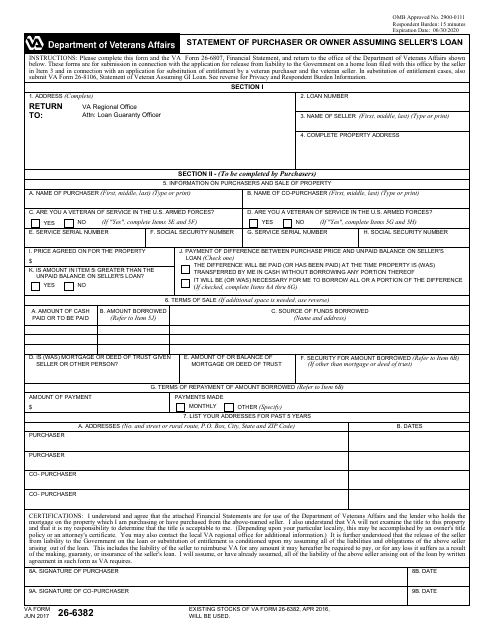

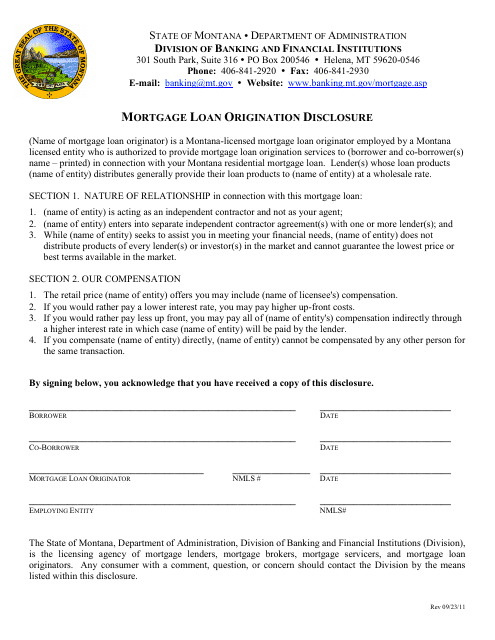

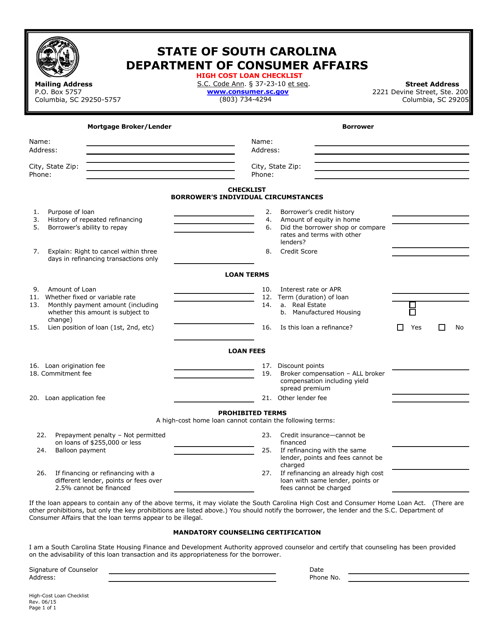

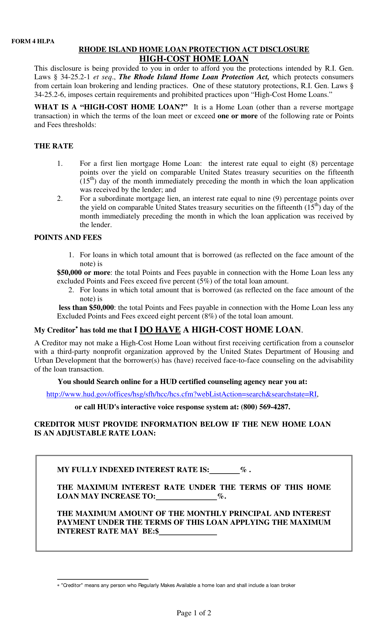

Examples of loan disclosure documents include the VA Form 26-6382 Statement of Purchaser or Owner Assuming Seller's Loan, Mortgage Loan Origination Disclosure Form - Montana, High Cost Loan Checklist - South Carolina, and Form 4 Rhode Island Home Loan Protection Act Disclosure High-Cost Home Loan - Rhode Island. Each of these documents is specific to the respective state or loan type and provides borrowers with the necessary information to make an informed decision.

By having access to loan disclosures, you can ensure that you understand the terms and conditions of your loan and make confident financial decisions.

Documents:

12

This Form is used for buyers or owners who are assuming the seller's loan.

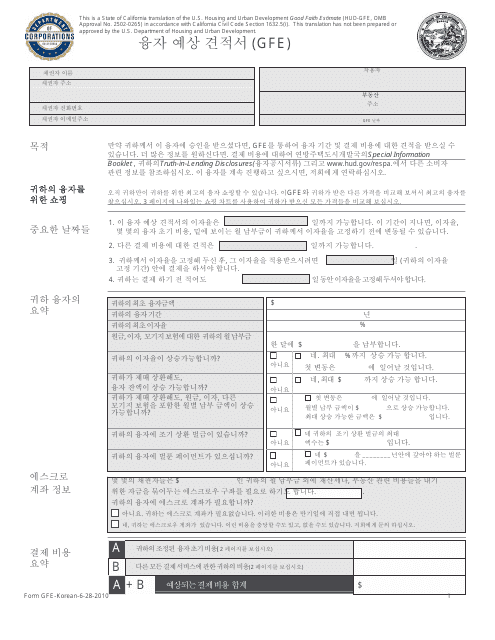

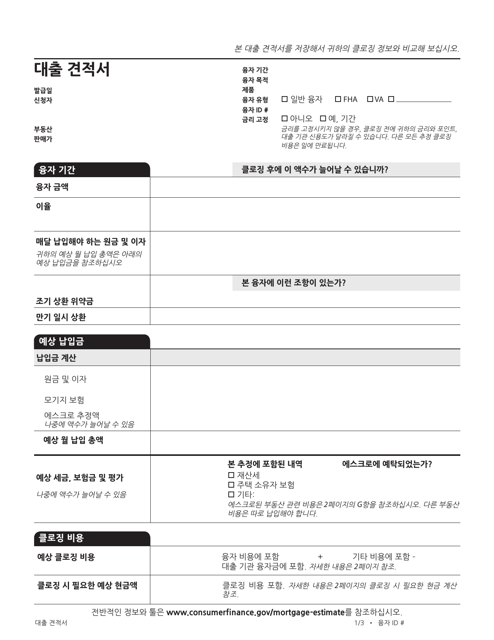

This type of document is used for providing an estimate of the closing costs for a mortgage loan in California. The form is available in Korean.

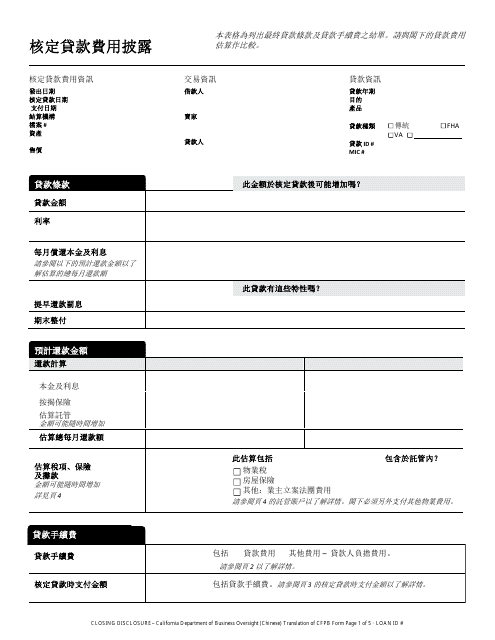

This document is used for providing closing details in a real estate transaction in California. It is available in Chinese language for convenience.

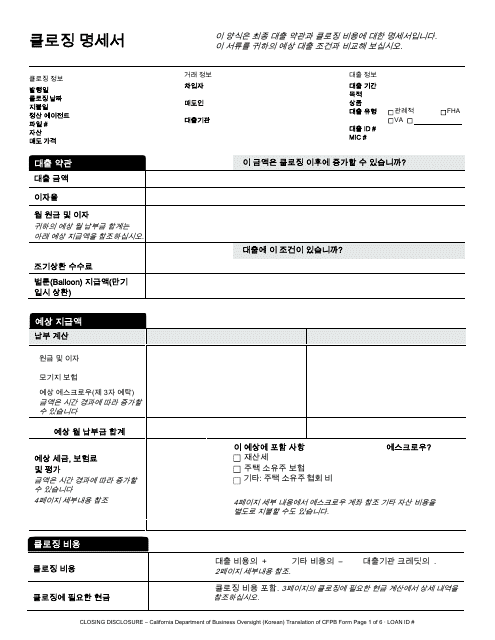

This document is used for providing the final details of a mortgage loan to a borrower in California who speaks Korean. It is required by law and outlines the terms and costs associated with the loan.

This form is used for disclosing important information about the mortgage loan origination process in Montana. It provides details about the terms, fees, and costs associated with obtaining a mortgage loan.

This document provides a loan estimate form from the Consumer Financial Protection Bureau specifically for residents of California who speak Korean. The form is used to understand the terms and costs associated with a loan.

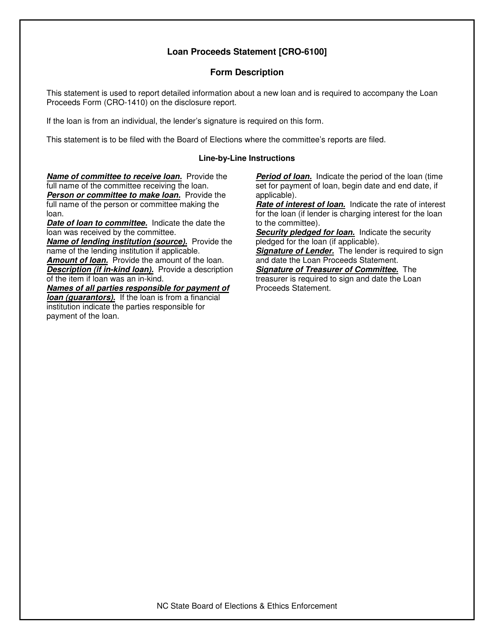

This form is used to provide instructions for completing Form CRO-6100 Loan Proceeds Statement in North Carolina. It provides guidance on how to accurately report loan proceeds for various purposes.

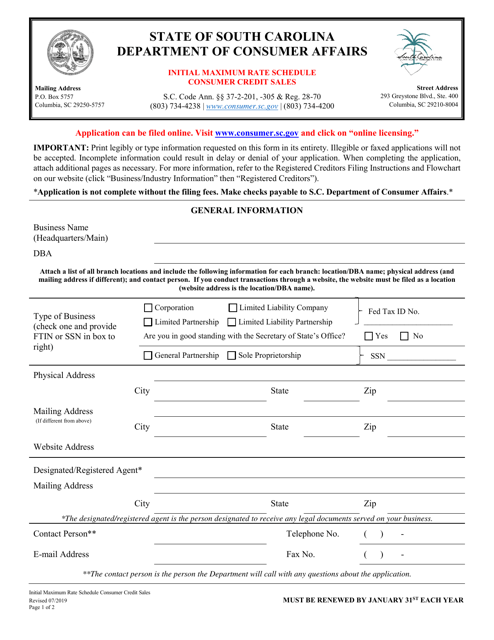

This document provides the maximum interest rates for consumer credit sales in South Carolina.

This document is a checklist that helps South Carolina residents assess the expenses and terms associated with high-cost loans in order to make informed decisions.

This form is used for disclosing information related to high-cost home loans in Rhode Island under the Rhode Island Home Loan Protection Act. It provides important details about the loan terms and costs.

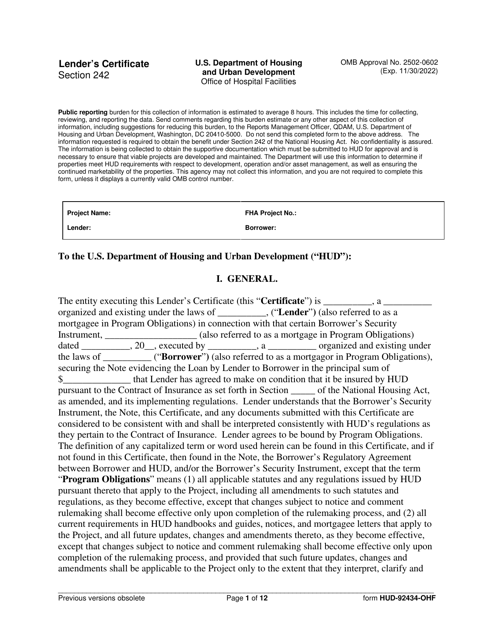

This form is used for lenders to certify compliance with specific requirements for the OneHome Program.

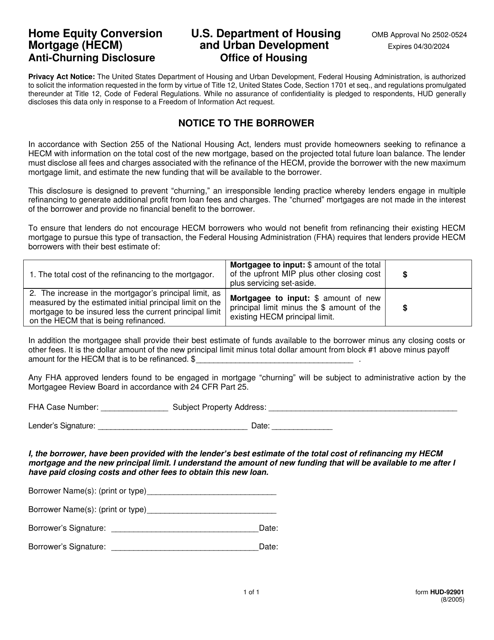

This form is used for disclosing information related to anti-churning in Home Equity Conversion Mortgages (HECMs).