Property Tax Relief Templates

Are you a homeowner looking for ways to alleviate the burden of property taxes? Our property tax relief program is designed to provide you with financial assistance and peace of mind. We understand that property taxes can be overwhelming, especially for those on a fixed income or facing financial hardship. That's why we offer a range of options to help reduce or even eliminate your property tax costs.

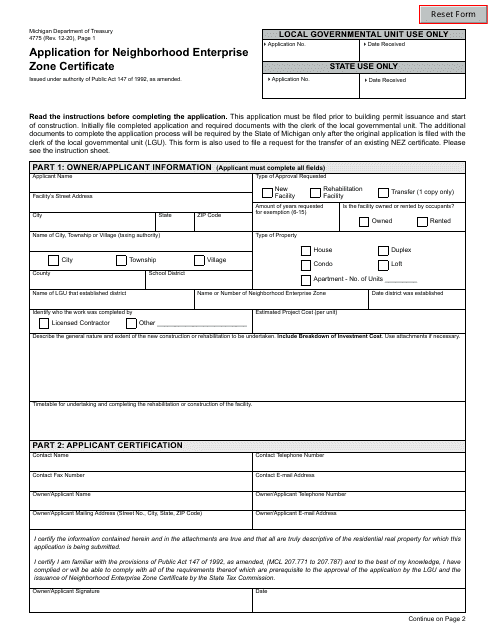

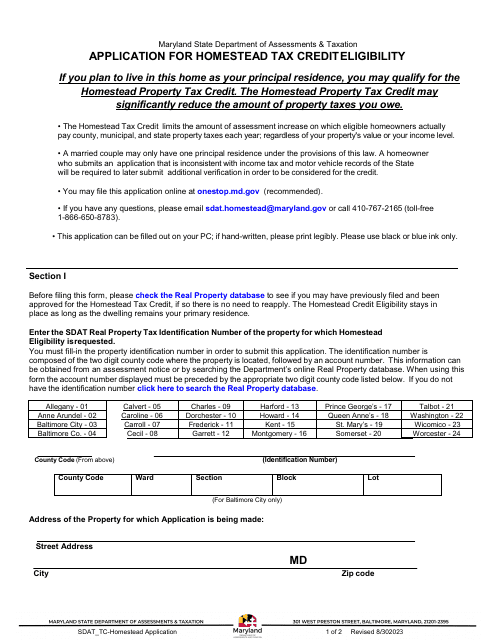

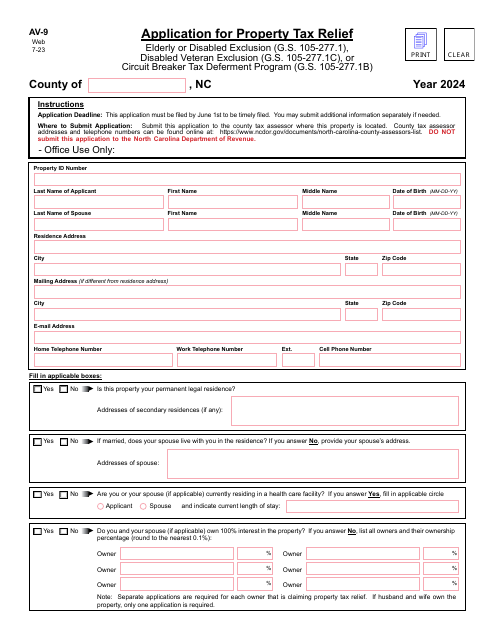

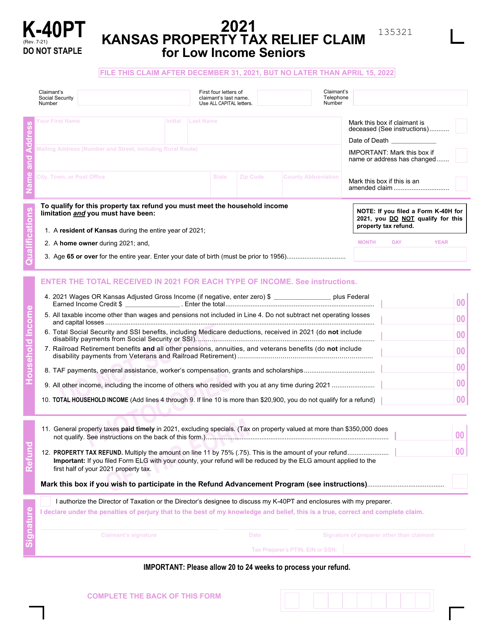

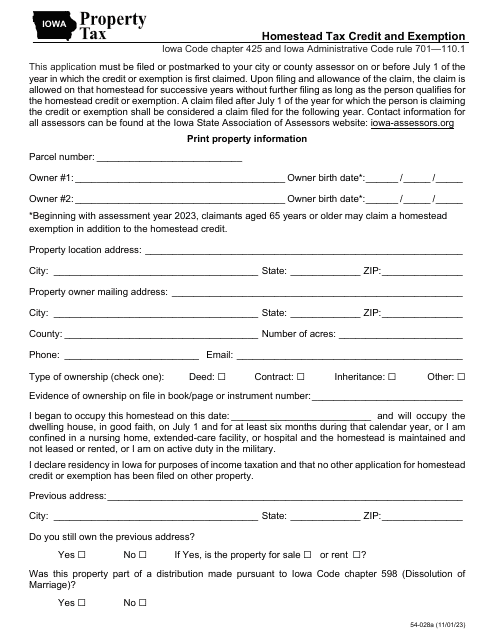

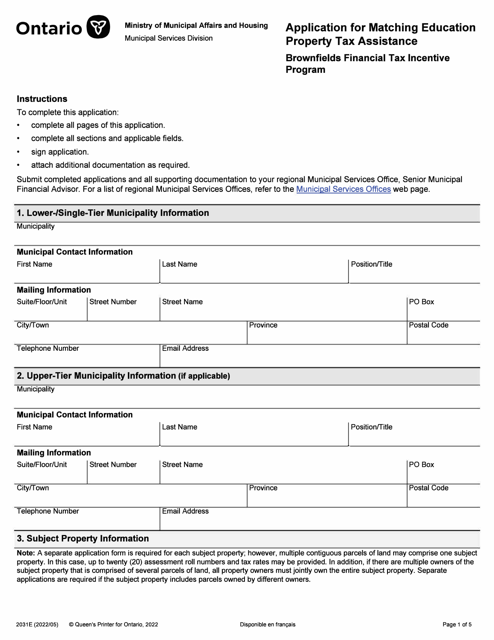

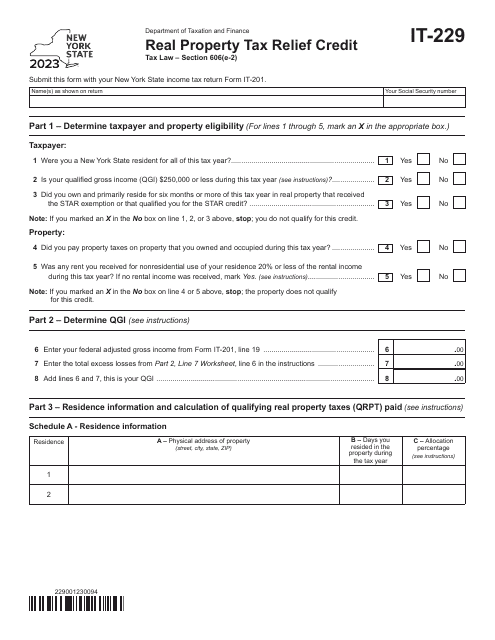

Our program, also known as property tax relief, aims to make the application process as simple as possible. Whether you're applying for a neighborhood enterprise zone certificate, an exemption for blind persons, or seeking relief through small retailer property tax credits, we have the resources and forms you need to get started. Our user-friendly online platform allows you to access and fill out the necessary forms from the comfort of your own home.

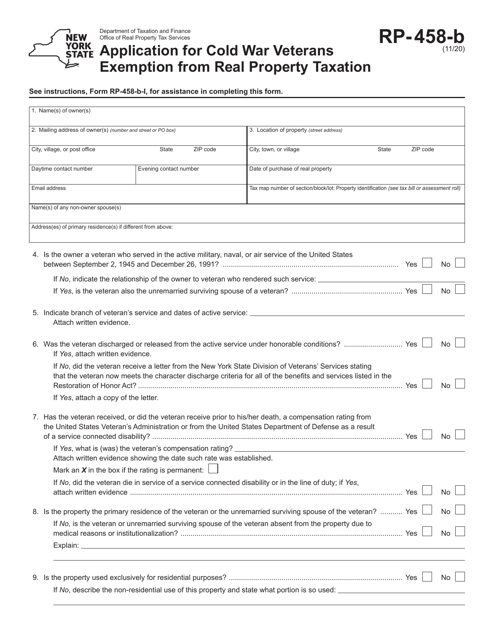

At Templateroller.com, we recognize the importance of property tax relief for disabled veterans and their survivors. That's why we offer a specific exemption for those who have bravely served our country. By taking advantage of this program, eligible individuals can significantly reduce their property tax burdens and free up funds for other essential expenses.

Rest assured that our property tax relief program is designed to make a difference in your life. We understand that every situation is different, and our knowledgeable team is ready to assist you in finding the best solution for your needs. Don't let high property taxes weigh you down – explore our property tax relief options today and experience the financial relief you deserve.

(Note: If you are unable to write the text, please let me know and I will provide an alternative response)

Documents:

48

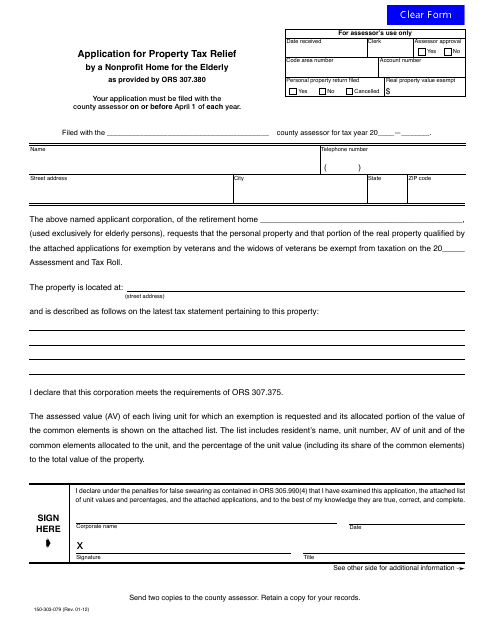

This form is used for nonprofit homes for the elderly in Oregon to apply for property tax relief. It helps them reduce their tax burden and continue providing essential services for the elderly population.

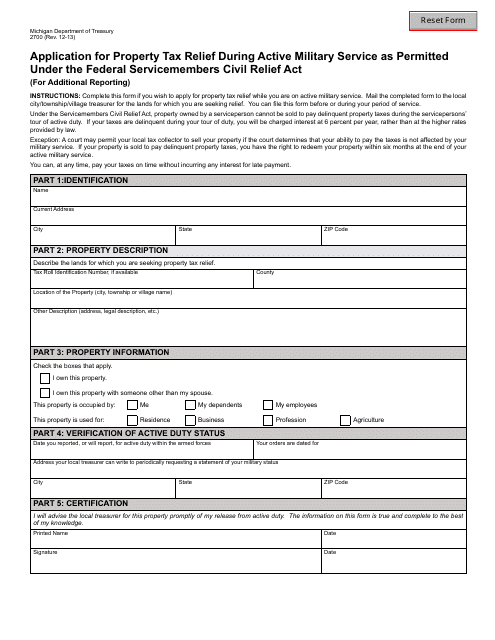

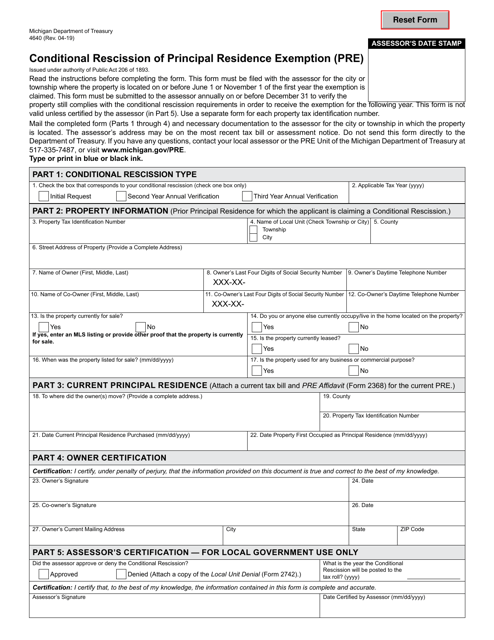

This Form is used for applying for property tax relief in Michigan for individuals serving in active military duty under the Federal Service Members Civil Relief Act.

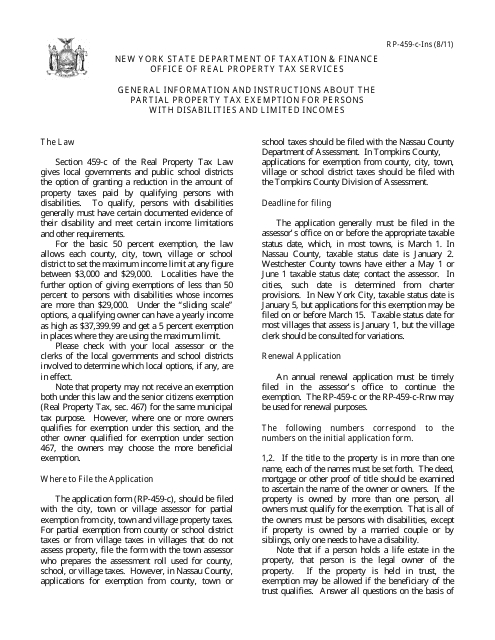

This Form is used for claiming a partial property tax exemption in New York for individuals with disabilities and limited incomes. It provides instructions on how to apply for the exemption and the documentation required.

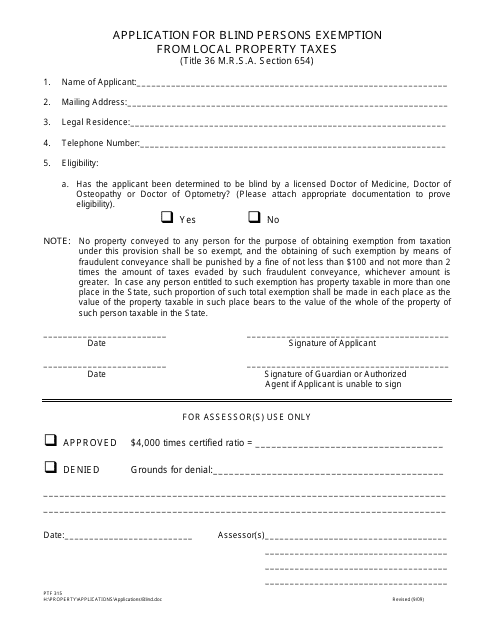

This form is used for applying for an exemption from local property taxes in Maine for blind persons.

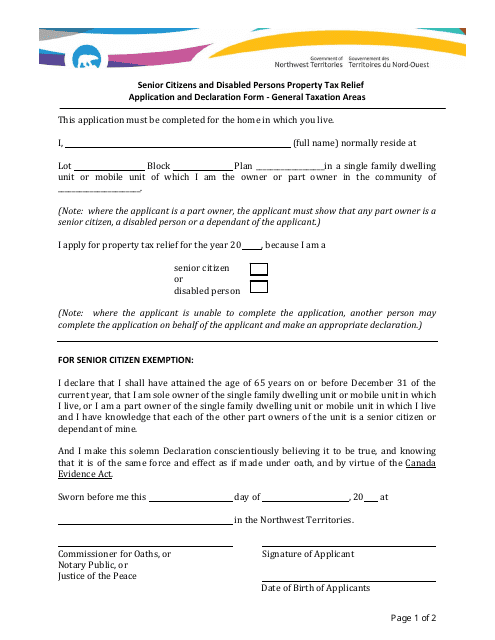

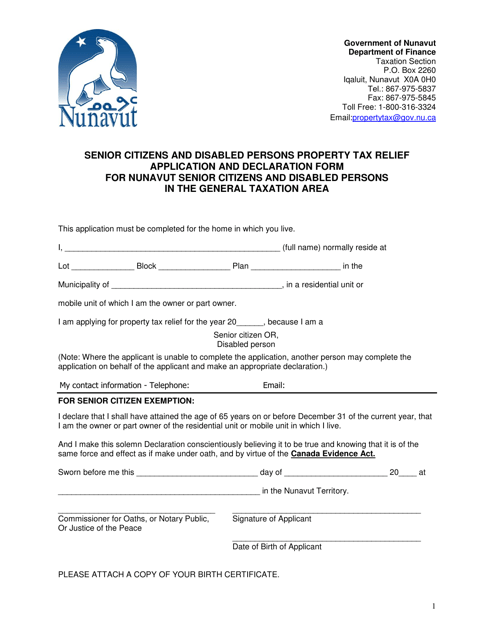

This form is used for applying for property tax relief specifically for senior citizens and disabled persons in the Northwest Territories, Canada. It is applicable in general taxation areas.

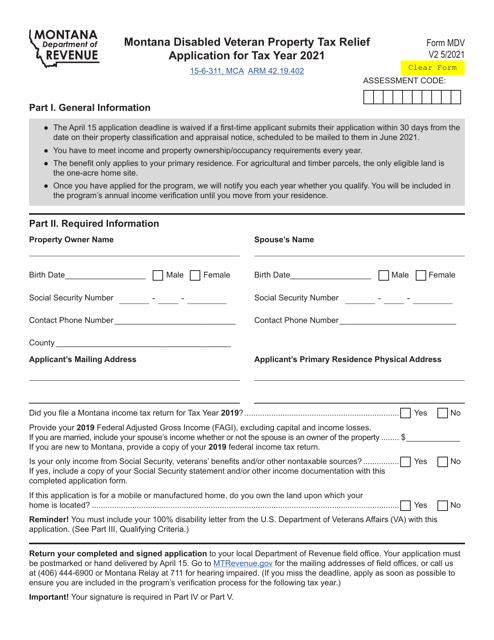

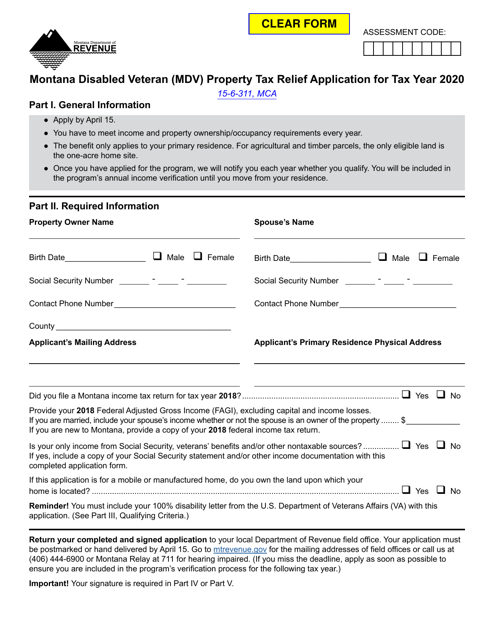

This form is used for disabled veterans in Montana to apply for property tax relief.

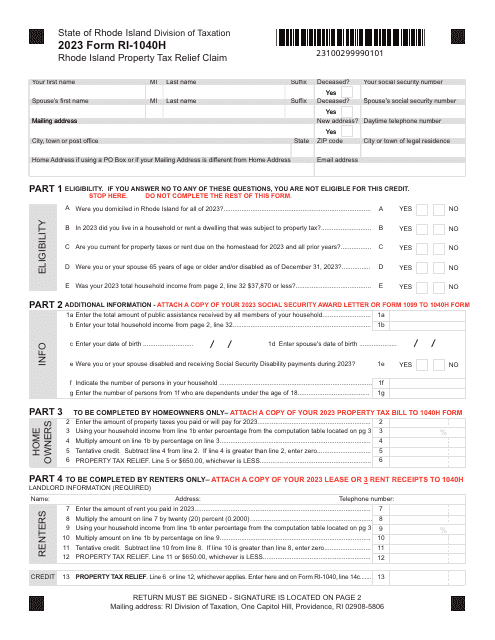

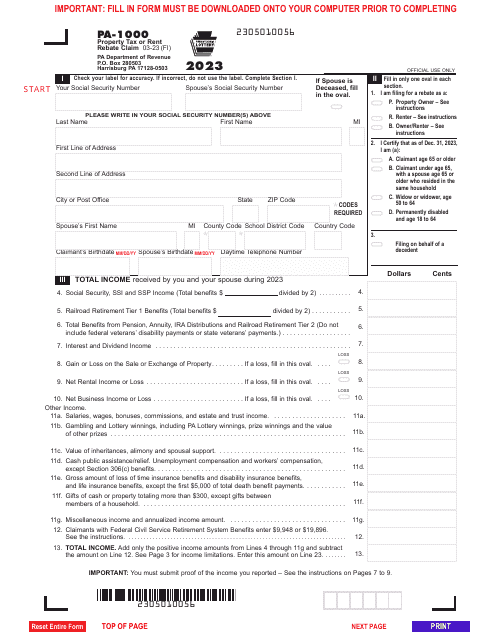

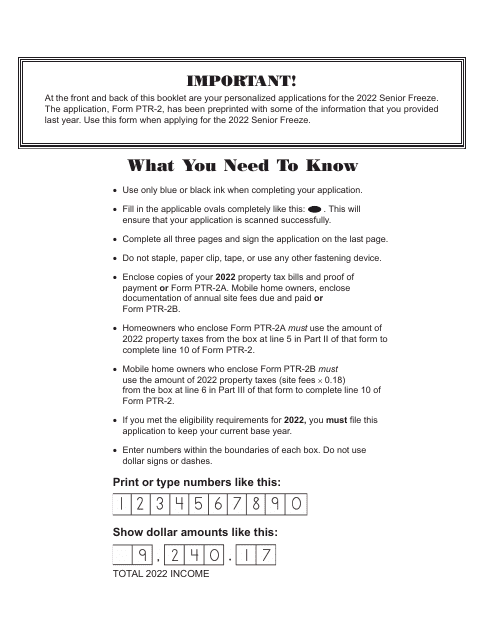

Pennsylvania residents may fill in this legal document if they wish to get a refund for a portion of rent or property tax paid on their residence.

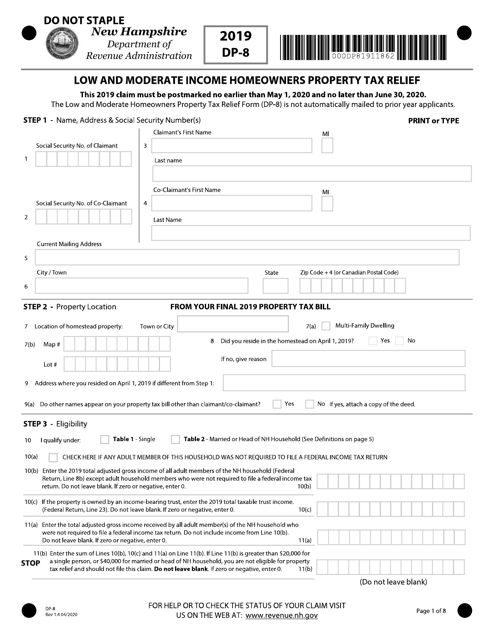

This form is used for applying for low and moderate income homeowners property tax relief in the state of New Hampshire.

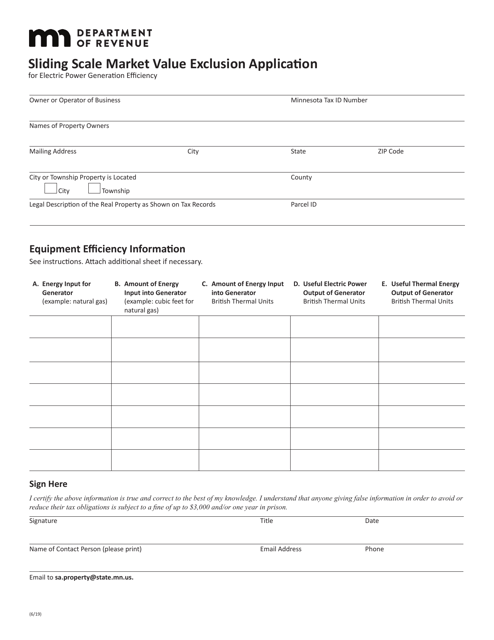

This form is used to apply for the sliding scale market value exclusion in Minnesota.

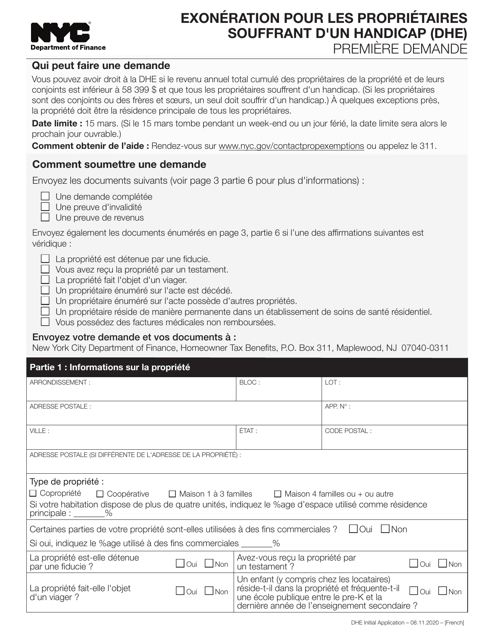

This document for applying for the Disabled Homeowners' Exemption in New York City. It is available in French.

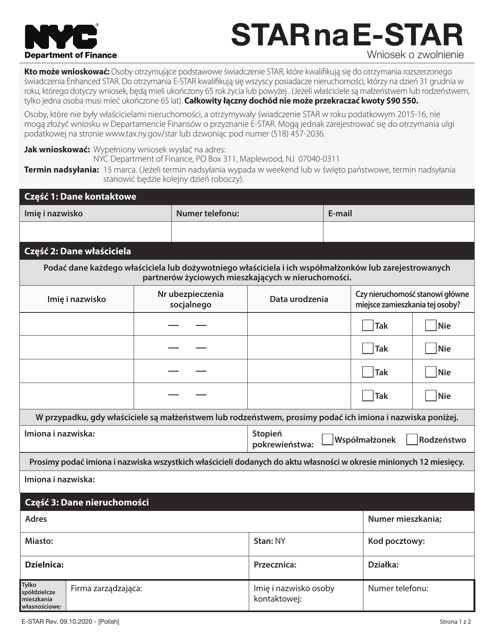

This Form is used for applying for the Star to E-Star Exemption in New York City for Polish-speaking residents.

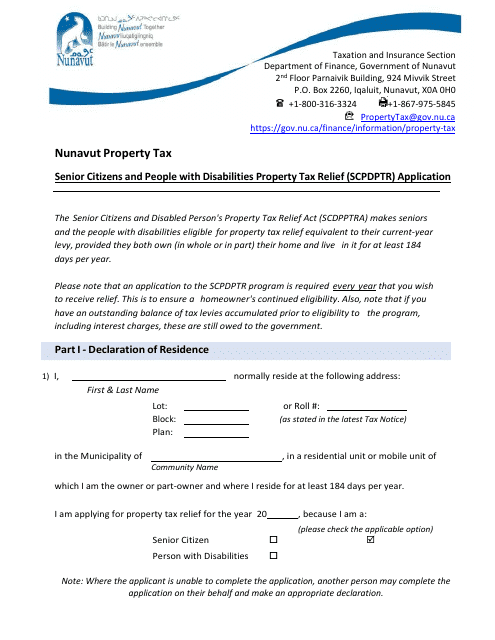

This Form is used for applying for property tax relief for senior citizens and disabled persons in Nunavut, Canada.

This Form is used for applying for a tax abatement on real property in Washington, D.C.

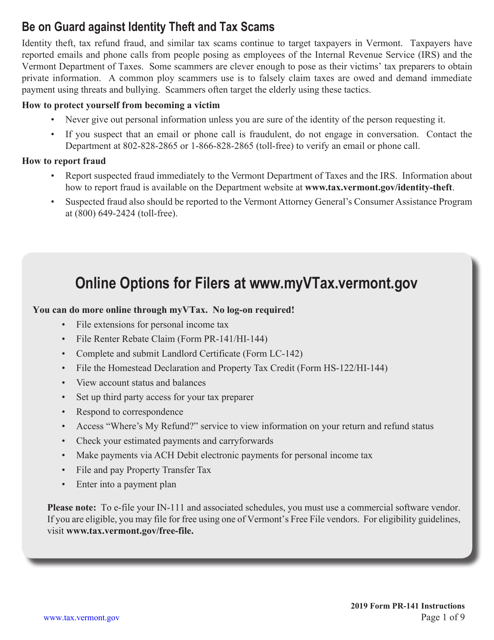

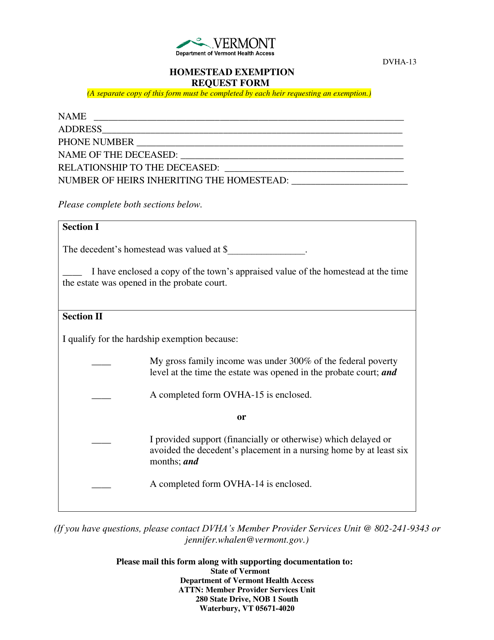

This form is used for requesting a homestead exemption in the state of Vermont.

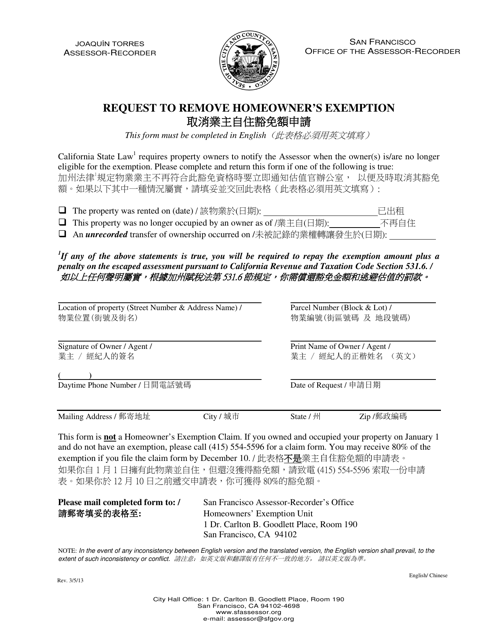

This form is used for requesting the removal of the homeowner's exemption in San Francisco, California. It is available in both English and Chinese.

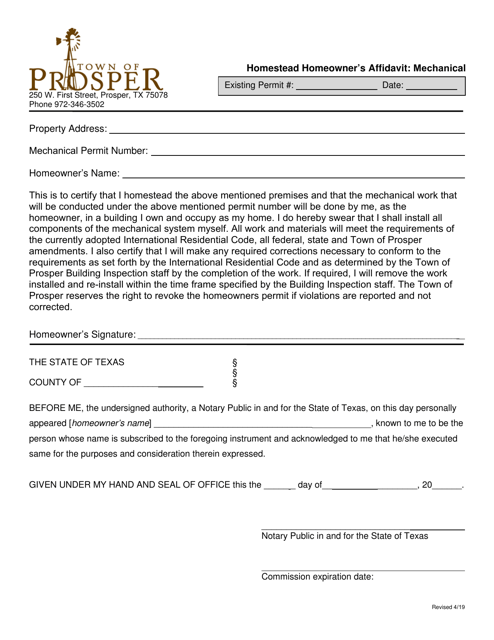

This document is used for homeowners in the Town of Prosper, Texas to provide an affidavit related to mechanical systems in their homestead property.

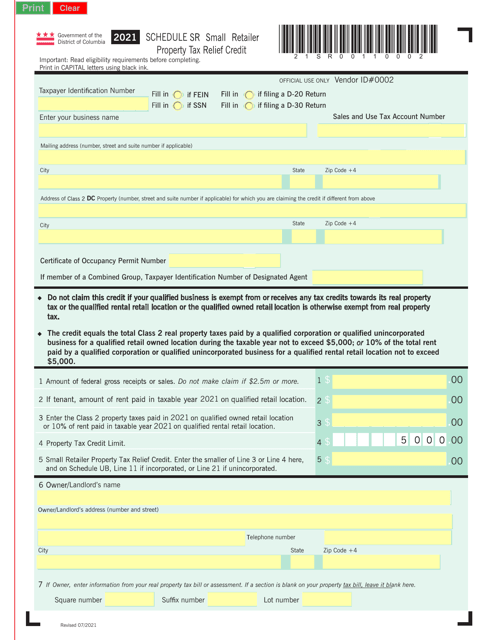

This document is used for claiming the Small Retailer Property Tax Relief Credit in Washington, D.C. It provides a schedule to report information related to the credit.

This document is for residents of Nunavut, Canada who are senior citizens or people with disabilities. It is an application for property tax relief.