Income Averaging Templates

Are you a farmer or fisherman with fluctuating income? If so, income averaging could be a helpful strategy for managing your taxes. Also referred to as "income smoothing" or "averaging income", this approach allows you to spread out your income over a number of years, potentially reducing your overall tax liability.

Income averaging is particularly beneficial for individuals in professions such as farming and fishing, where income can vary significantly from one year to the next. By utilizing this method, you can calculate your tax liability based on the average income over a specified period, rather than the actual income earned in any given year.

With income averaging, you can take advantage of the lower tax rates that may apply to your average income, resulting in potential tax savings. This can be especially advantageous during high-income years, as it allows you to smooth out your tax burden over multiple years.

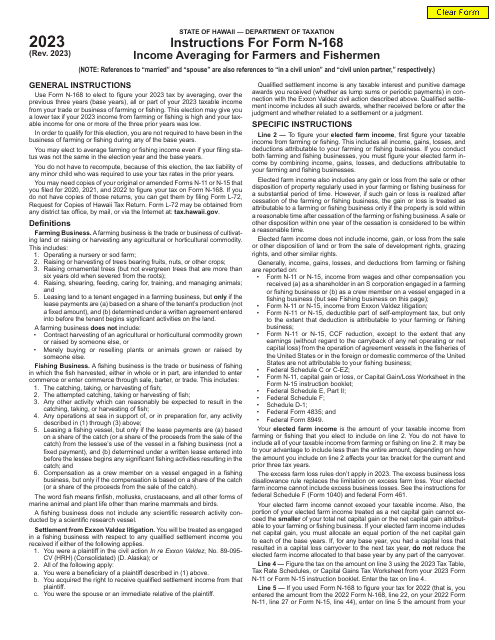

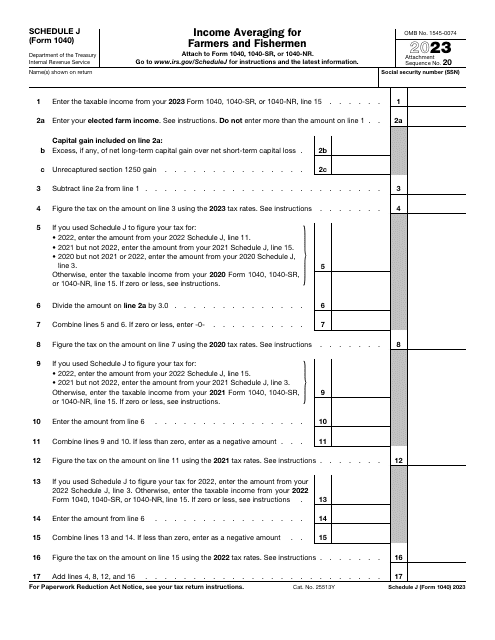

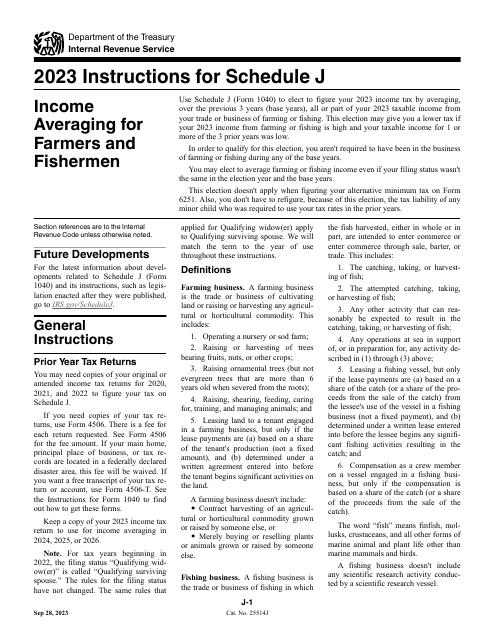

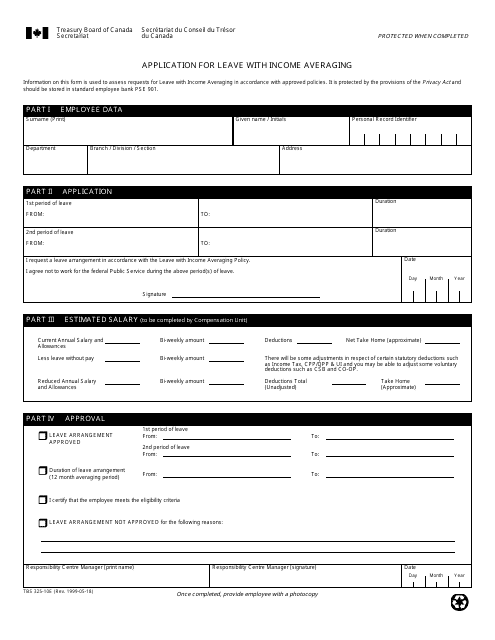

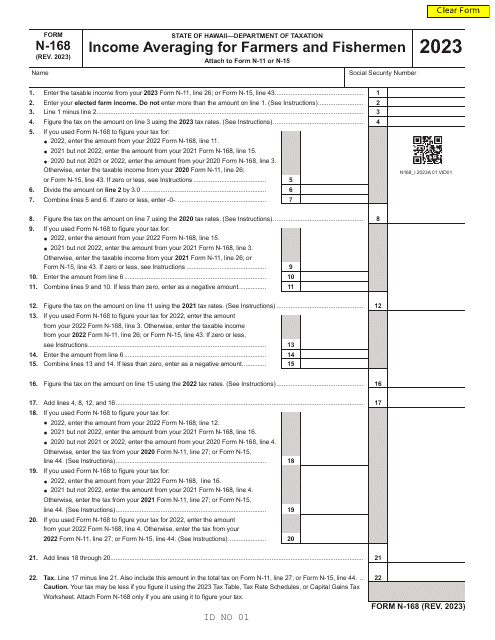

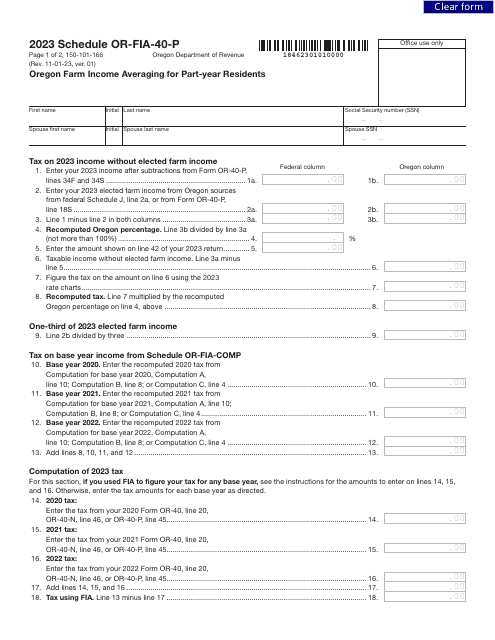

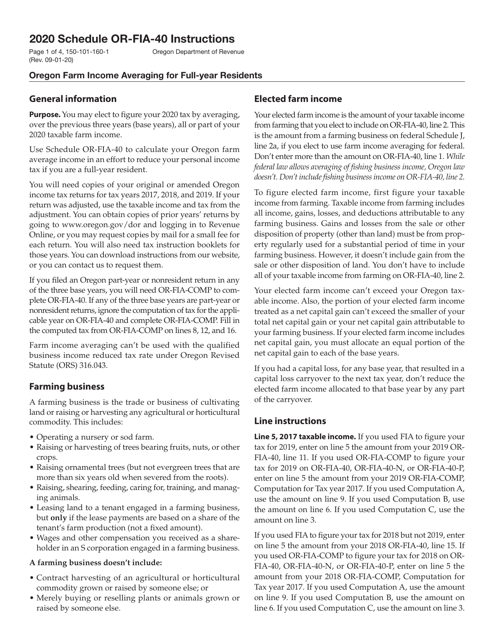

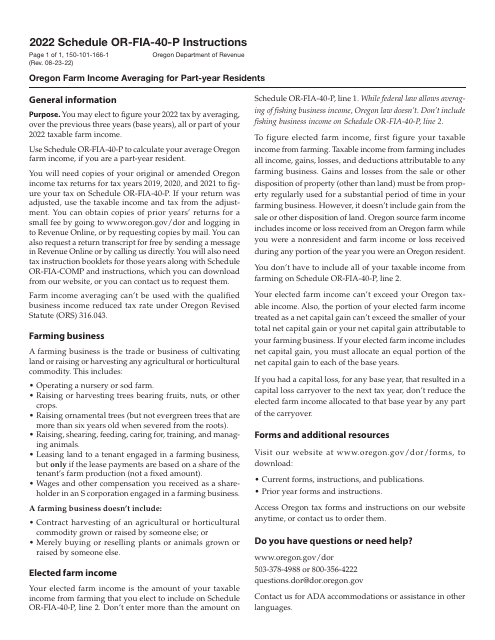

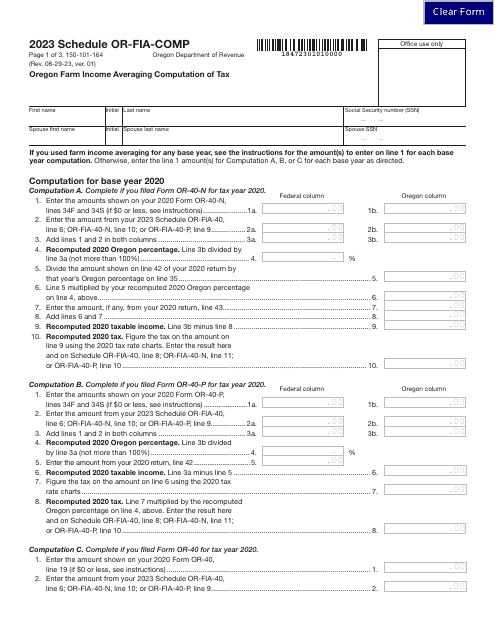

To take advantage of income averaging, you will need to complete the necessary forms and calculations. These include Form N-168 Income Averaging for Farmers and Fishermen in Hawaii, IRS Form 1040 (1040-SR) Schedule J Income Averaging for Farmers and Fishermen, Instructions for Form 150-101-166 Schedule OR-FIA-40-P Oregon Farm Income Averaging for Part-Year Residents in Oregon, Instructions for Form N-168 Income Averaging for Farmers and Fishermen in Hawaii, and IRS Form 1040 Schedule J Income Averaging for Farmers and Fishermen.

Don't let fluctuating income levels take a toll on your taxes. Utilize income averaging to smoothen your tax burden and potentially save money. Contact our experts to learn more about how income averaging can benefit you and ensure that you don't miss out on any potential tax savings.

Documents:

26

This form is used for Canadian employees to apply for leave with income averaging.

This Form is used for Oregon residents who are farmers to calculate their average income for tax purposes. It helps them determine if they qualify for income averaging and how to report their farm income.