Quarterly Tax Payments Templates

Are you a business owner or an individual who needs to make quarterly tax payments? Ensuring that your taxes are paid on time is crucial to avoiding penalties and staying in compliance with the law. That's why we have gathered a comprehensive collection of resources and documents related to quarterly tax payments.

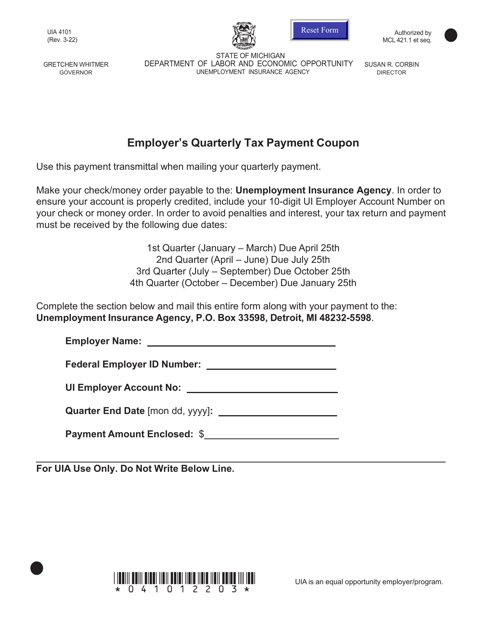

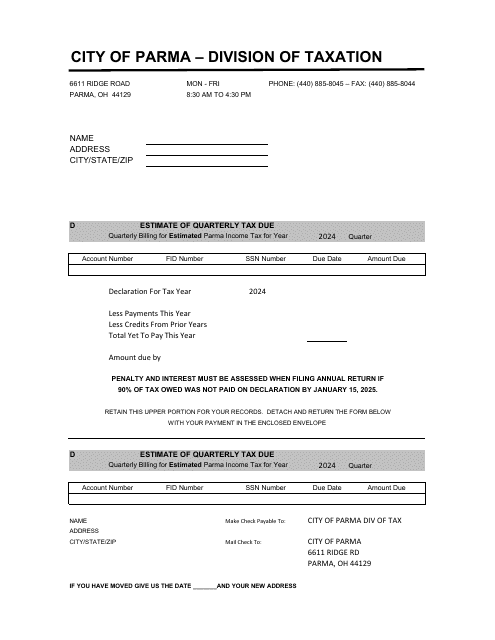

Our collection includes forms like the Form UIA4101 Employer's Quarterly Tax Payment Coupon, which is specific to the state of Michigan, or the Individual Estimate of Quarterly Tax Due for the City of Parma, Ohio. Additionally, we offer the widely used IRS Form 1040-ES, which is an Estimated Tax form for individuals.

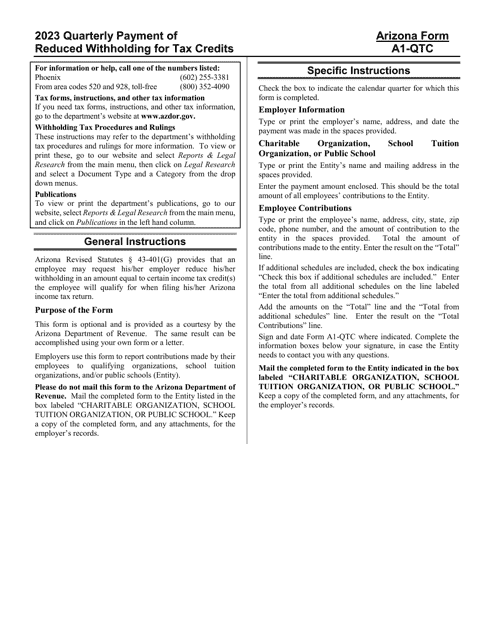

If you are residing in Arizona and eligible for tax credits, you may find the Instructions for Arizona Form A1-QTC, ADOR10762 Quarterly Payment of Reduced Withholding for Tax Credits particularly useful.

With our extensive selection of documents, you can ensure that your quarterly tax payments are accurate and submitted on time, helping you avoid any unnecessary penalties or interest charges. Trust our resources to help simplify your tax obligations, allowing you to focus on what matters most - running your business or managing your finances.

Note: Linking to the actual documents or providing proper instructions would make the text more helpful for users.

Documents:

6

This form is a coupon used as payment transmittal when paying the state Unemployment Insurance (UI) tax, one of Michigan's taxes that employers must pay.

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.