Credit Card Debt Templates

Are you struggling to manage your credit card debt? Don't worry, we can help. Our credit card debt resources are designed to assist individuals like you in gaining control over their finances and getting out of debt.

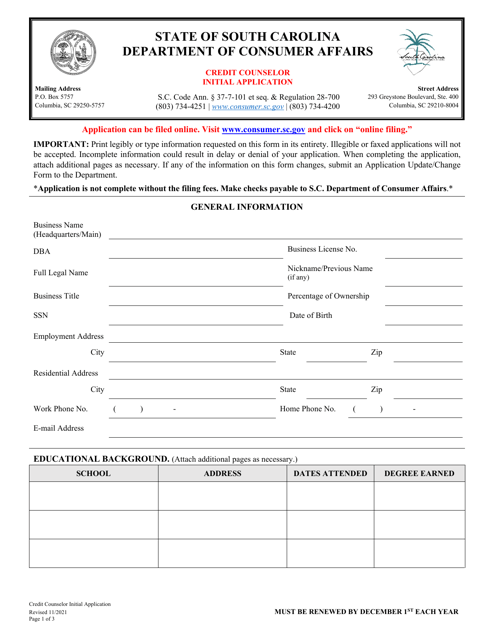

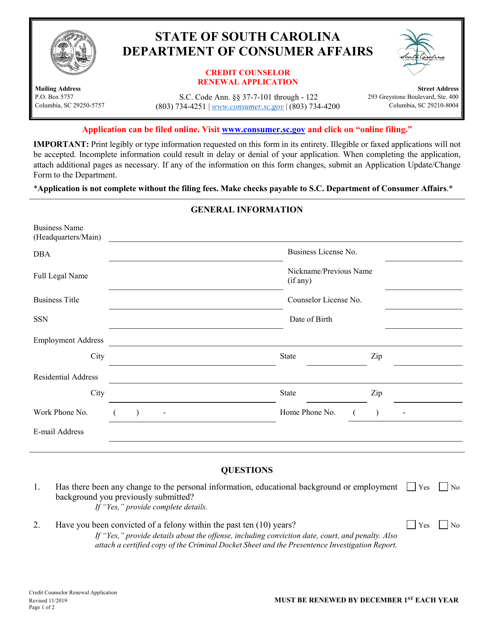

Our collection of documents includes a wide range of helpful resources, such as credit counselor applications and renewal forms. These forms can be used to apply for assistance from a credit counselor or renew your existing agreement.

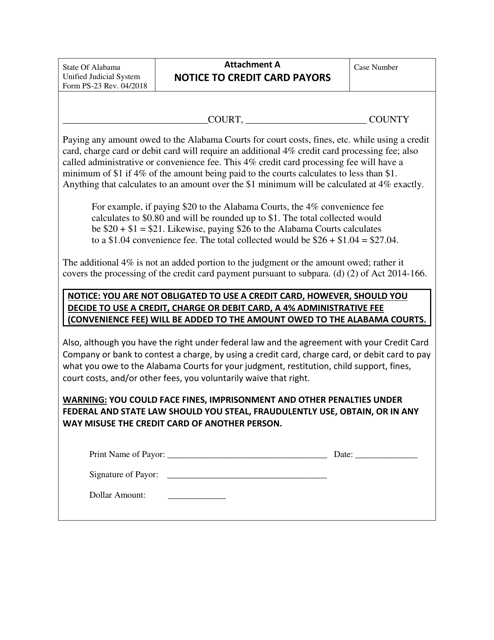

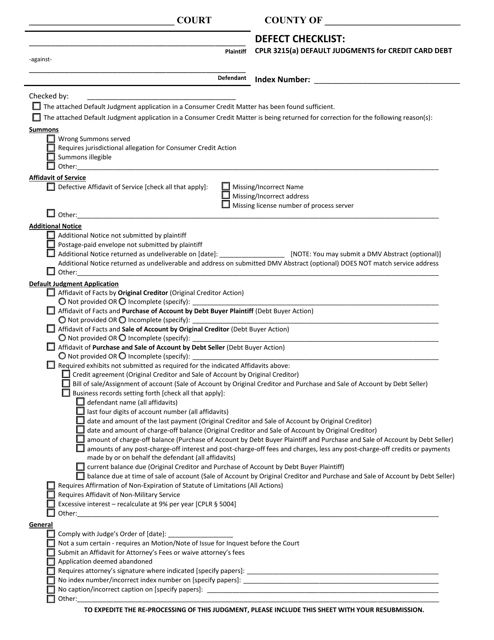

We also provide documents related to legal matters involving credit card debt. Our defect checklist for default judgments in New York can help you navigate the legal process if you've been sued for credit card debt. Additionally, our notice to credit card payors agreement in Alabama provides valuable information on paying off someone else's debt.

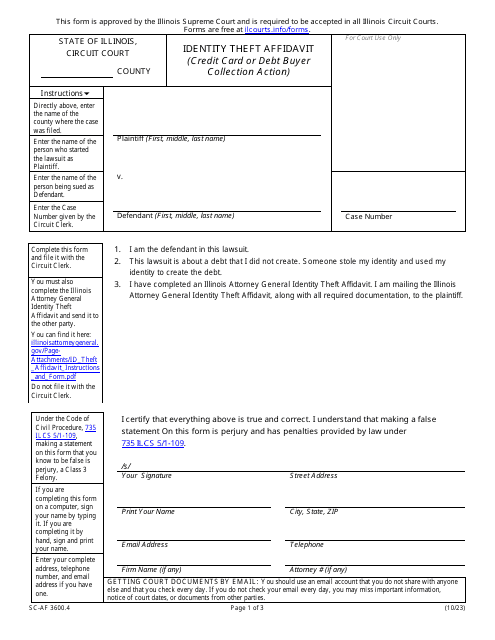

If you've been a victim of identity theft related to credit cards or debt buyers, our identity theft affidavit in Illinois can assist you in resolving the issue and protecting your financial well-being.

With our extensive collection of credit card debt resources, you can take the necessary steps to overcome your financial challenges and achieve a debt-free future. Don't let credit card debt hold you back - explore our documents today.

Documents:

7

This document is used for renewing the license of a credit counselor in South Carolina.

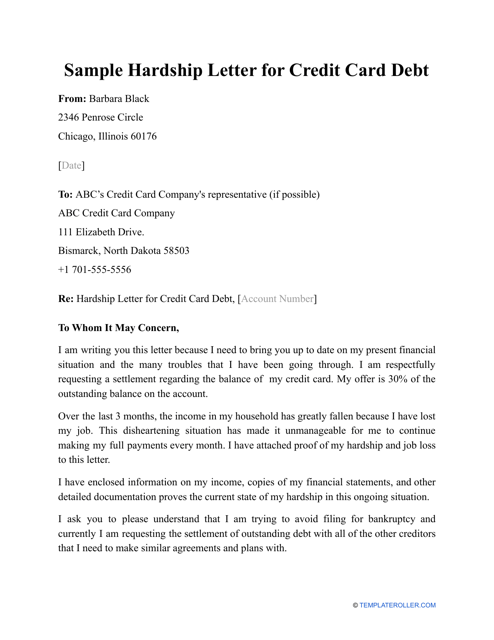

Owners of credit cards can reduce their debt by submitting a Hardship Letter explaining their situation to their credit card company.

This type of debt settlement letter is used by filers who want to decrease the debt on their credit card.

This form is used for providing notice to credit card payors in Alabama about an agreement to pay the debt of another person.

This document is a defect checklist for default judgments regarding credit card debt in New York under CPLR 3215(A).