Disaster Loan Templates

Disaster Loan Assistance: Helping Businesses Recover from Emergencies

When an unexpected disaster strikes, businesses need financial assistance to overcome the challenges that comes its way. Disaster loans, also known as disaster loans or disaster recovery loans, are meant to provide much-needed financial support to businesses in times of emergencies. These loans are specifically designed to help businesses recover and rebuild following natural disasters, such as hurricanes, floods, or wildfires.

At USA, Canada and other countries, we understand the importance of a quick and efficient disaster loan assistance program to aid businesses in their recovery process. Our disaster loans provide low-interest funds to help businesses cover the costs of property damage, inventory replacement, equipment repair, and even operating expenses during the recovery phase.

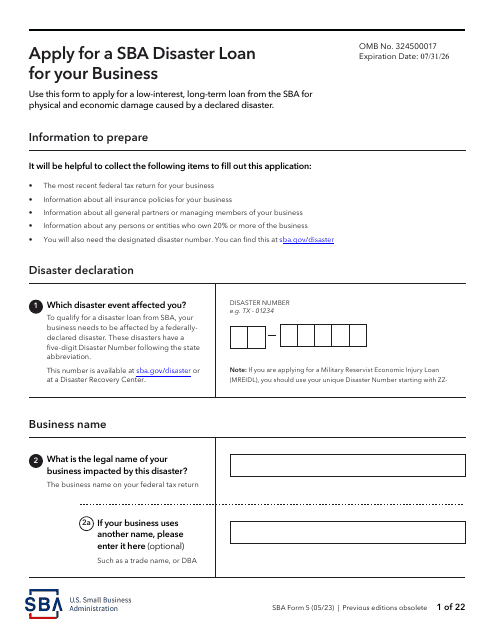

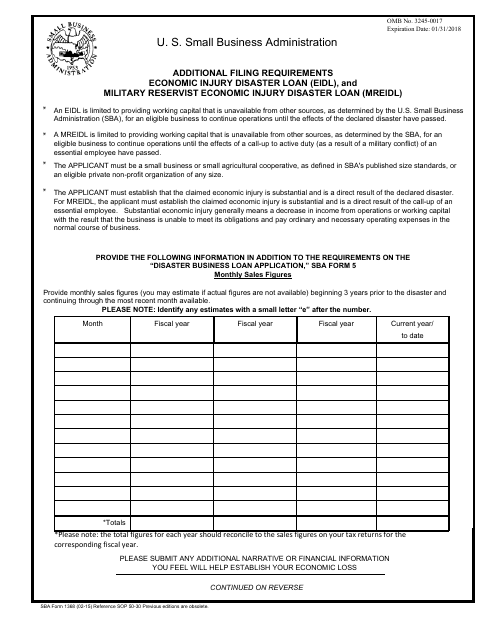

Our disaster loan programs offer a variety of options to cater to the unique needs of businesses affected by disasters. Whether you're a small business owner or an established enterprise, our range of disaster loan programs, including the SBA Form 5 Disaster Business Loan Application, SBA Form 1368 Additional Filing Requirements Economic Injury Disaster Loan (EIDL), and Military Reservist Economic Injury Disaster Loan (MREIDL), can help you access the financial resources you need to get back on your feet.

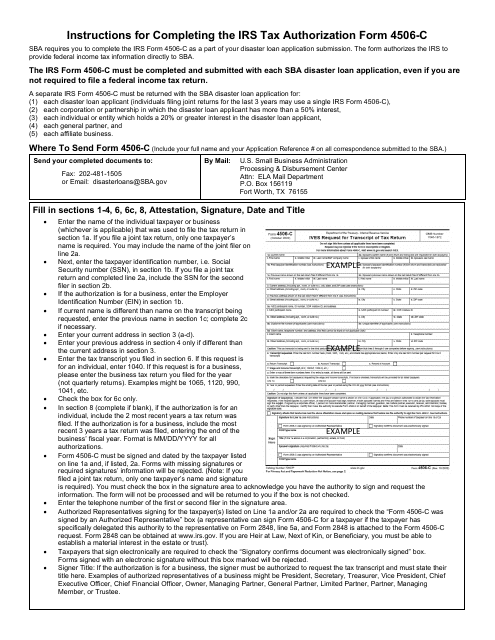

To simplify the loan application process, we provide detailed instructions and guidance on various forms and certifications needed to apply for a disaster loan. From the Borrower's Progress Certification to the Borrower's Consent to Verify Information and 3rd Party Authorization for Disaster Loans, we ensure that you have all the necessary documents prepared to expedite the loan application process.

To ensure the accuracy of your loan application, we also provide instructions for IRS Form 4506-C Ives Request for Transcript of Tax Return (SBA Disaster Loan), allowing you to seamlessly request the essential tax information required for loan approval.

In times of distress, achieving financial stability is crucial for businesses to recover effectively. With our disaster loan assistance programs, we offer a lifeline to businesses, allowing them to rebuild, revive, and forge ahead in the face of adversity. Apply for a disaster loan today and let us help you navigate the path to recovery.

Documents:

5

Use this form to enter information on the business's monthly revenue for three years prior to the disaster. You can also use this form to provide your financial forecast of income and expenses until the time when you estimate your business will operate normally.

This form is used for borrowers to certify their progress in the SBA Disaster Assistance Program. It helps track and verify the borrower's use of funds and the progress made towards recovery.

This document allows the lender to verify the borrower's information and gives authorization to share information with third parties for disaster loans.