Child Care Tax Credit Templates

Are you a parent or guardian who could benefit from financial assistance with your child care expenses? If so, you may be eligible for the Child Care Tax Credit. This tax credit, also known as the Child Care Tax Credits or the Child Care Tax Credit Program, is designed to help working families offset the cost of child care.

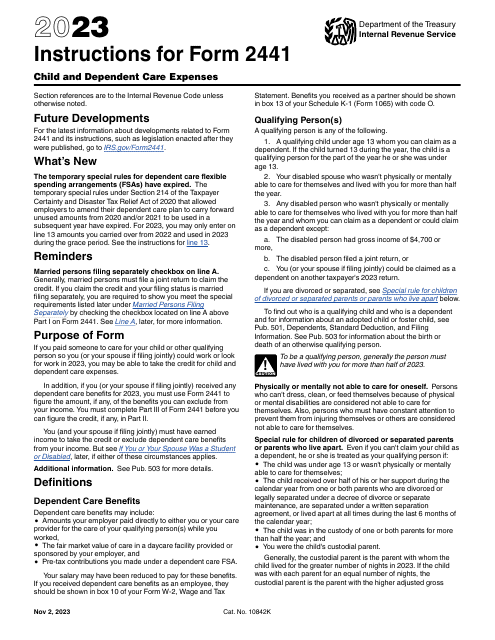

The Child Care Tax Credit program is administered by the Internal Revenue Service (IRS), and they offer a range of documents to guide you through the process. One of the key documents is the IRS Form 2441 Child and Dependent Care Expenses, which allows you to claim your child care expenses as a tax credit. Additionally, the Instructions for IRS Form 2441 provide valuable information on how tofill out the form correctly.

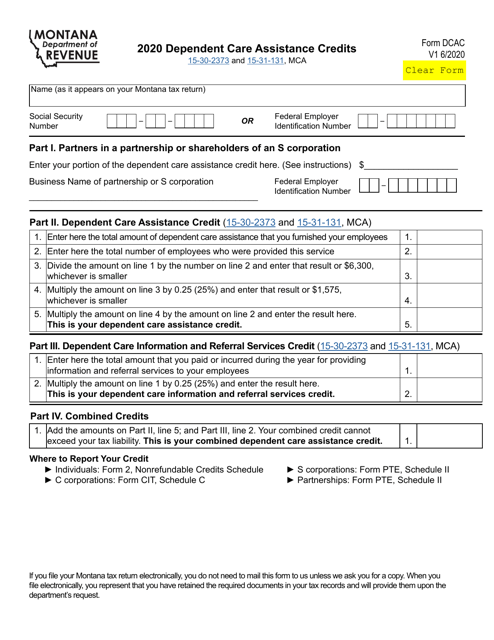

If you reside in the state of Montana, you may also want to familiarize yourself with the Form DCAC Dependent Care Assistance Credits. This form is specific to Montana residents and can help you claim additional child care tax credits.

Whether you have questions about eligibility, how to calculate your credit, or which expenses are eligible, the IRS documents related to the Child Care Tax Credit can provide you with the information you need. Remember, the Child Care Tax Credit can provide significant financial relief, so it's worth exploring if you qualify.

Documents:

5

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.