Angel Investor Tax Credit Templates

Angel Investor Tax Credit is a government program designed to support and encourage investment in startups and small businesses by providing tax incentives to angel investors. This program aims to foster innovation and economic growth by attracting capital to early-stage companies.

The Angel Investor Tax Credit program offers various benefits to eligible individuals and businesses looking to invest in qualifying businesses. By taking advantage of this incentive, investors can receive tax credits based on a percentage of their investment, helping to offset their tax liability.

The program requirements and application process vary from state to state, but generally, investors need to meet certain criteria to be eligible for the tax credit. These criteria may include investing in qualified businesses that meet specific industry or size requirements and meeting certain residency or licensing criteria.

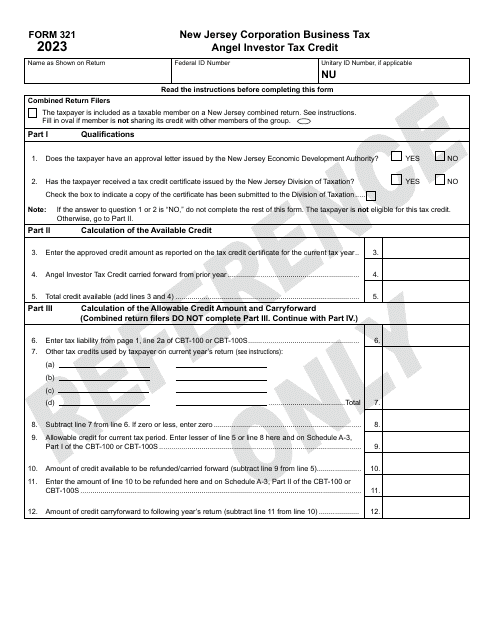

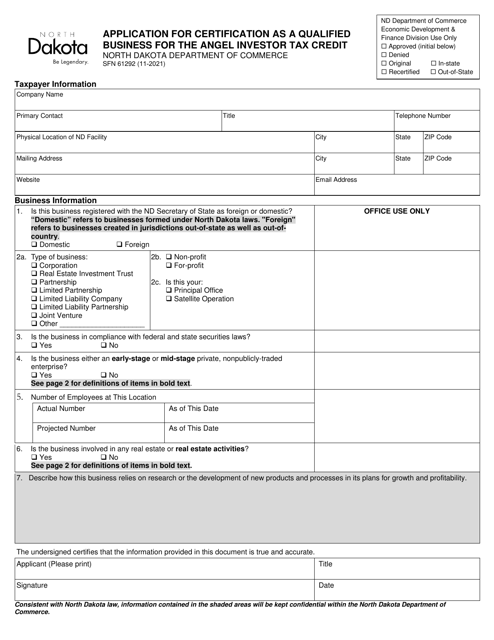

To apply for the Angel Investor Tax Credit, investors need to fill out the necessary forms and provide supporting documentation. These forms typically include information about the investor, the investment, and the qualifying business. Additionally, some states may require additional certifications or clearances to ensure the legitimacy of the investment.

In states like New Jersey and North Dakota, the Angel Investor Tax Credit forms are available for download on the official government websites. These forms, such as Form 321 and SFN61292, help investors navigate the application process and provide the necessary information to qualify for the tax credit.

Investors considering participating in the Angel Investor Tax Credit program should carefully review the requirements and guidelines set by their state's government. Engaging with a qualified tax professional or legal advisor can also be beneficial in understanding the intricacies of the program and maximizing the potential benefits.

The Angel Investor Tax Credit is a powerful tool for both investors and businesses, stimulating economic growth and innovation. By offering tax incentives to angel investors, the program encourages capital flow into startups and small businesses, driving job creation and fostering entrepreneurial success.

Whether you're an investor looking to support emerging businesses or a startup seeking investment, explore the possibilities of the Angel Investor Tax Credit. Take advantage of the benefits provided by this program, contribute to the growth of innovative enterprises, and make a positive impact on the economy.

Documents:

6

This form is used for applying to become a certified qualified business for the Angel Investor Tax Credit in North Dakota.