Tax Advice Templates

Tax Advice: Expert Guidance for Filing Your Taxes

Welcome to our comprehensive tax advice resource! Whether you're a U.S. taxpayer or a Canadian resident, navigating the complex world of tax forms and regulations can be overwhelming. Our expert team has compiled a wide range of valuable resources to help you understand the tax implications of different financial situations and ensure your compliance with both U.S. and Canadian tax laws.

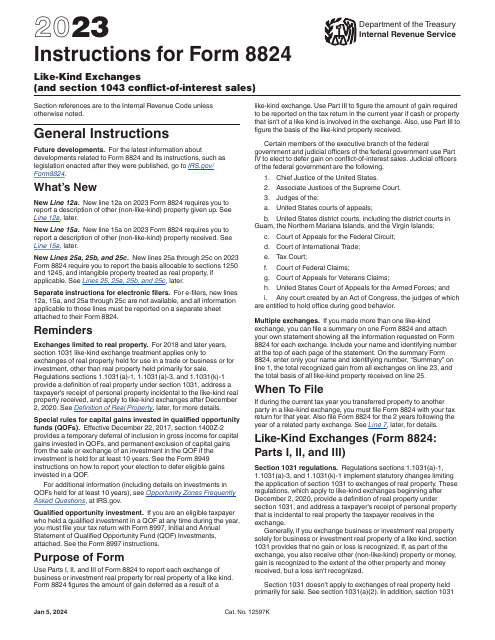

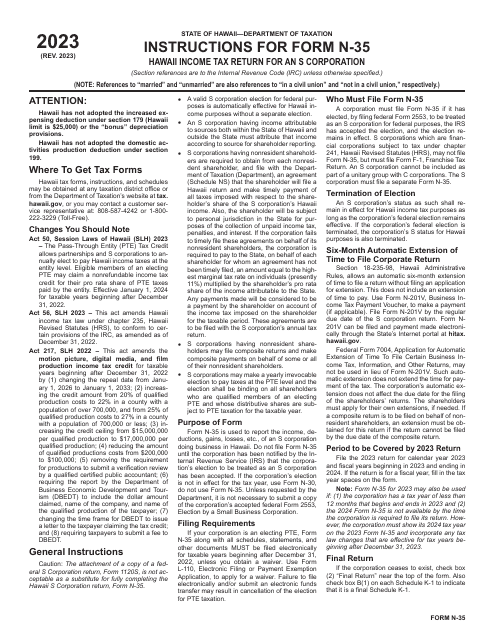

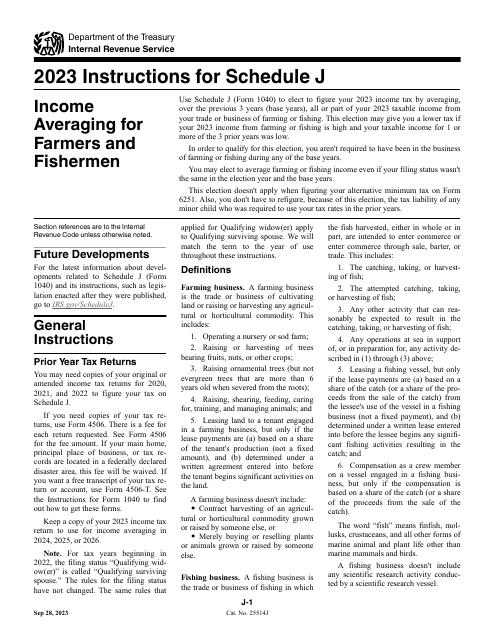

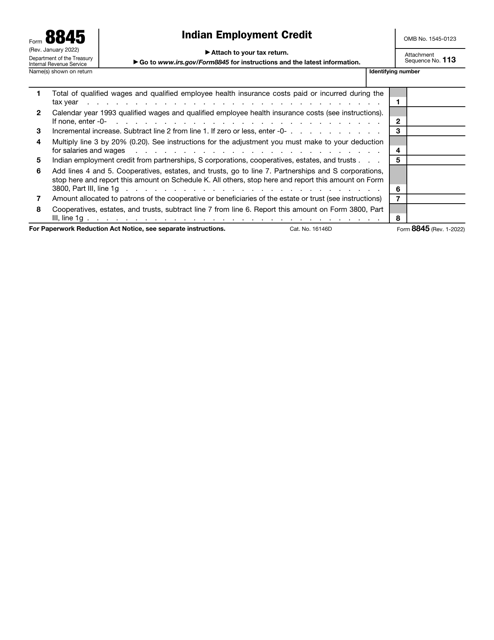

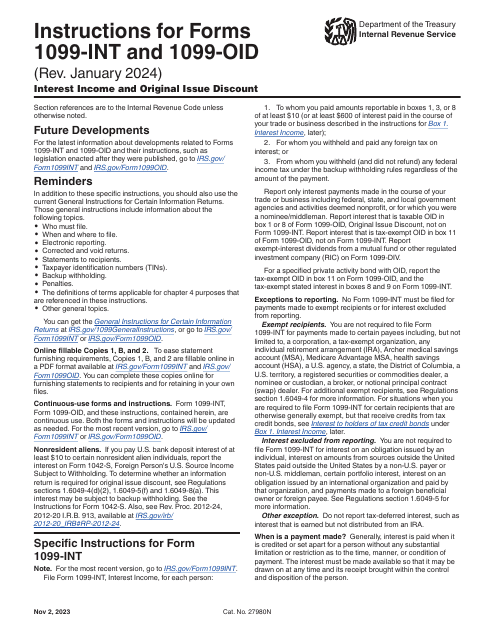

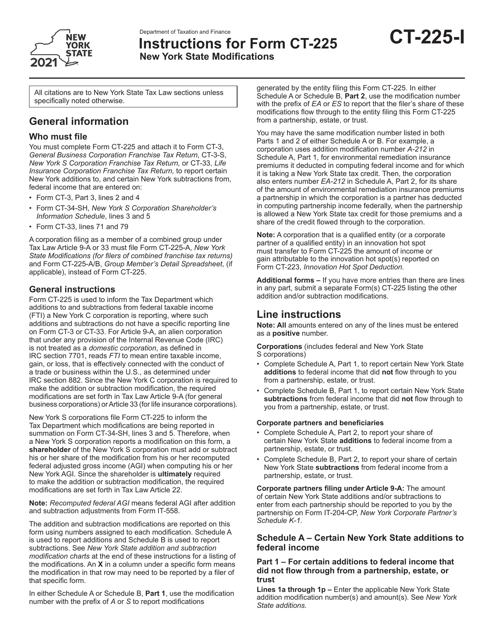

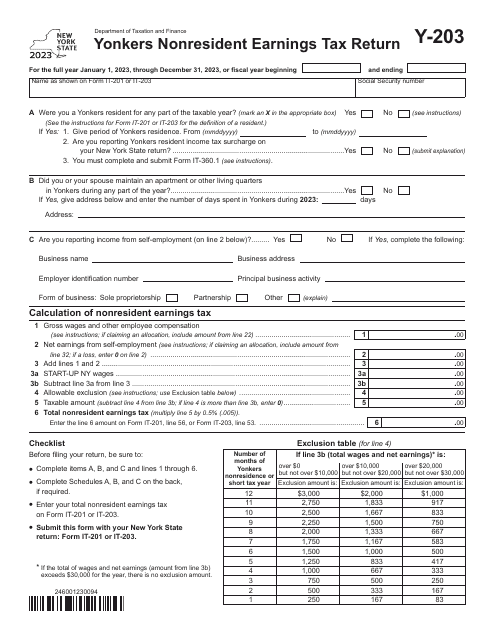

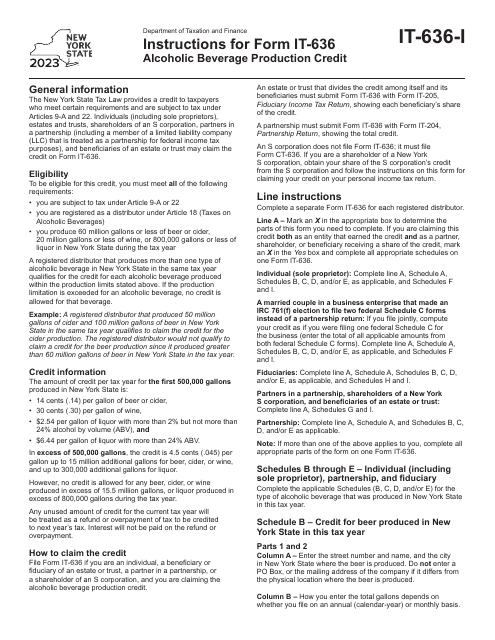

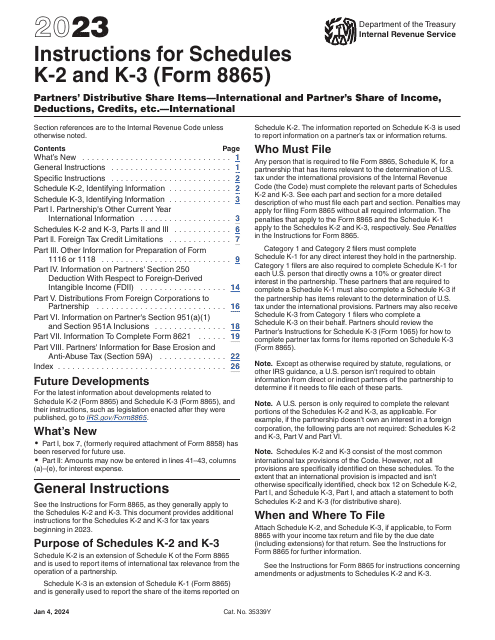

Our tax advice covers a broad spectrum of topics, including instructions for various IRS forms such as the IRS Form 2555 Foreign Earned Income and IRS Form 1099-INT, 1099-OID. These forms can be confusing, but our detailed guidance will walk you through the process step-by-step, ensuring accuracy when reporting your income and deductions.

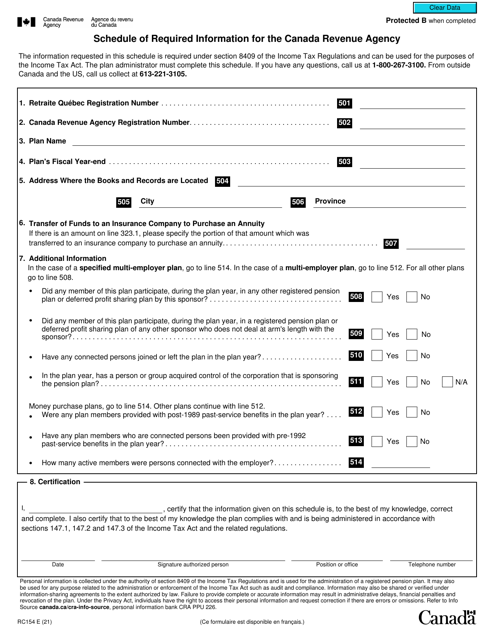

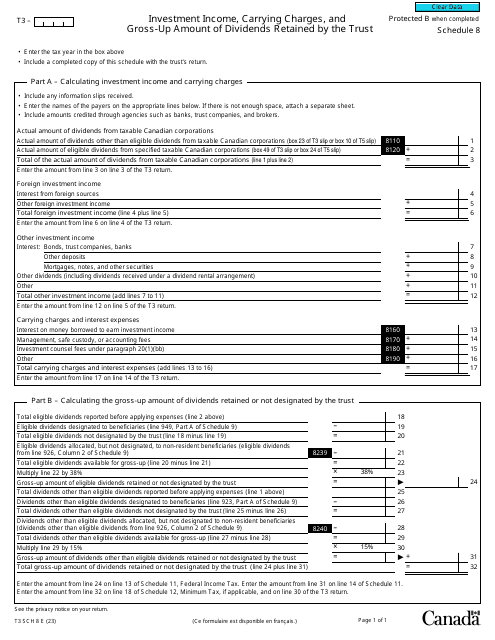

For our Canadian audience, we provide helpful instructions for Form T3 Schedule 8, which specifically deals with investment income, carrying charges, and gross-up amount of dividends retained by the trust. Our comprehensive Canadian tax advice ensures you have the necessary knowledge to complete your tax forms accurately and efficiently.

We understand that tax season can be stressful, and it's essential to have access to reliable resources that provide clear and concise information. Our tax advice collection aims to simplify the complexities of tax filings, helping you save time and make informed decisions.

In addition to detailed instructions for IRS and Canadian tax forms, we also offer valuable insight into common tax deductions, credits, and strategies for reducing your tax liability. Our goal is to empower you with the knowledge and confidence to maximize your financial resources.

Whether you're a first-time taxpayer or an experienced filer, our tax advice collection is designed to assist you in accurately preparing your taxes while minimizing the risk of errors or audits. Trust our expert guidance to ensure a smooth and hassle-free tax filing experience.

Documents:

40

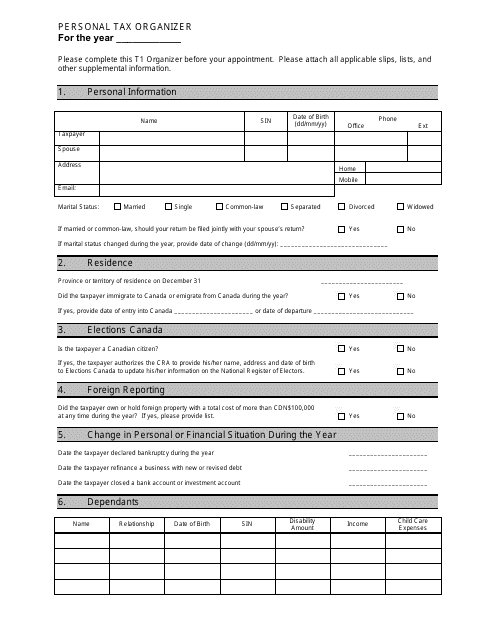

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

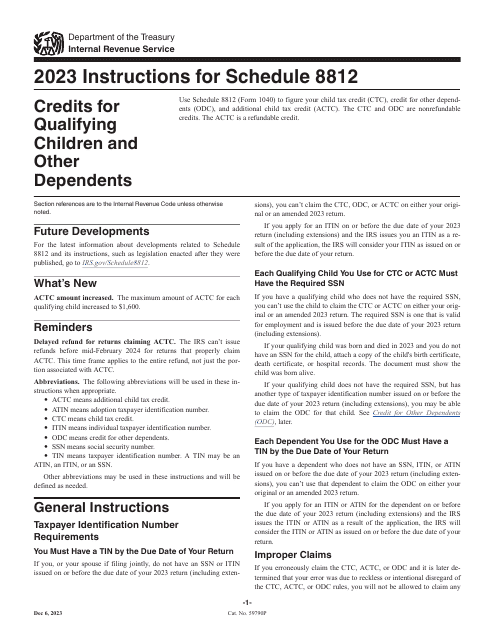

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

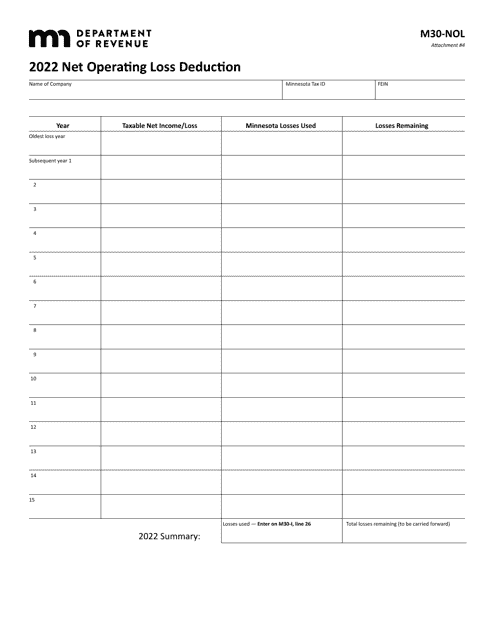

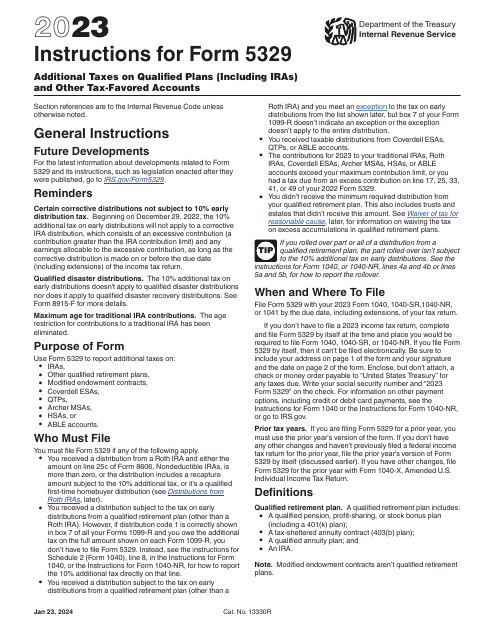

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

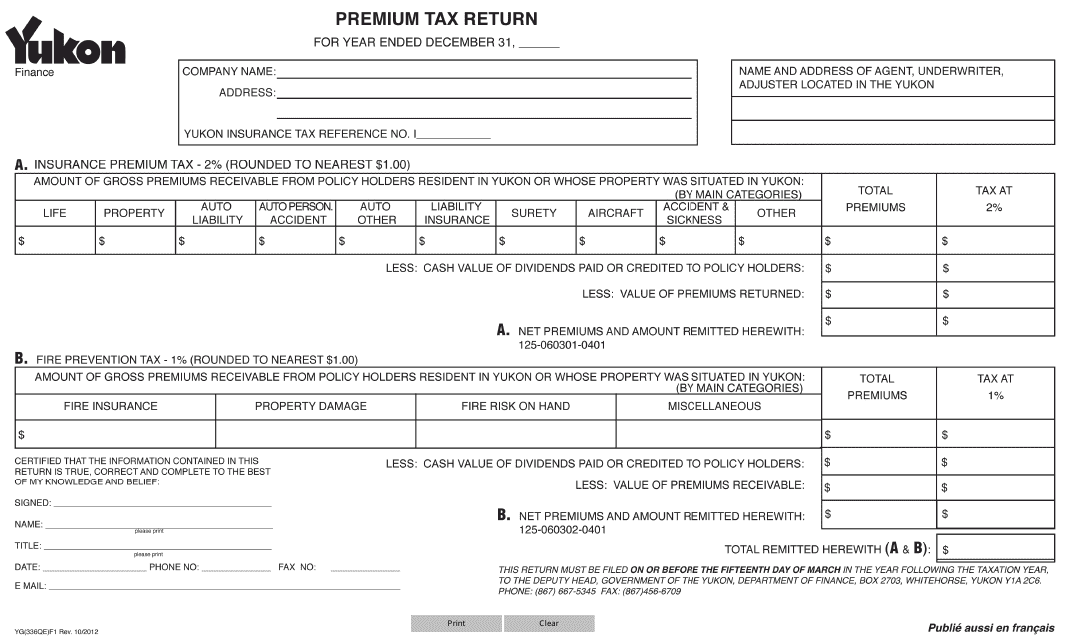

This form is used for filing premium tax returns in Yukon, Canada.

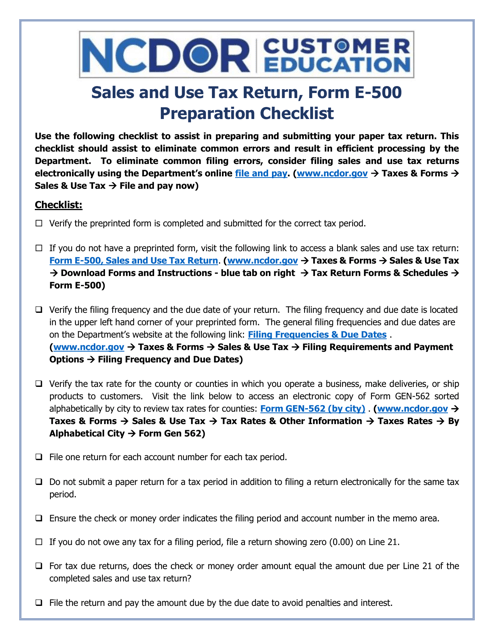

This form is used for preparing and ensuring accuracy of the E-500 tax form in North Carolina.

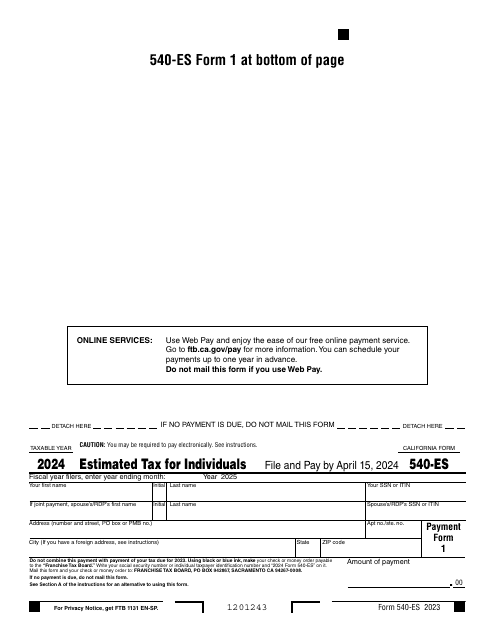

Fill out this form over the course of a year to pay your taxes in the state of California.

This document provides information about the Taxpayer Advocate Service, a resource available to help individuals with their tax-related issues.

This document provides information about the Taxpayer Advocate Service, a resource available to help taxpayers with their tax-related issues and concerns.

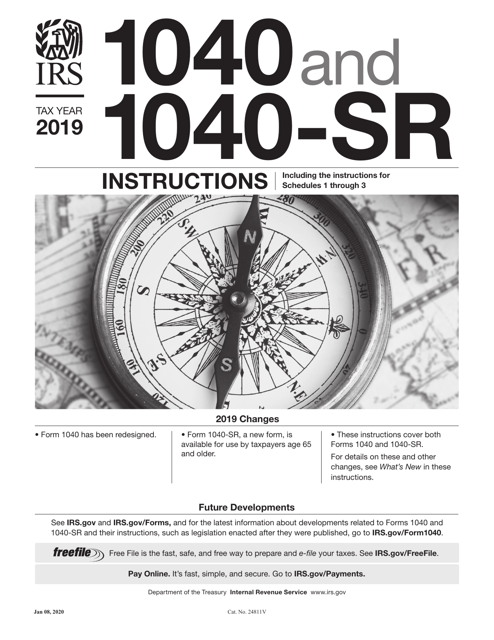

This document provides instructions for filling out IRS Form 1040 and 1040-SR. It guides you through the process of reporting your income, deductions, and credits to calculate your tax liability.

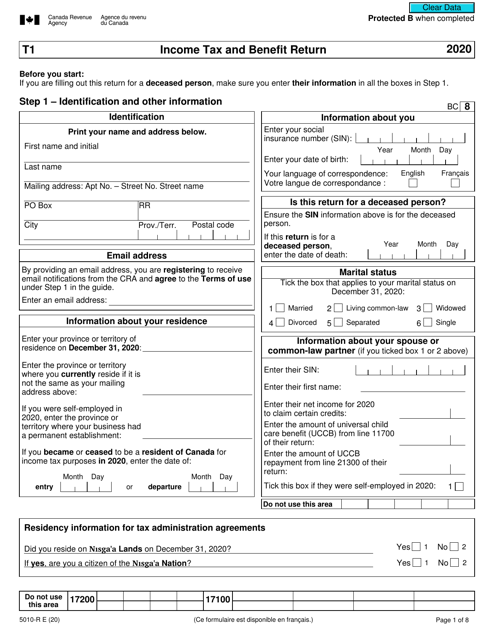

This form is used to report income, deductions, and tax credits for individuals in Canada filing their income tax and benefit return.

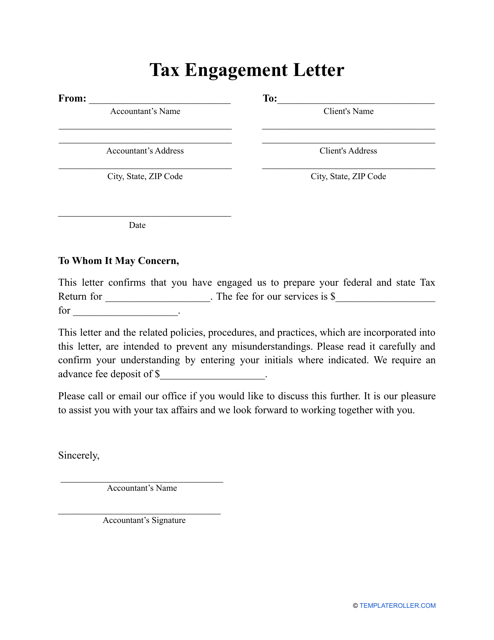

Complete this template to describe the work to be performed, the terms and conditions of performing that work, any limitations, and payment terms to the client.

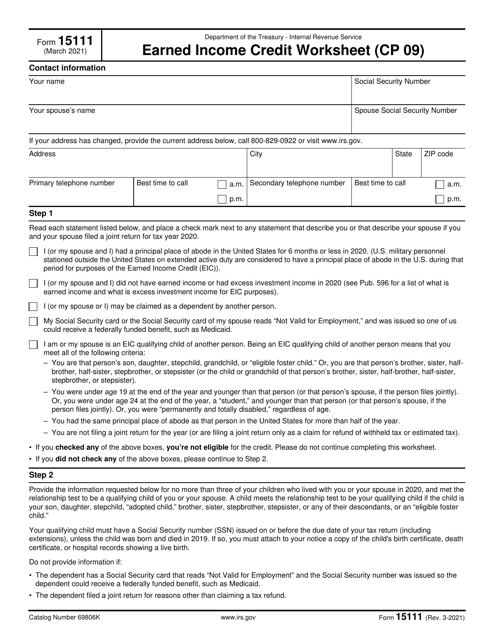

This form is used to calculate the Earned Income Credit for eligible taxpayers.