US Tax Law Templates

Are you looking for comprehensive information on US tax laws? Our website provides a complete guide to US tax laws, ensuring that you stay informed and compliant with the latest regulations. Understanding and complying with tax laws is crucial for individuals and businesses alike, and our website is here to make it easier for you. Whether you are an exempt individual, a US citizen living abroad, or a foreign company operating in the US, our website covers a wide range of topics to suit your needs.

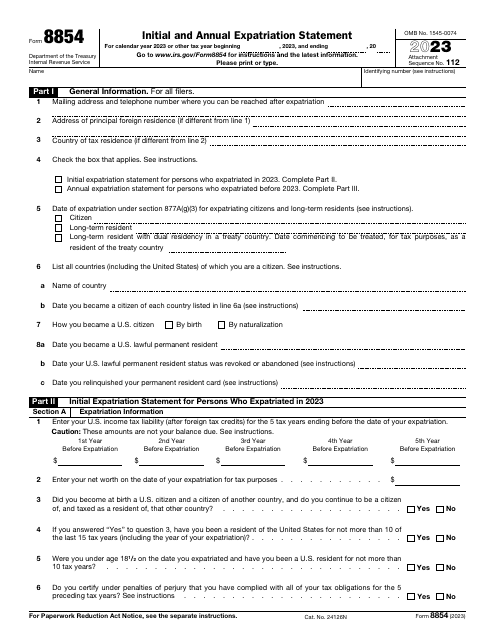

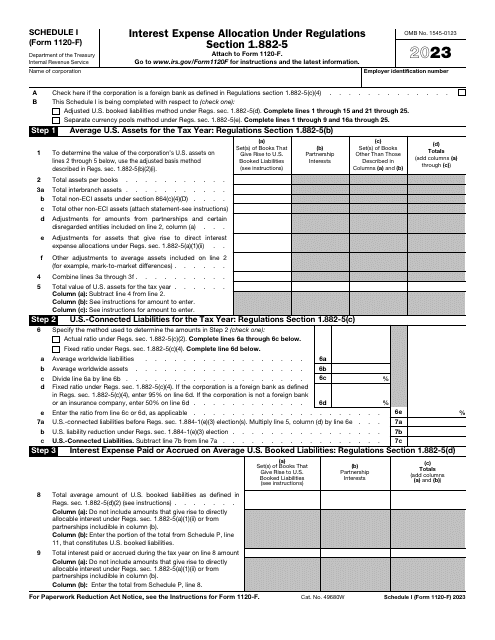

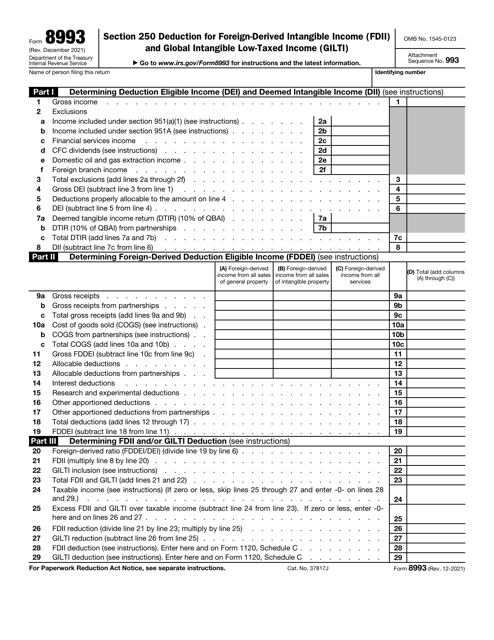

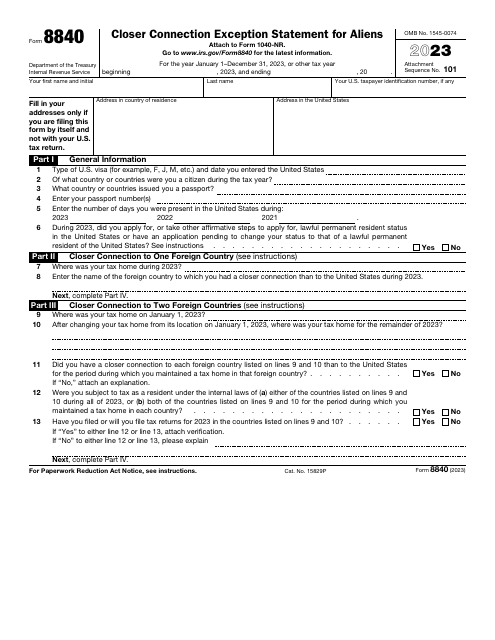

Our collection of documents includes IRS forms such as Form 8843 (Statement for Exempt Individuals and Individuals With a Medical Condition), Form 8854 (Initial and Annual Expatriation Statement), Form 1120-F (Schedule I Interest Expense Allocation Under Regulations Section 1.882-5), Form 8993 (Section 250 Deduction for Foreign Derived Intangible Income [FDII] and Global Intangible Low-Taxed Income [GILTI]), and Form 8840 (Closer Connection Exception Statement for Aliens).

Also known as US tax laws or US tax regulations, our website provides easy access to these forms and a wealth of information to help you navigate the complex world of US taxes. Whether you're filing your annual tax return, reporting foreign income, or trying to understand deductions and exemptions, our website has the resources you need. Stay up-to-date with the latest changes in tax laws, find answers to your tax-related questions, and ensure that you are in compliance with the IRS.

Take advantage of our user-friendly interface and comprehensive information to make the tax-filing process a breeze. Our website is your one-stop resource for all your US tax law needs, offering reliable and accurate information to help you make informed decisions. Simplify your tax journey today with our expert guidance and stay on top of your tax obligations.

Documents:

5

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.