Debt Tracking Templates

Are you struggling to keep track of your debts? Look no further than our comprehensive debt tracking system. Whether you need to monitor your personal finances or manage the debts of your business, our debt tracking system is the perfect solution. With customizable templates like our Debt Worksheet Template and Business Debt Schedule Template, you can easily organize and analyze your debts in black and white or varicolored formats. Take control of your financial obligations with our user-friendly debt tracking system. Start tracking your debts today and regain peace of mind.

Documents:

10

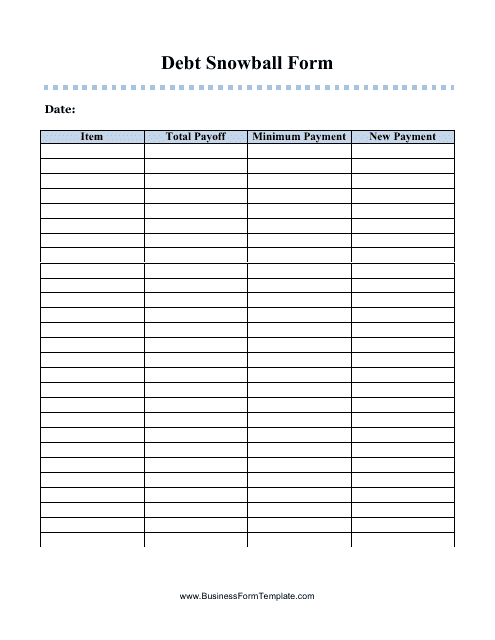

This form is used for organizing and managing your debt repayment strategy using the debt snowball method.

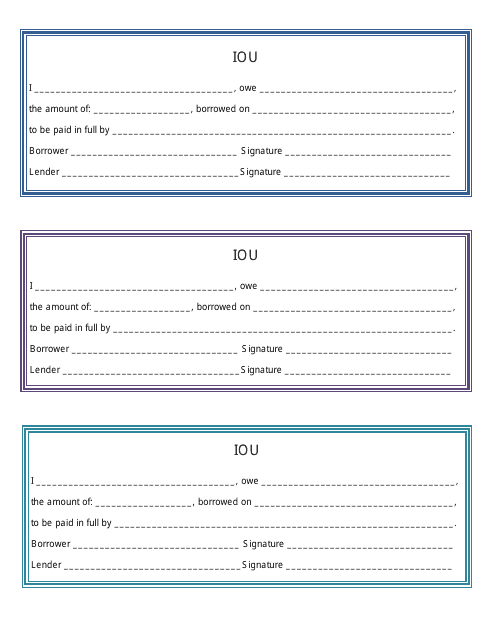

This document is a template that allows you to create three "I Owe You" forms on a single page. It is a convenient way to keep track of personal debts or favors.

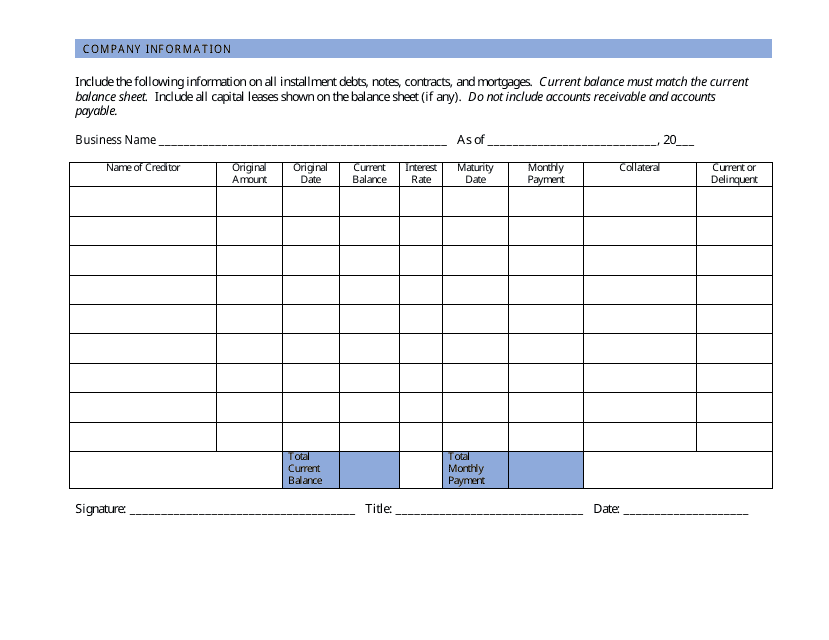

This type of document is a template that helps you manage and track your debts. It provides a structured format for organizing your debt information, including balances, interest rates, and payment schedules. Using a debt worksheet template can help you create a repayment plan and keep track of your progress towards becoming debt-free.

This document helps you keep track of your debt collector interactions and payments. It is a useful tool for managing your debts and ensuring that you are staying on top of your financial obligations.

This Excel template is used to organize and track a company's debts. It helps businesses to understand their debt obligations, such as loan repayments and interest payments, over a specified period of time. With this template, businesses can effectively manage their debt and plan for future financial commitments.

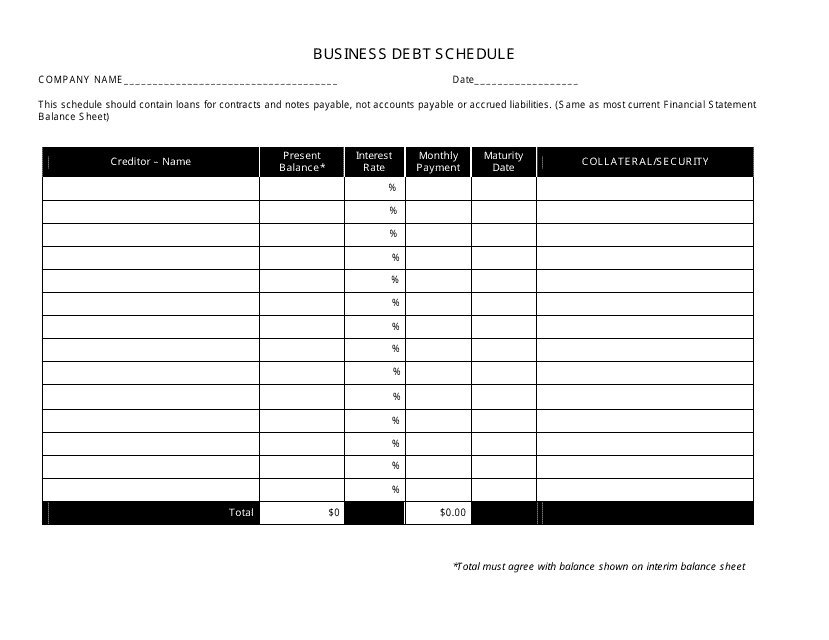

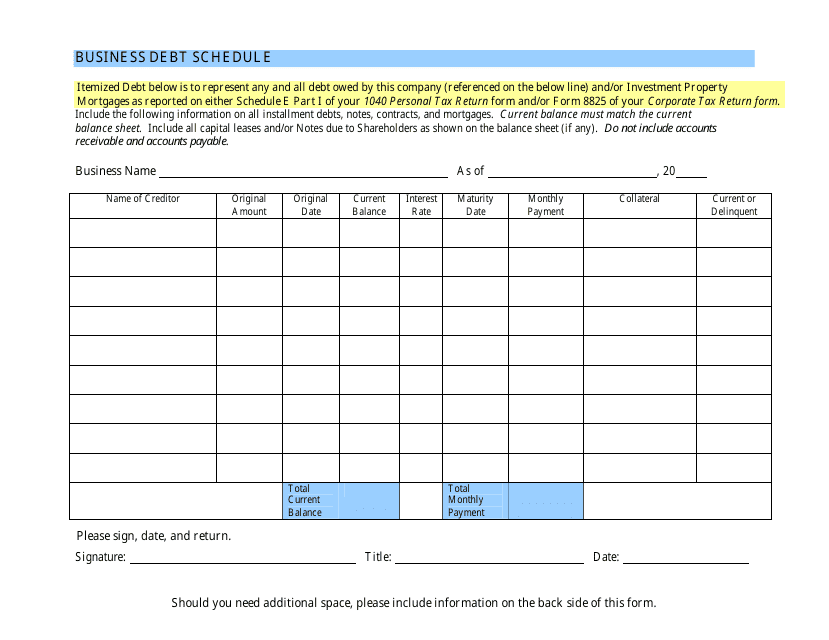

This document provides a template for creating a schedule of business debts. It is designed in a black and white format for easy printing and use.

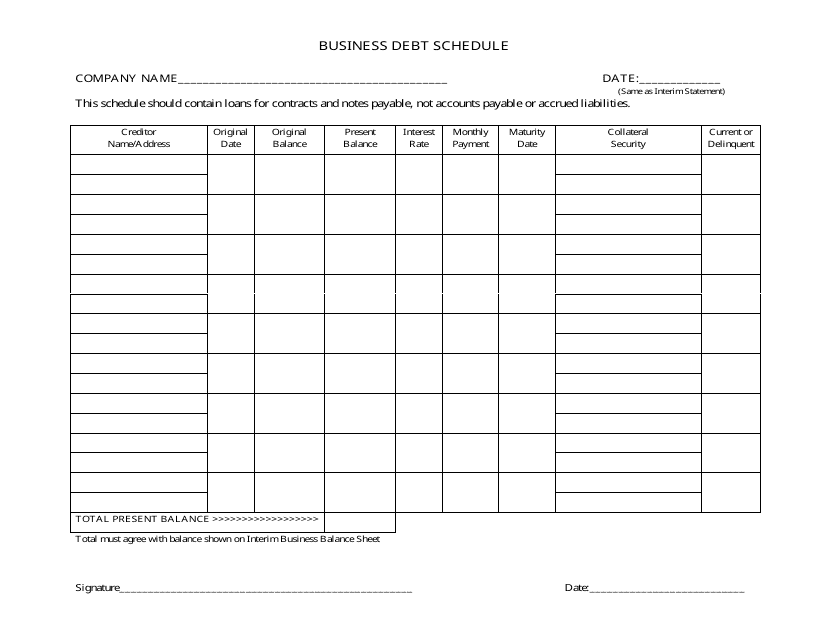

This document is a template that helps businesses organize and track their debt schedule. It provides a varicolored format for easy visualization.

This document helps businesses organize and track their debts. It provides a template for listing the details of each debt, such as the amount owed, interest rate, and repayment terms. By using this template, businesses can better manage their debt obligations and make informed financial decisions.

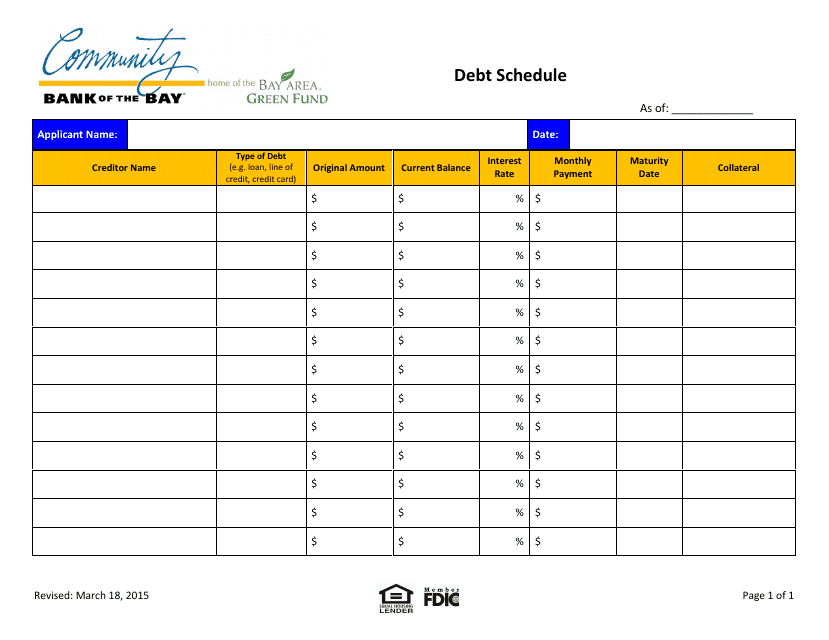

This document is a debt schedule template provided by Community Bank of the Bay. It helps individuals or businesses in organizing their debt repayment schedule.

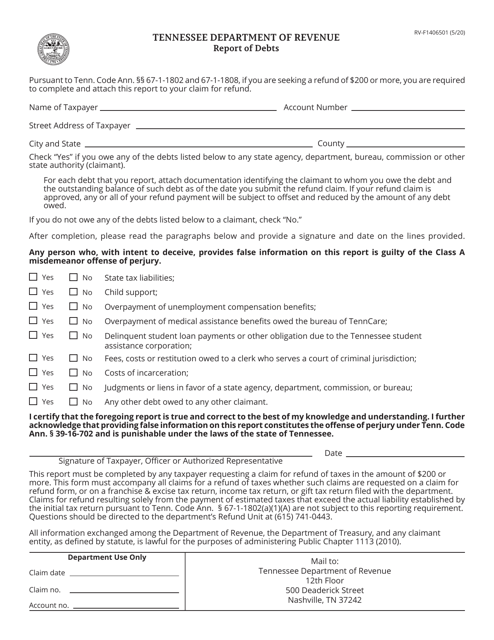

This form is used for reporting debts in the state of Tennessee. It is used to provide detailed information about any outstanding debts a person or entity may have.