Tax Brackets Templates

Are you confused about tax brackets? Do you want to understand how they work and how they might affect your income tax? Look no further! Our website provides comprehensive information about tax brackets, also known as tax brackets or tax bracket groups.

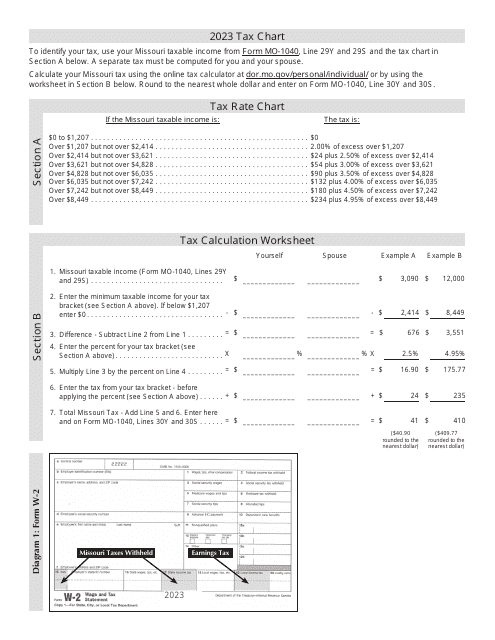

Tax brackets are an essential part of the tax system. They determine the rate at which your income is taxed, based on your income level. By understanding tax brackets, you can make informed decisions regarding your finances and plan for the future.

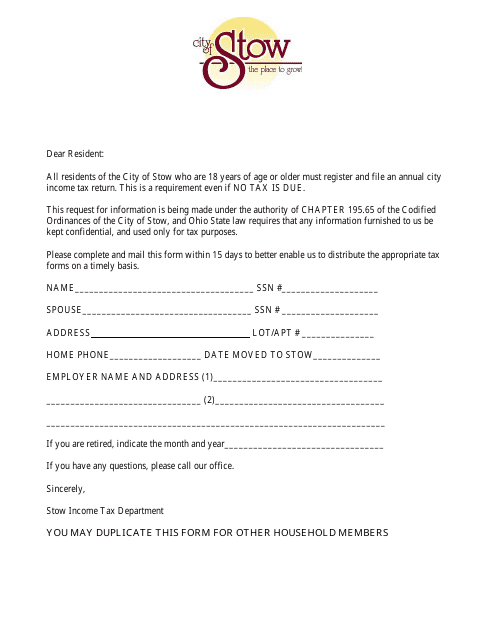

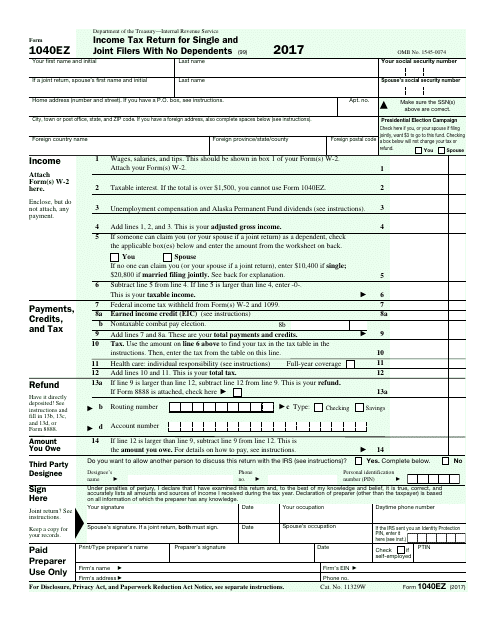

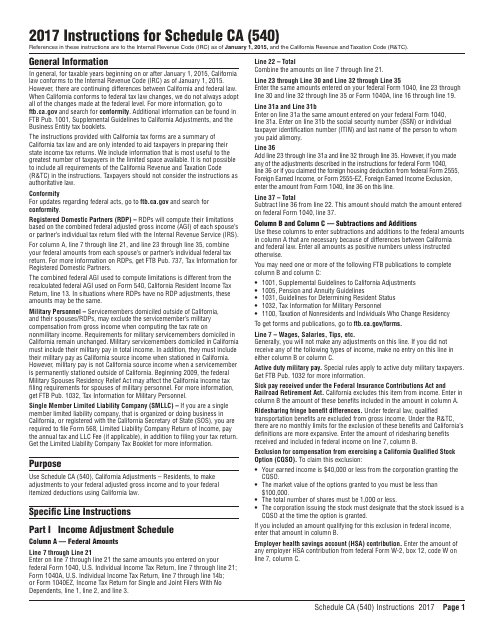

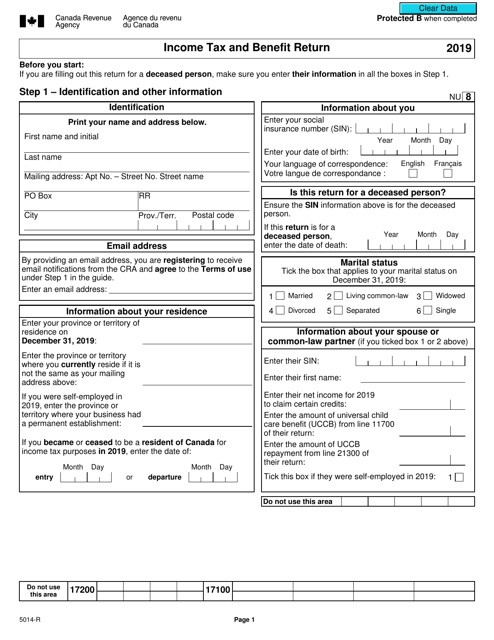

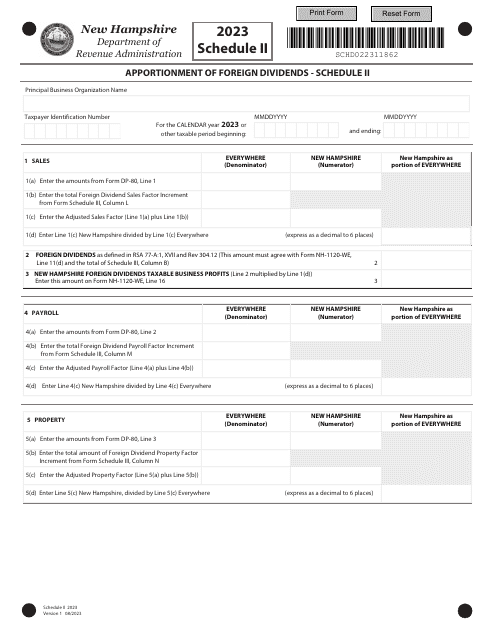

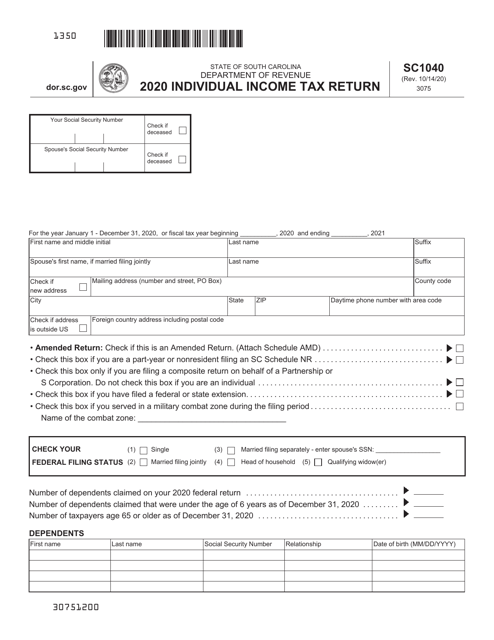

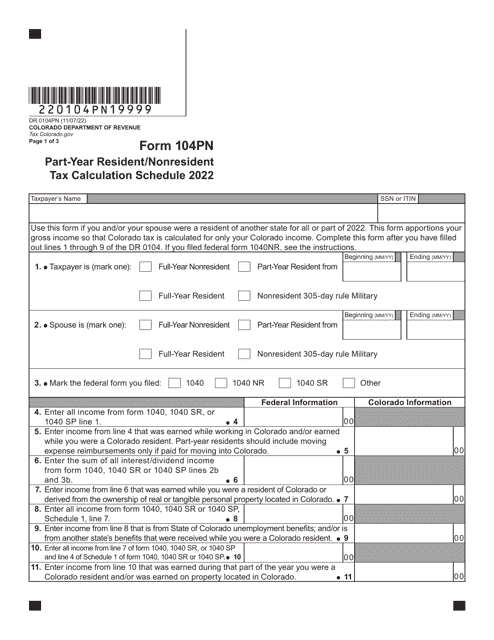

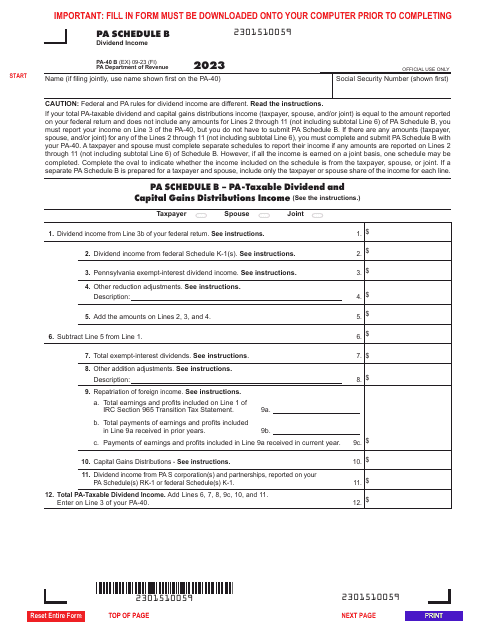

We have compiled a wide range of documents related to tax brackets from different jurisdictions, such as the Income Tax Return Form from the City of Stow, Ohio, the Form 5014-R Income Tax and Benefit Return from Canada, the Form SC1040 Individual Income Tax Return from South Carolina, the Instructions for Form PIT-1 New Mexico Personal Income Tax Return from New Mexico, and the Form DR0104PN Part-Year Resident/Nonresident Tax Calculation Schedule from Colorado.

Whether you want to learn about the different tax brackets, find the right form to file your income tax, or understand the calculations involved, our collection of documents has got you covered. With our user-friendly interface, you can easily navigate through the documents and find the information you need.

Don't let tax brackets overwhelm you. Take control of your tax situation today by exploring our comprehensive collection of tax bracket documents. Start planning your finances efficiently and ensure you are paying the right amount of tax.

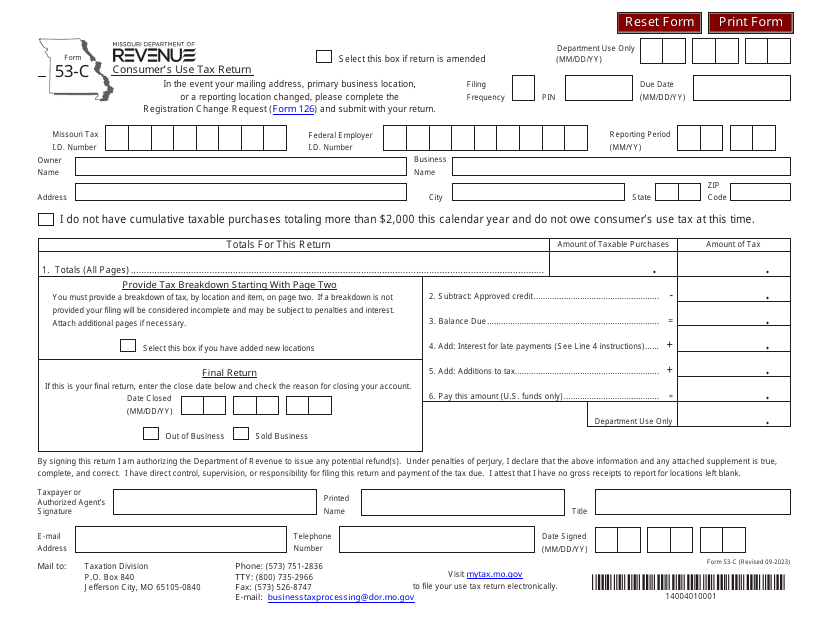

Documents:

22

This Form is used for filing your income tax return in the City of Stow, Ohio.

This Form is used for reporting California-specific tax adjustments for residents of California on their Form 540 tax return. It ensures accurate calculation of state tax liability for California residents.

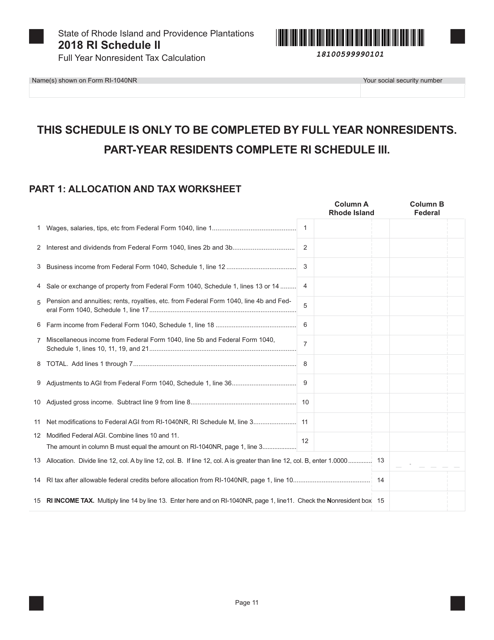

This document is used for calculating the full-year nonresident tax for Schedule II in Rhode Island.

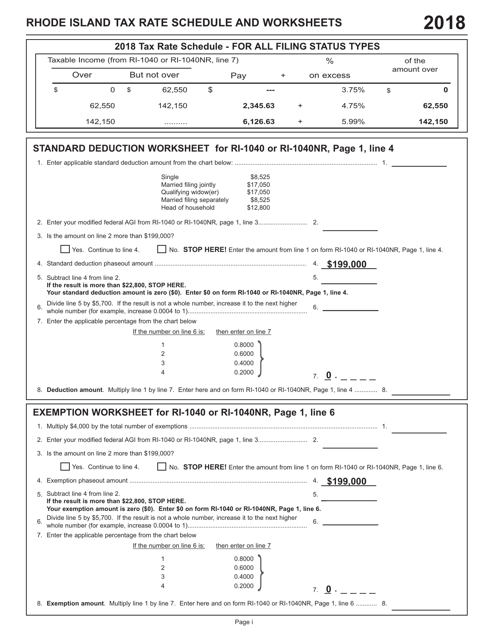

This document provides information about the tax rate schedule and worksheets for residents of Rhode Island. It includes details on how to calculate and pay taxes based on income brackets.

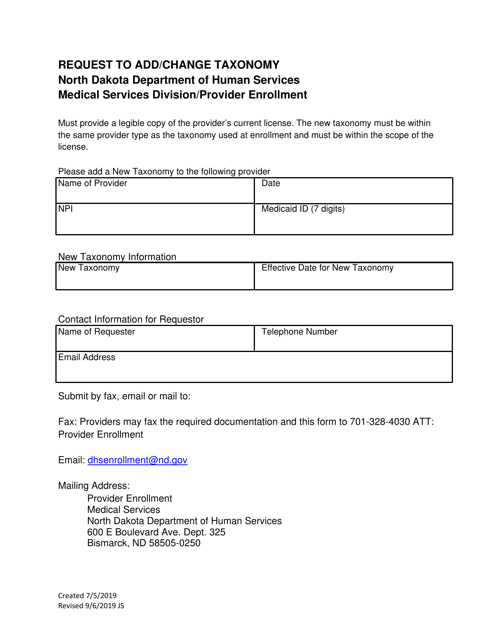

This document is a request form used in North Dakota to add or change a taxonomy.

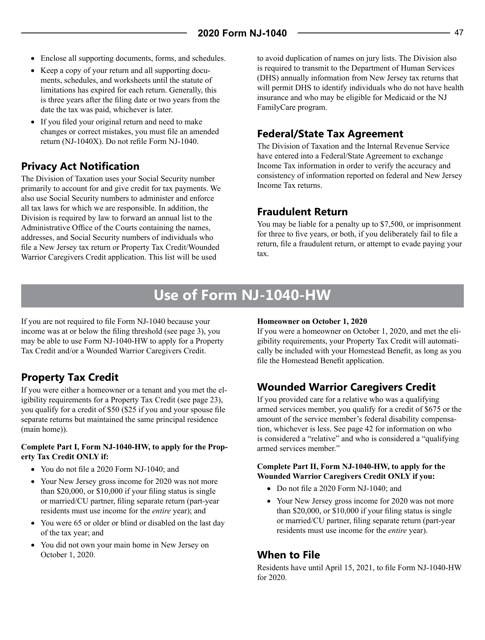

This Form is used for filing New Jersey Resident Income Tax Return for residents of New Jersey. It provides instructions for completing the form and includes information on tax filing requirements and deductions specific to New Jersey.

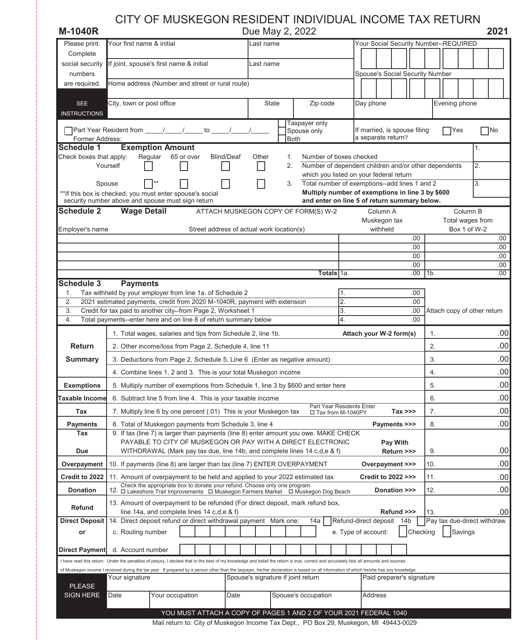

This form is used for reporting and filing resident individual income taxes for residents of Muskegon, Michigan.

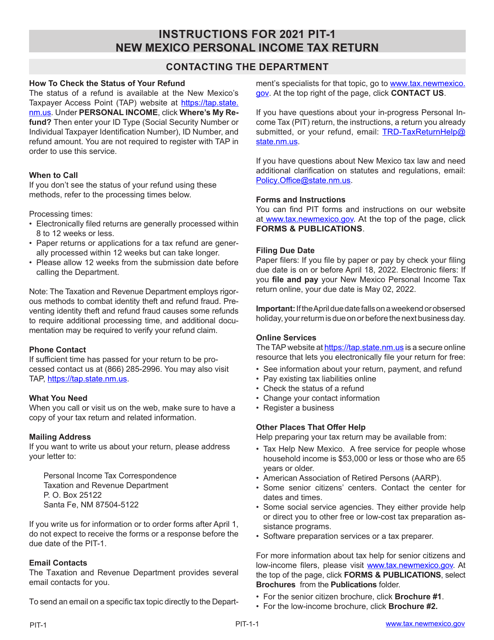

This Form is used for filing the New Mexico Personal Income Tax Return in the state of New Mexico. It provides instructions on how to accurately complete and submit the PIT-1 form for income taxes.

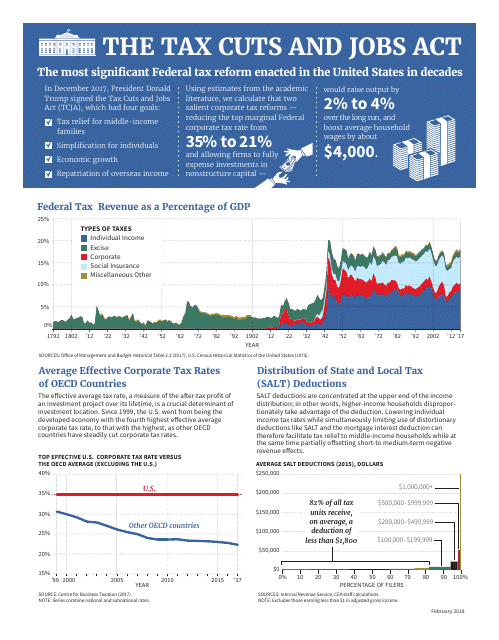

This document explains the Tax Cuts and Jobs Act, a law in the United States that made changes to the tax code with the goal of promoting economic growth and job creation.

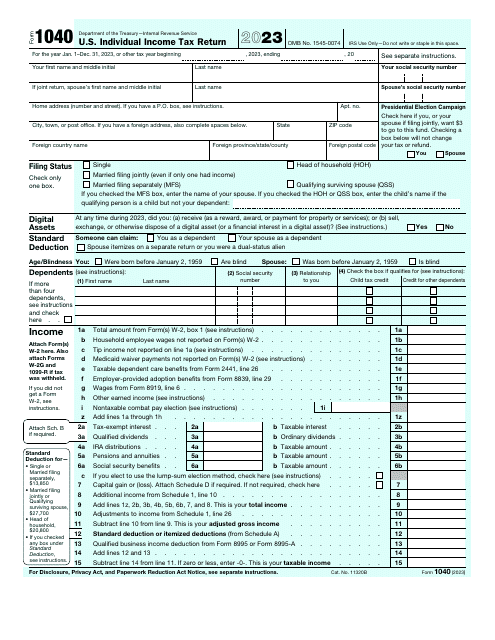

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.