Expense Credit Templates

Welcome to our Expense Credit webpage, where we provide detailed information and guidance on claiming expense credits. Whether you refer to it as "expense credit" or "expenses credit," this is a term used to describe the credits and deductions available to individuals who have incurred various expenses related to their profession or specific circumstances.

Expense credits can be beneficial for a wide range of individuals, including teachers, self-employed professionals, and employees who incur expenses as part of their job. These credits can help offset the costs associated with job-related expenses such as professional development courses, classroom supplies, or travel expenses.

Our webpage provides comprehensive resources and support for individuals looking to navigate the process of claiming expense credits. We have a range of documents that address different types of expenses and provide you with the necessary forms and guidelines.

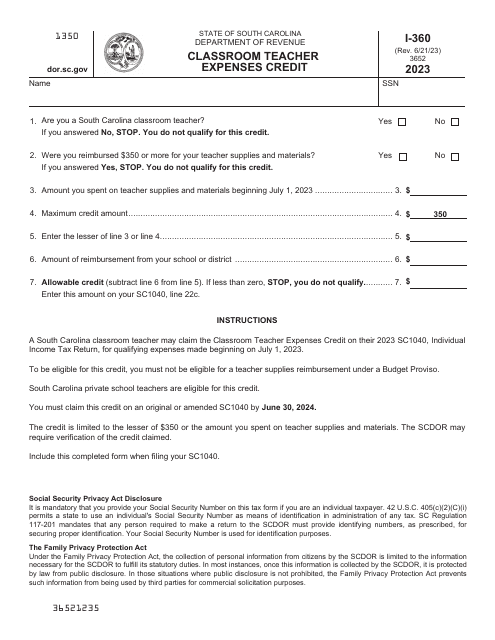

For example, if you are a teacher in South Carolina, you may be interested in learning about the Form I-360 Classroom Teacher Expenses Credit specific to your state. This document outlines the eligibility requirements, allowable expenses, and the steps to claim the credit effectively.

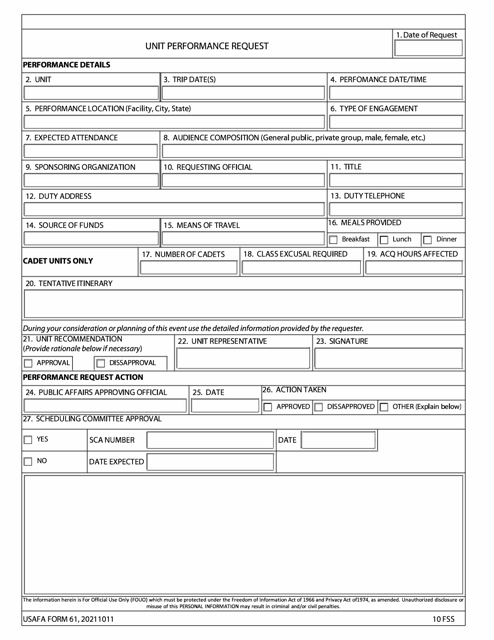

We also provide information on the USAFA Form 61 Classroom Teacher Expenses Credit, which is another document that covers teacher-related expenses. This resource is useful for teachers who have incurred eligible expenses and want to understand the process of claiming this credit.

At our Expense Credit webpage, you will find a wealth of information to help you understand the different types of expense credits, the documents you need to claim them, and the steps involved. We aim to simplify the process and provide you with the knowledge and resources you need to maximize your expense credits.

Please note that the document titles mentioned above are just a few examples of the resources available on our webpage. We have an extensive collection of documents catering to different states, professions, and circumstances. Whether you are seeking information on classroom expenses or other job-related costs, we are here to guide you through the expense credit process.