Documentary Stamp Tax Templates

Documentary Stamp Tax (DST), also known as the Documentary Stamp Tax, is an important aspect of tax regulation in many countries, including the United States and Canada. It is a tax imposed on the transfer of certain documents, such as property deeds, mortgages, and legal agreements.

The purpose of the DST is to ensure the proper recording and documentation of important transactions, while also generating revenue for the government. The DST is typically calculated as a percentage of the total value of the document being transferred, and it is required to be paid by the party responsible for the transfer.

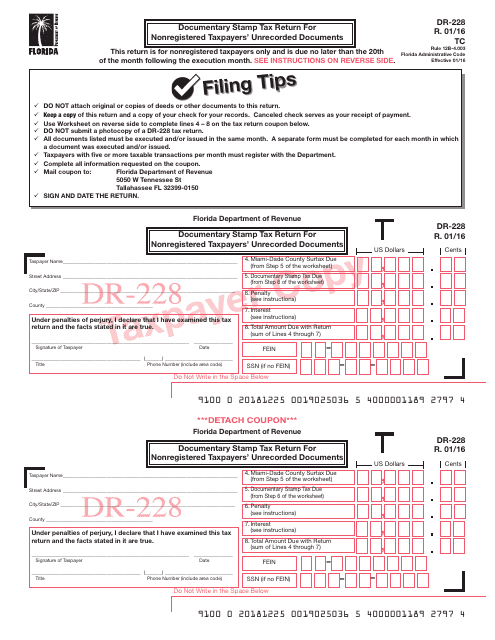

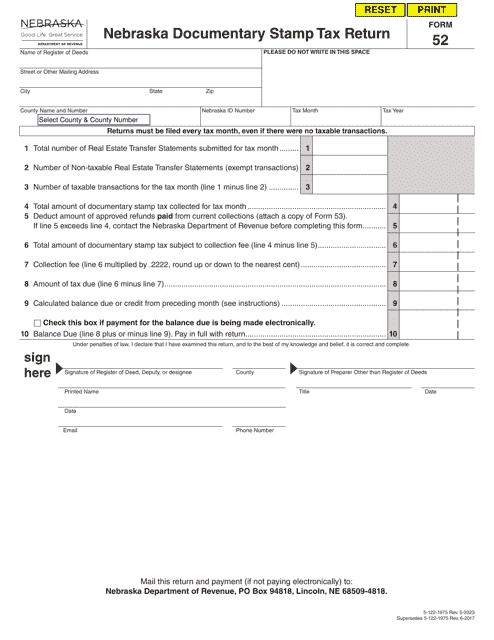

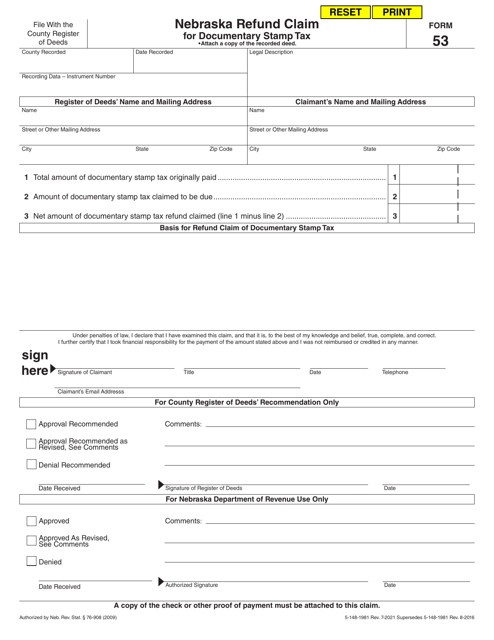

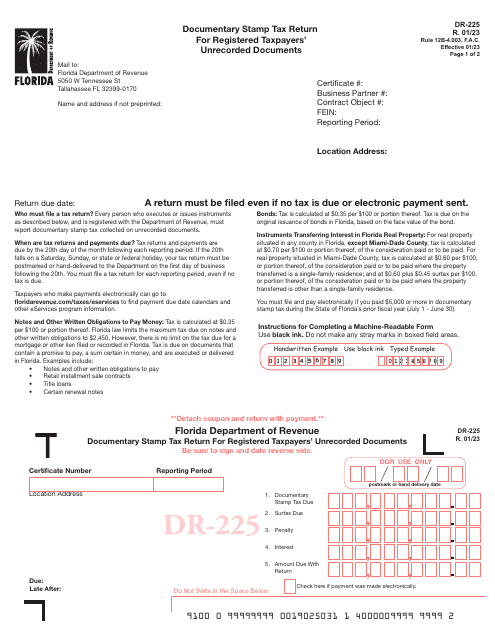

In order to comply with DST regulations, individuals and businesses must complete and submit specific tax forms to the relevant tax authorities. These forms vary depending on the jurisdiction and nature of the transaction. For example, in Florida, nonregistered taxpayers are required to file Form DR-228, while registered taxpayers must use Form DR-225. Similarly, in Nebraska, there is Form 53 for refund claims related to DST.

To make the process easier, various alternate names for the DST documents collection may be used, such as "Documentary Stamp Tax Return Forms," "Certificate of Title Documentary Stamp Tax Remittance Forms," or "Forms for Documentary Stamp Tax Compliance." These forms play a crucial role in ensuring accurate reporting and payment of DST, thereby avoiding potential penalties or legal issues.

Navigating the complexities of the DST regulations and complying with the necessary documentation requirements can be overwhelming. However, understanding the importance of DST and utilizing the appropriate forms is essential for individuals and businesses involved in transactions subject to this tax. Whether you are a property owner, a mortgage lender, or a legal professional, familiarizing yourself with the requirements and ensuring timely compliance will help you abide by the law and avoid any complications related to documentary stamp tax.

Documents:

7

Form DR-228 Documentary Stamp Tax Return for Nonregistered Taxpayers' Unrecorded Documents - Florida

This form is used for nonregistered taxpayers in Florida to report and pay documentary stamp tax on unrecorded documents.

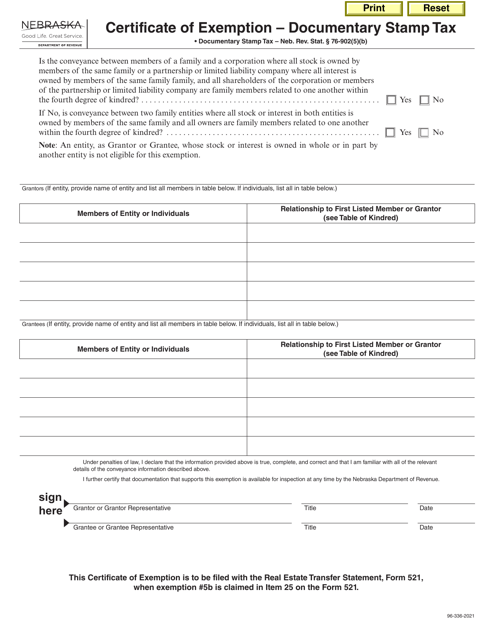

This type of document is a Certificate of Exemption for the Documentary Stamp Tax in the state of Nebraska. It is used to claim an exemption from paying documentary stamp tax on certain types of transactions.

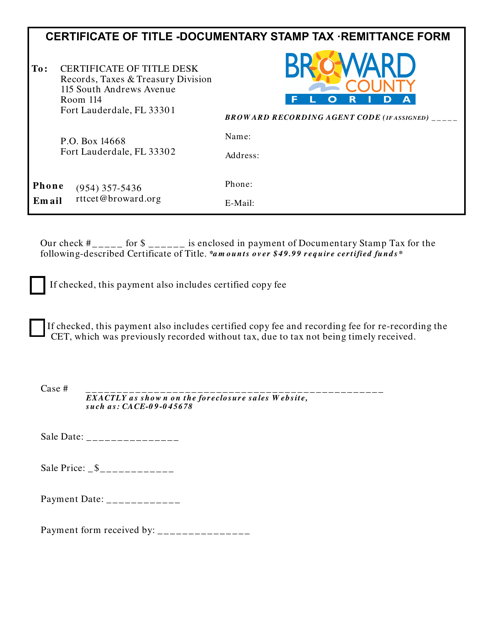

This form is used for remitting documentary stamp tax for the Certificate of Title in Broward County, Florida.