Fuel Industry Templates

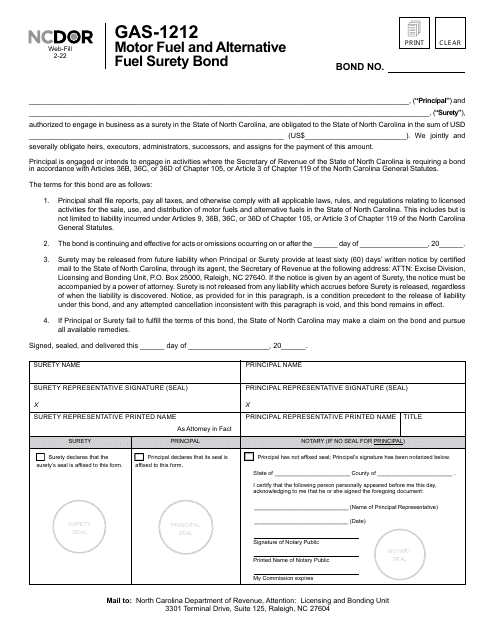

The fuel industry, also known as the industrial fuel sector, plays a critical role in powering various sectors of the economy. This encompassing collection of documents governs the regulations and reporting requirements that ensure the smooth operation and compliance within the fuel industry.

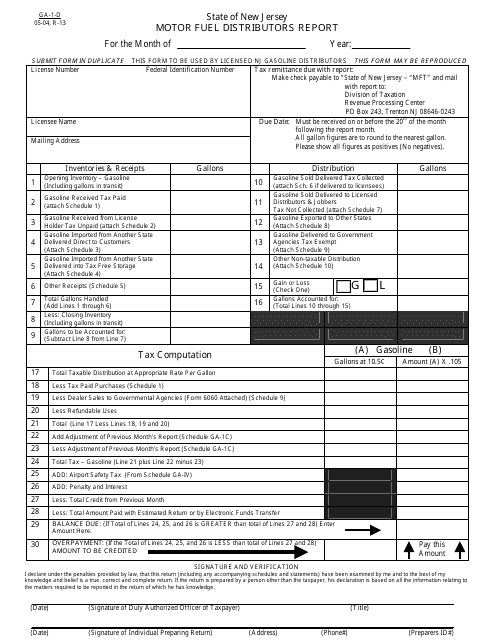

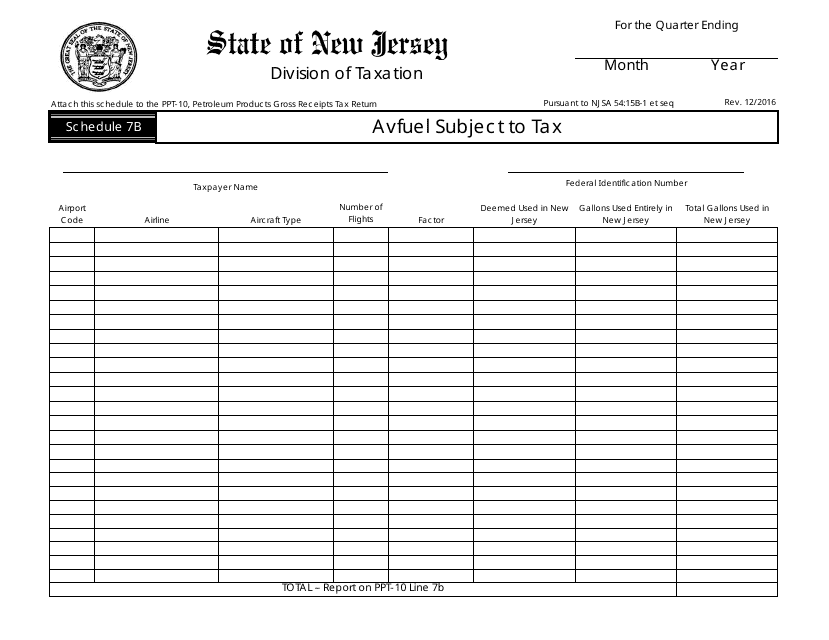

Within this diverse array of documents, one can find crucial information such as the Form GA-1-D Motor Fuel Distributors Report from New Jersey, which provides a comprehensive overview of motor fuel distribution activities. Another essential document is the Form PPT-10 Schedule 7B Avfuel Subject to Tax from New Jersey, which outlines the tax obligations for avfuel in the state.

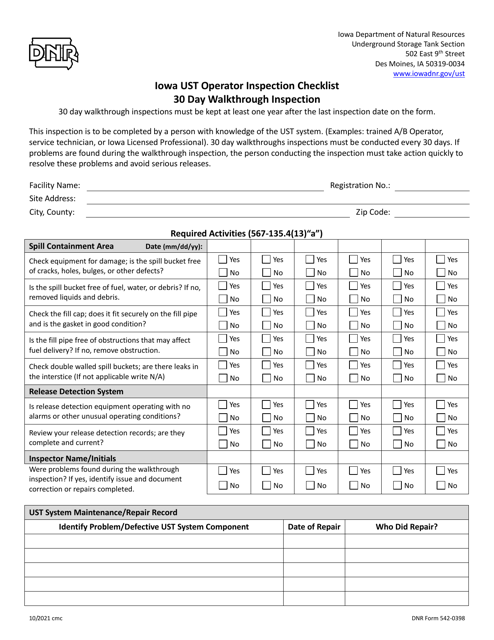

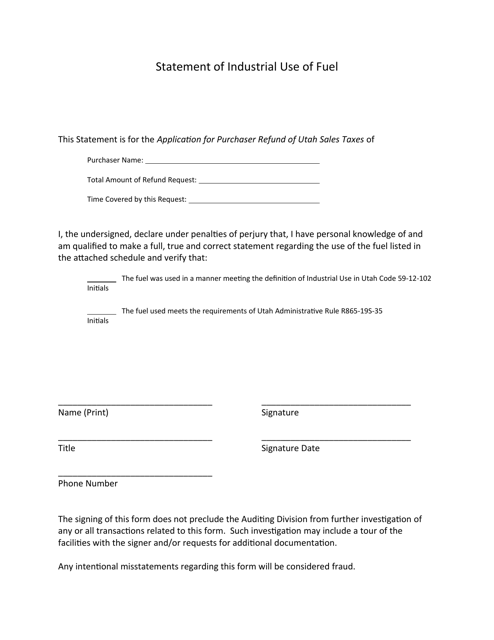

For fuel industry professionals in Iowa, the DNR Form 542-0398 Iowa Ust Operator Inspection Checklist serves as a valuable tool for conducting thorough 30-day walkthrough inspections of underground storage tanks. In Utah, the Statement of Industrial Use of Fuel serves as a means for businesses to accurately report and disclose their fuel consumption for industrial purposes.

Moreover, for a broader perspective on the fuel industry, individuals can refer to the Instructions for Form EIA-809 Weekly Oxygenate Report. This document provides guidance on reporting weekly oxygenate consumption, offering critical insights into the fuel landscape.

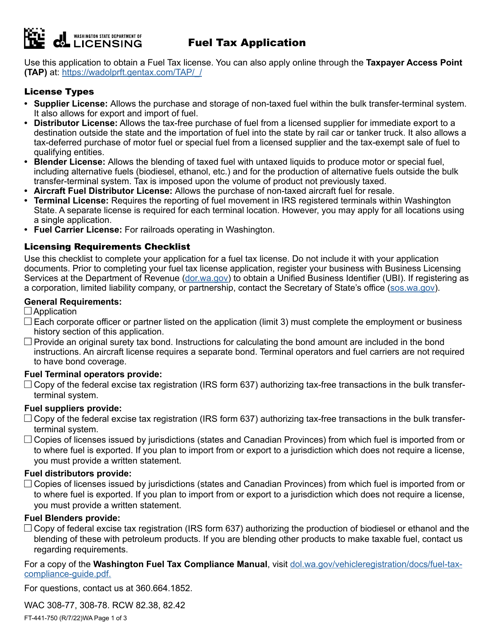

The fuel industry, synonymous with the term industrial fuel, operates within a highly regulated framework, and adherence to these documents is crucial for maintaining compliance and efficiency. Explore this comprehensive collection of documents to gain a deeper understanding of the fuel industry's intricacies.

Documents:

16

This Form is used for motor fuel distributors in New Jersey to report their activities.

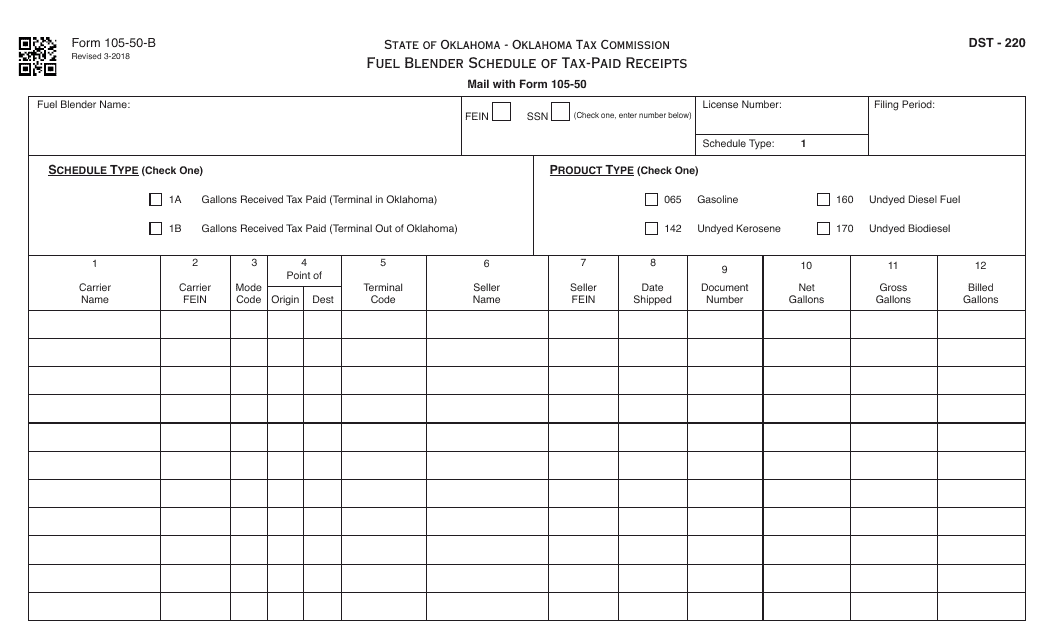

This form is used for reporting tax-paid receipts for fuel blending in Oklahoma.

This Form is used for reporting Avfuel subject to tax in New Jersey.

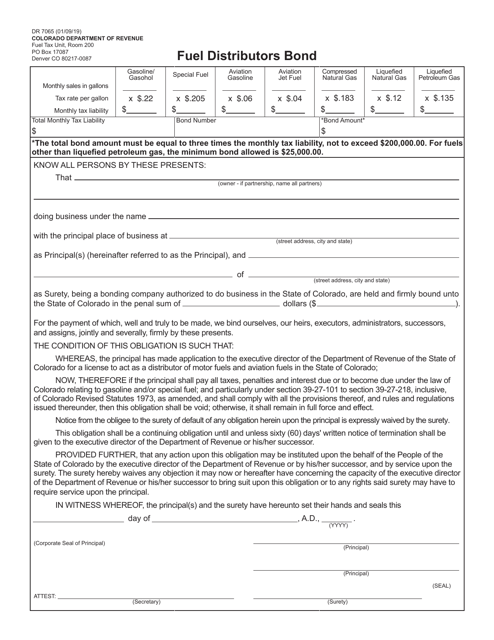

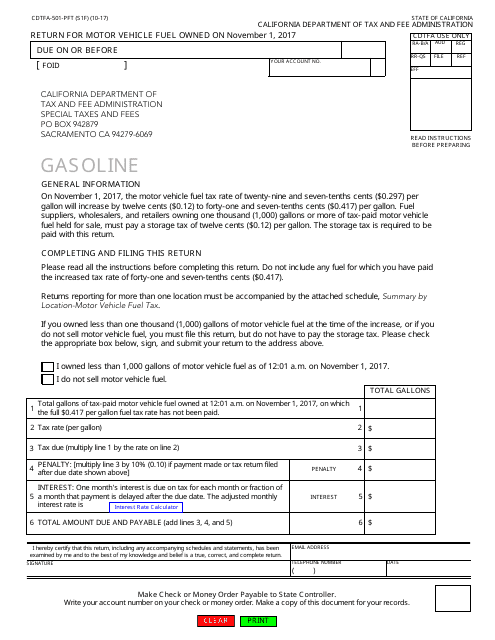

This Form is used for reporting and paying taxes on motor vehicle fuel owned in California on November 1, 2017. It is necessary for compliance with state tax laws.

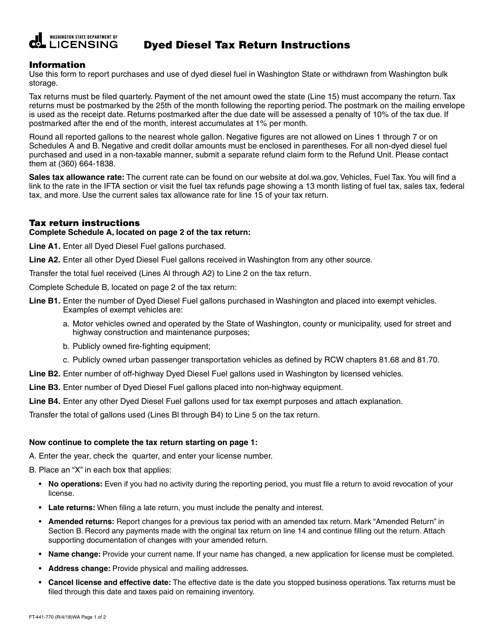

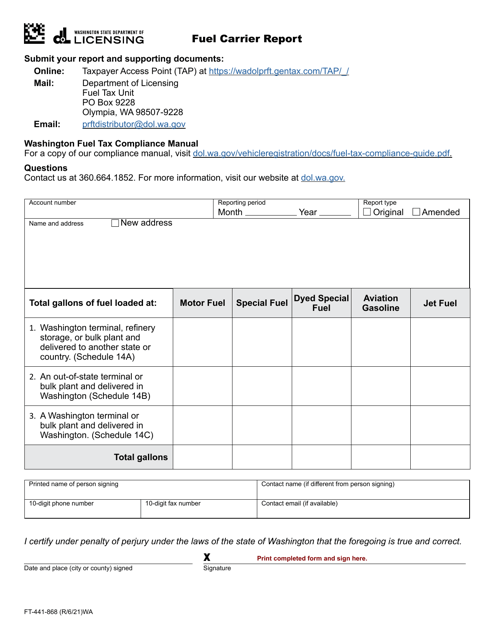

This form is used for reporting and paying taxes on dyed diesel fuel in the state of Washington.

This document is used to provide information about the industrial use of fuel in the state of Utah.