Senior Citizen Exemption Templates

Are you a senior citizen looking for property tax exemptions? Look no further! Our senior citizen exemption program provides financial relief for eligible individuals aged 65 and over. With this exemption, you can enjoy reduced property tax rates, allowing you to save money and make the most of your retirement.

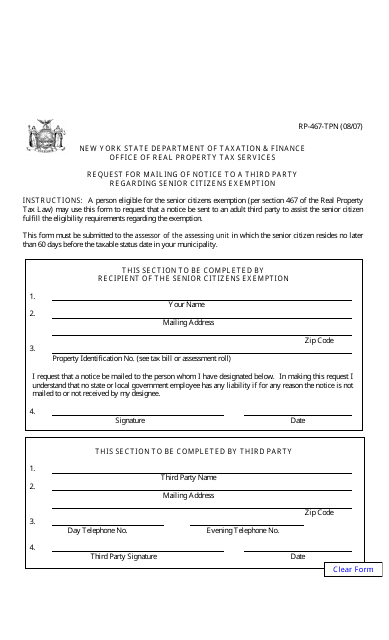

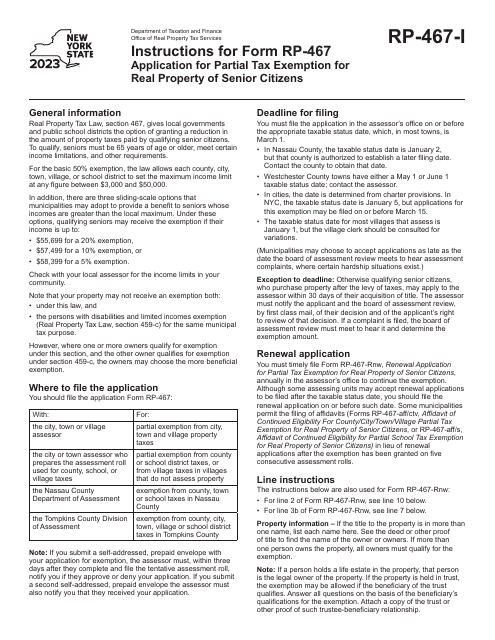

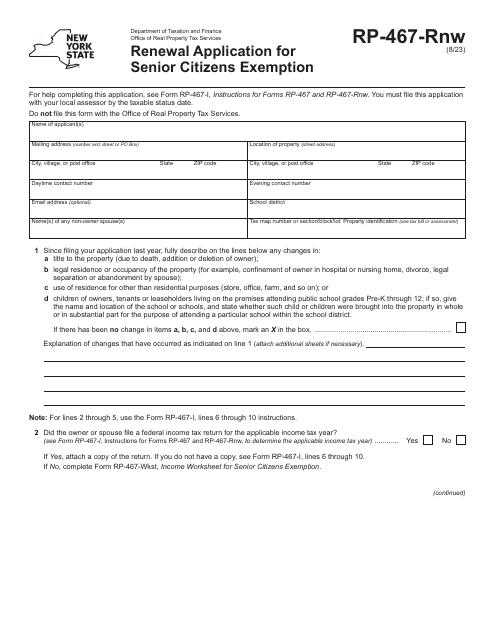

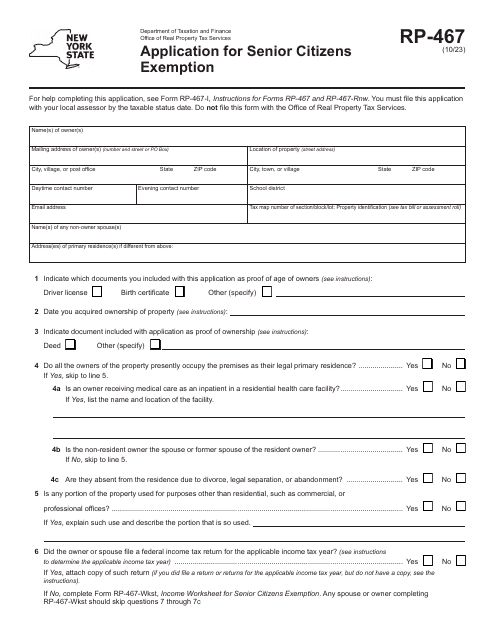

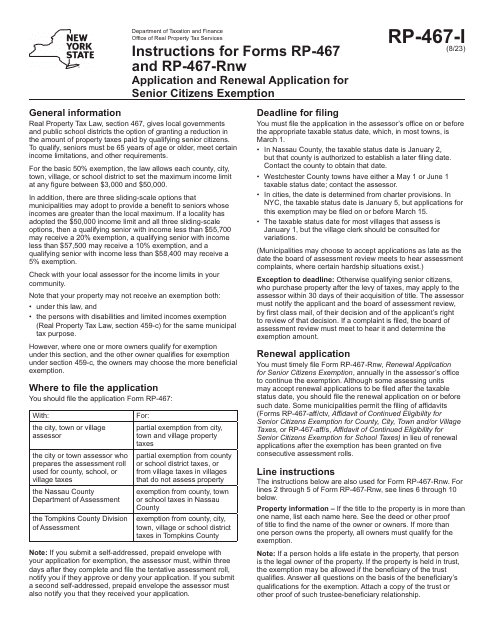

Whether you're a homeowner in New York or Washington, our program offers various forms and applications to help you apply for the senior citizens exemption. For instance, you can fill out Form RP-467-TPN, which allows you to request the mailing of a notice to a third party regarding your exemption in New York. Additionally, we provide clear instructions on how to complete Form RP-467, the application for the senior citizens exemption in New York.

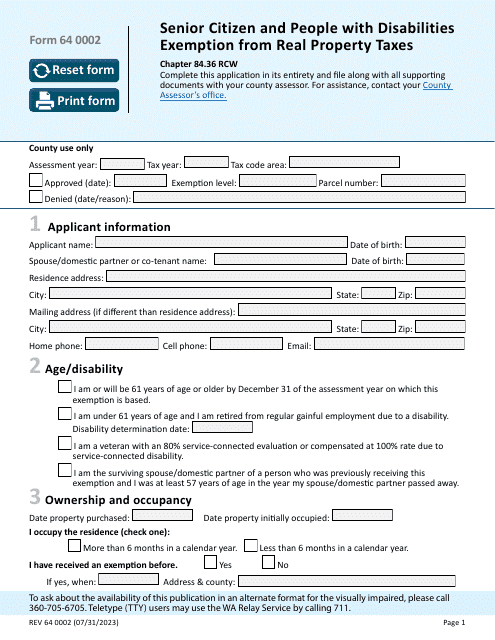

We understand the importance of accessibility and financial assistance for senior citizens. That's why our program also offers Form REV64 0002, specifically designed for senior citizens and people with disabilities seeking exemption from real property taxes in Washington. Additionally, our instructions for Form RP-467-RNW provide guidance for both the initial application and renewal application for the senior citizens exemption in New York.

Take advantage of the benefits that our senior citizen exemption program provides. Apply today and see how much you can save on your property taxes. Don't miss out on the opportunity to enjoy your retirement without the burden of high taxes.

Documents:

7

This form is used for requesting the mailing of a notice to a third party regarding senior citizens exemption in New York.

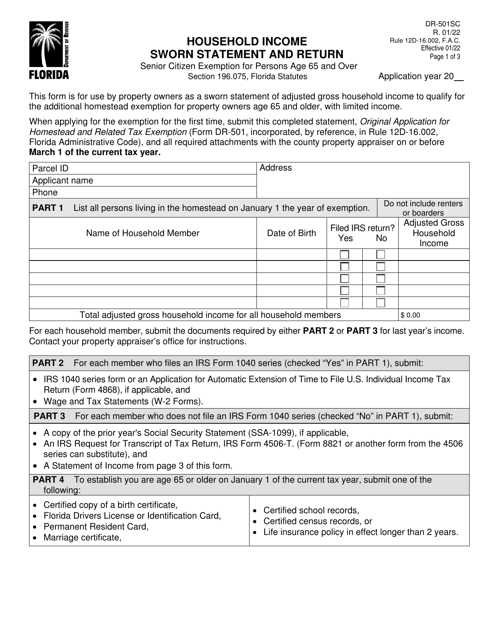

This form is used for senior citizens in Florida who want to apply for a tax exemption for persons aged 65 and over. It requires a sworn statement and return of household income.