Withheld Federal Income Tax Templates

Withheld Federal Income Tax Documentation

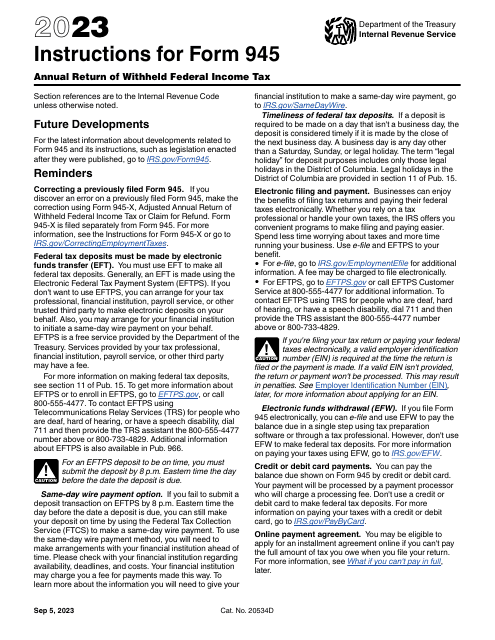

Our withheld federal income tax documentation provides valuable resources for individuals and businesses seeking information about filing their annual returns and claiming refunds. Whether you're a taxpayer looking for instructions on completing the IRS Form 945-X Adjusted Annual Return of Withheld Federal Income Tax or a business owner in need of guidance with the IRS Form 945 Annual Return of Withheld Federal Income Tax, our comprehensive collection of documents has you covered.

Explore our range of withheld federal income tax documentation, including detailed instructions for various IRS forms and step-by-step guidelines on how to accurately report and reconcile your tax obligations. Our documentation is designed to simplify the complex process of managing withheld federal income tax, ensuring that you have the necessary tools at your disposal to meet your obligations and maximize your potential refund.

Discover the latest updates and regulations surrounding withheld federal income tax, empowering yourself with the knowledge and resources needed to navigate the ever-changing tax landscape. Our documentation covers a multitude of topics, from understanding the requirements of filing a claim for refund to staying compliant with IRS guidelines.

Browse our withheld federal income tax documentation today and gain access to essential information, instructions, and guidance to effectively manage your tax obligations. Take control of your tax situation and ensure that you are making accurate filings while optimizing your potential refunds.

Documents:

10

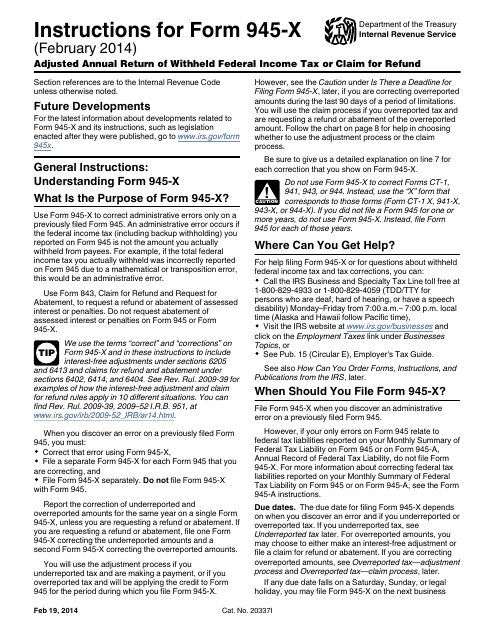

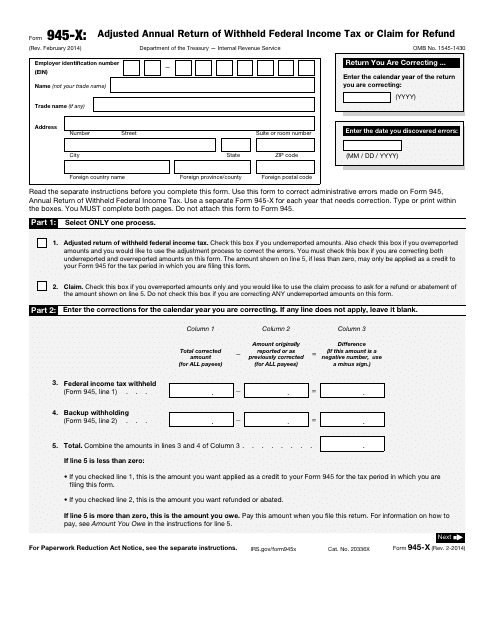

This Form is used for making adjustments to the annual return of withheld federal income tax or claiming a refund. It is specifically designed for the IRS Form 945-X.

This is a fiscal form used by taxpayers to modify the information they submitted via IRS Form 945, Annual Return of Withheld Federal Income Tax.

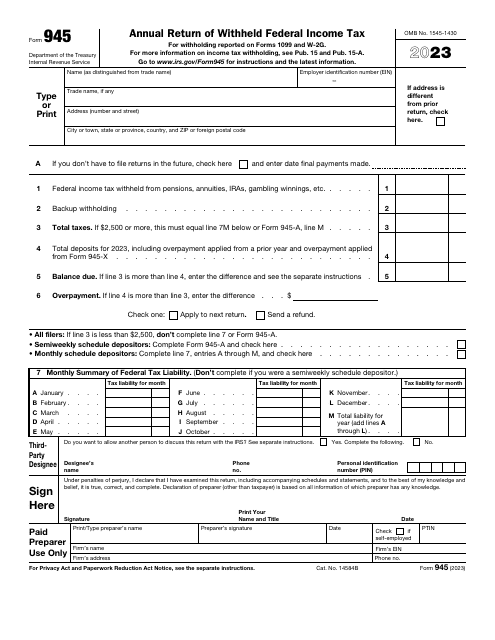

This is a fiscal form taxpayers are obliged to prepare and submit to provide information about nonpayroll payments subject to tax and confirm they are paying an accurate amount of tax for the last year.