Qualified Adoption Expenses Templates

Are you looking for information about qualified adoption expenses? Look no further. Our webpage provides a comprehensive guide on qualifying adoption expenses, also known as qualified adoption expenses. Whether you are considering adopting a child or have already gone through the process, understanding the financial aspects is crucial.

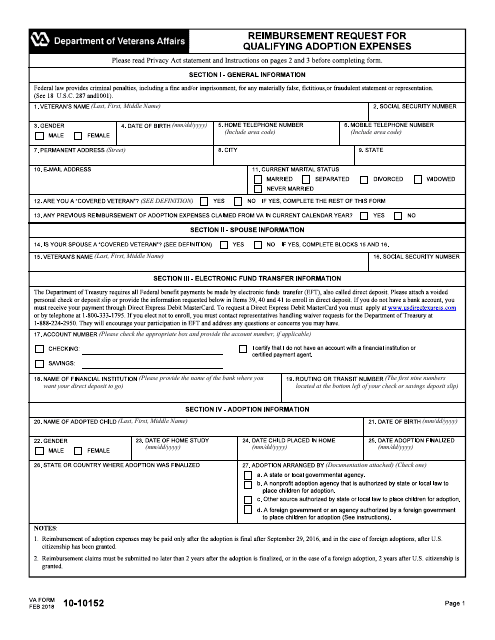

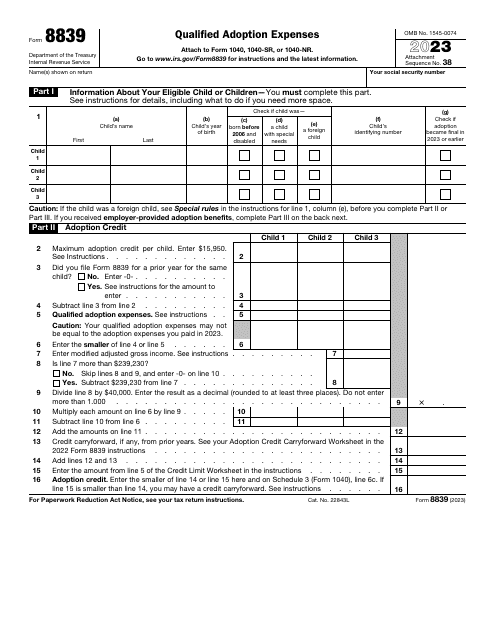

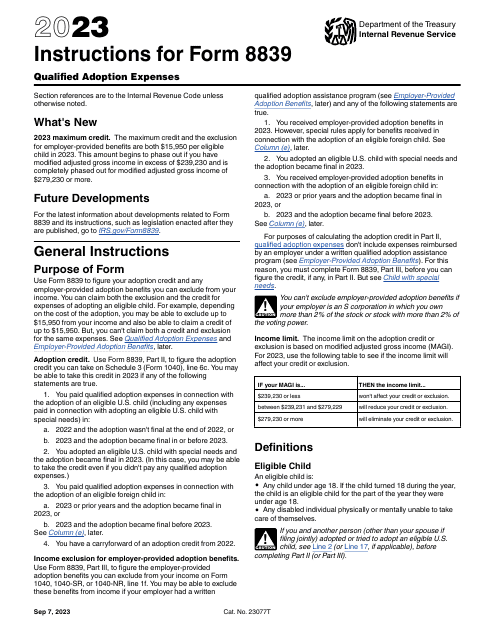

On our webpage, you will find valuable resources such as the IRS Form 8839 Qualified Adoption Expenses and its accompanying instructions. These documents are essential for individuals who have incurred qualifying adoption expenses and are seeking to claim any potential tax benefits. Our webpage breaks down the form and instructions, providing clear explanations and guidance to ensure you navigate the process smoothly.

Adopting a child is a joyous and life-changing experience, but it can also be expensive. That's why it's important to familiarize yourself with the concept of qualifying adoption expenses, which can help offset some of the financial burden. Our webpage offers insights into what expenses qualify, how to document them, and what deductions or credits may be available to you.

We understand that the adoption process can be overwhelming, which is why our webpage aims to simplify the information surrounding qualified adoption expenses. Whether you need assistance in completing IRS Form 8839 or want to learn more about the financial implications of adoption, our webpage is a valuable resource.

Don't let the complexities of qualified adoption expenses discourage you from pursuing your dream of adoption. Visit our webpage today to gain the knowledge and understanding you need to navigate this aspect of the adoption process with confidence.

Documents:

13

This form is used for requesting reimbursement for qualifying adoption expenses.