Diesel Tax Templates

Are you looking for information about diesel tax and how it applies to your area? Look no further! Our website provides comprehensive resources and knowledge about diesel tax regulations and procedures.

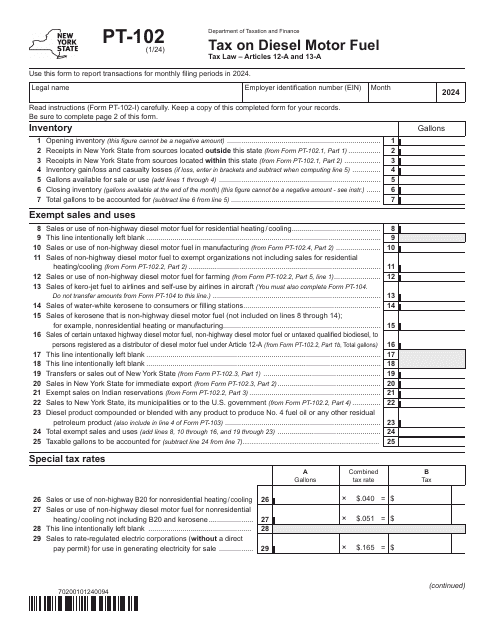

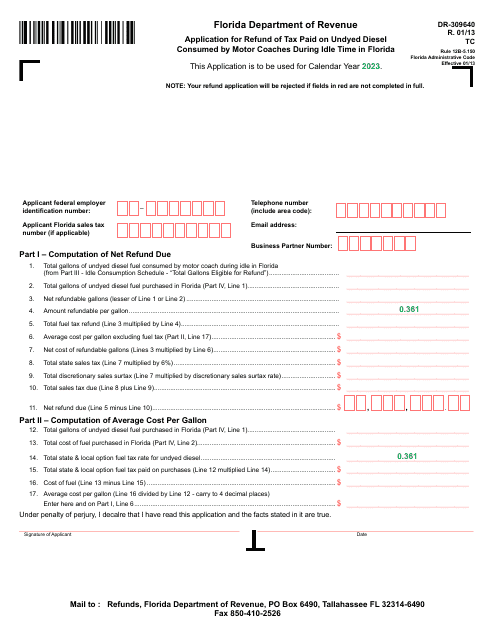

Diesel tax, also known as the tax on diesel motor fuel, is an important aspect of the transportation industry. It is levied on the purchase and use of diesel fuel and is used to fund various transportation initiatives and infrastructure in the USA, Canada, and other countries.

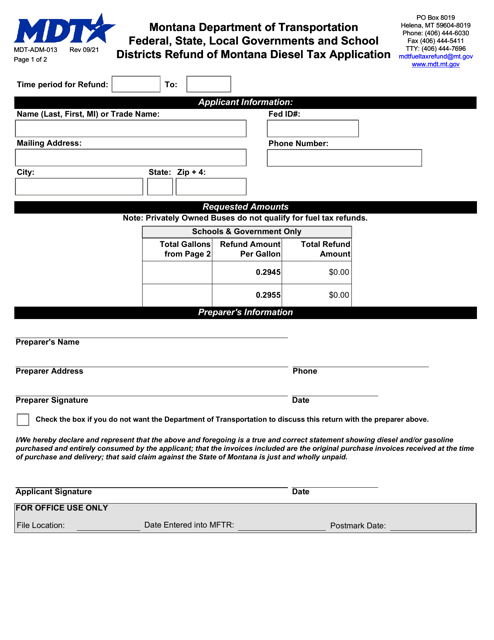

At our website, we have a wide range of documents and forms related to diesel tax. These documents include application forms for various tax refunds and exemptions, such as the Off-Road Refund of Montana Diesel and/or Gasoline Tax Application, the Pto Refund of Montana Diesel and/or Gas Tax Application, and the Federal, State, Local Governments and School Districts Refund of Montana Diesel Tax Application, among others.

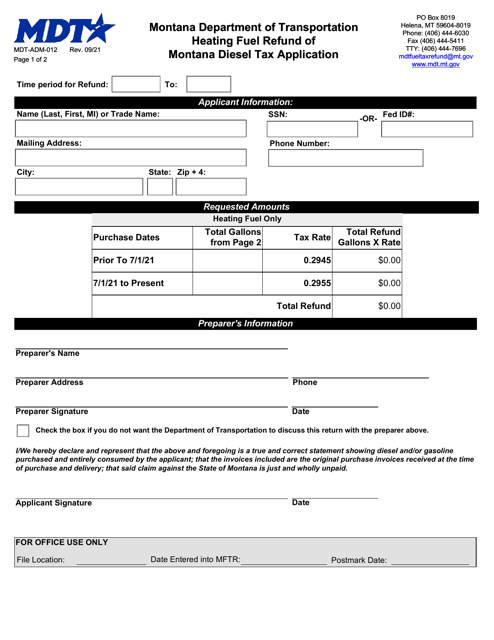

We also have resources specific to certain industries or uses of diesel fuel. For example, if you use diesel fuel for heating purposes, we have the Heating Fuel Refund of Montana Diesel Tax Application specifically designed for you.

In addition to the specific documents mentioned above, we have a vast collection of other resources related to diesel tax, including guidelines, FAQs, and informational articles. Whether you are a business owner, a truck driver, or a private individual, our website is a valuable hub of information for anyone seeking to understand and comply with diesel tax regulations.

Our user-friendly interface makes it easy to navigate and find the information you need. So, if you have any questions or need assistance with diesel tax related matters, browse through our collection of documents and resources or reach out to our knowledgeable team for guidance.

Trust our website to be your go-to source for all things diesel tax. Stay informed, stay compliant, and make the most out of your diesel fuel-related activities with the help of our comprehensive resources. Start exploring our collection of documents today!

Note: Please note that we provide general information about diesel tax and related procedures. It is important to consult with local authorities and tax professionals for specific advice and regulations that apply to your area.

Documents:

14

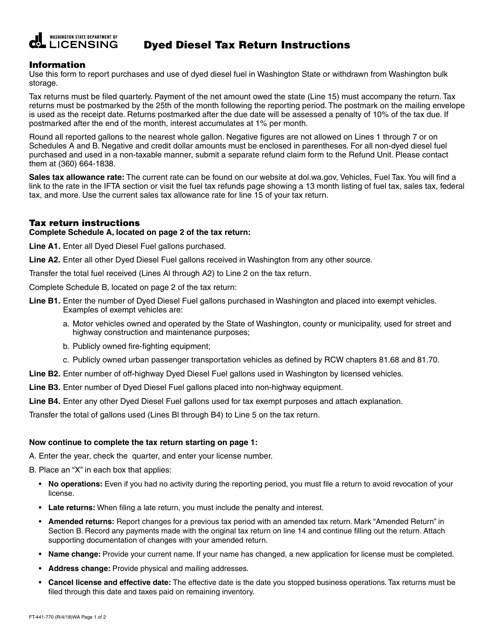

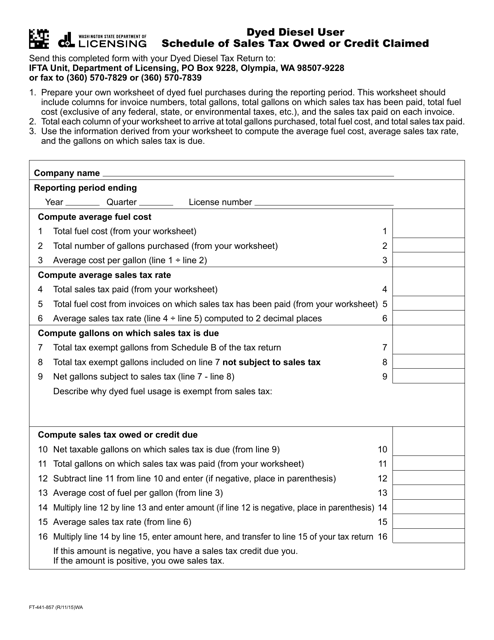

This form is used for reporting and paying taxes on dyed diesel fuel in the state of Washington.

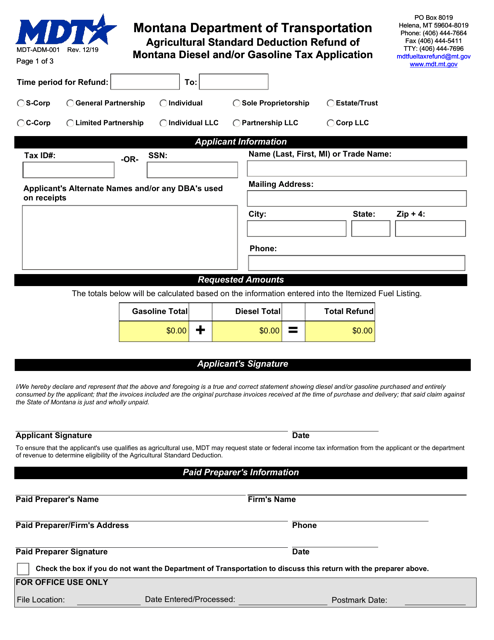

This document is for applying for a refund of Montana diesel and/or gasoline tax under the Agricultural Standard Deduction.

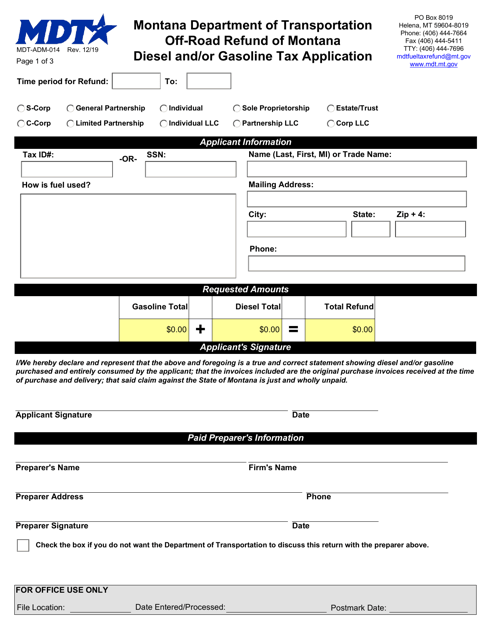

This form is used for applying for a refund of Montana diesel and/or gasoline tax for off-road use.

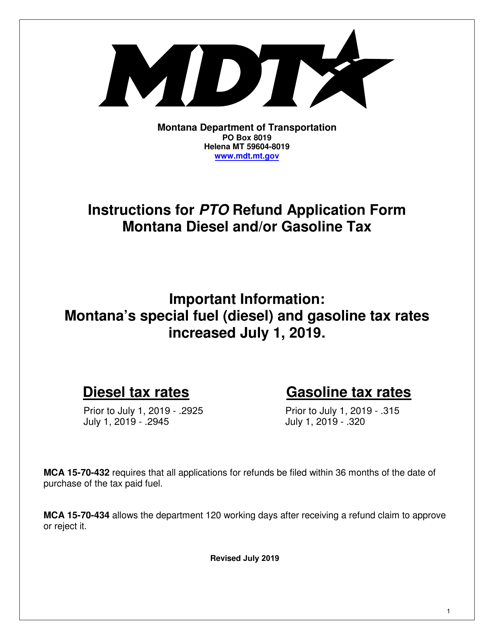

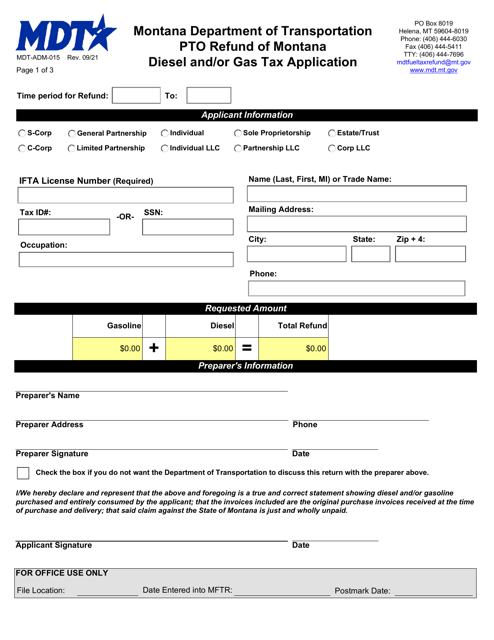

This type of document provides instructions for filling out Form MDT-ADM-015, which is used for applying for a refund of Montana Diesel and/or Gas Tax in Montana.

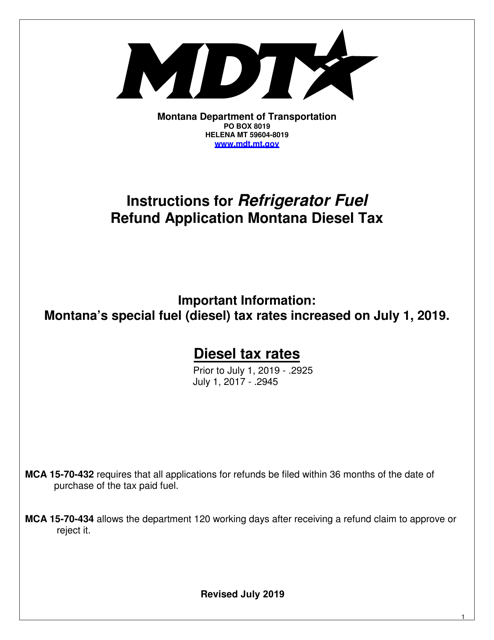

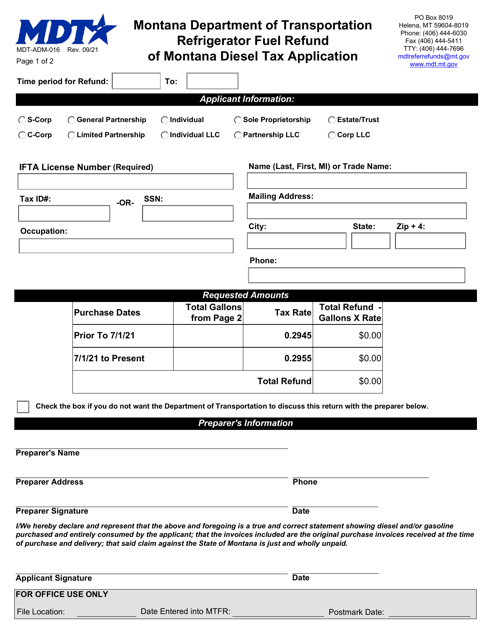

This Form is used for applying for a refund of Montana diesel tax paid on refrigerator fuel in Montana.

This form is used for reporting and calculating the sales tax owed or claiming a credit for the sale of dyed diesel fuel in the state of Washington.