Tax Computation Templates

Are you looking for information on tax computations? Our tax computation services provide a comprehensive analysis and calculation of your tax liabilities. Whether you're an individual or a business, understanding your tax obligations is essential for financial planning and compliance.

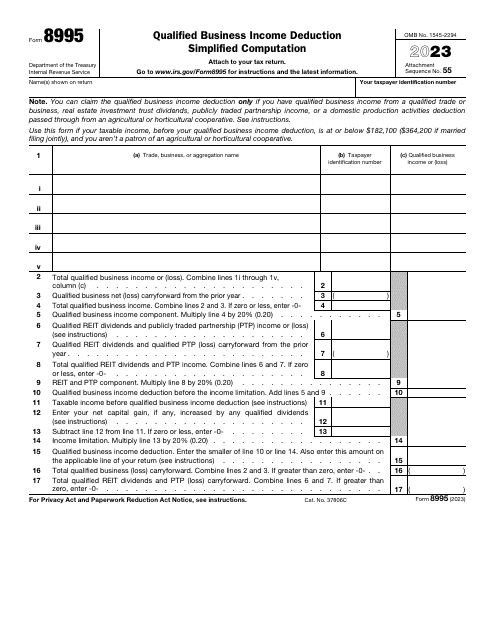

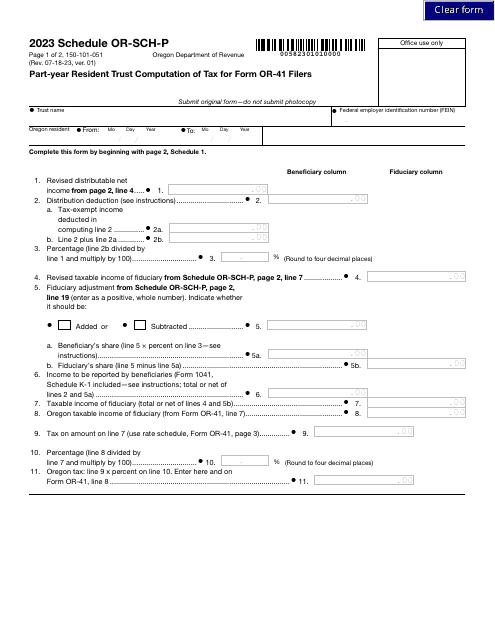

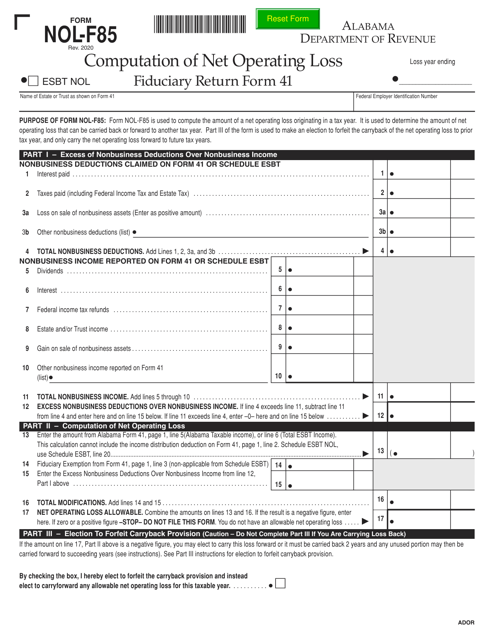

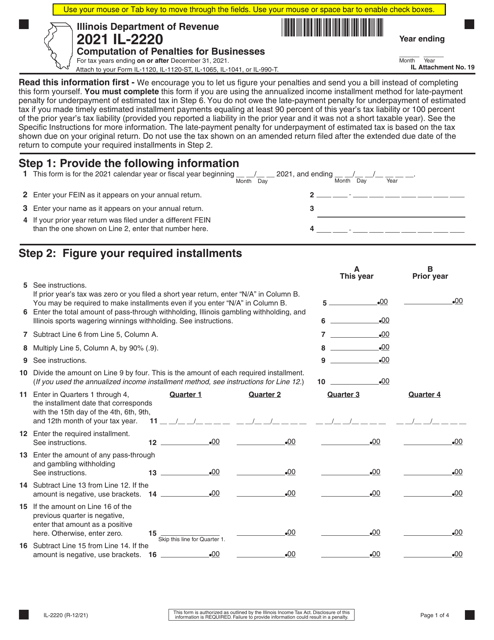

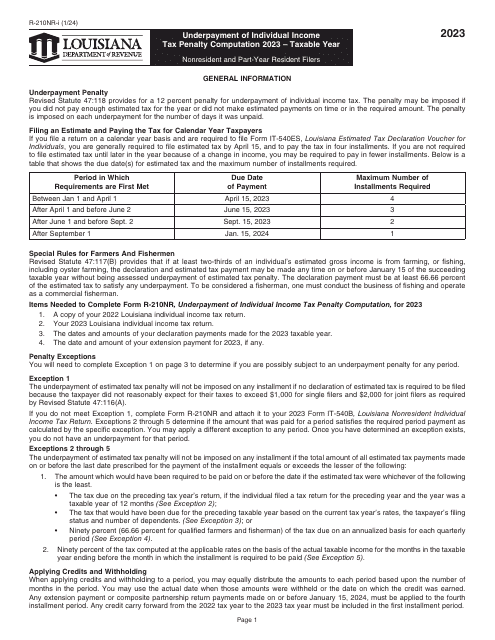

Our tax computation service handles various forms and schedules, such as Form NOL-F85 Computation of Net Operating Loss for Alabama, Schedule 2A Combined Reporting Schedule for Washington, D.C., and Form IL-2210 Computation of Penalties for Individuals in Illinois. We can also assist with IRS Form 1120-F Schedule M-1, M-2 Reconciliation of Income (Loss), and the Ri-1041 Tax Computation Worksheet Draft in Rhode Island.

With our expert knowledge and experience, we ensure accurate and precise tax computations to facilitate your decision-making process. Our team of tax professionals is well-versed in tax laws and regulations, constantly updating their skills to provide you with the most current and relevant information.

We understand that tax computations can be complex and time-consuming. That's why our service offers a streamlined and efficient process, saving you both time and effort. By entrusting your tax computations to us, you can focus on more critical aspects of your business or personal finances.

Let us take care of your tax computations and alleviate the stress associated with tax obligations. Contact us today to learn more about our tax computation services and how we can assist you in optimizing your tax strategy.

Documents:

65

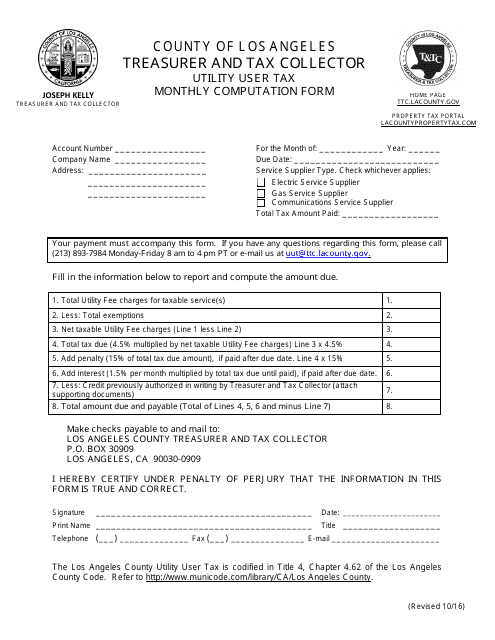

This document is used for calculating the monthly utility user tax in Los Angeles County, California. It is necessary for individuals and businesses to pay this tax based on their utility usage.

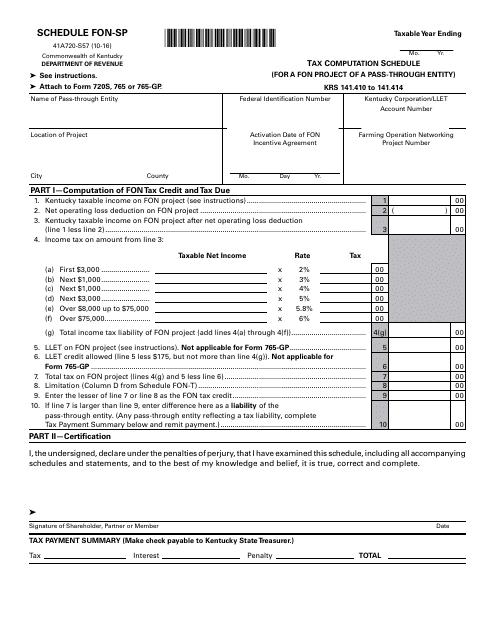

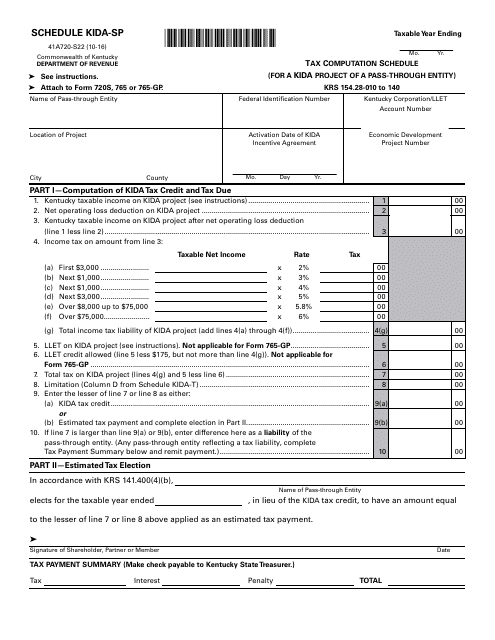

This Form is used for calculating tax for a Fon project of a pass-through entity in Kentucky.

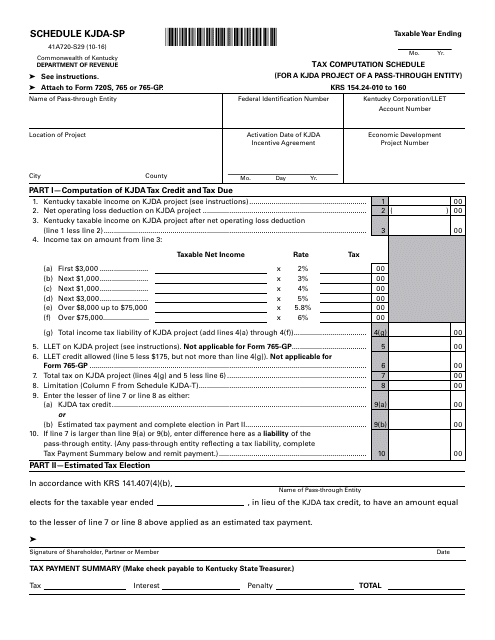

This Form is used for calculating the tax for a specific type of project in Kentucky that is owned by a pass-through entity.

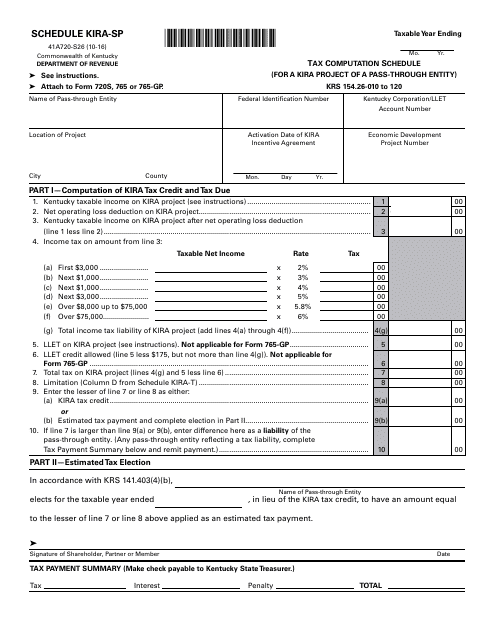

This form is used for calculating and reporting taxes for a Kira Project of a pass-through entity in Kentucky.

This Form is used for calculating tax for a Kida project of a pass-through entity in Kentucky.

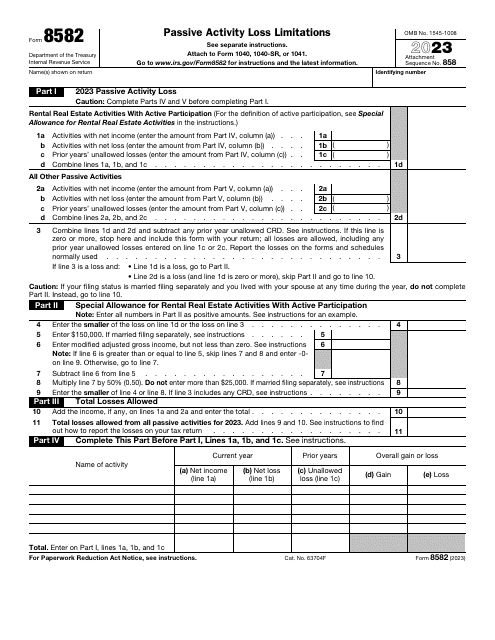

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

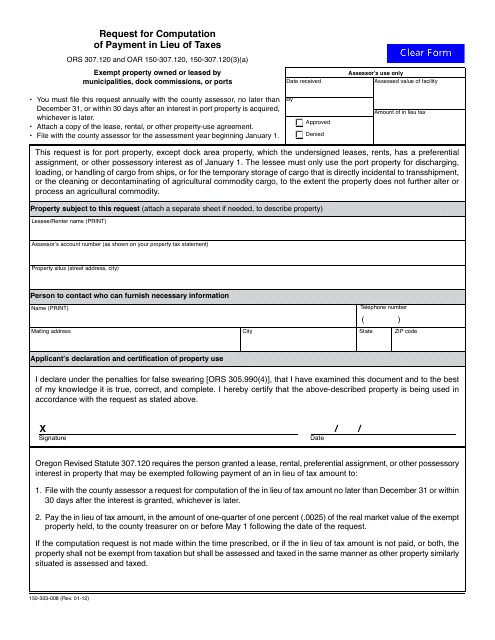

This form is used for requesting the computation of payment in lieu of taxes in the state of Oregon.

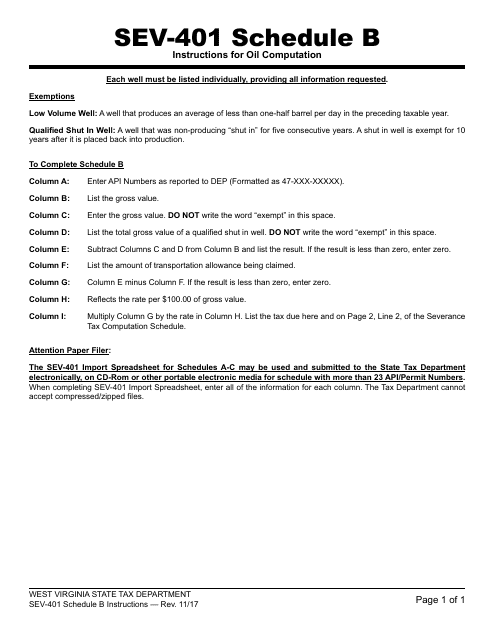

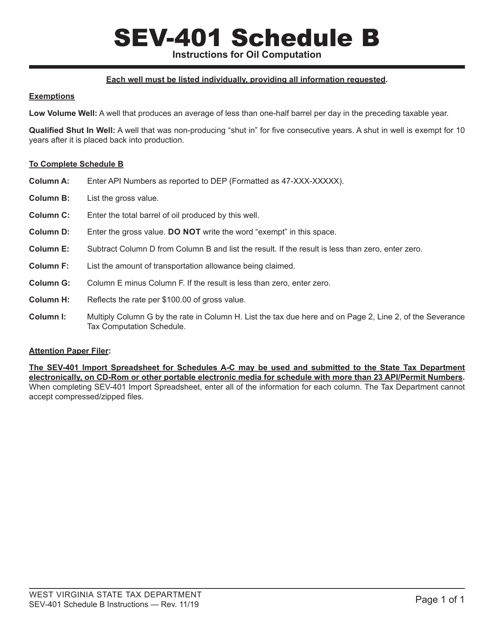

This Form is used for calculating oil production for tax purposes in the state of West Virginia.

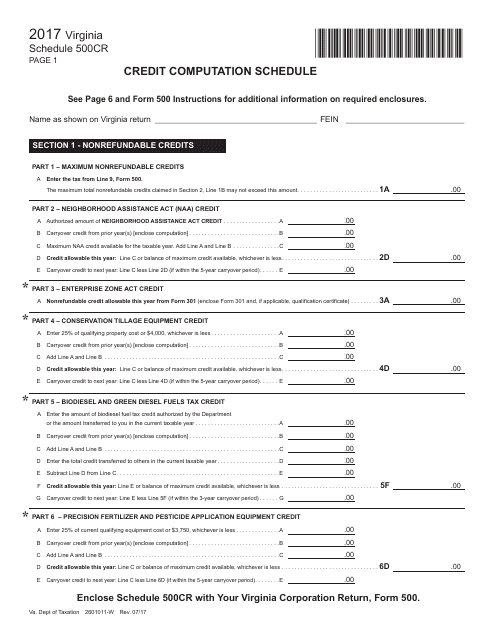

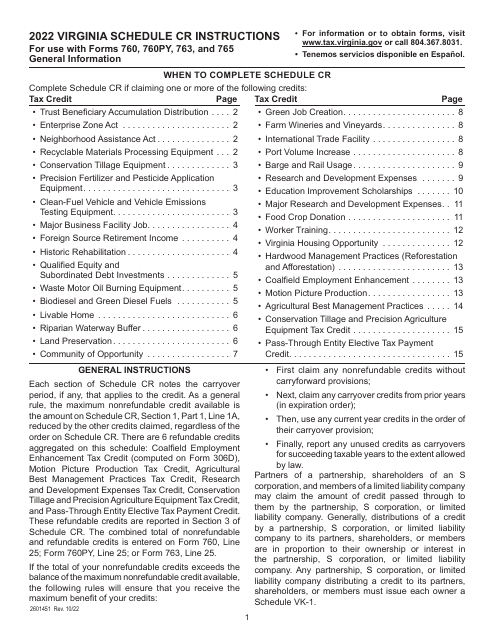

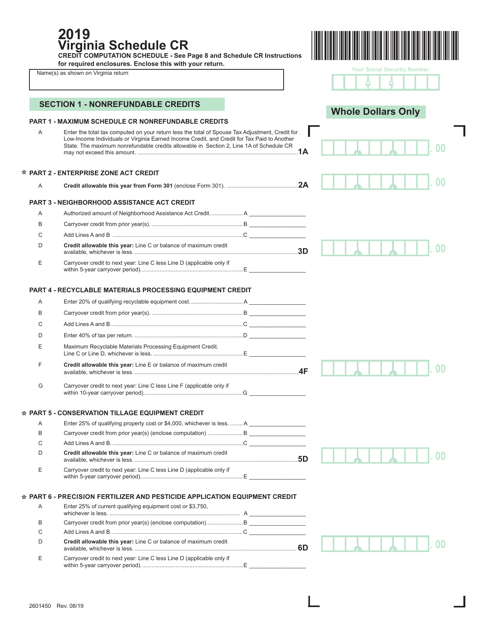

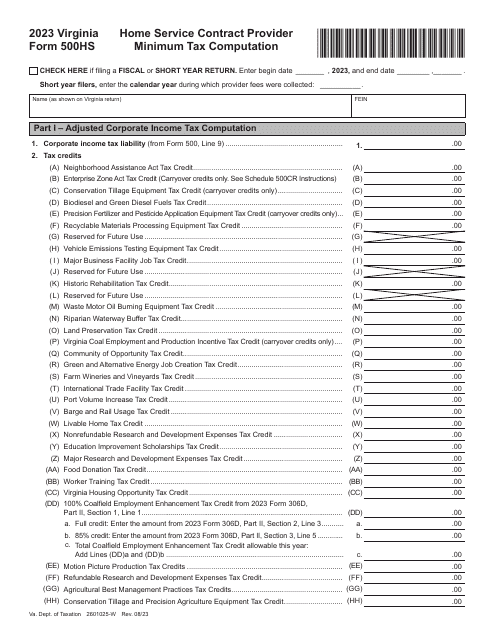

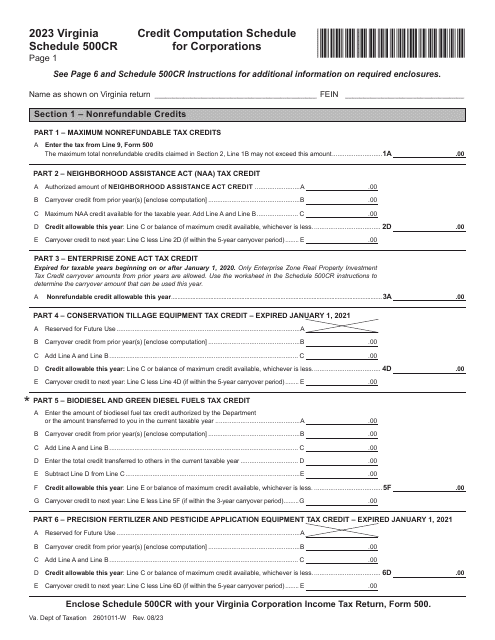

This Form is used for calculating the credit computation schedule for the state of Virginia.

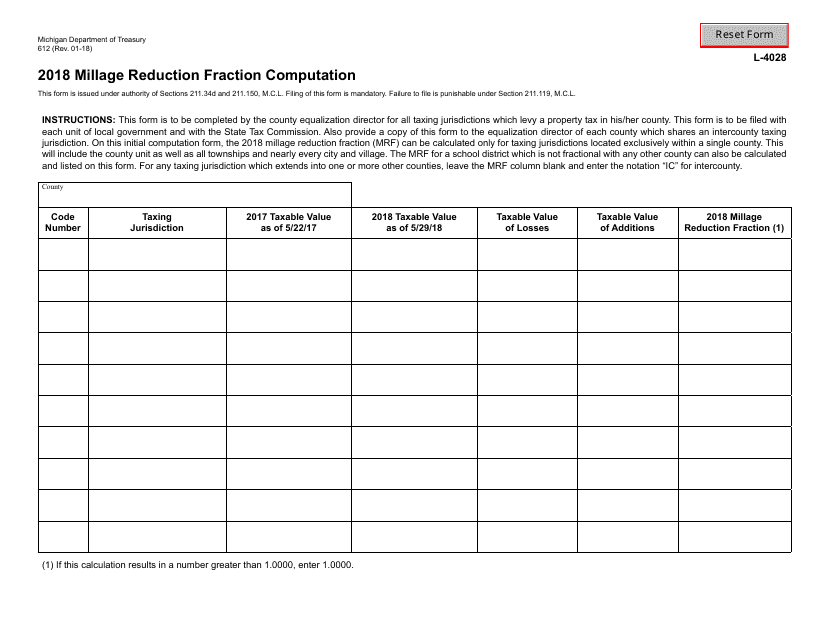

This form is used for calculating the millage reduction fraction in the state of Michigan.

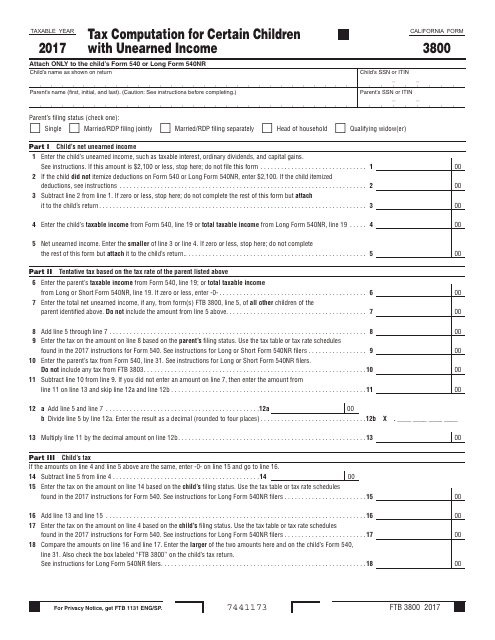

This form is used for calculating the tax for certain children in California who have unearned income. It helps determine the correct amount of tax owed based on the child's income.

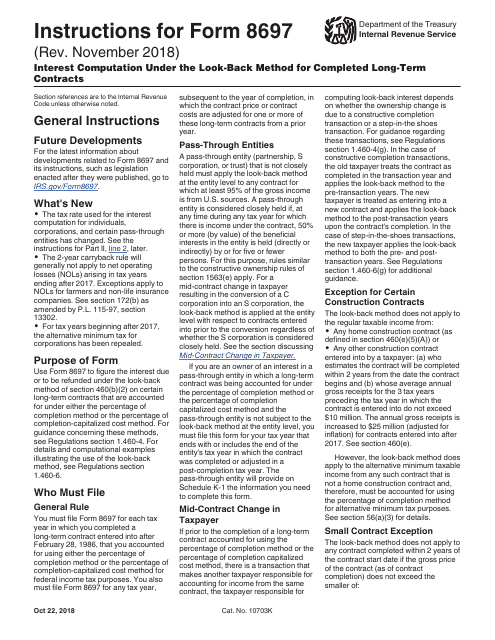

This Form is used for calculating interest under the look-back method for long-term contracts completed by the IRS. It provides instructions on how to determine the interest amount and report it accurately on your tax return.

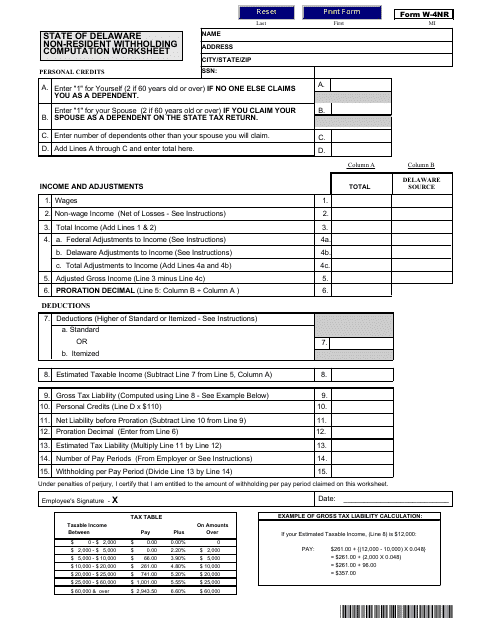

This form is used for calculating withholding taxes for non-resident taxpayers in Delaware.

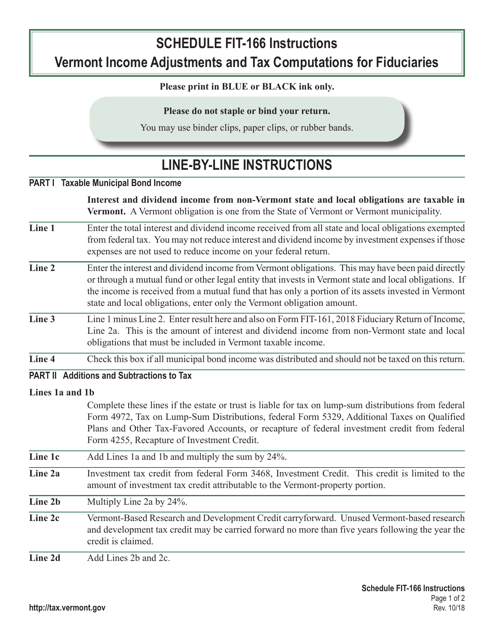

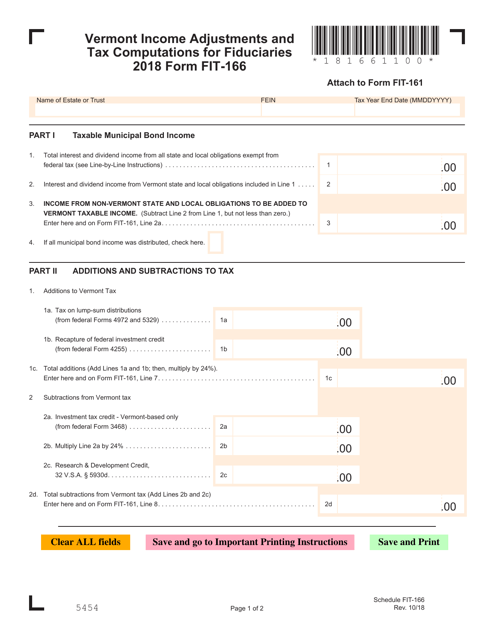

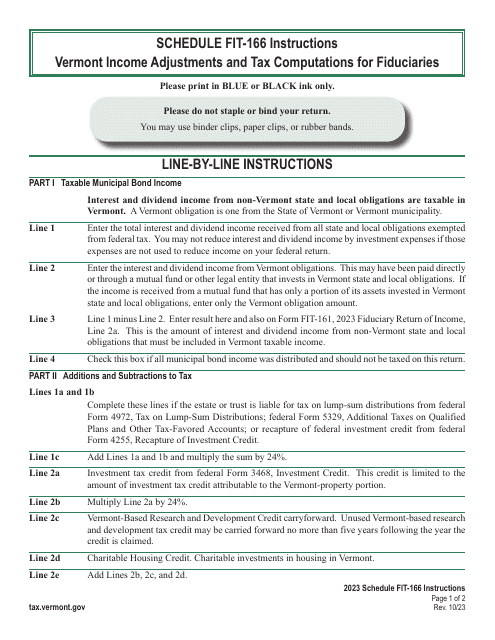

This Form is used for reporting income adjustments and tax computations for fiduciaries in Vermont. It provides instructions on how to accurately complete the VT Form FIT-166.

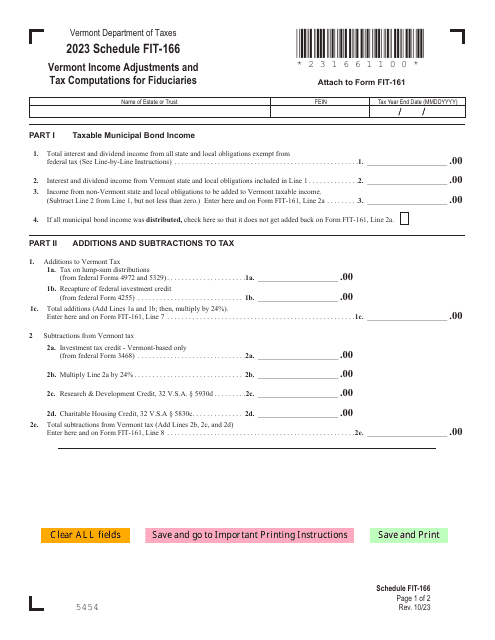

This form is used for calculating income adjustments and tax computations for fiduciaries in Vermont.

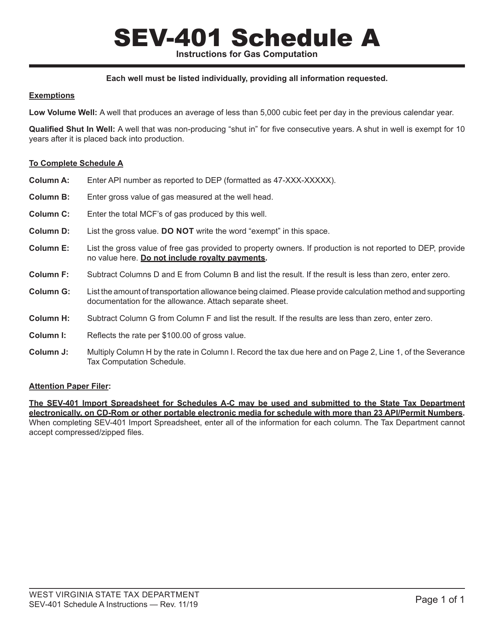

This document is used for calculating taxes and exemptions for natural gas in West Virginia. It provides instructions on how to fill out Form SEV-401 Schedule A.

This document is used for calculating the oil tax and claiming exemptions in West Virginia.

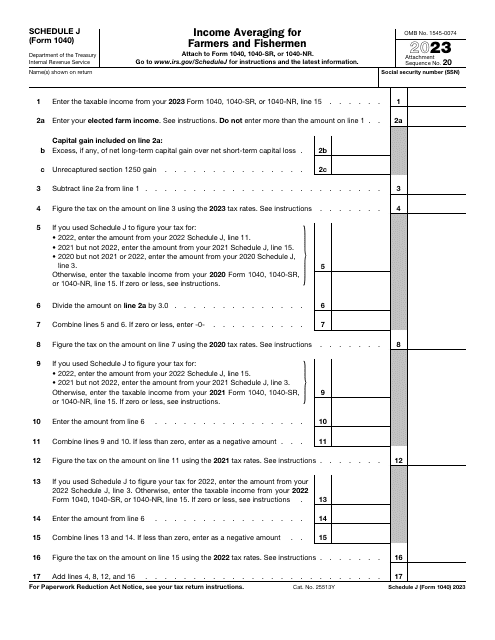

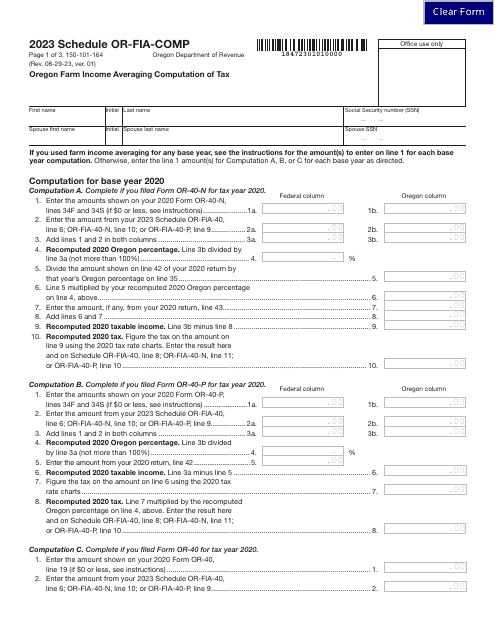

Form 150-101-164 Schedule OR-FIA-COMP Oregon Farm Income Averaging Computation of Tax - Oregon, 2023

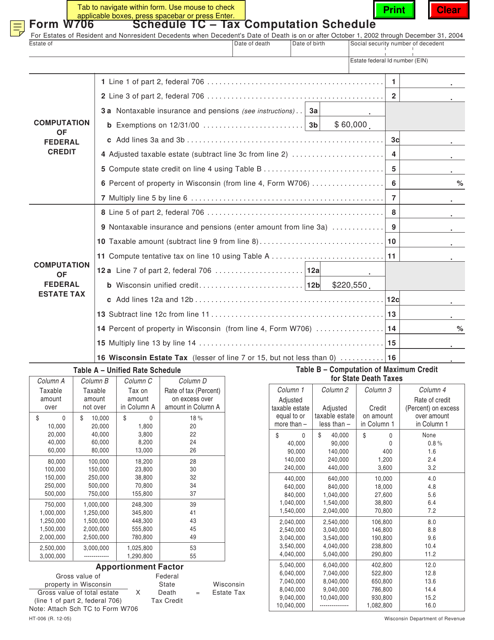

This form is used for tax computation for deaths in Wisconsin occurring between October 1, 2002 and December 31, 2004.

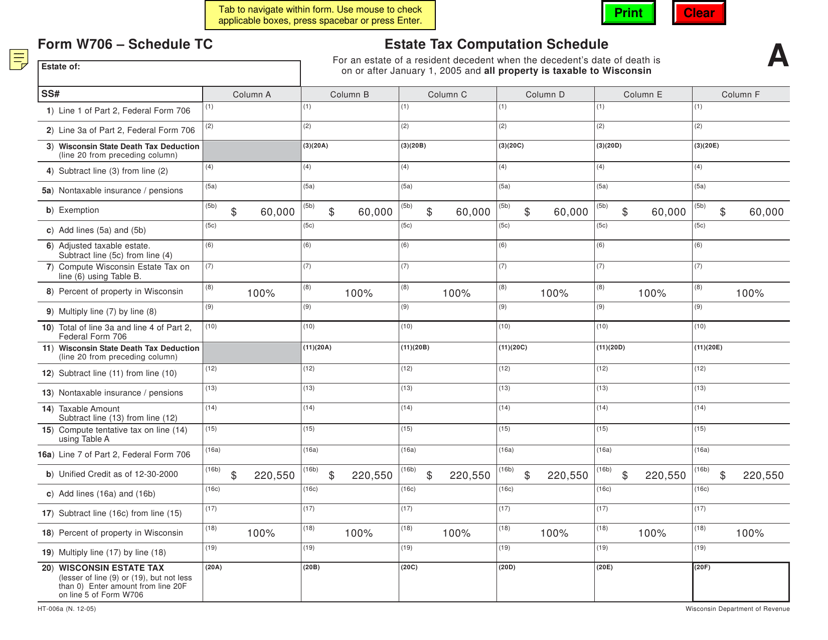

This document is a tax computation schedule used for deaths that occurred on or after January 1, 2005 in Wisconsin. It applies to situations where all property is taxable in Wisconsin.