Gross Receipts Tax Templates

Are you looking for information about gross receipts taxes? Also known as gross receipts tax or gross receipts taxes, this type of tax applies to the total gross receipts generated by businesses.

Gross receipts taxes are imposed by various state governments to generate revenue and fund public services. These taxes are usually calculated based on the total amount of revenue generated by a business, regardless of whether it was from sales, services, or other business activities.

If you operate a business that is subject to gross receipts taxes, it is important to understand the reporting and compliance requirements. Failure to comply with these requirements can result in penalties and additional fees.

To help businesses navigate the complexities of gross receipts taxes, state governments provide various forms and instructions. These documents outline the specific reporting requirements, deadlines, and any exemptions or deductions that may apply.

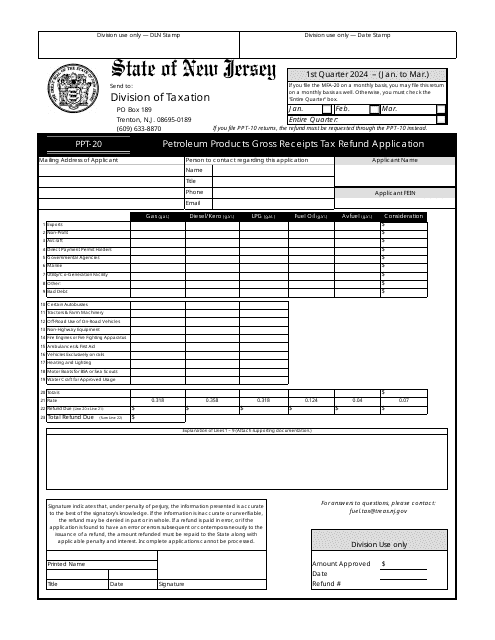

For example, in New Jersey, businesses may need to file the "Instructions for Form PPT-D2-INV Floor StocksInventory Report for Petroleum Products Gross Receipts Tax" or the "Form PPT-20 Petroleum Products Gross Receipts Tax Refund Application" depending on their specific circumstances. These forms ensure that businesses accurately report and pay their gross receipts taxes.

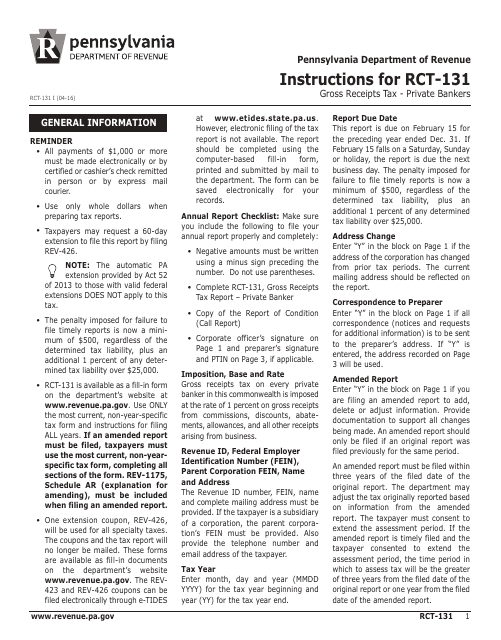

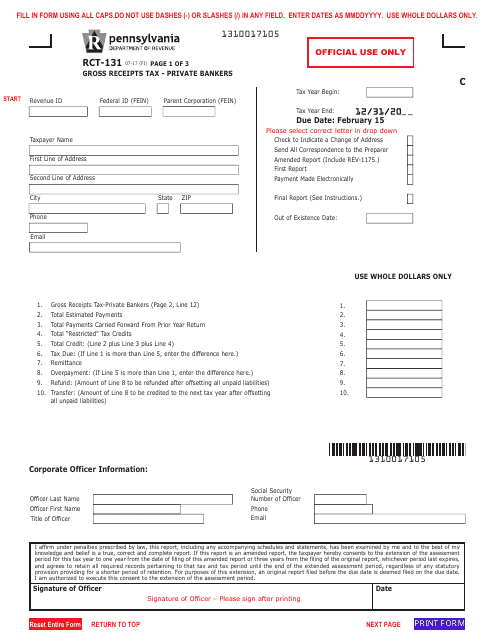

Similarly, in Pennsylvania, private bankers may need to complete the "Form RCT-131 Gross Receipts Tax" to comply with the state's gross receipts tax requirements.

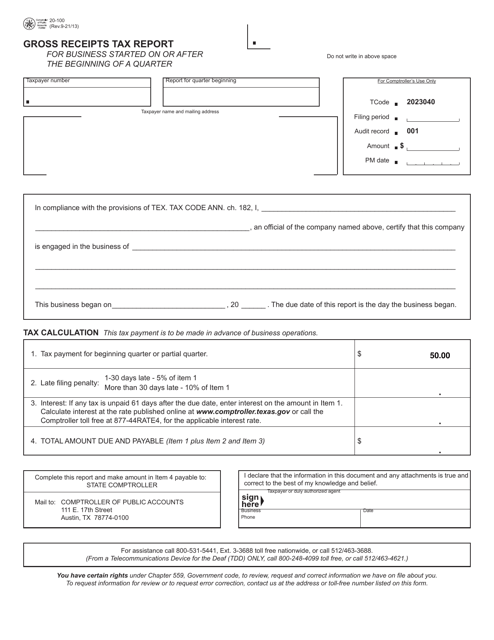

States such as Texas also have their own forms, like the "Form 20-100 Gross Receipts Tax Report," which businesses started on or after the beginning of a quarter may need to complete.

Understanding and fulfilling your gross receipts tax obligations is crucial to maintaining compliance and avoiding potential penalties. The various forms and instructions provided by state governments are essential resources for businesses subject to these taxes.

If you require further information or assistance on gross receipts taxes and related forms, consult with a qualified tax professional or reach out to the relevant state tax agency. They can provide guidance specific to your business and help ensure compliance with gross receipts tax requirements.

Documents:

45

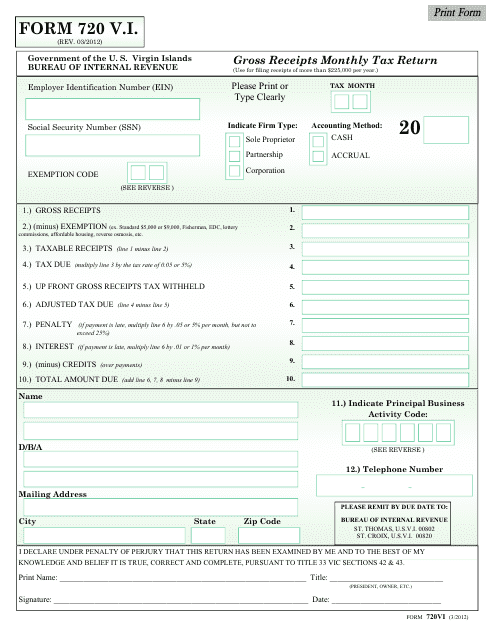

This form is used for reporting monthly gross receipts tax in the US Virgin Islands.

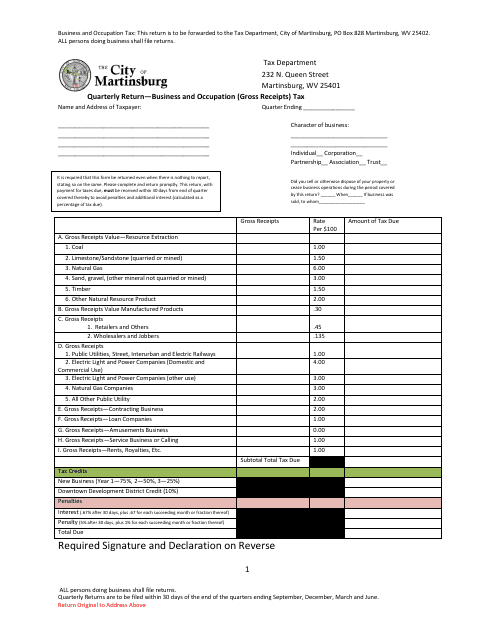

This type of document is used for reporting and paying the Business and Occupation (Gross Receipts) Tax on a quarterly basis in West Virginia.

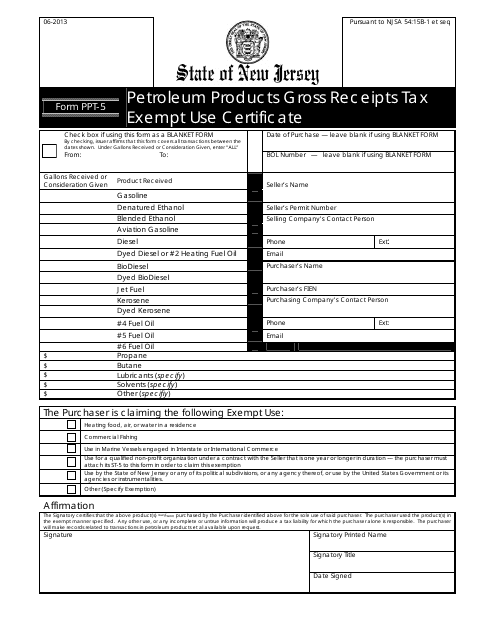

This Form is used for applying for an exemption from the gross receipts tax on the use of petroleum products in New Jersey.

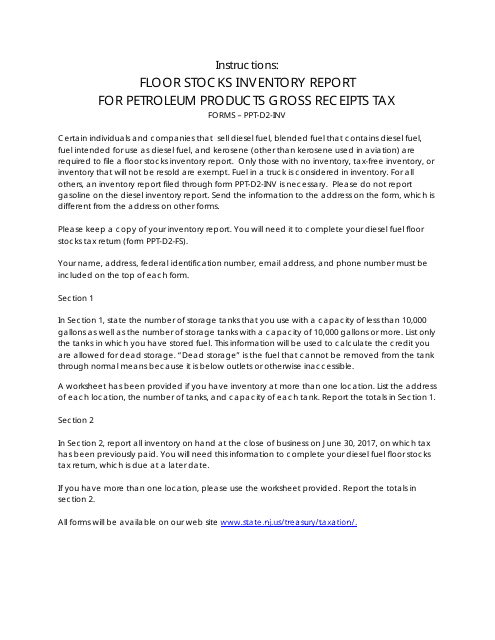

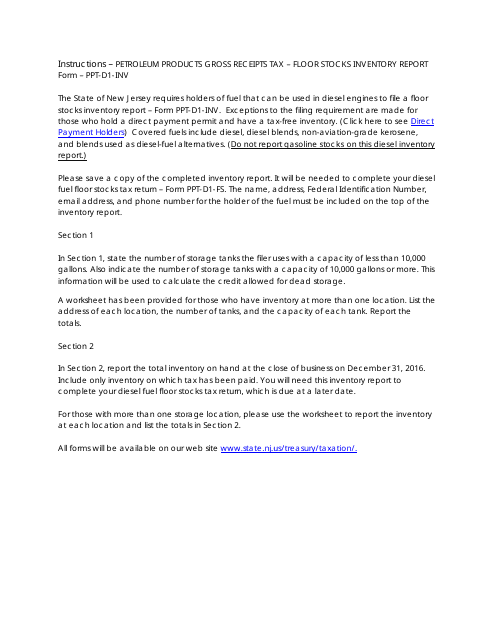

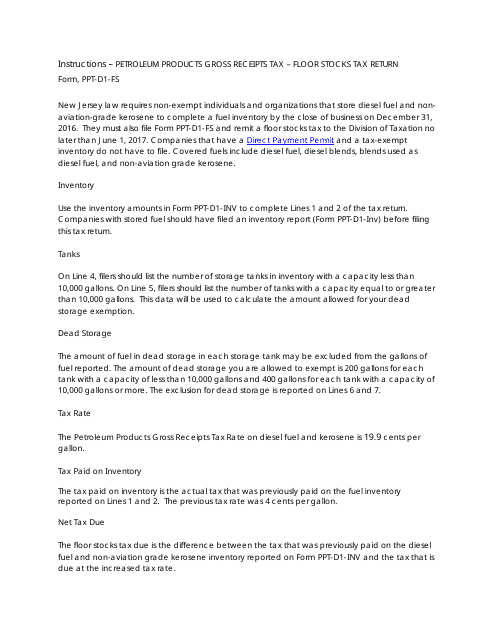

This document provides instructions for completing Form PPT-D2-INV, which is used to report floor stocks inventory for petroleum products gross receipts tax in New Jersey.

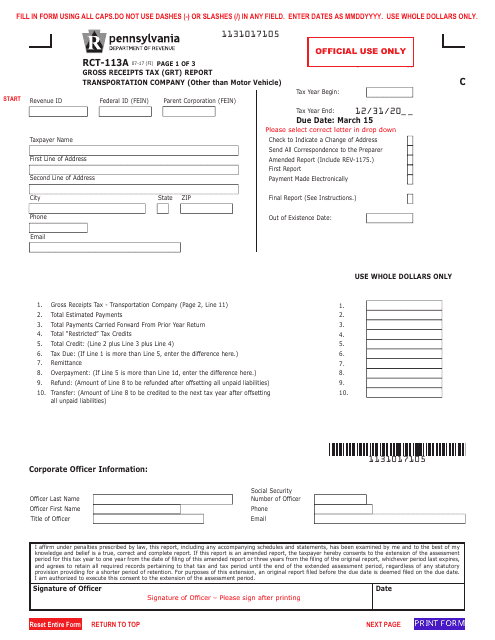

This form is used for reporting gross receipts tax for transportation companies in Pennsylvania that are not motor vehicle companies.

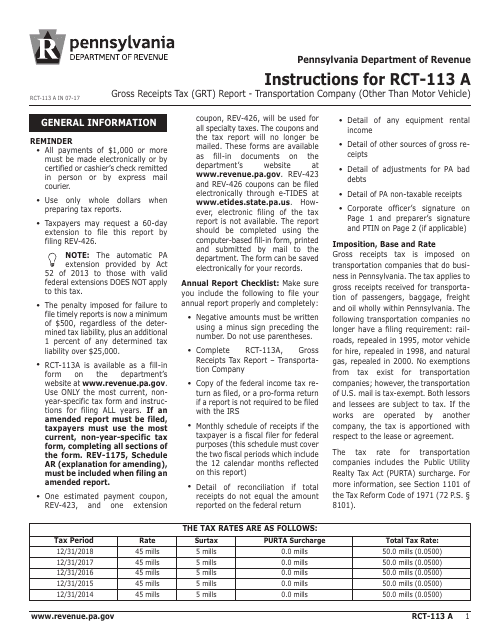

This Form is used for reporting Gross Receipts Tax (GRT) for transportation companies in Pennsylvania, excluding those operating motor vehicles. It provides instructions on how to accurately report and pay the tax.

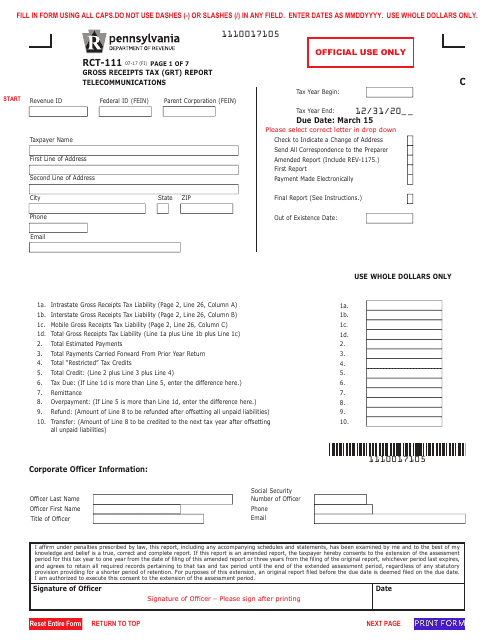

This form is used for reporting gross receipts tax (GRT) in the telecommunications industry in Pennsylvania.

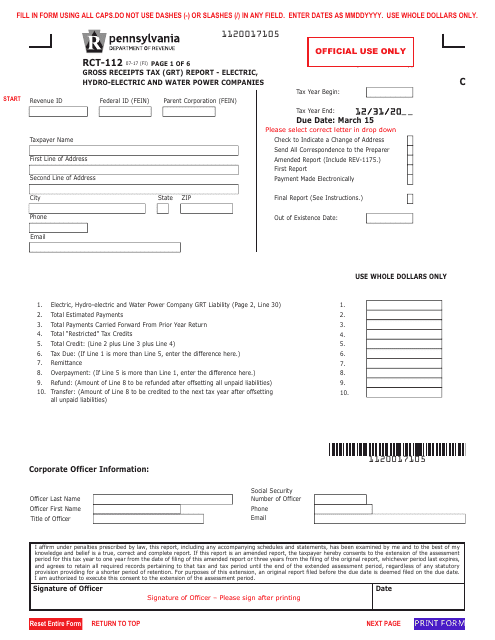

This Form is used for reporting the gross receipts tax for electric, hydro-electric, and water power companies in Pennsylvania.

This Form is used for reporting and paying the Gross Receipts Tax for private bankers in the state of Pennsylvania. It provides instructions on how to calculate and submit the tax owed.

This Form is used for reporting gross receipts tax for private bankers in Pennsylvania.

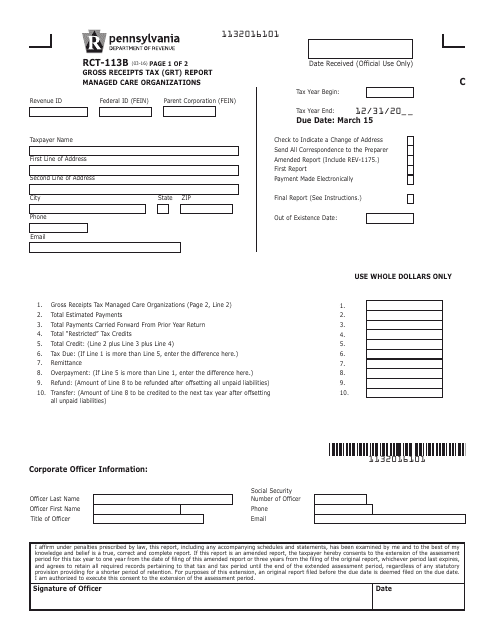

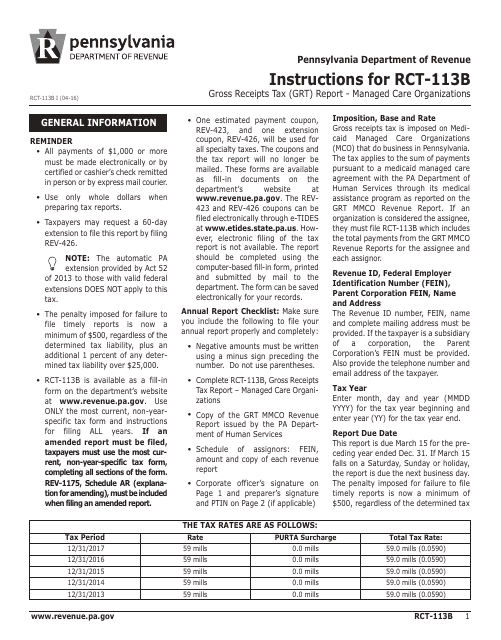

This form is used for reporting Gross Receipts Tax (GRT) for managed care organizations in Pennsylvania.

This Form is used for reporting gross receipts tax for managed care organizations in Pennsylvania. It provides instructions on how to fill out the RCT-113B Gross Receipts Tax (GRT) Report.

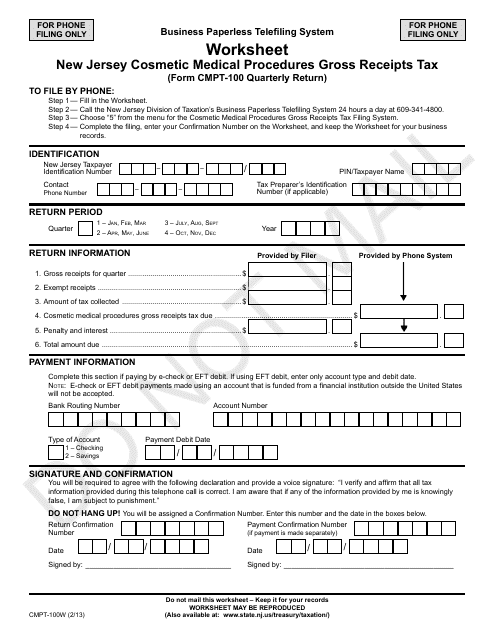

This form is used for calculating and reporting the gross receipts tax for cosmetic medical procedures in New Jersey.

This form is used for reporting and paying the New Jersey Cosmetic Medical Procedures Gross Receipts Tax. It provides instructions on how to fill out the form and what information is required.

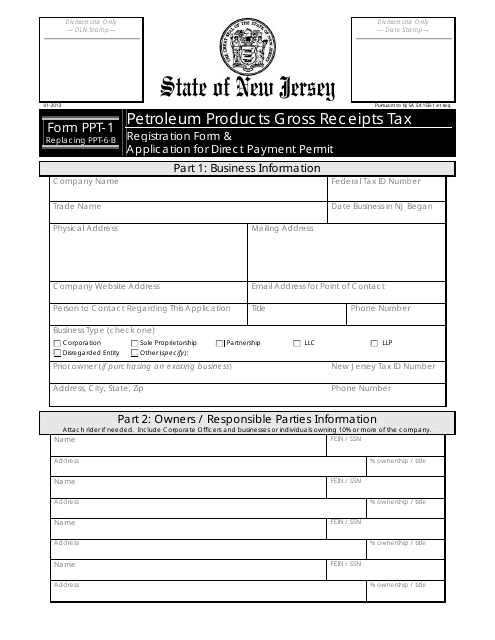

This Form is used for reporting and paying the Petroleum Products Gross Receipts Tax in the state of New Jersey.

This Form is used for reporting floor stocks inventory of petroleum products for the purpose of calculating the gross receipts tax in New Jersey.

This form is used for reporting and paying the Petroleum Products Gross Receipts Tax (Floor Stocks Tax) in New Jersey. It provides instructions on how to correctly fill out and submit the tax return.

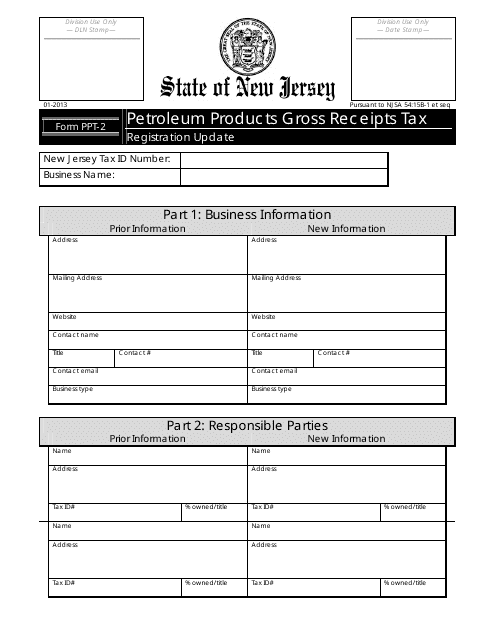

This form is used for updating the registration information for the Petroleum Products Gross Receipts Tax in New Jersey.

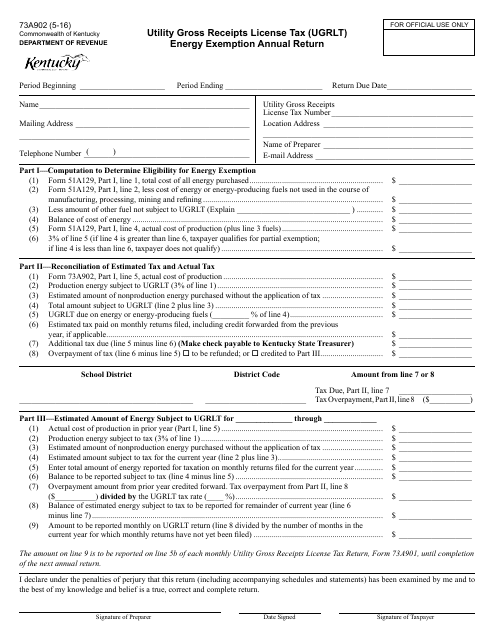

This document is used for filing an annual return to claim exemption from the Utility Gross Receipts License Tax (UGRLT) Energy Exemption in Kentucky.

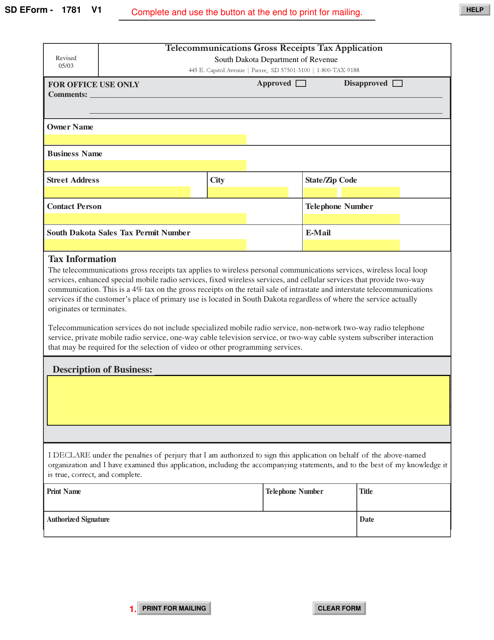

This Form is used for applying for the Telecommunications Gross Receipts Tax in South Dakota. It is a tax application form specific to the telecommunications industry in the state.

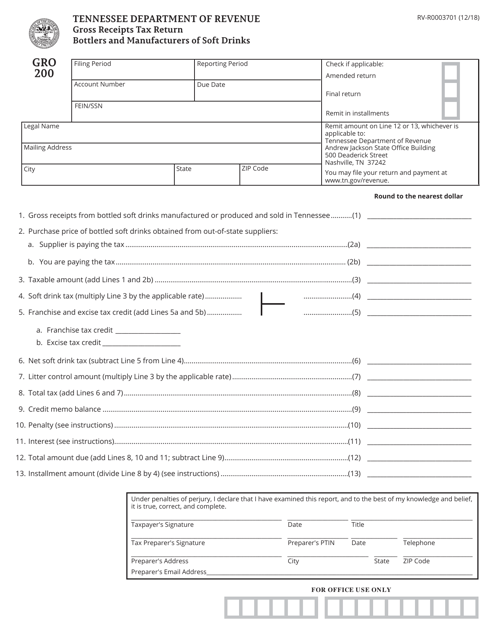

This Form is used for filing the Gross Receipts Tax Return by bottlers and manufacturers of soft drinks in the state of Tennessee.

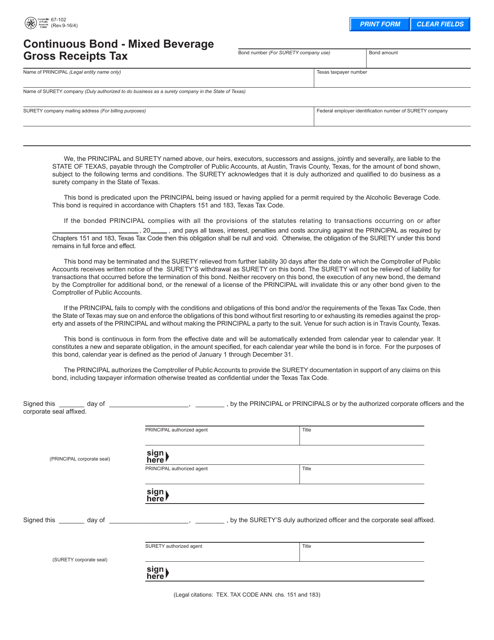

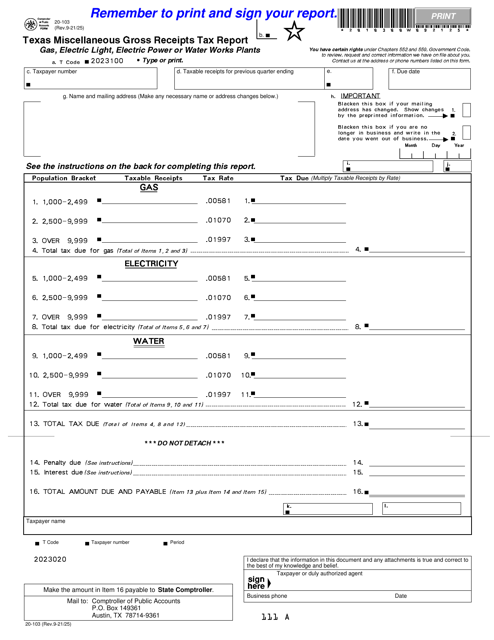

This Form is used for reporting and paying the mixed beverage gross receipts tax in the state of Texas.

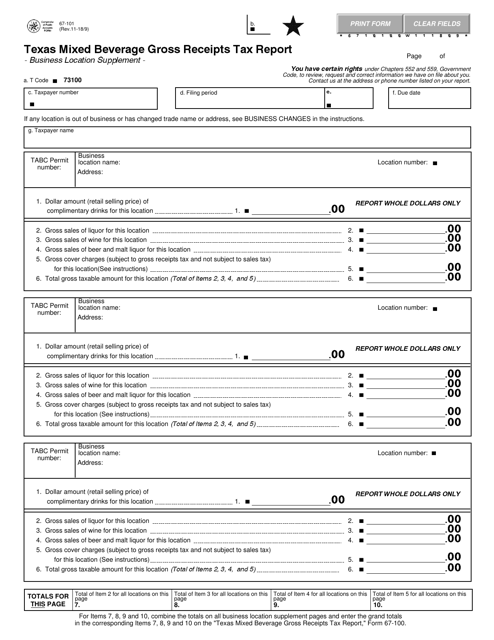

This form is used to report the gross receipts tax for businesses in Texas that sell mixed beverages. It is a supplement form that provides additional information about the business location.

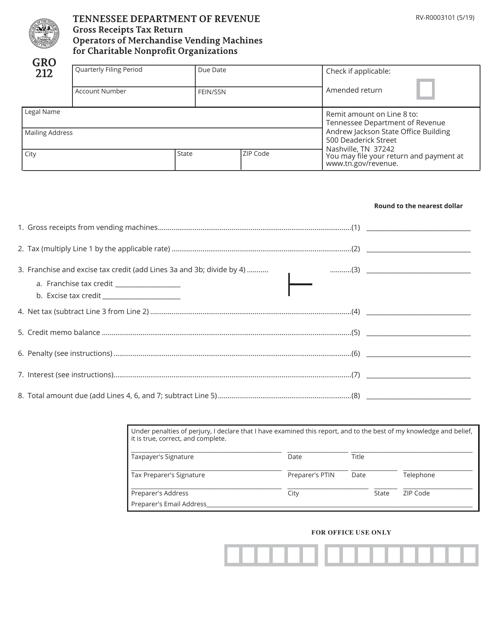

This form is used for filing Gross Receipts Tax Return for operators of merchandise vending machines who are affiliated with charitable nonprofit organizations in Tennessee.

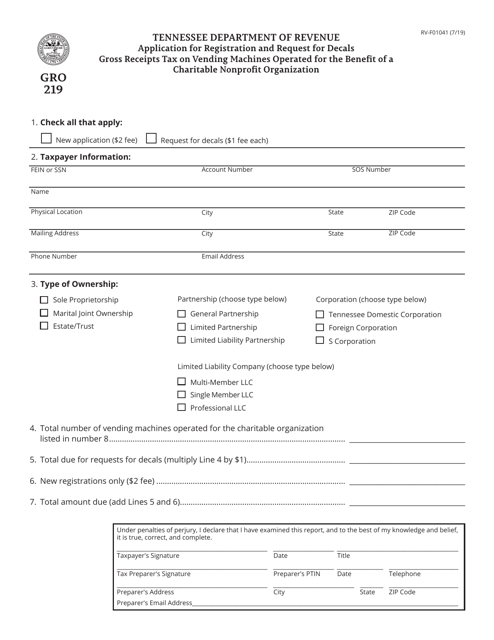

This Form is used for applying for registration and requesting decals for vending machines operated by a charitable nonprofit organization in Tennessee. The purpose is to comply with the Gross Receipts Tax on Vending Machines.

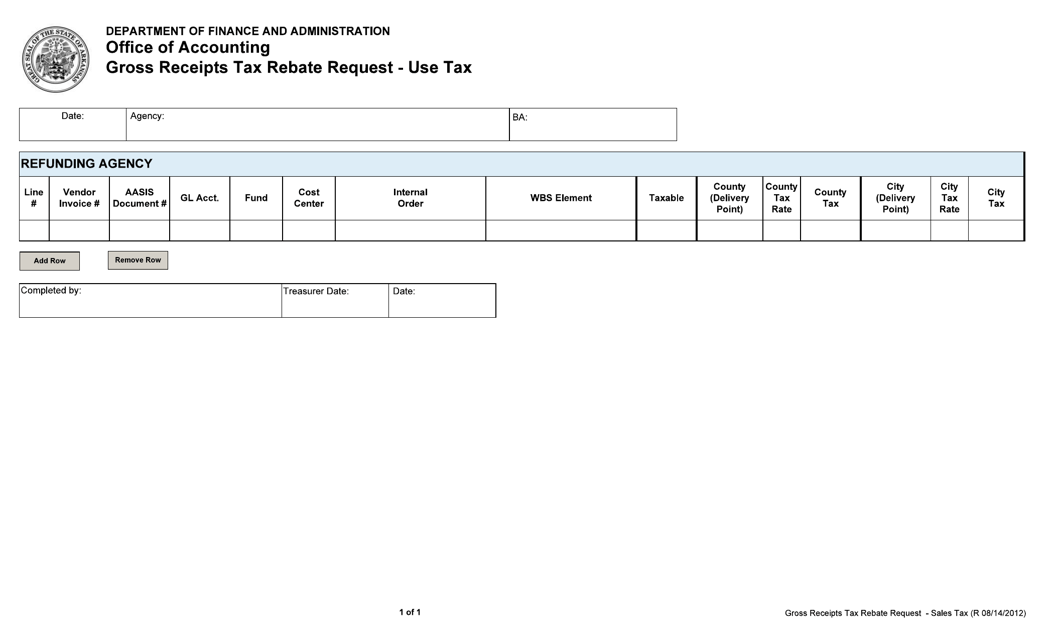

This document is used for requesting a rebate of the Gross Receipts Tax on Use Tax in Arkansas.

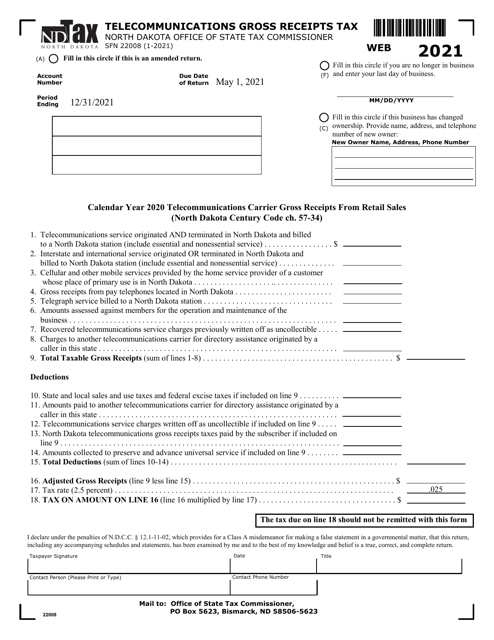

This form is used for calculating and reporting the telecommunications gross receipts tax in North Dakota.

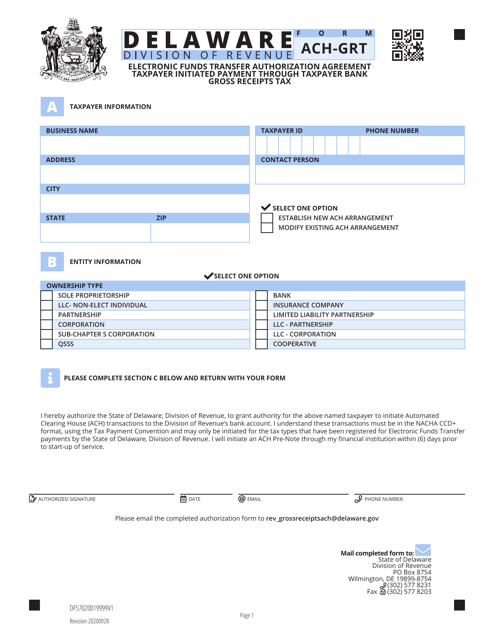

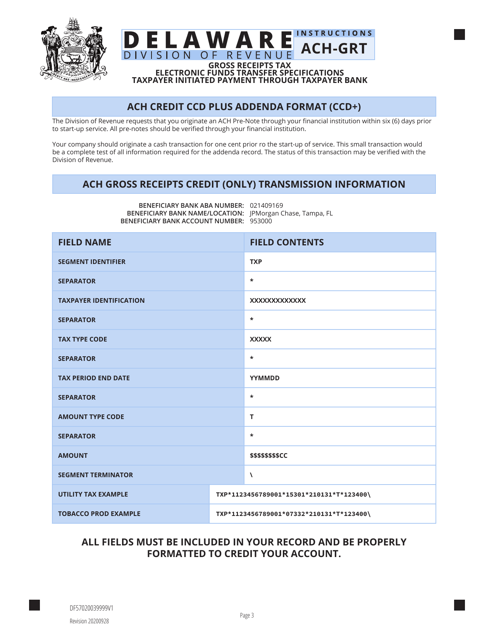

This Form is used for authorizing electronic funds transfer payments for the Delaware Gross Receipts Tax through the taxpayer's bank.

This Form is used for authorizing electronic funds transfers for taxpayer-initiated payments of Gross Receipts Tax in Delaware.

This Form is used for reporting the gross receipts tax for businesses that started operating in Texas during a quarter.

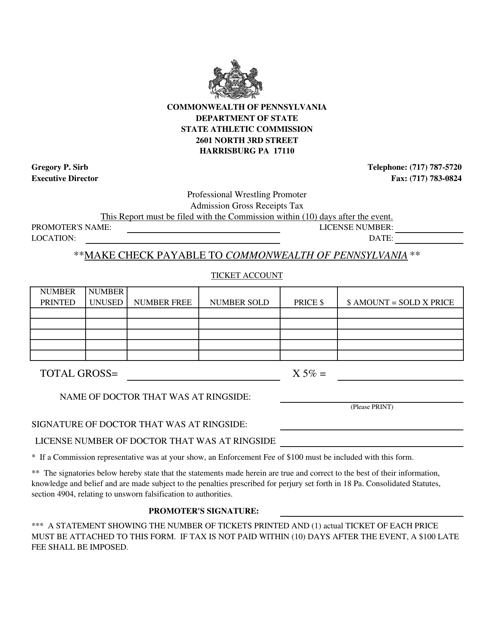

This document is for professional wrestling promoters in Pennsylvania who need to pay the admission gross receipts tax.