Charitable Solicitation Templates

Charitable Solicitation Documents

Are you a charitable organization or fundraising counsel engaging in solicitation activities? If so, it's crucial to comply with the legal requirements set forth by the government. Our collection of Charitable Solicitation Documents

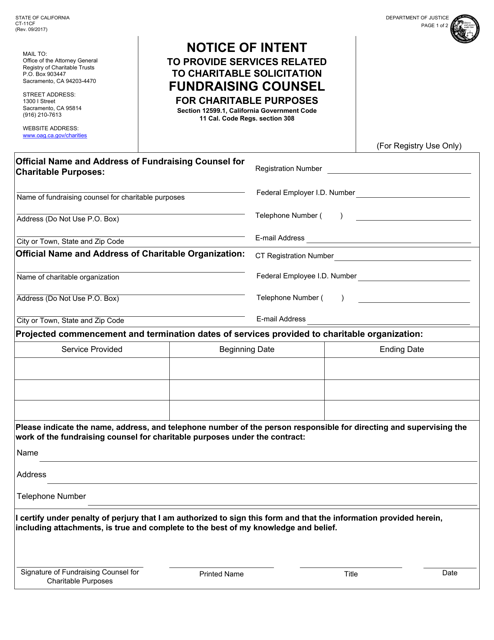

provides you with the necessary forms and registration statements needed to ensure that you're operating in accordance with the law.Whether you're a charitable organization in Nevada seeking exemption from registration, or an out-of-state charitable organization that needs to file a registration statement, our documents cater to your specific needs. For instance, we offer the Form 280203 Exemption from Charitable Solicitation Registration Statement and the Form CT-11CF Notice of Intent to Provide Services Related to Charitable Solicitation - Fundraising Counsel, among others.

Our comprehensive collection of Charitable Solicitation Documents

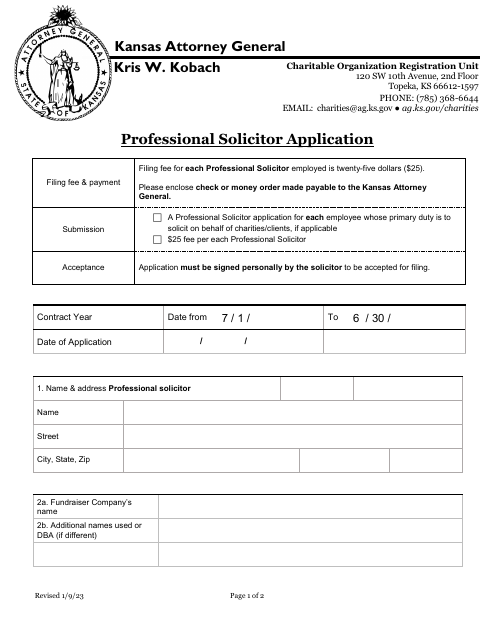

spans various states, including Nevada, California, and Kansas. We understand that each state has its own regulations and requirements, which is why we've curated a diverse range of forms and statements to meet your specific jurisdiction's needs.Take the guesswork out of charitable solicitation compliance by utilizing our user-friendly and legally sound documents. Ensure that you're meeting the necessary requirements and avoid any penalties or legal issues in the process. With our Charitable Solicitation Documents

, you can focus on your important work while maintaining compliance with ease.Don't let the complexities of charitable solicitation overwhelm you. Simplify the process by accessing our comprehensive collection of Charitable Solicitation Documents

today.Documents:

28

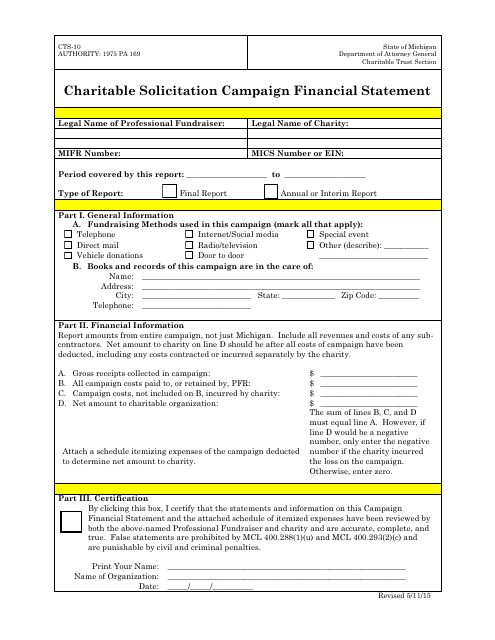

This Form is used for reporting the financial statement of charitable solicitation campaigns in the state of Michigan.

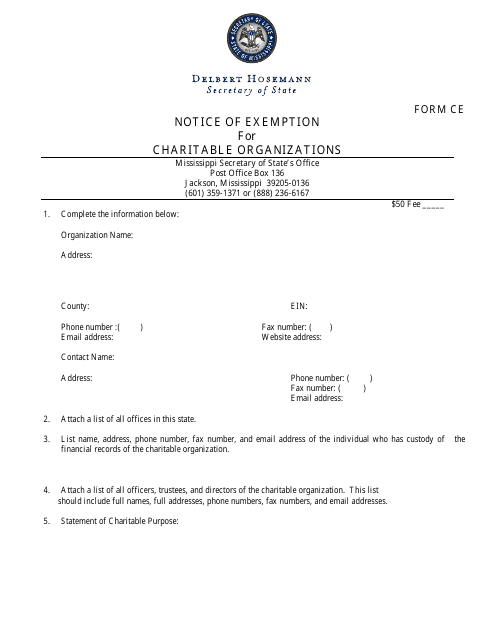

This form is used for charitable organizations in Mississippi to apply for an exemption from certain taxes.

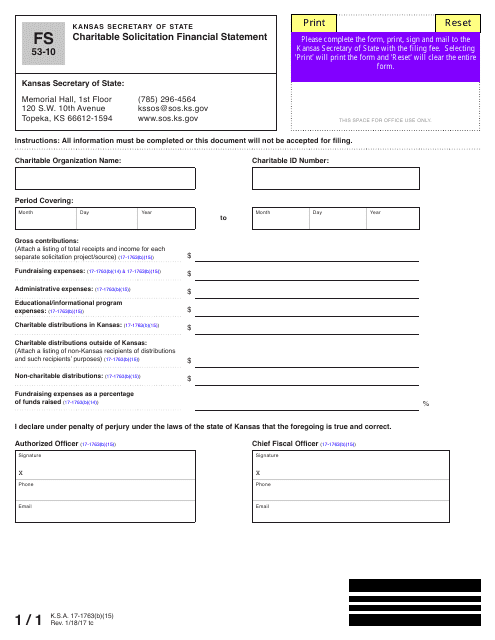

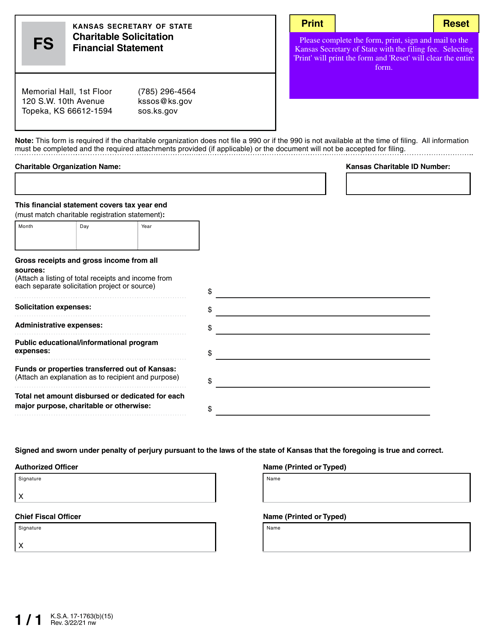

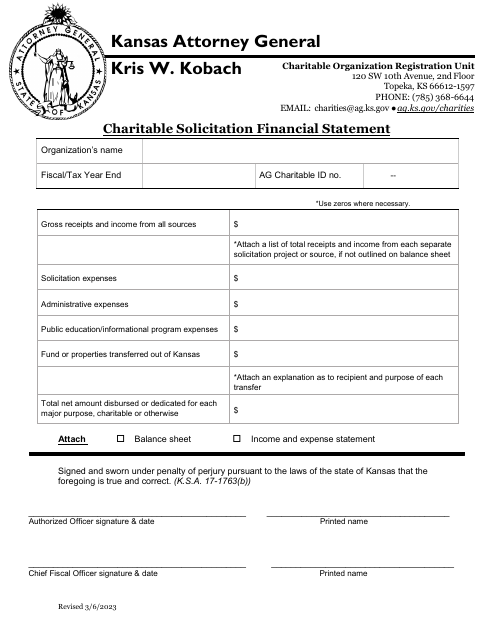

This Form is used for reporting the financial information of charitable organizations that operate in Kansas and engage in solicitation activities. It provides details on the organization's income, expenses, assets, and liabilities.

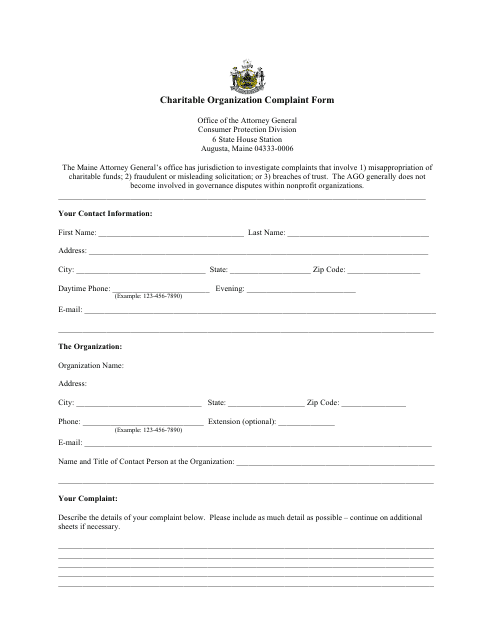

This form is used for filing complaints against charitable organizations operating in Maine.

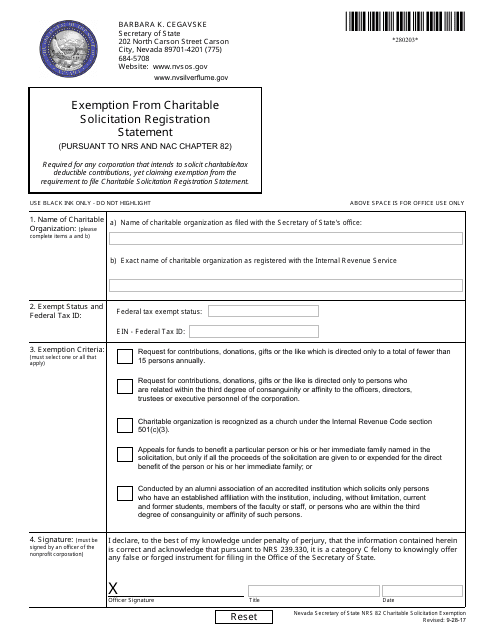

This Form is used for requesting an exemption from charitable solicitation registration in the state of Nevada. It is specific to Nrs and Nac Chapter 82.

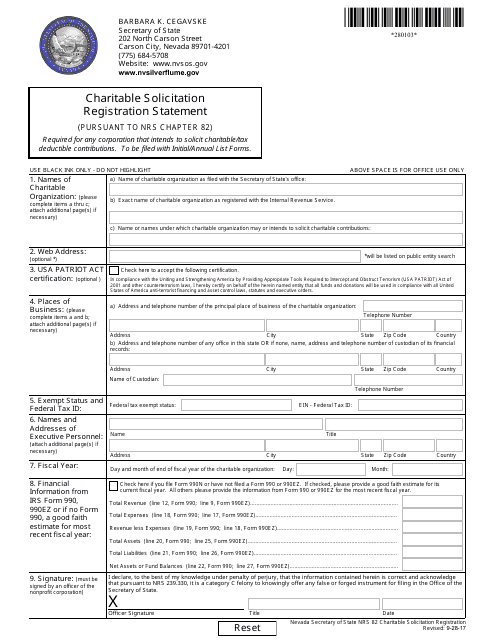

This form is used for registering charitable solicitations in Nevada, in compliance with Chapter 82 of the Nevada Revised Statutes (NRS). It is required for organizations that engage in fundraising activities for charitable purposes in the state of Nevada.

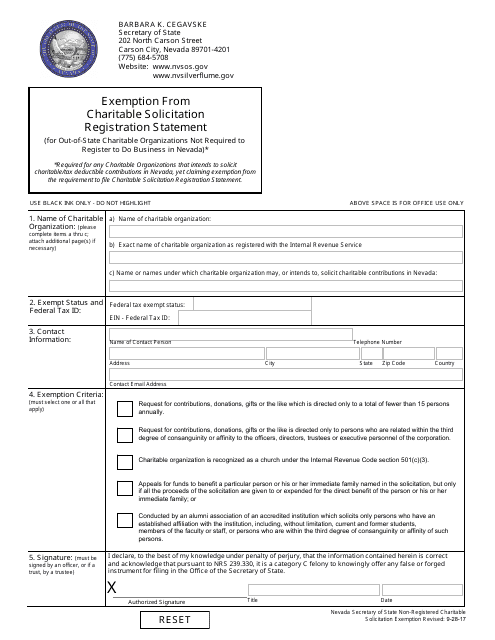

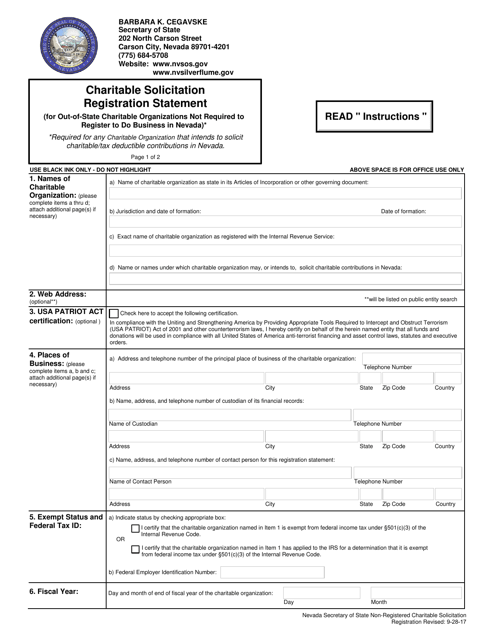

This type of document is used by out-of-state charitable organizations that are not required to register to do business in Nevada to claim exemption from the charitable solicitation registration statement.

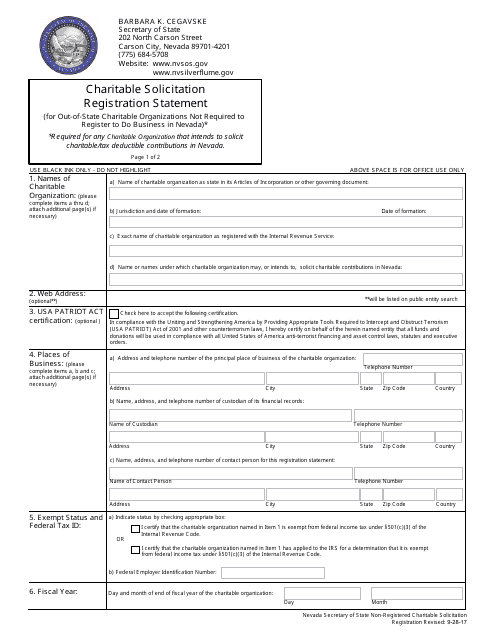

This form is used for out-of-state charitable organizations that are not required to register to do business in Nevada. It is for the purpose of filing a charitable solicitation registration statement.

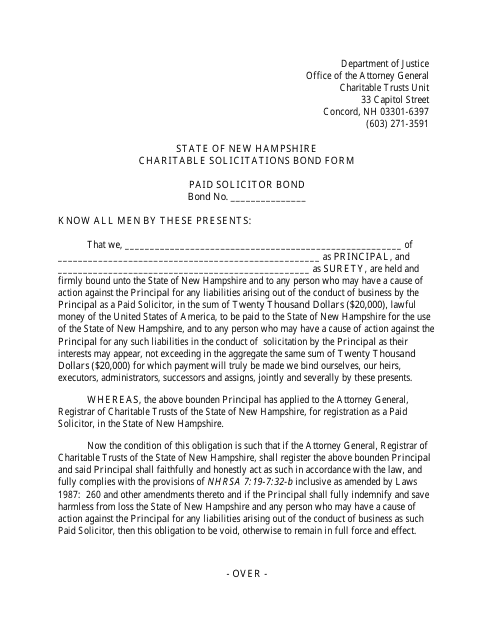

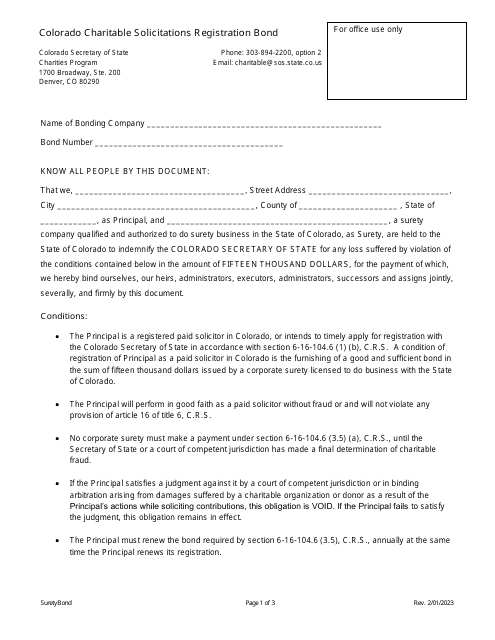

This form is used for obtaining a charitable solicitations bond in New Hampshire.

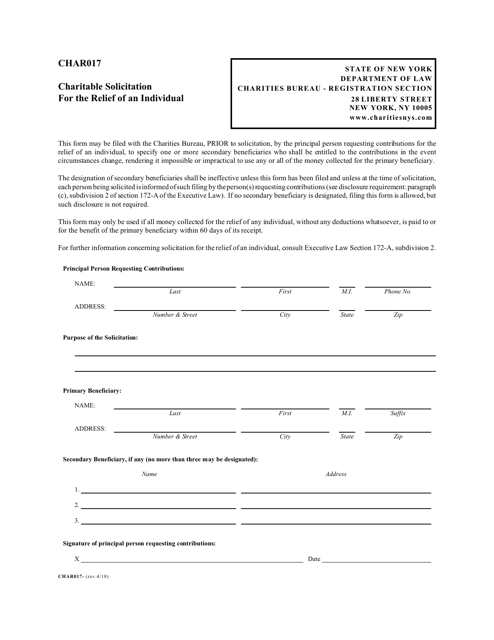

This form is used for soliciting charitable donations to provide relief to a specific individual in New York.

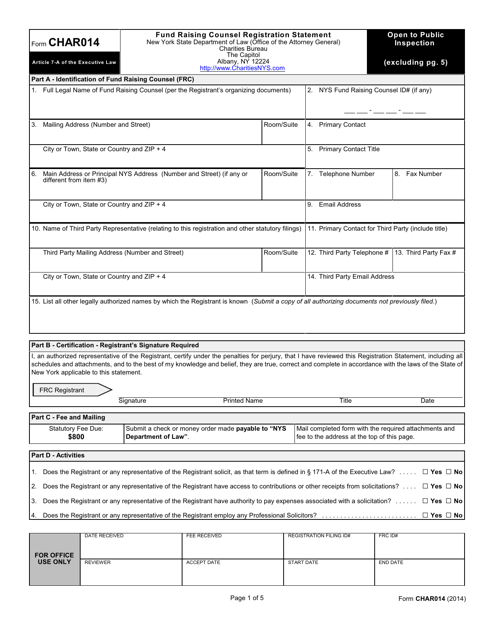

This Form is used for registering as a fund raising counsel in the state of New York.

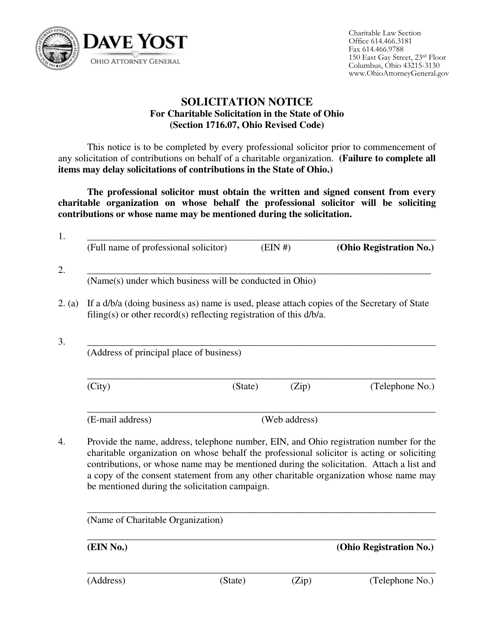

This document provides information on the solicitation notice required for charitable solicitation in the state of Ohio, based on Section 1716.07 of the Ohio Revised Code.

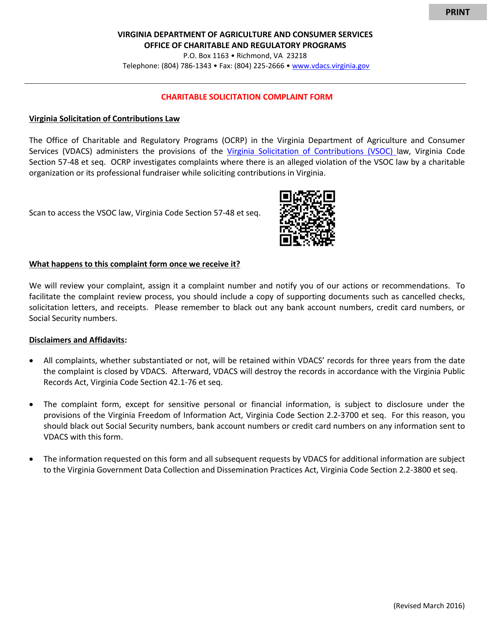

This Form is used for reporting charitable solicitation compliance in the state of Virginia. It ensures that organizations are following the necessary rules and regulations for soliciting donations.

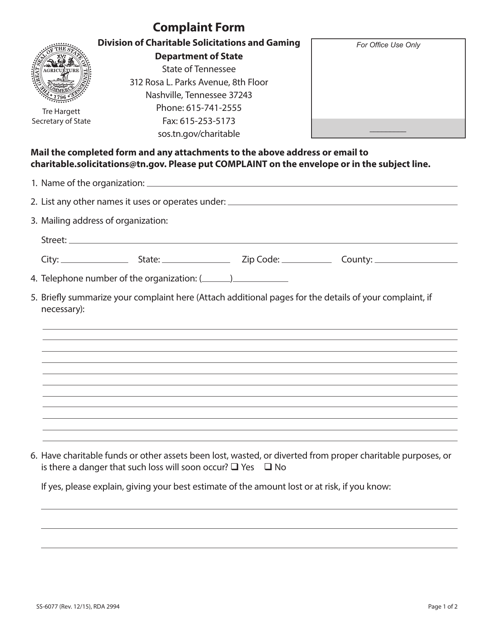

This Form is used for filing a complaint regarding charitable solicitations in the state of Tennessee.

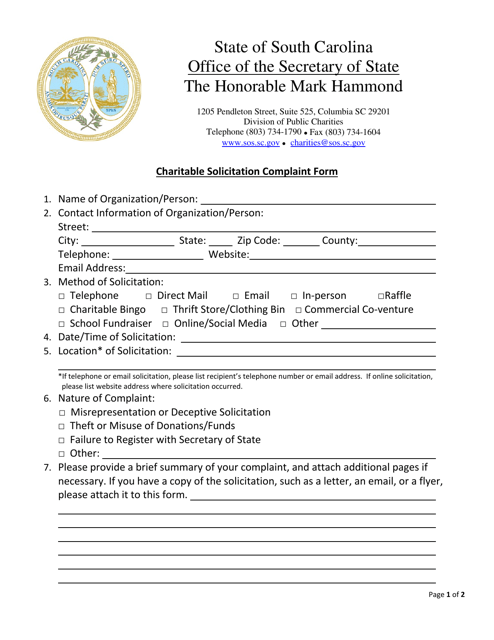

This form is used for filing a complaint regarding charitable solicitations in South Carolina.

This document is for out-of-state charitable organizations that are not required to register to do business in Nevada. It is used to submit a registration statement for charitable solicitation in the state of Nevada.

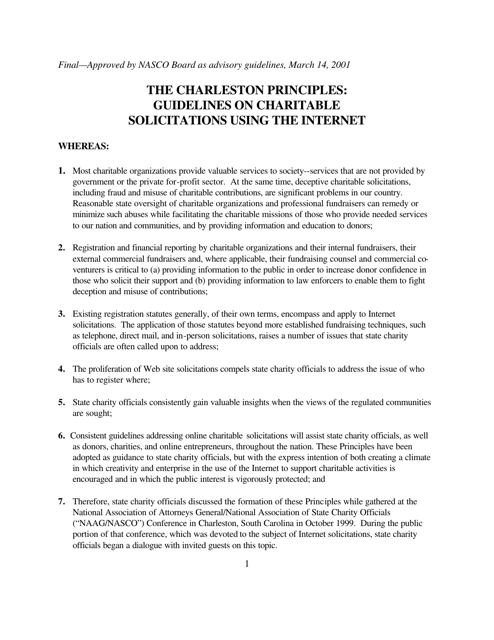

This document provides guidelines for charitable organizations on how to solicit donations online and comply with regulations.

This form is used for reporting financial information of charitable organizations in Kansas that engage in solicitation activities.

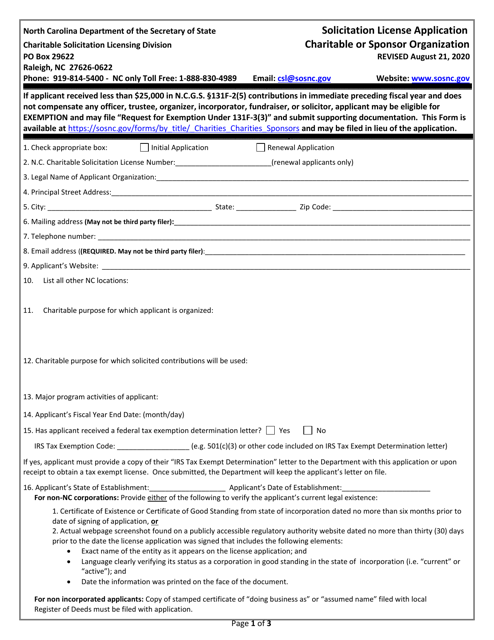

This document is used for applying for a solicitation license in North Carolina for charitable or sponsor organizations.

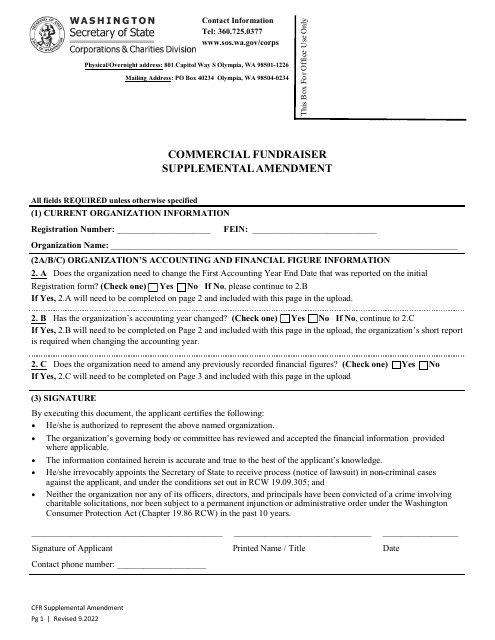

This form is used for submitting additional information to amend a commercial fundraiser registration in Washington state.

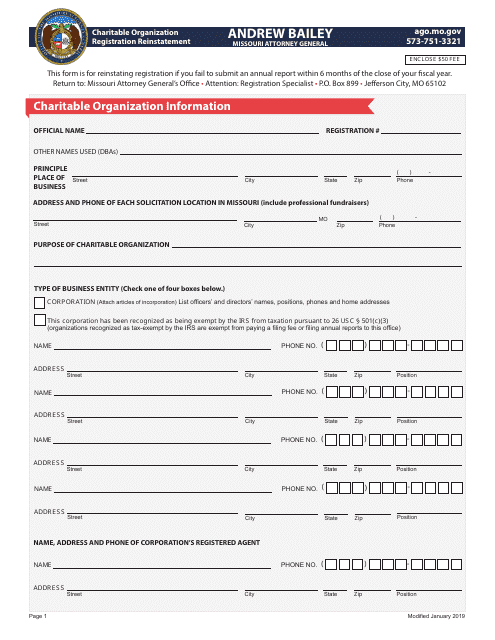

This document is for reinstating the registration of a charitable organization in the state of Missouri.

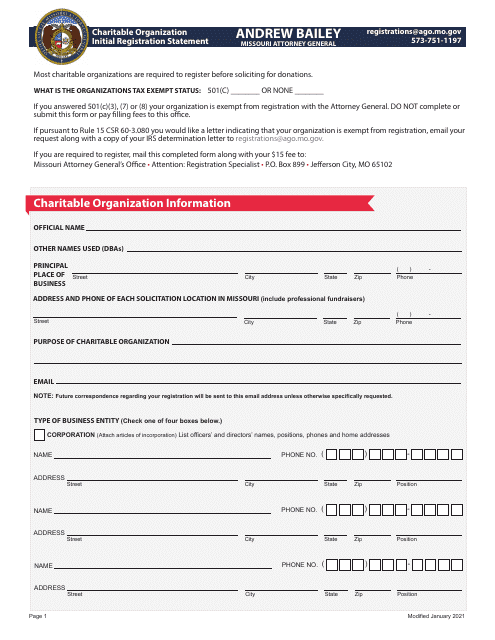

This document is used for the initial registration of a charitable organization in the state of Missouri. It is required to provide information about the organization's purpose, activities, and financial details in order to be recognized as a charitable entity in the state.