Trust Income Tax Templates

Are you looking for information on trust income tax? Our webpage provides comprehensive resources and insights on the tax regulations and requirements applicable to trusts. Trust income tax, also known as T3 Trust Income Tax and Information Return, is a crucial aspect of managing and reporting income earned by trusts.

Trusts play a significant role in estate planning and asset management, making it essential to understand the associated tax obligations. Our webpage offers detailed guidance and explanations to help you navigate the complex landscape of trust income tax.

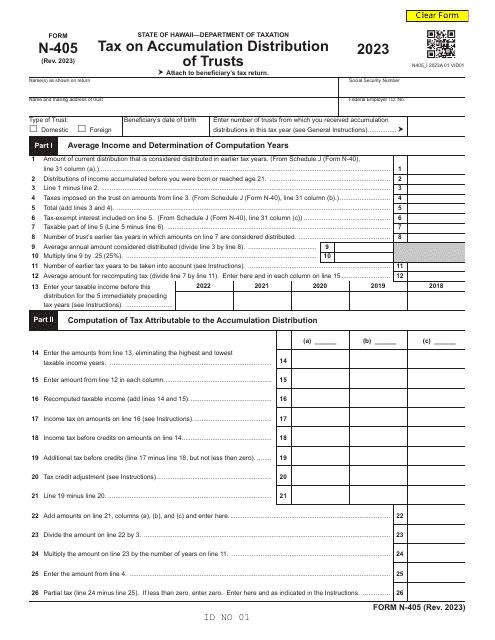

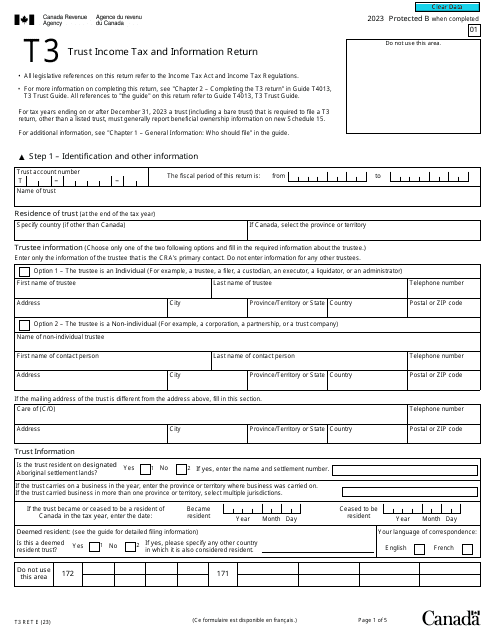

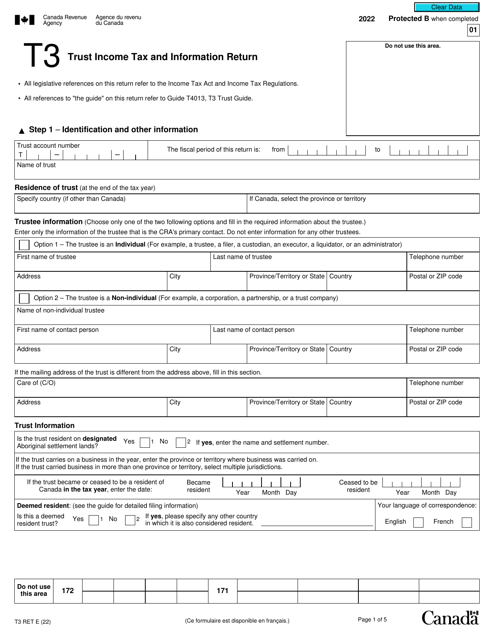

Whether you are a trust administrator, a trustee, or a beneficiary, understanding the rules and regulations related to trust income tax is vital. You will find valuable information on various topics, such as the tax implications of accumulation distributions, tax rates applicable to trusts, and reporting requirements.

Our webpage covers trust income tax guidelines from different countries, including Canada and the United States. We provide information on relevant forms, such as Form T3RET Trust Income Tax and Information Return, used for reporting trust income and details.

With our webpage as your go-to resource, you can confidently handle the intricacies of trust income tax compliance. Stay up to date with the latest regulations and ensure that your trust's tax affairs are in order. Trust income tax is a complex field, but our webpage simplifies it for you.

Documents:

5