Employee Retention Credit Templates

Are you looking for ways to save money on your business expenses? One often overlooked opportunity is the Employee Retention Credit. Also known as the ERC, this tax credit is designed to encourage businesses to retain their employees during challenging times.

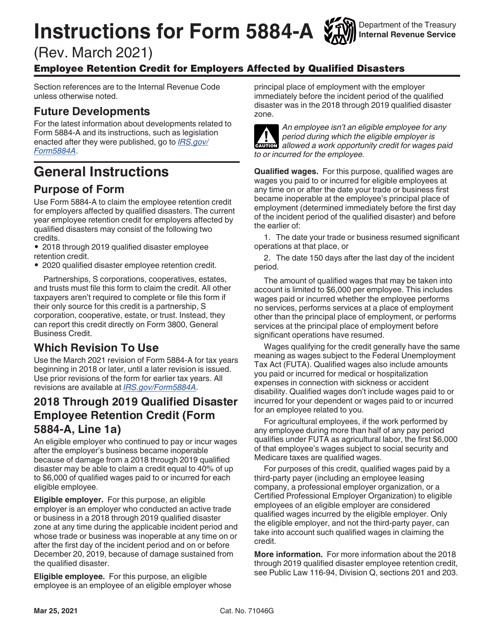

The ERC can provide significant tax savings for employers affected by qualified disasters by offering a credit based on qualified wages paid to eligible employees. By taking advantage of the ERC, you can not only support your workforce but also reduce your overall tax liability.

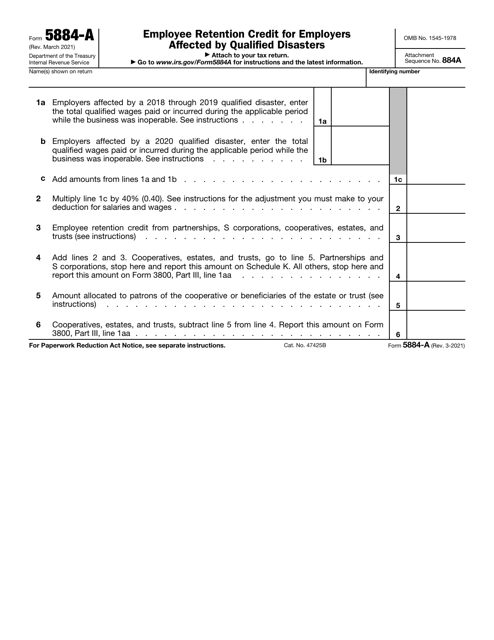

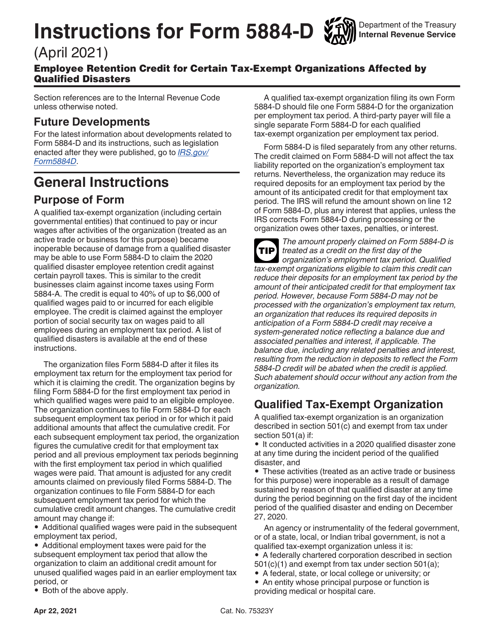

To help you navigate the complexities of the ERC, we have compiled a collection of resources that include instructions for IRS Form 5884-A and Form 5884-D. These documents provide detailed guidance on how to claim the credit and outline the specific eligibility requirements. Whether you are an employer affected by qualified disasters or a tax-exempt organization, we have you covered.

Don't miss out on this opportunity to save money and support your employees. Explore our collection of documents and discover how you can benefit from the Employee Retention Credit.

Documents:

6

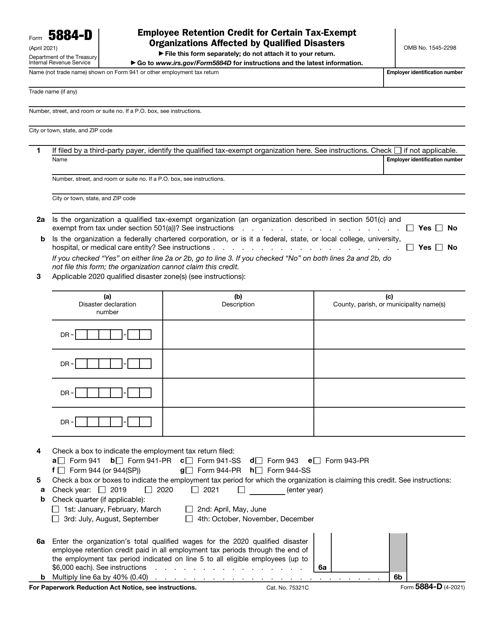

This form is used for claiming the Employee Retention Credit for certain tax-exempt organizations affected by qualified disasters. It provides instructions on how to fill out the form and claim the credit.

This form is used for claiming the Employee Retention Credit by certain tax-exempt organizations that have been affected by qualified disasters. The credit is meant to provide financial relief to these organizations in order to retain their employees.