Taxable Property Templates

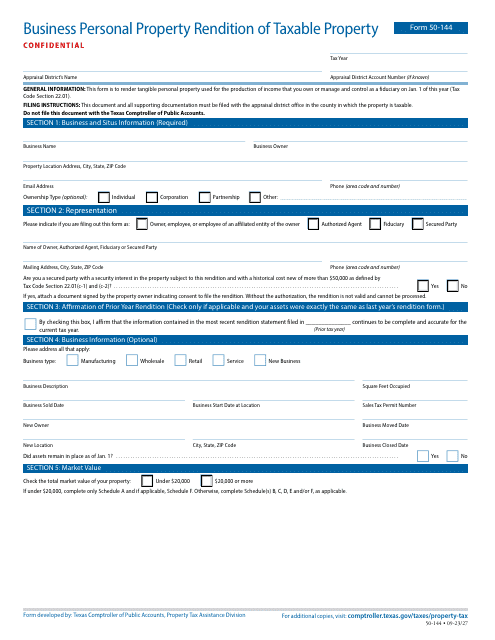

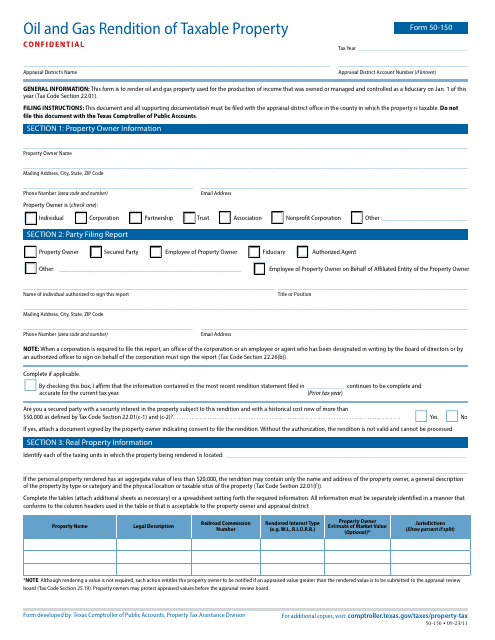

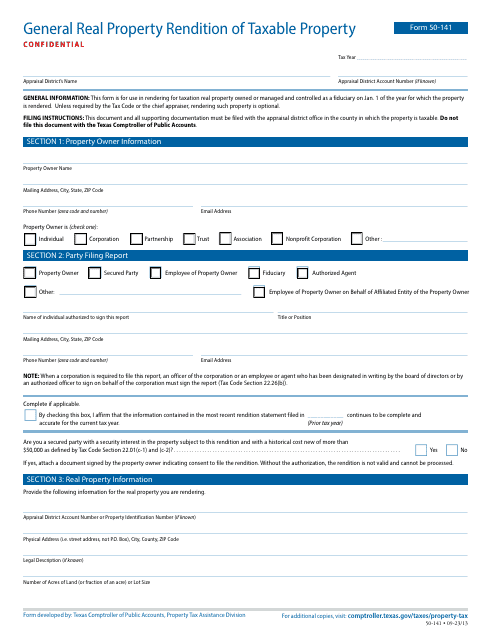

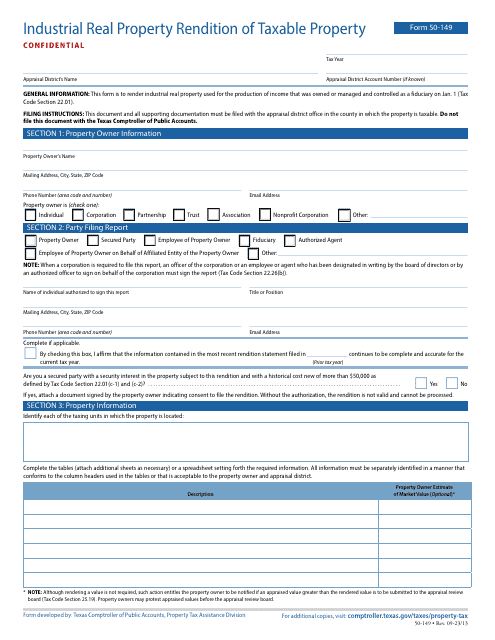

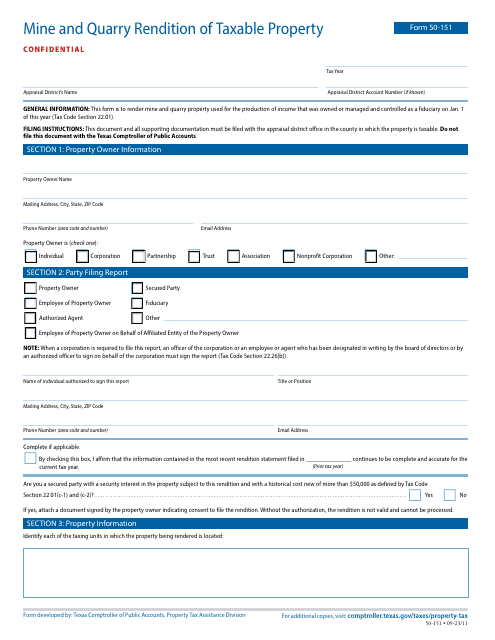

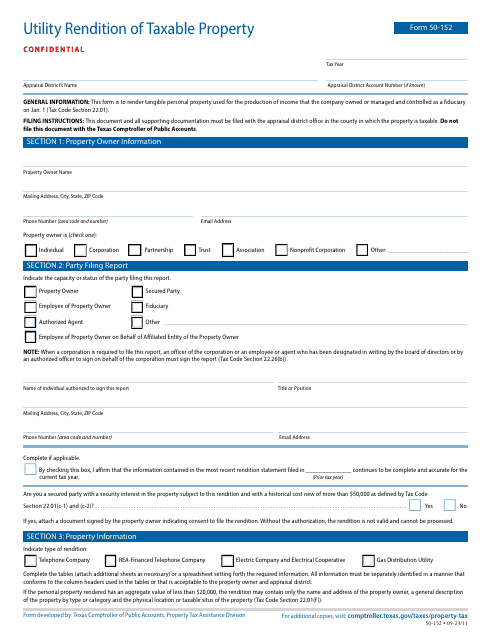

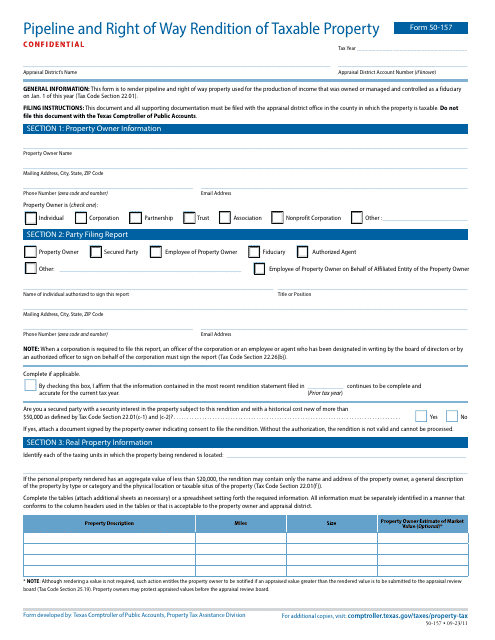

Are you looking for information on taxable property? Look no further! Our website provides valuable resources and documents related to taxable property, also known as taxable property forms or the taxable property collection. Whether you need to fill out a form, understand the instructions for reporting oil, gas, and geothermal personal property in California, or request a list of taxable property in Maine, we've got you covered. Our extensive collection includes forms such as the Gas Distribution Utility Rendition of Taxable Property and the Mine and Quarry Rendition of Taxable Property, both from Texas. Additionally, we offer the General Real Property Rendition of Taxable Property form, also from Texas. At our website, you'll find all the information you need to navigate the complexities of taxable property, ensuring that you stay compliant with local regulations and reporting requirements.

Documents:

32

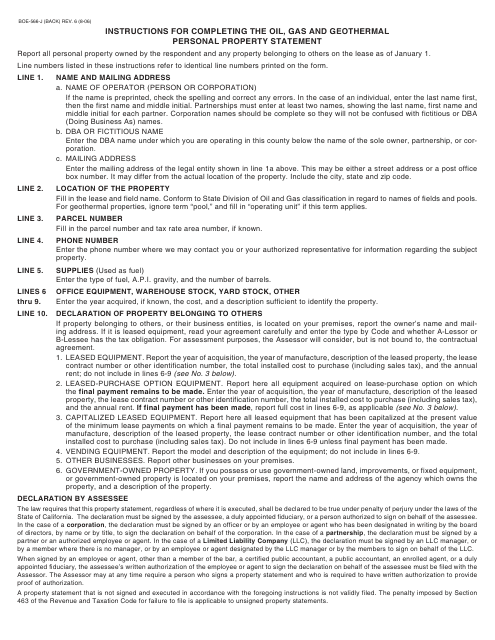

This Form is used for reporting oil, gas, and geothermal personal property in California. It provides instructions on how to fill out and submit the Form BOE-566-J.

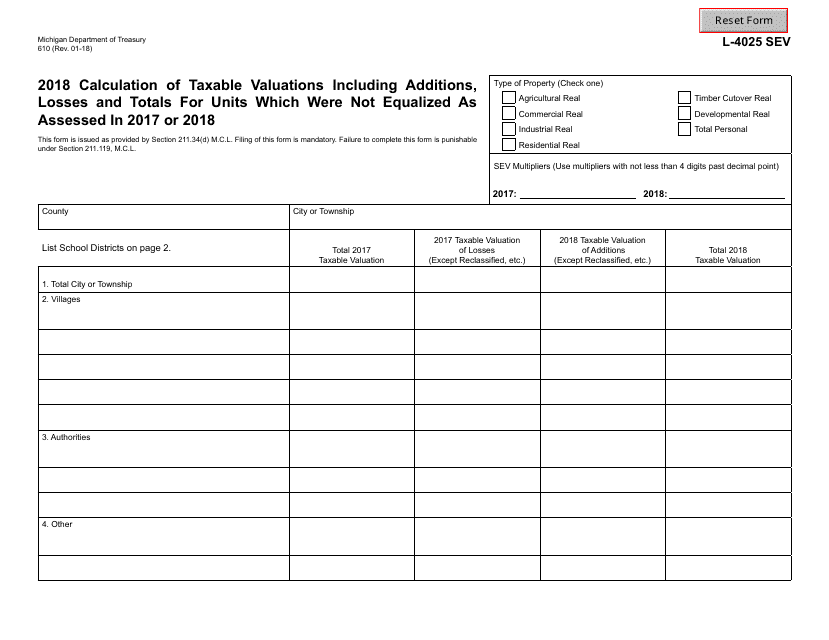

This Form is used for calculating the taxable valuations of units that were not equalized as assessed in 2017 or 2018 in the state of Michigan.

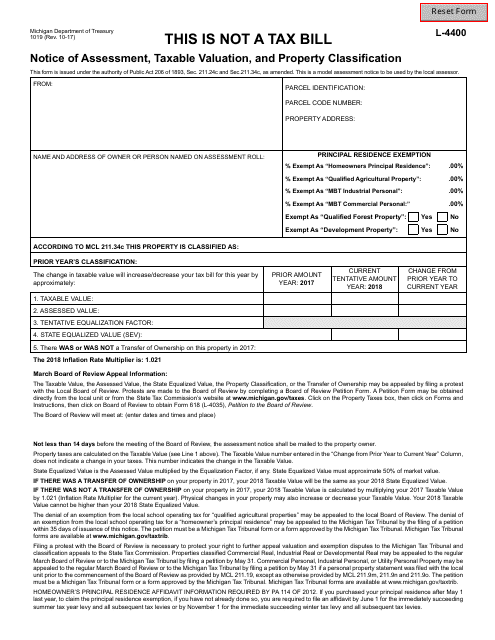

This form is used for notifying taxpayers in Michigan about the assessment, taxable valuation, and classification of their property for tax purposes. It provides information about the tax amount owed based on the property's value and classification.

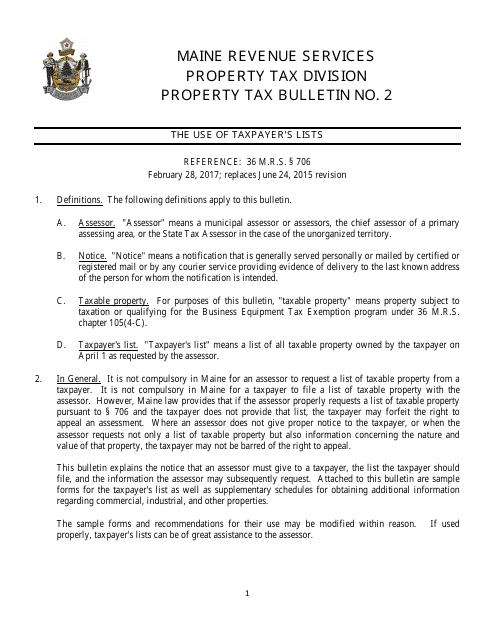

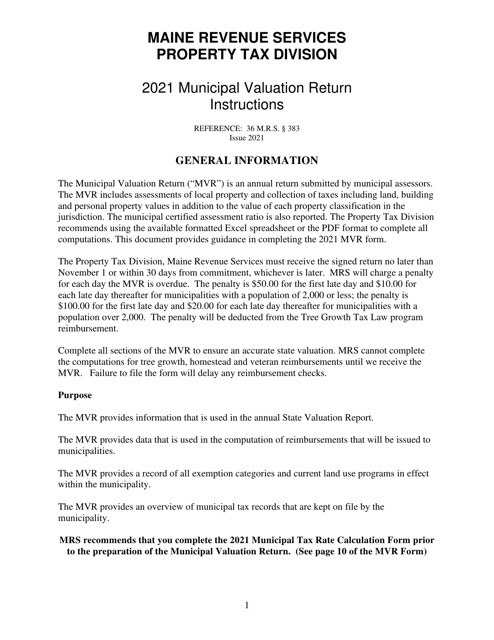

This document is a request for a list of taxable property in the state of Maine. It is used to gather information on properties that are subject to taxation.

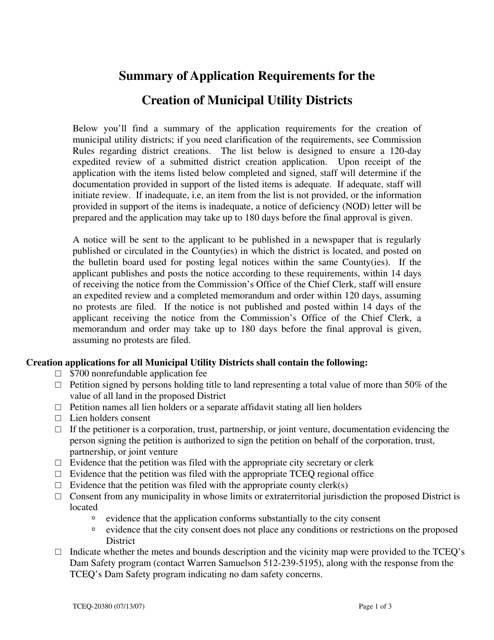

This form provides a summary of the application requirements for creating Municipal Utility Districts (MUDs) in Texas. It outlines the necessary steps and information needed to establish a MUD in the state.

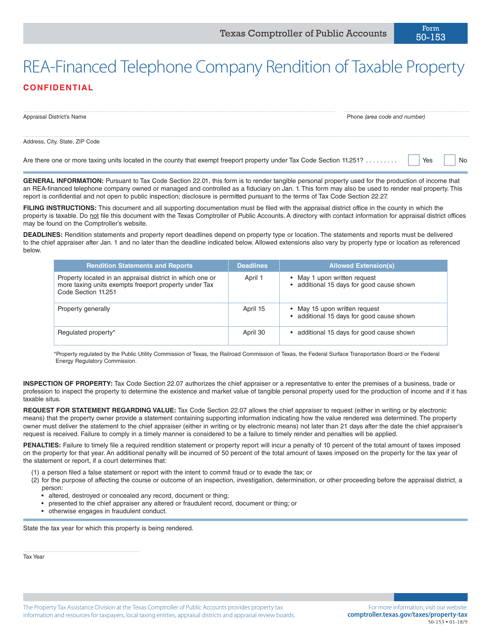

This form is used for a telephone company in Texas to report the taxable property that has been refinanced.

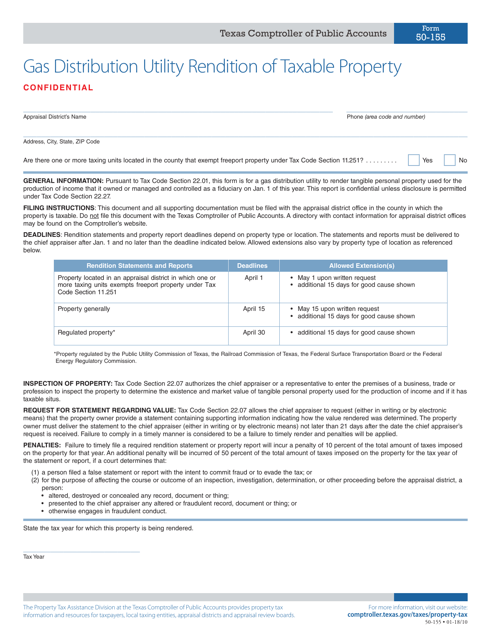

This form is used for gas distribution utilities in Texas to report their taxable property for tax purposes.