Tax Documents Checklist Templates

Having the right tax documents in order is essential for every taxpayer. With our comprehensive tax documents checklist, you can ensure that you have all the necessary forms and records to fulfill your tax obligations accurately and efficiently. Our checklist covers a wide range of tax documents, including IRS forms such as 1096, 1097, 1098, 1099, 3921, 3922, 5498, and W-2G Certain Information Returns.

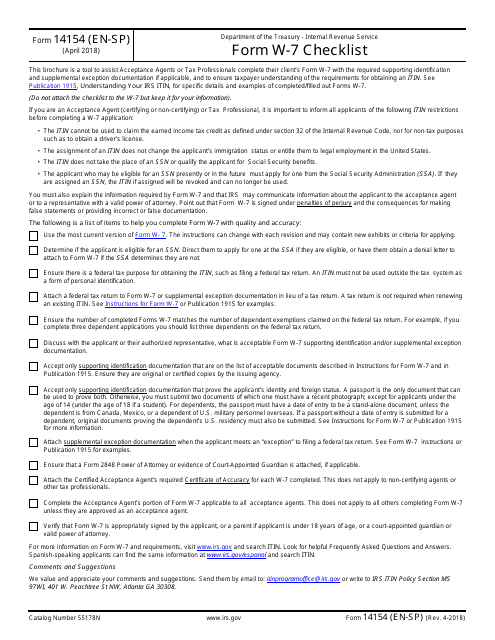

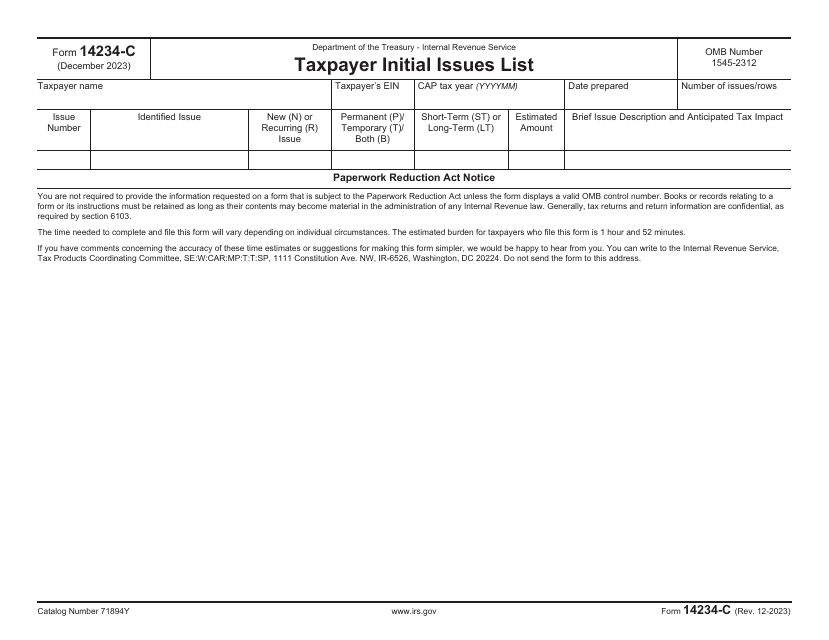

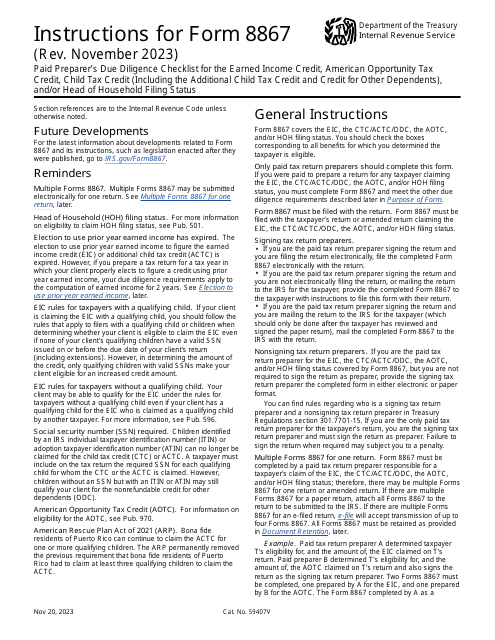

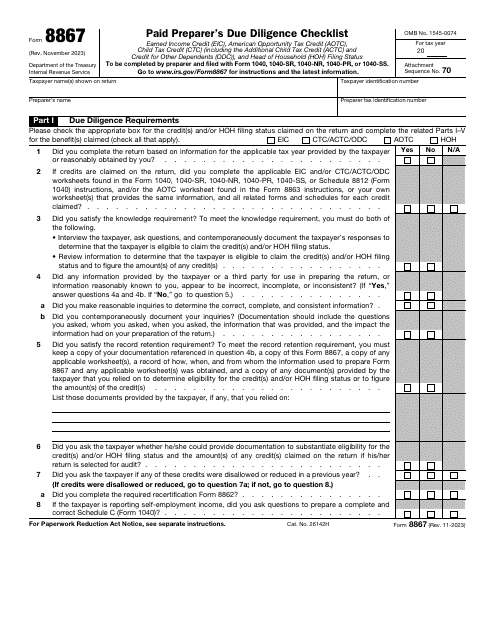

In addition to the standard forms, our tax documents checklist also includes essential resources such as IRS Form 14154 (EN-SP) Form W-7 Checklist (English/Spanish) for nonresident aliens and resident aliens who need to apply for an Individual Taxpayer Identification Number (ITIN). We also provide detailed instructions for IRS Form 8867 Paid Preparer's Due Diligence Checklist, which is necessary for professionals assisting taxpayers with the Earned Income Credit, American Opportunity Tax Credit, Child Tax Credit (Including the Additional Child Tax Credit and Credit for Other Dependents), and/or Head of Household Filing Status.

Organizing your tax documents has never been easier with our user-friendly tax documents checklist. Say goodbye to the stress and confusion of missing documents. Start preparing for tax season with our comprehensive tax documents checklist, also known as the tax checklist or tax forms checklist, and ensure a smooth and hassle-free filing process. Trust us to guide you through the complex world of tax documentation, so you can focus on maximizing your tax benefits and minimizing your liabilities.

Documents:

9

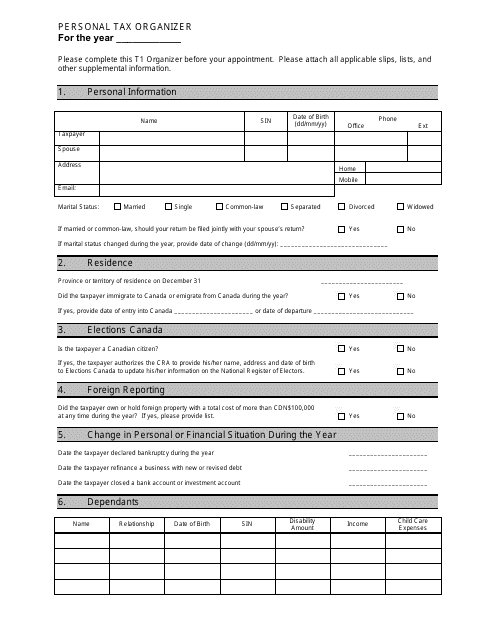

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

This document is a checklist for Form W-7, which is used to apply for an Individual Taxpayer Identification Number (ITIN). It is available in both English and Spanish.

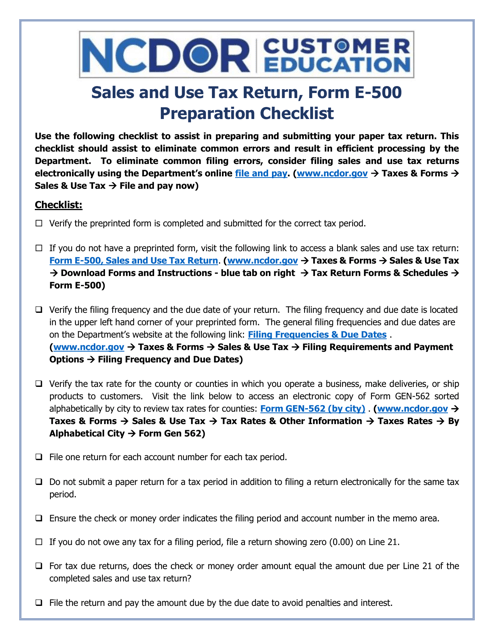

This form is used for preparing and ensuring accuracy of the E-500 tax form in North Carolina.

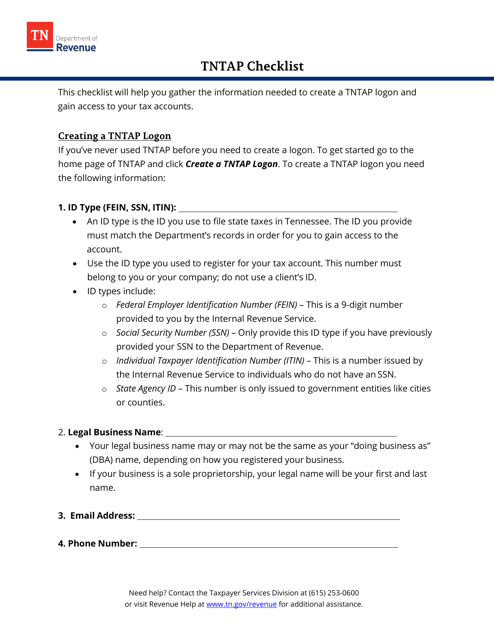

This document provides a checklist for individuals or businesses in Tennessee who need to use the TNTAP (Tennessee Taxpayer Access Point) system for various tax-related activities. The checklist helps ensure that all necessary information and requirements are met when using the TNTAP system.