Renters Property Tax Refund Templates

Are you a renter looking for a way to get money back on your property taxes? Look no further than the Renters Property Tax Refund, also known as the Renters Property Tax Refund Program. This program is designed to provide financial relief to eligible renters who pay property taxes.

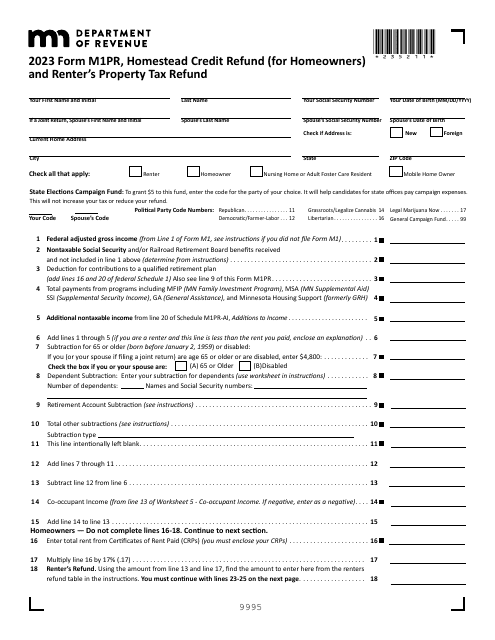

In Minnesota, the main document you need to file for the Renters Property Tax Refund is Form M1PR Homestead Credit Refund. This form allows you to claim the refund based on your rent and property taxes paid. It's essential to fill out this form accurately to ensure you receive the maximum refund you're entitled to.

The Renters Property Tax Refund program also provides detailed instructions to help you complete the necessary paperwork correctly. These instructions come in the form of the Instructions for Form M1PR Homestead Credit Refund and are crucial in guiding you through the application process.

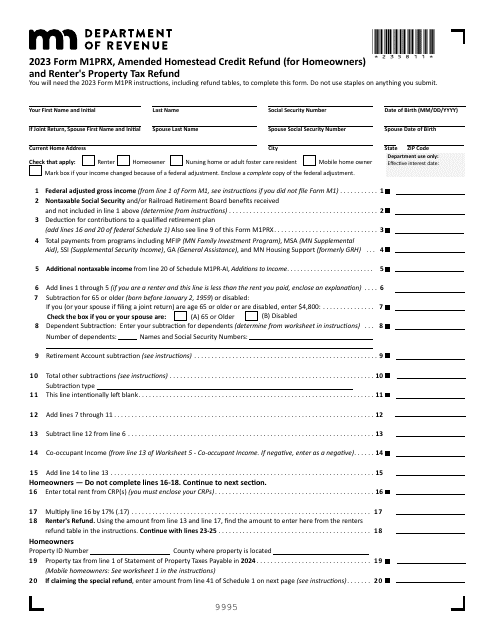

If you need to make any changes or corrections to your initial claim, you can use Form M1PRX Amended Homestead Credit Refund. This form allows you to amend your original claim if you made any errors or if your circumstances have changed.

Overall, the Renters Property Tax Refund program is an excellent opportunity for renters to get some financial relief by receiving a refund on their property taxes. Make sure to take advantage of this program and claim the refund you deserve.

Documents:

6

The purpose of this document is to let Minnesota taxpayers get a refund based on their household income and the property taxes or rent paid on their primary residence if they qualify.