Loan Repayment Schedule Templates

A loan repayment schedule, also known as a debt schedule or loan payment plan, is a crucial tool for borrowers and lenders alike. It outlines the repayment terms and schedule for a loan, ensuring transparency and accountability throughout the repayment process.

A loan repayment schedule provides borrowers with a clear understanding of their monthly installment payments, interest rates, and total repayment amounts. It allows them to budget accordingly and make informed financial decisions. Lenders, on the other hand, can use the repayment schedule to track and manage their loan portfolios, ensuring that borrowers are meeting their repayment obligations.

Whether you're a bank, financial institution, or an individual borrower, a well-organized loan repayment schedule is essential for successful loan management. It helps streamline the repayment process, mitigates any confusion or misunderstandings, and promotes a healthy borrower-lender relationship.

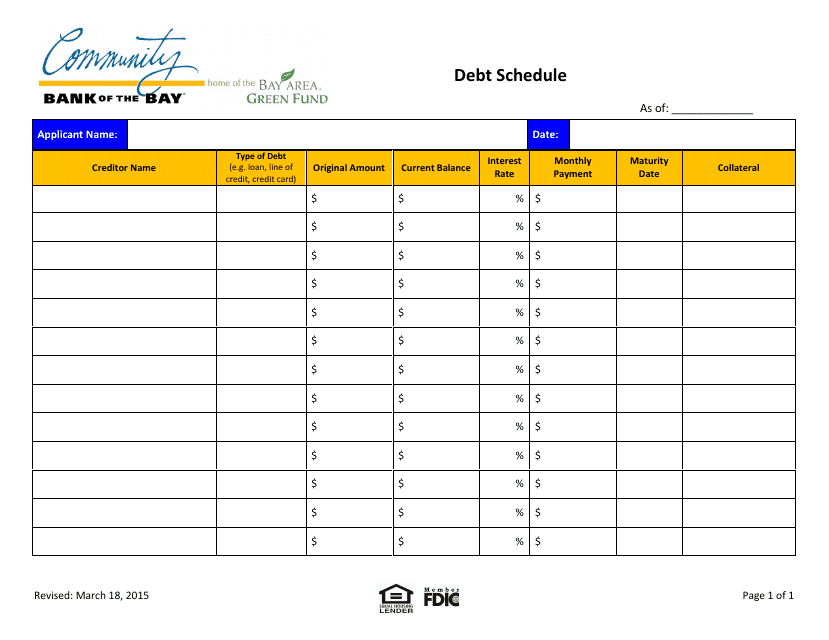

At Community Bank of the Bay, we understand the importance of a comprehensive debt schedule template. Our user-friendly template simplifies the process of creating an accurate loan repayment schedule, tailored to your specific needs and requirements. With our template, you can easily calculate your monthly installment payments, interest accruals, and projected repayment timeline.

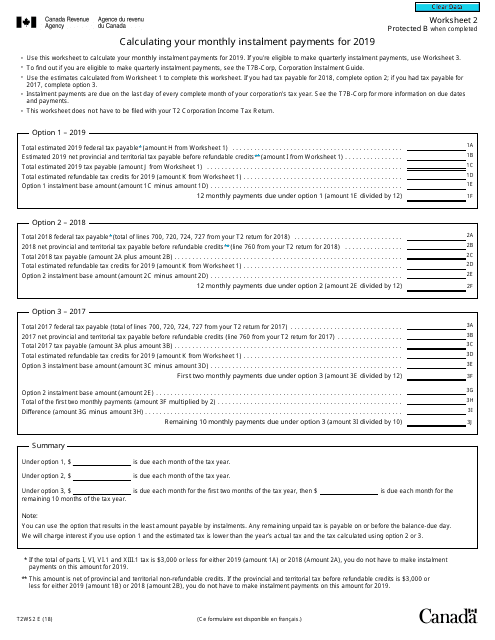

In Canada, the Form T2WS2 Worksheet 2 is a handy tool for borrowers looking to calculate their monthly installment payments accurately. This form takes into account various factors such as interest rates, loan terms, and any additional fees or charges. By providing all the necessary information, the form generates a clear repayment schedule, allowing borrowers to plan their finances effectively.

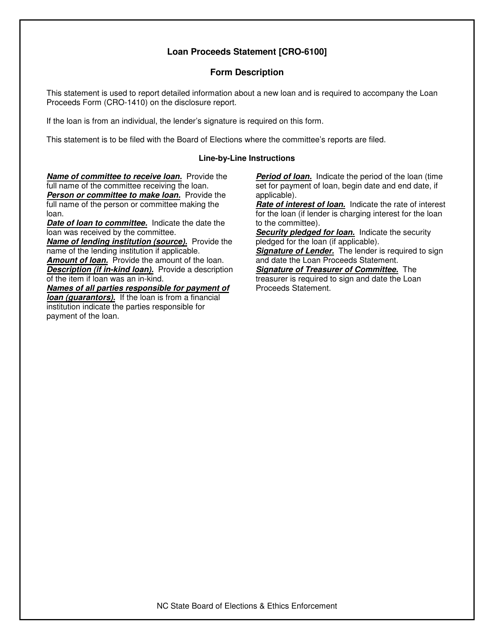

For borrowers based in North Carolina, the Instructions for Form CRO-6100 Loan Proceeds Statement can guide you through the loan repayment process. This document outlines the necessary steps and documentation required to ensure a seamless repayment experience. By following these instructions, borrowers can ensure that their loan proceeds are allocated correctly and that their repayment schedule is accurately maintained.

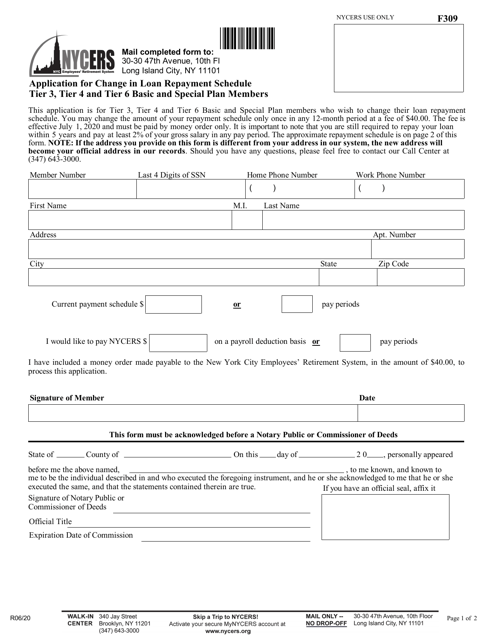

New York City residents who are part of the Tier 3, Tier 4, or Tier 6 Basic and Special Plan Members can benefit from Form F309 Application for Change in Loan Repayment Schedule. This form allows individuals to request a modification in their loan repayment terms, taking into account any changes in their financial circumstances. Through this form, borrowers can align their repayment schedule with their current needs and obligations.

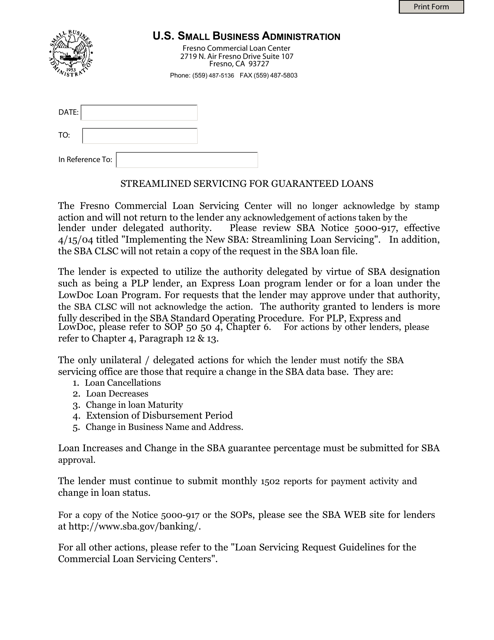

A streamlined servicing program for guaranteed loans is another effective resource for borrowers and lenders. This program optimizes the loan repayment process by leveraging technology and automation, ensuring efficiency and accuracy. With streamlined servicing, borrowers can expect a simplified and hassle-free experience, making loan repayment more manageable and less time-consuming.

In summary, a loan repayment schedule plays a vital role in managing loan obligations and fostering healthy borrower-lender relationships. Whether you're a borrower or a lender, having access to accurate and well-structured repayment documents is essential. From debt schedule templates to specialized forms for loan modification or guaranteed loans, these resources empower borrowers to take control of their financial journey and lenders to ensure a seamless repayment experience.

Documents:

8

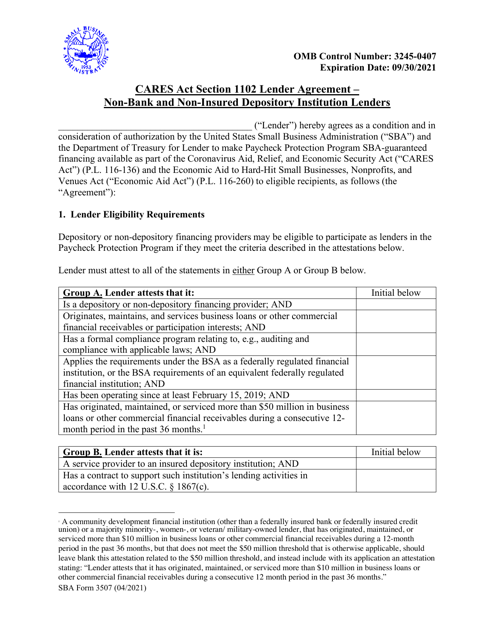

This document is a debt schedule template provided by Community Bank of the Bay. It helps individuals or businesses in organizing their debt repayment schedule.

This form is used for calculating your monthly installment payments in Canada. It helps you determine how much you need to pay each month for various types of loans or financing arrangements.

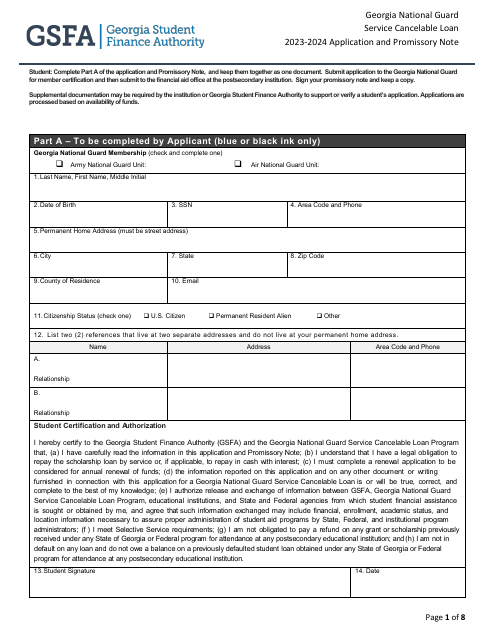

This document provides information and guidelines for a simplified process of managing and servicing loans that are guaranteed by a certain entity. It outlines the steps and requirements for efficient loan administration.

This form is used to provide instructions for completing Form CRO-6100 Loan Proceeds Statement in North Carolina. It provides guidance on how to accurately report loan proceeds for various purposes.

This form is used for Tier 3, Tier 4, and Tier 6 basic and special plan members in New York City who want to apply for a change in their loan repayment schedule.

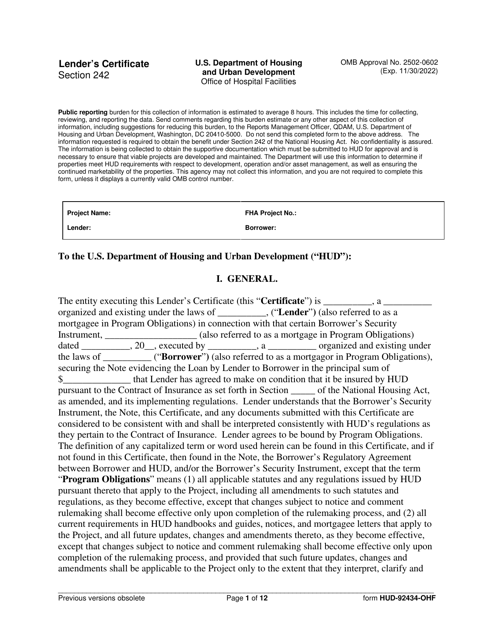

This form is used for lenders to certify compliance with specific requirements for the OneHome Program.