Tax Filing Requirements Templates

Are you overwhelmed by tax filing requirements? Looking for clear instructions on how to complete your tax forms? Look no further! Our comprehensive collection of tax filing requirement documents is here to help you navigate the complex world of taxes.

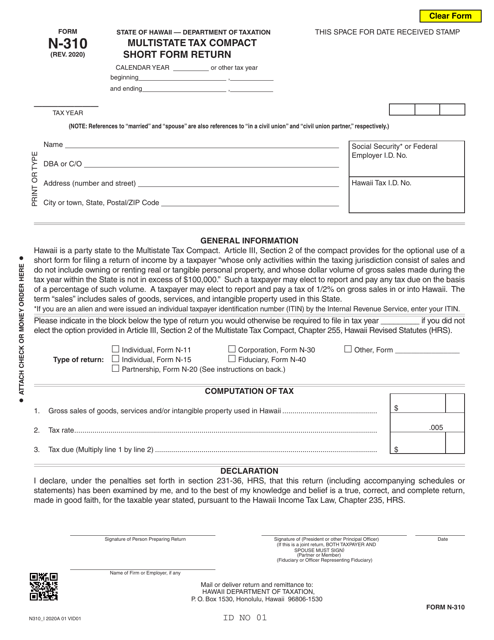

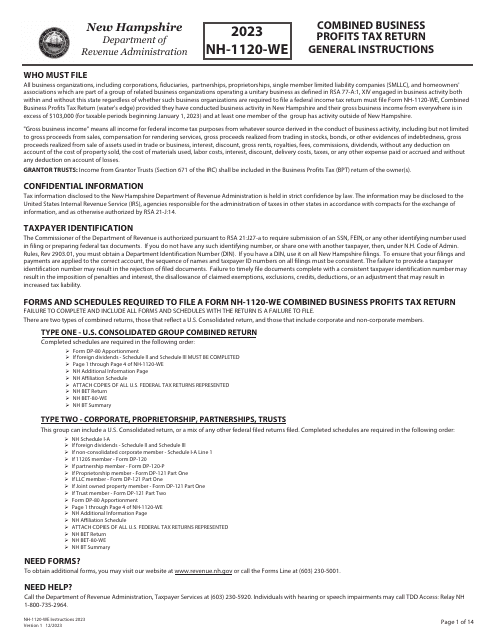

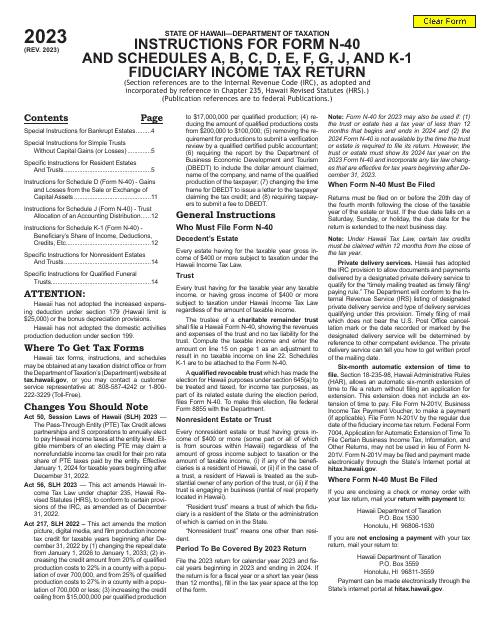

Whether you're filing individual income tax returns, business profits tax returns, or sales and use tax returns, we have the resources you need. Our collection includes a wide range of documents, such as the Form N-310 Multistate Tax Compact Short Form Return from Hawaii, the Instructions for Form NH-1120-WE Combined Business Profits Tax Return from New Hampshire, and the Instructions for IRS Form 1099-R, 5498.

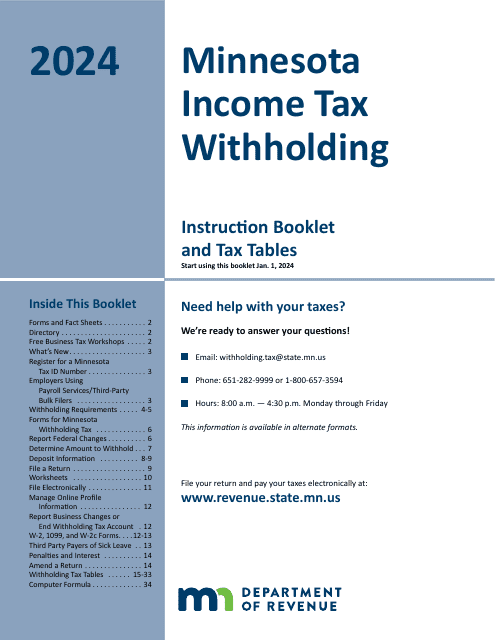

We understand that tax season can be confusing, which is why we've compiled these helpful documents to make the process easier for you. Our collection also includes instructions for the Form E-500 Sales and Use Tax Return from North Carolina and the Form TPD Tax Position Disclosure from Minnesota.

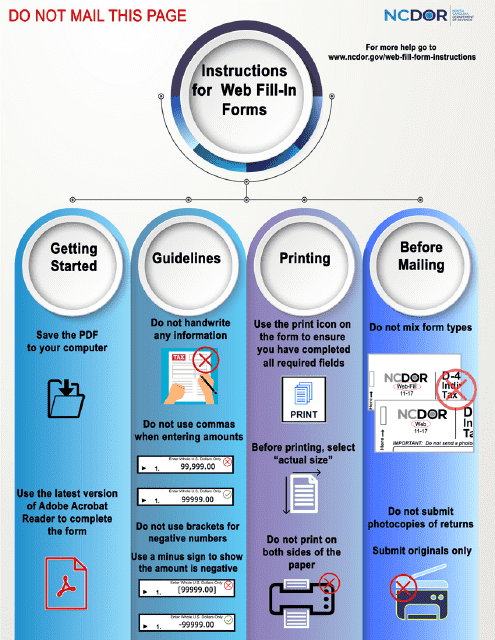

Don't let tax filing requirements stress you out. Take advantage of our extensive collection of tax filing requirement documents to ensure that you stay compliant with tax regulations. Our user-friendly instructions and forms will guide you step-by-step through the filing process, saving you time and minimizing the risk of errors.

So why wait? Explore our tax filing requirement documents today and take the guesswork out of your tax filings. Simplify your tax season with our comprehensive and easy-to-understand resources.

Documents:

55

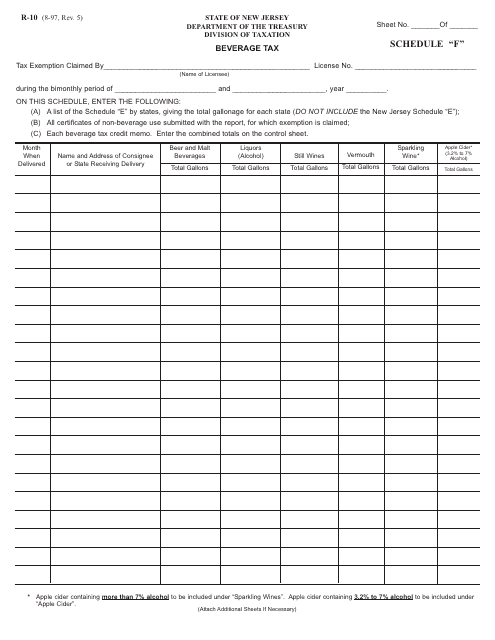

This form is used for reporting beverage taxes in New Jersey

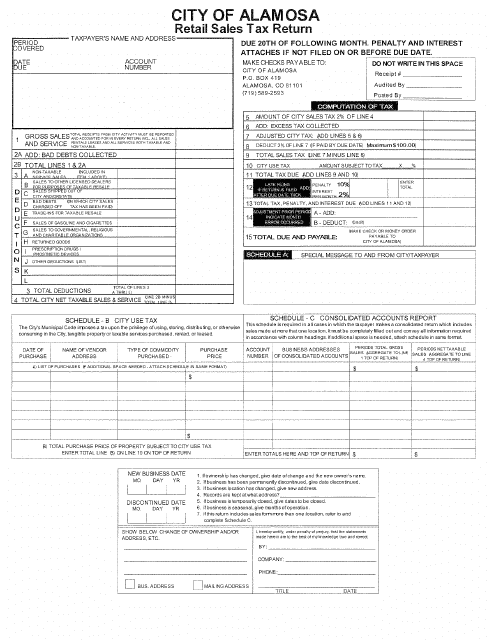

This Form is used for reporting and paying retail sales tax in the City of Alamosa, Colorado.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

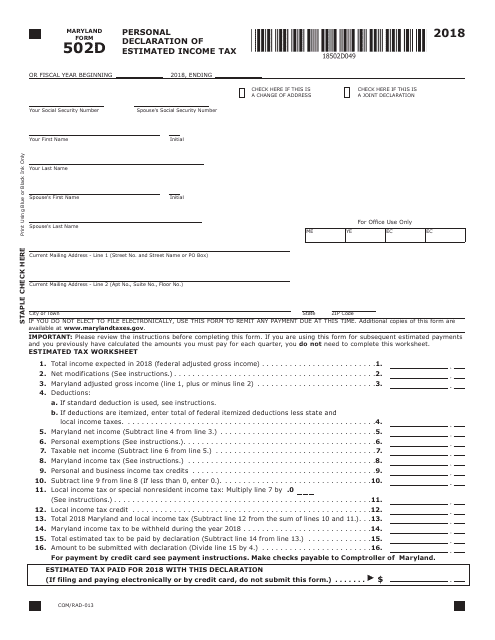

This form is used for residents of Maryland to declare their estimated income tax for the year. It allows individuals to calculate and submit their projected income tax liability to the state.

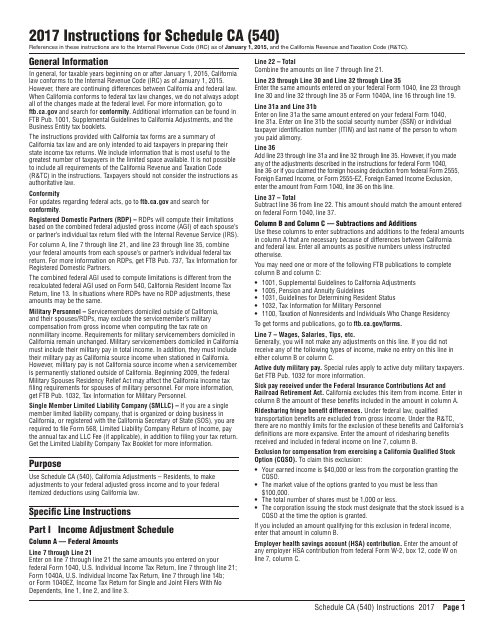

This Form is used for reporting California-specific tax adjustments for residents of California on their Form 540 tax return. It ensures accurate calculation of state tax liability for California residents.

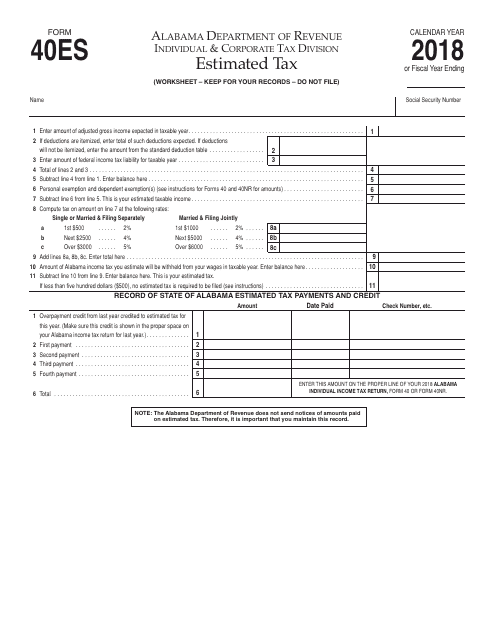

This form is used for individuals in Alabama to report and pay estimated taxes.

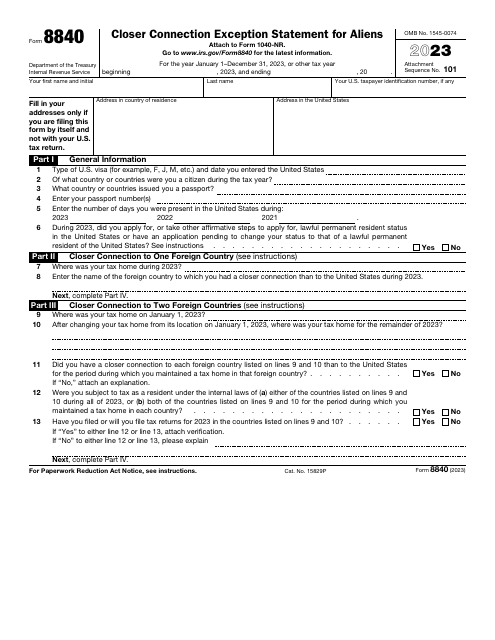

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.

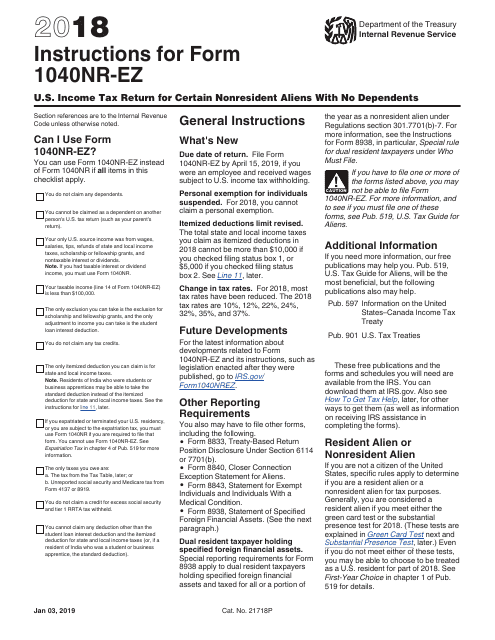

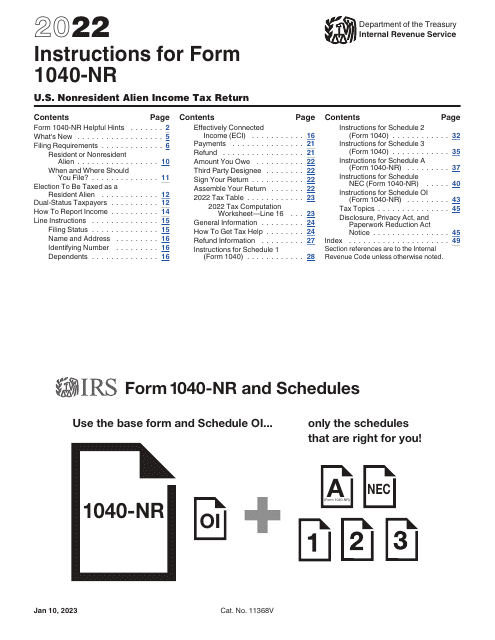

This document is for nonresident aliens with no dependents who need to file their U.S. income tax return. It provides instructions on how to complete IRS Form 1040NR-EZ.

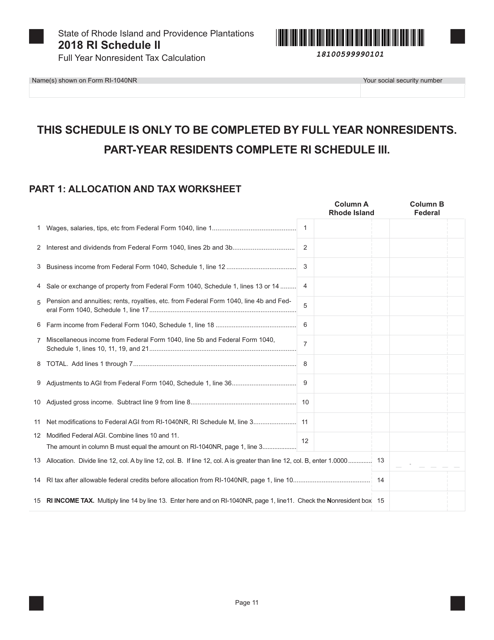

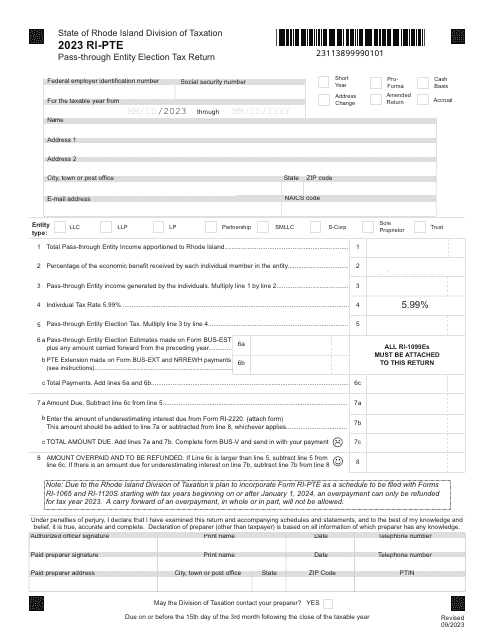

This document is used for calculating the full-year nonresident tax for Schedule II in Rhode Island.

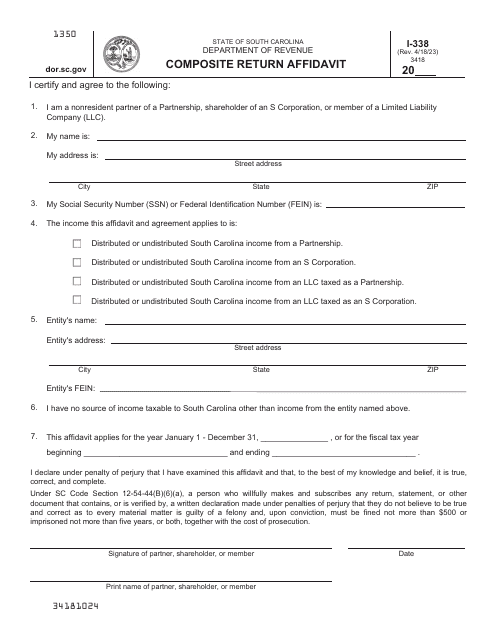

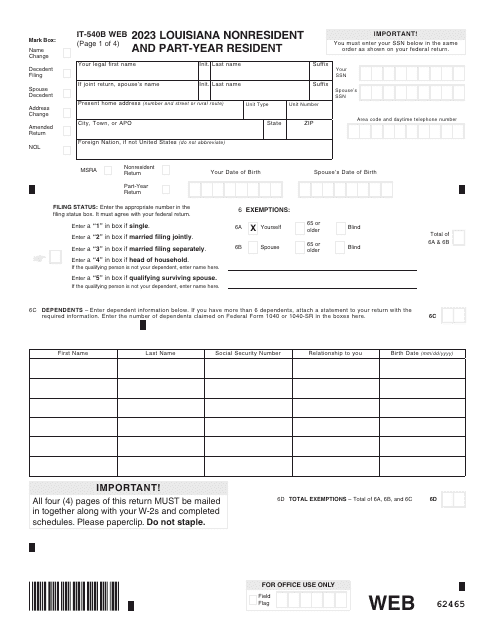

This Form is used for filing nonresident individual income tax return in the state of Virginia.

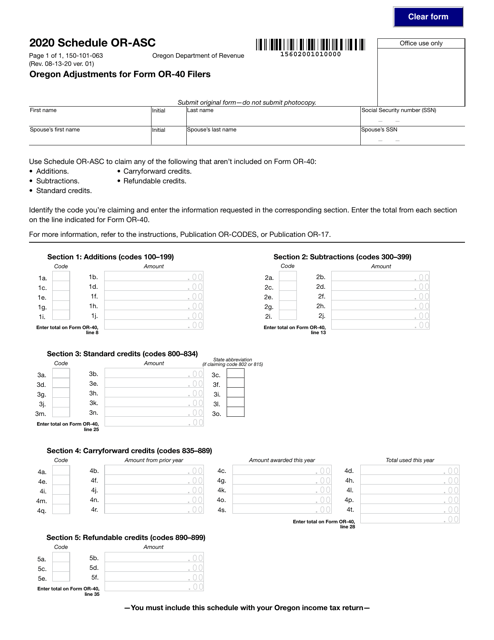

This form is used for making adjustments to the Oregon tax return (Form OR-40) filed by individuals in Oregon. It is specifically designed for Oregon residents and allows them to make corrections or additions to their original tax return. This form helps taxpayers in Oregon ensure that their tax returns are accurate and complete.

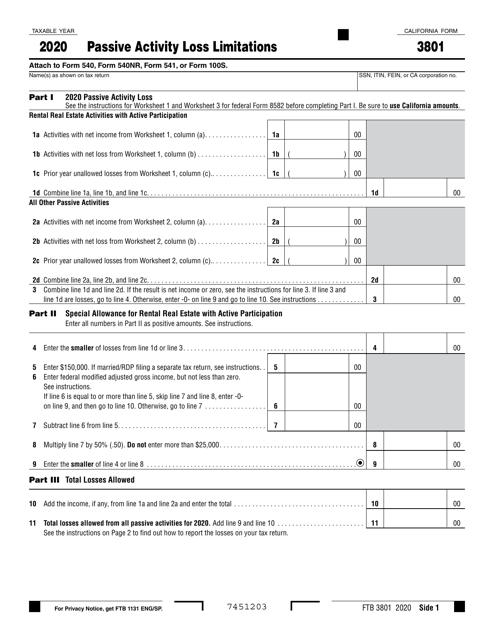

This form is used for reporting passive activity loss limitations in California.

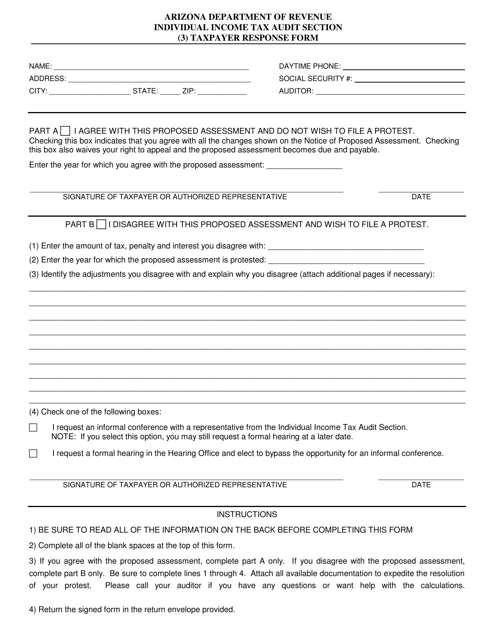

This Form is used for taxpayers in Arizona to respond to correspondence from the tax authorities.

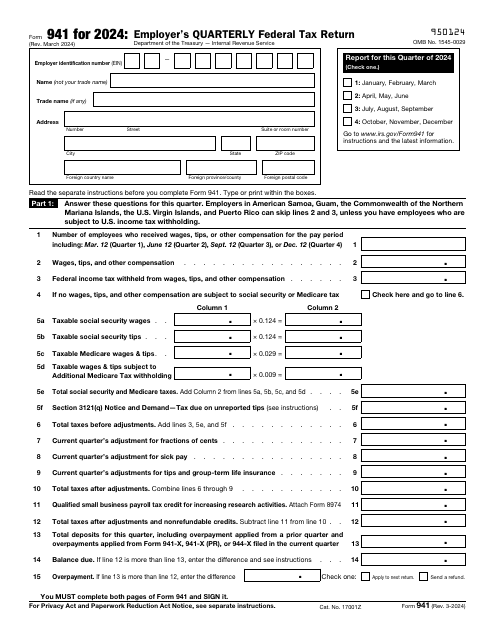

This is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have received over the course of the previous quarter and the tax already subtracted from the workers' salaries.