Tax Exempt Organizations Templates

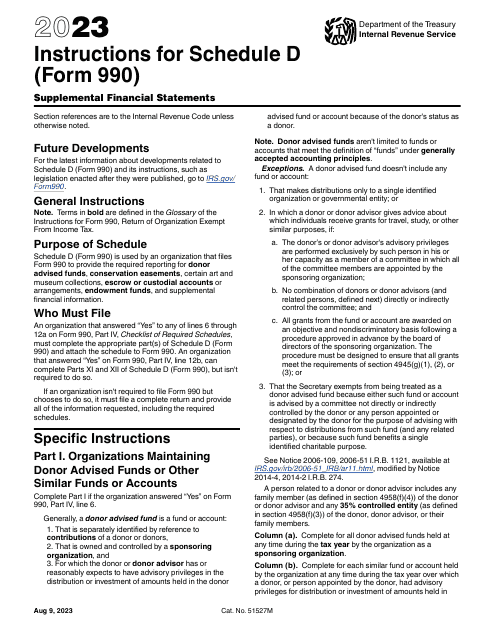

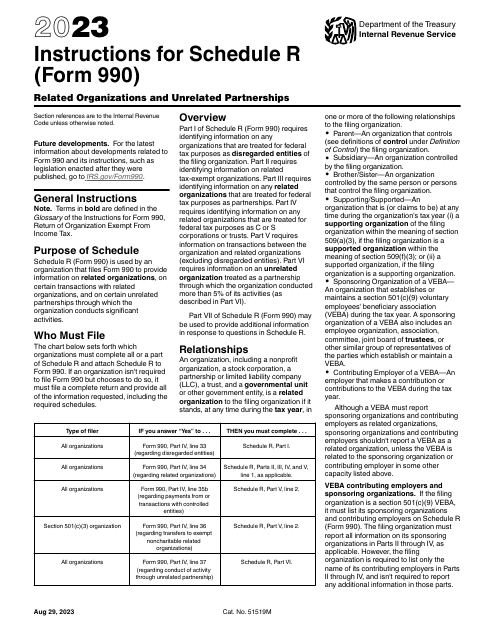

Are you a tax-exempt organization looking for information on tax forms and regulations? Look no further! We have a comprehensive collection of resources that will help you navigate the complex world of tax-exempt organizations. Whether you're seeking guidance on filing your tax return, understanding your organization's financial statements, or estimating your unrelated business taxable income, our collection of documents has got you covered.

We understand that tax-exempt organizations face unique challenges when it comes to complying with tax laws and regulations. That's why we have compiled a range of helpful resources specifically tailored to the needs of tax-exempt organizations like yours. Our documents are designed to provide clear instructions and explanations, ensuring that you have all the information you need to meet your tax obligations.

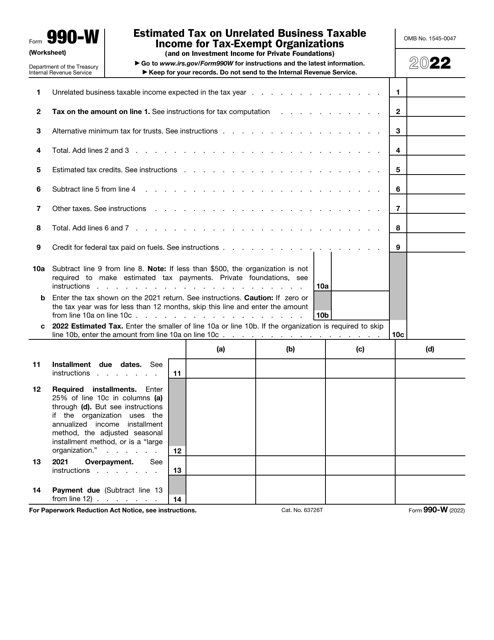

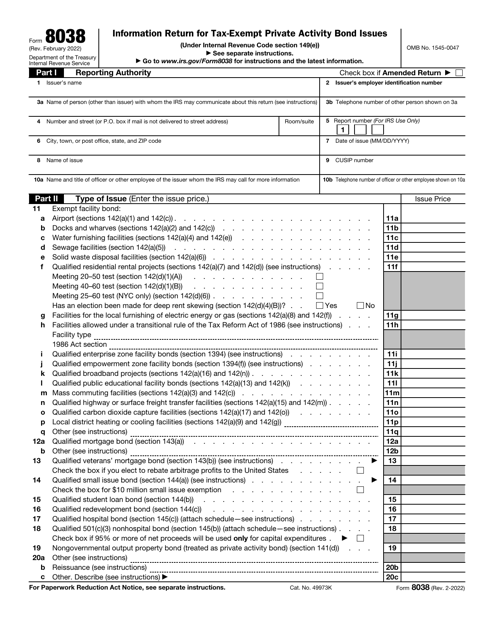

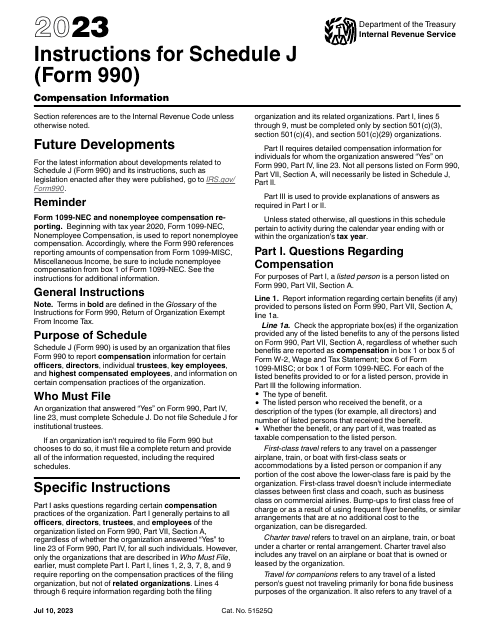

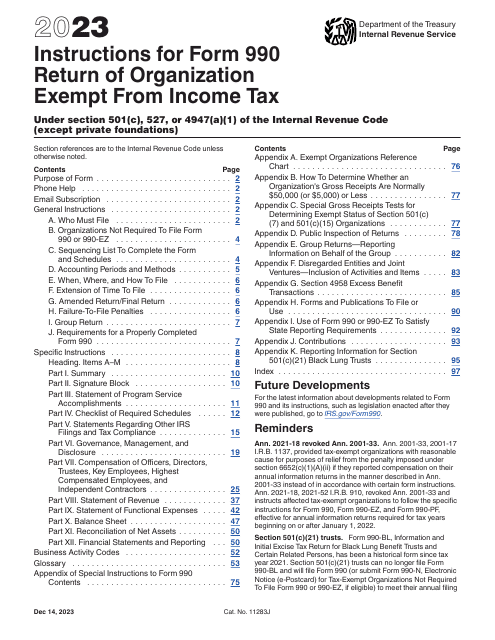

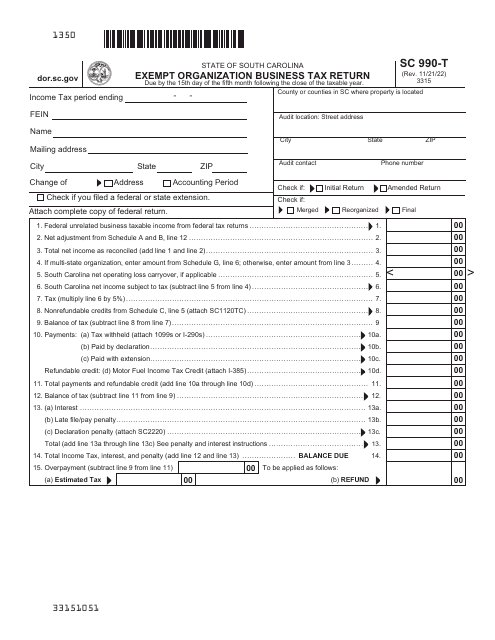

Our collection includes a variety of forms, such as the IRS Form 990-W Estimated Tax on Unrelated Business Taxable Income for Tax-Exempt Organizations and the Arizona Form 99T (ADOR10419) Arizona Exempt OrganizationBusiness Income Tax Return - Arizona. We also have comprehensive guides, such as the Instructions for Form M-990T Unrelated Business Income Tax Return - Massachusetts, to help you understand the ins and outs of filing your tax return.

Don't get overwhelmed by the complexities of tax-exempt organization tax forms. Trust our collection of resources to provide you with the information you need to navigate the process smoothly. Our documents will help you accurately report your organization's income, minimize your tax liability, and maintain compliance with tax laws and regulations.

So whether you're a seasoned tax-exempt organization or just starting out, our collection of documents will be your go-to resource for all your tax-related needs. Empower yourself with the knowledge and understanding you need to ensure the success and compliance of your tax-exempt organization. Start exploring our collection today!

Documents:

100

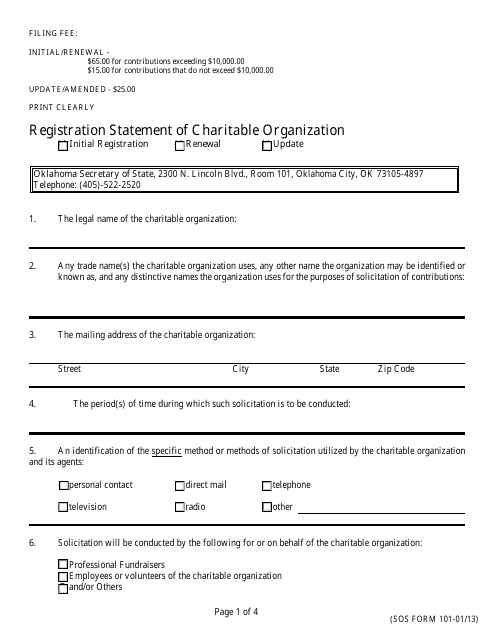

This Form is used for registering a charitable organization in Oklahoma. It is required by the state to ensure transparency and accountability in the fundraising activities of the organization.

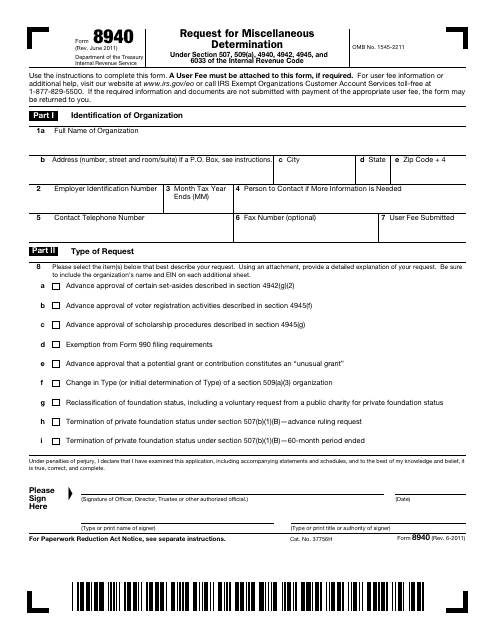

This form is used for requesting miscellaneous determinations from the IRS.

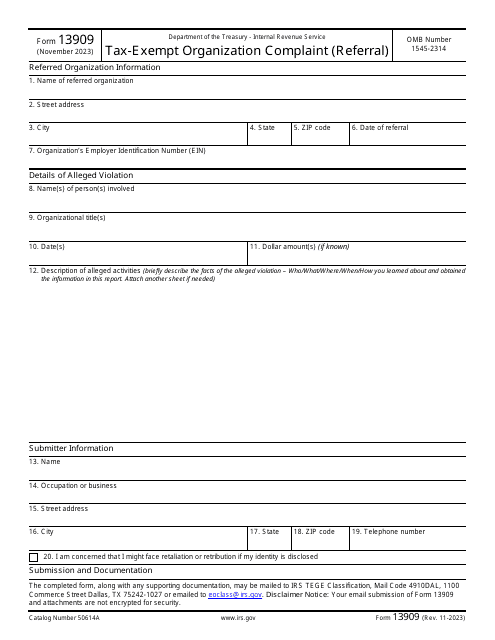

This is a written statement prepared by a concerned individual who believes a tax-exempt organization is violating tax laws.

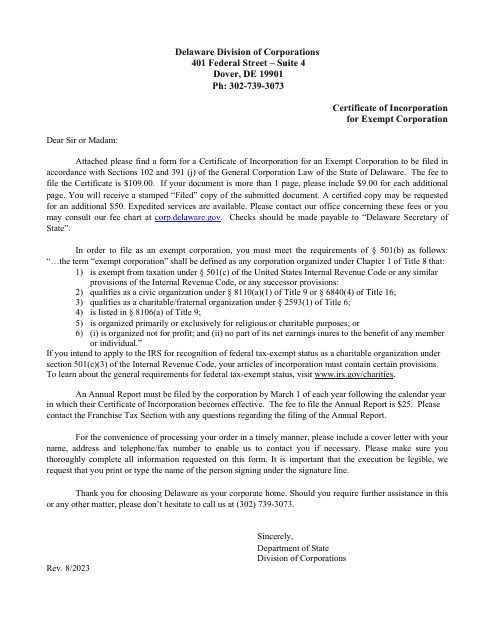

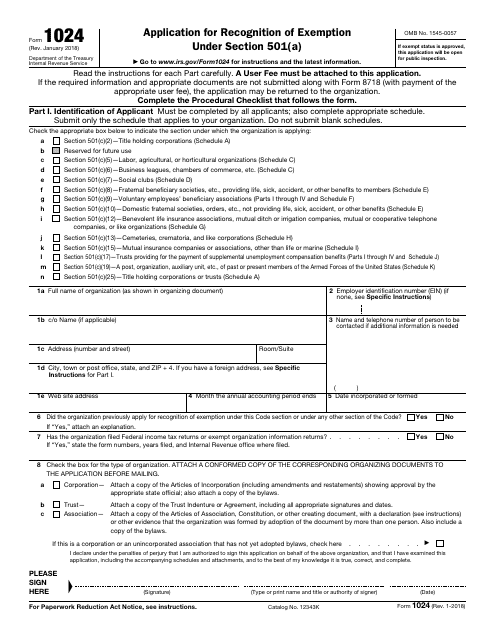

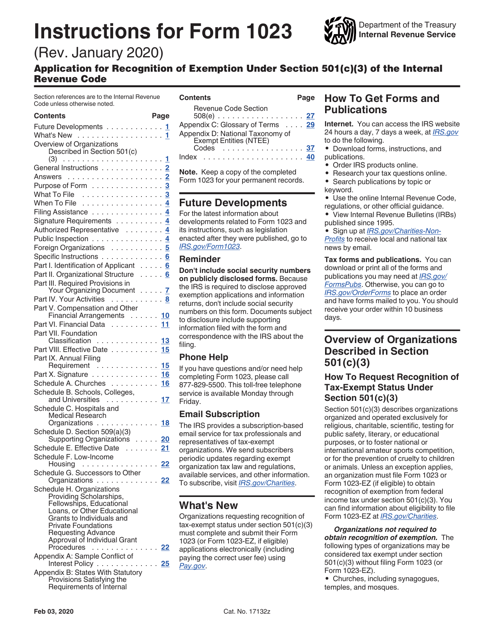

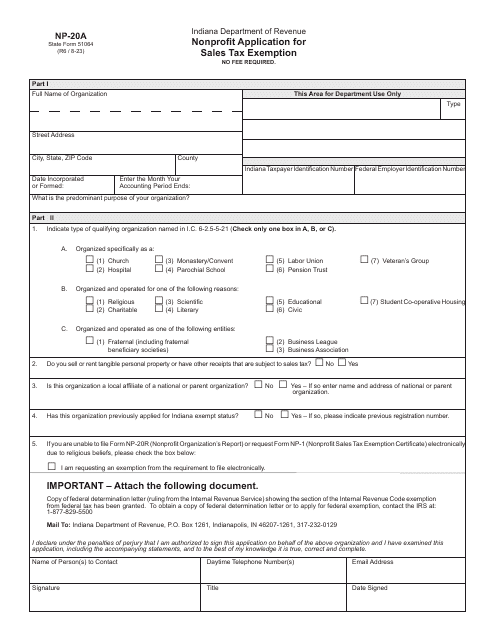

This Form is used for applying for recognition of exemption under Section 501(a) of the Internal Revenue Code. It is required by the IRS for organizations seeking tax-exempt status.

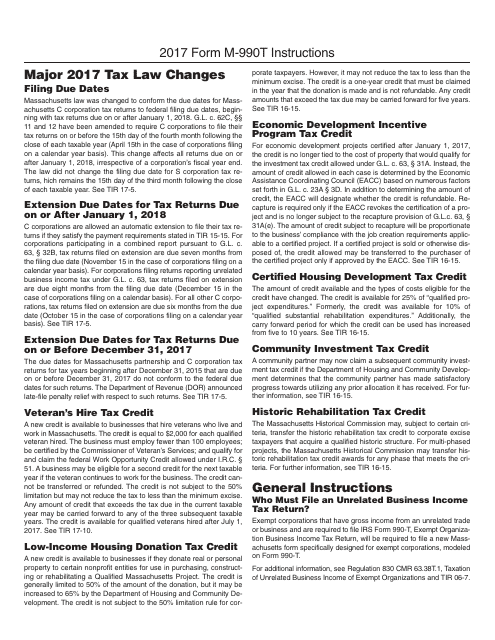

This Form is used for reporting and paying the Massachusetts Unrelated Business Income Tax. It applies to tax-exempt organizations that engage in unrelated business activities in Massachusetts. The form provides instructions on how to report and calculate the taxable income, exemptions, and credits for the tax year.

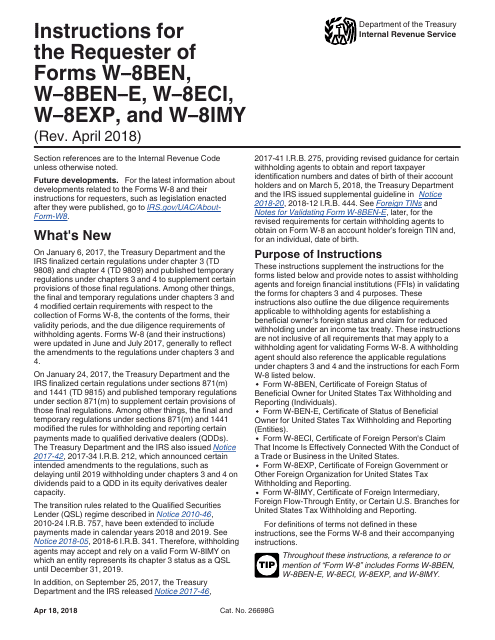

This document provides instructions for various IRS forms including W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. These forms are used to certify the foreign status of the taxpayer and claim eligibility for tax treaty benefits, exemption from withholding, or reduced withholding rates. The instructions guide taxpayers on how to complete these forms correctly and provide required information to the IRS.

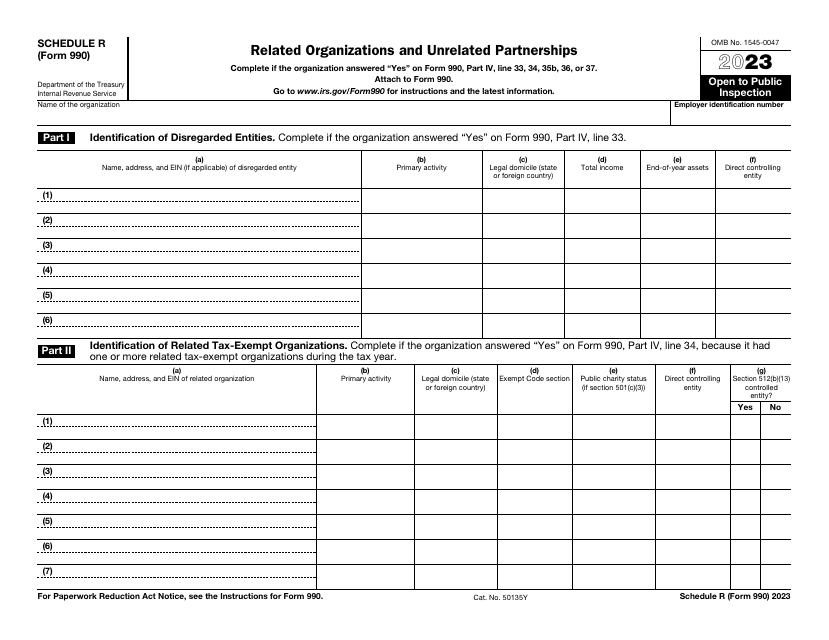

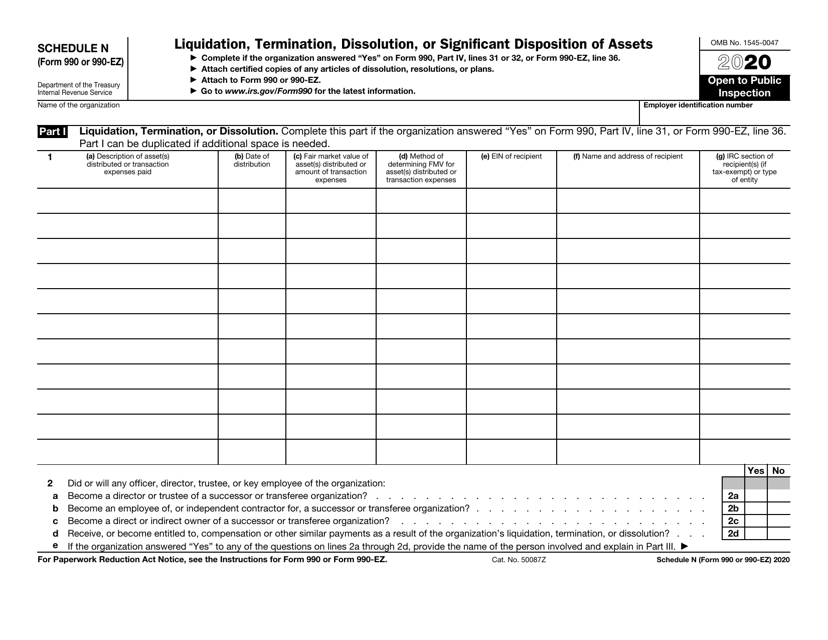

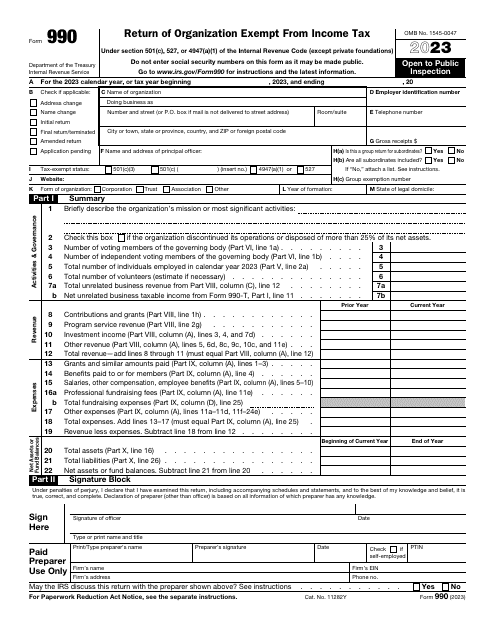

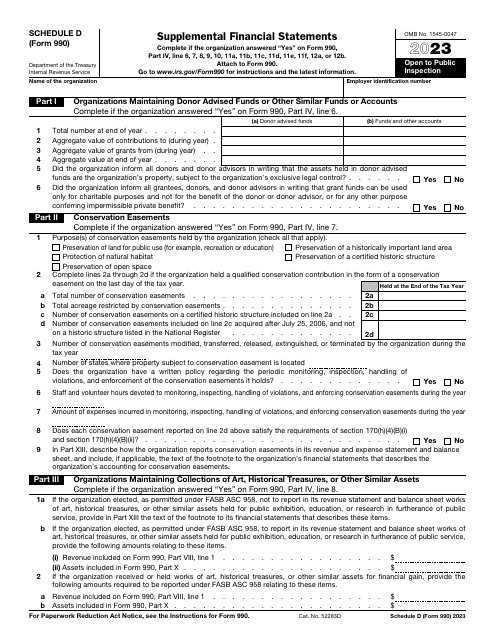

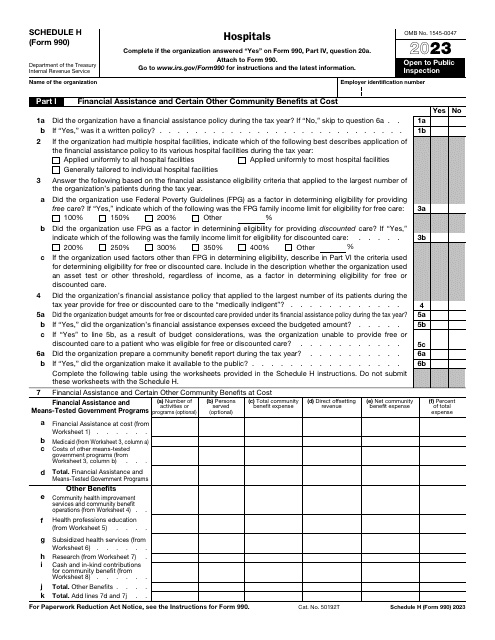

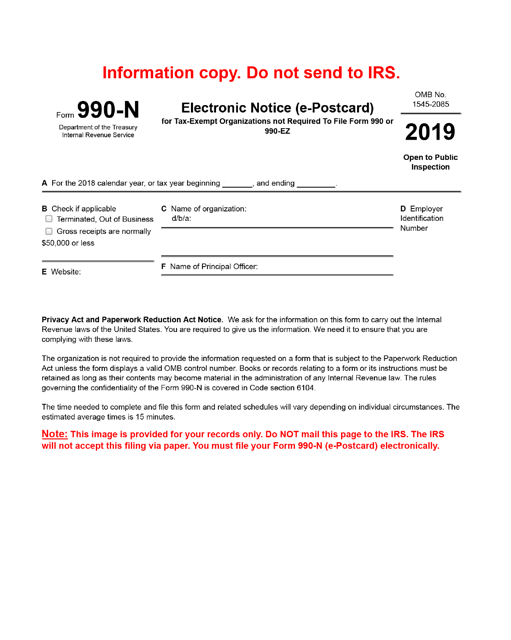

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

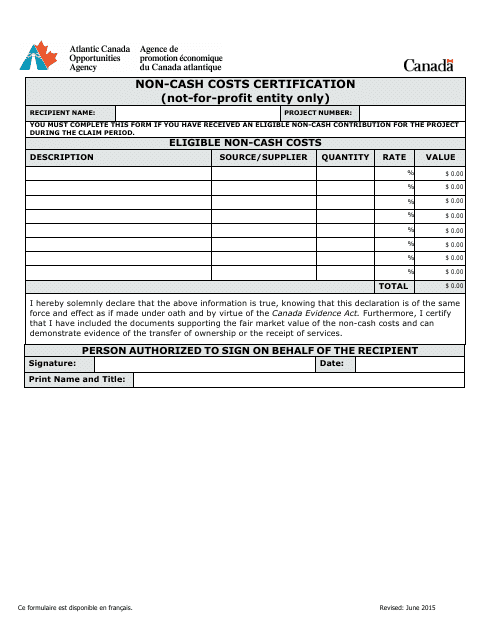

This document is used in Canada by not-for-profit entities to certify their non-cash costs.

This is a fiscal document used by nonprofit organizations to report the main specifics of their operations to tax authorities.

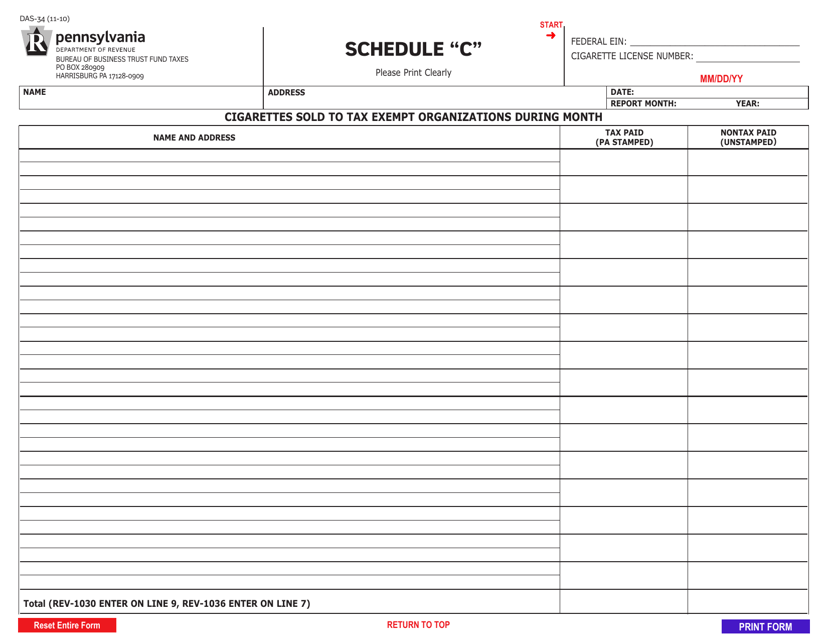

This form is used for reporting the sale of cigarettes to tax-exempt organizations in Pennsylvania during a specific month.

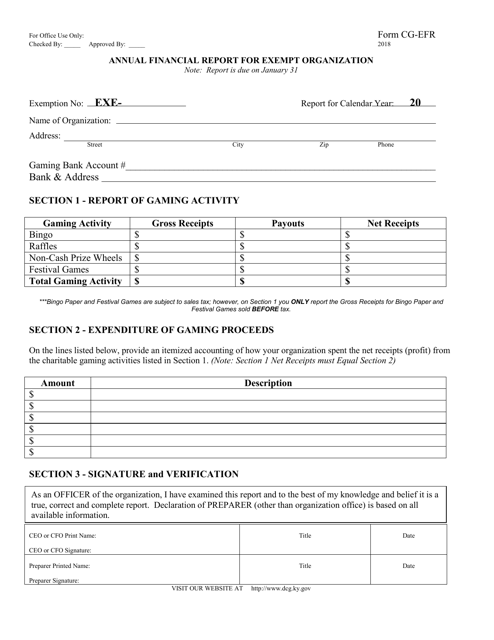

This Form is used for filing the Annual Financial Report for Exempt Organizations in the state of Kentucky.

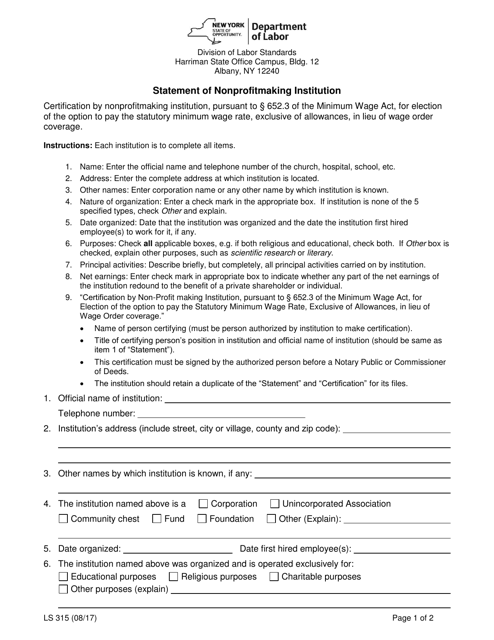

This form is used for reporting the financial status of a nonprofit organization in New York that does not make a profit. It provides information about the institution's revenues, expenses, and assets.