Compliance Assurance Process Templates

Compliance Assurance Process: Ensuring Regulatory Compliance with Ease

Our Compliance Assurance Process (CAP) is designed to help businesses and organizations effortlessly meet regulatory requirements and maintain compliance. Our CAP aims to streamline the compliance process, providing a systematic and efficient approach to fulfill your obligations. With our comprehensive documentation and resources, you can confidently navigate the complex landscape of regulatory compliance.

Alternative Names:

- Simplifying Compliance: The Assurance Process

- Compliant Today, Compliant Always: Ensuring Compliance with our CAP

- CAP: Your Trusted Partner in Compliance Assurance

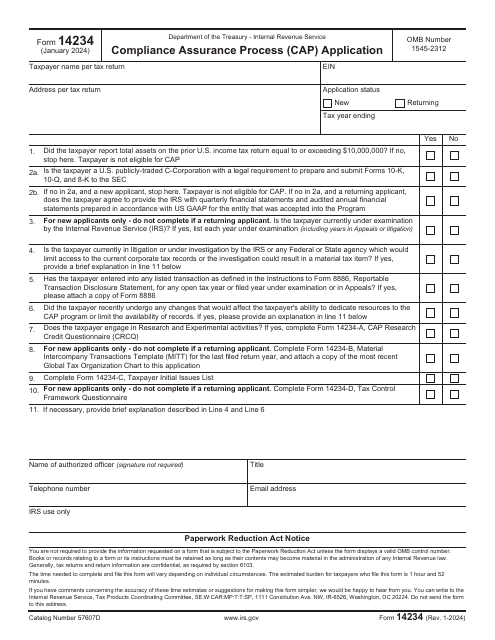

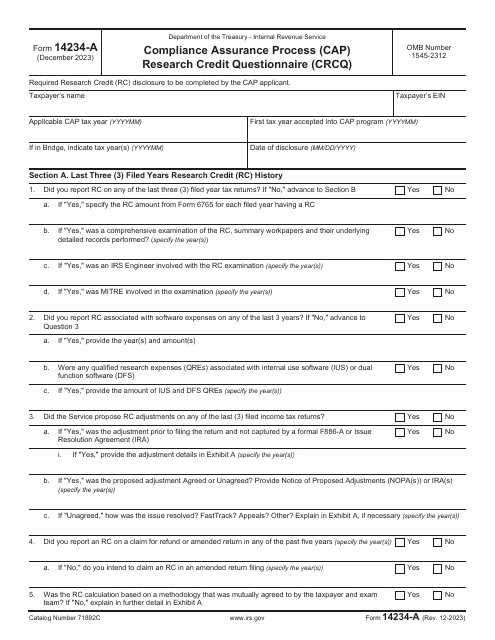

Our CAP documentation includes a range of resources to guide you through the compliance journey. From the IRS Form 14234-A Compliance Assurance Process (CAP) Research Credit Questionnaire (Crcq) to the IRS Form 14234 Compliance Assurance Process (CAP) Application, we have you covered. These documents are specifically designed to facilitate the compliance assessment, research credit evaluation, and the application process.

Navigating regulatory compliance can be a challenging task, but with our Compliance Assurance Process, it becomes more manageable. Our CAP documentation is constantly updated to reflect the latest regulatory changes and industry best practices. We strive to keep you informed, confident, and compliant.

Choose our Compliance Assurance Process and experience the peace of mind that comes with streamlined compliance. Take advantage of our comprehensive documentation, expert guidance, and reliable resources to stay ahead in today's complex regulatory landscape.