Tax Correction Templates

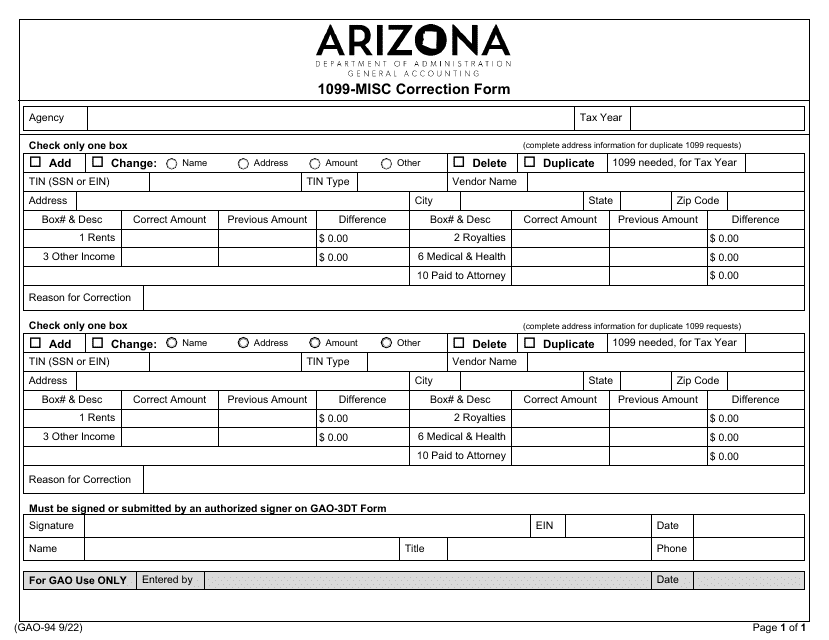

Are you looking to make corrections to your tax return? Look no further. We have a comprehensive collection of tax correction forms and information to help you rectify any errors on your tax documents. Whether you need to amend your individual income tax return, correct local use tax information, or report a school district code correction, we have the resources you need.

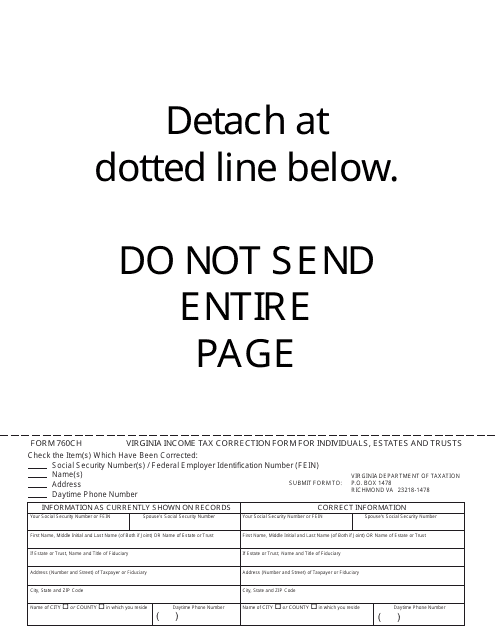

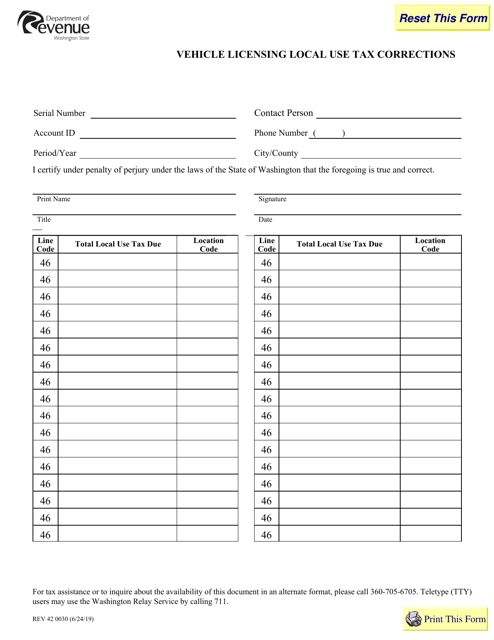

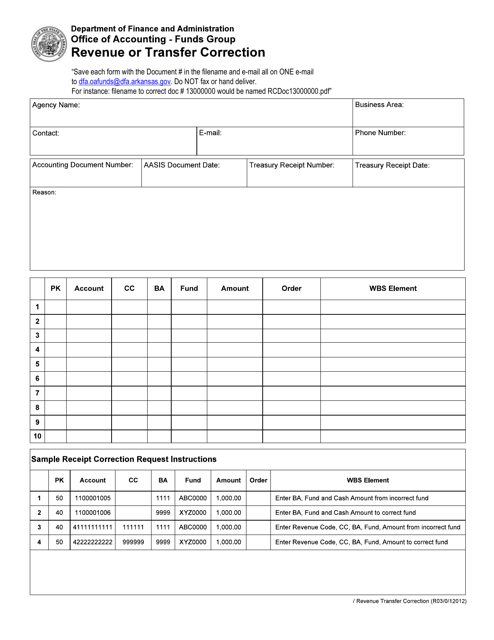

Our tax correction forms are designed to simplify the process of making corrections to your tax returns. With these forms, you can easily provide the necessary information to update your tax records accurately. Our collection includes forms from various states, such as the Form 760CH for Virginia, Form REV42 0030 for Washington, and the Revenue or Transfer Correction form for Arkansas.

In addition to providing the necessary forms, we also offer guidance on how to complete them correctly. Our step-by-step instructions will ensure that you navigate the correction process with ease and confidence. We understand that tax corrections can be complex, but our resources aim to simplify the process for you.

Don't let errors on your tax documents cause unnecessary stress. Take advantage of our tax correction forms and resources to ensure that your tax records are accurate and up-to-date. Trust us to provide you with the tools you need to correct any mistakes and maintain compliance with tax regulations.

So, whether you refer to it as tax correction, tax correction forms, or tax corrections, our dedicated collection of resources is here to assist you. With our guidance, you can rectify any errors and ensure that your tax documents are in order. Start making your tax corrections today!

Documents:

8

This form is used for correcting Virginia income tax filings for individuals, estates, and trusts in the state of Virginia. It is used to amend any errors or omissions made on previous tax returns.

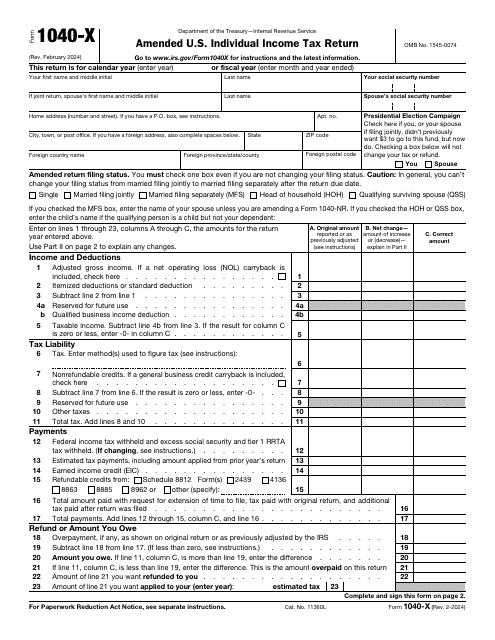

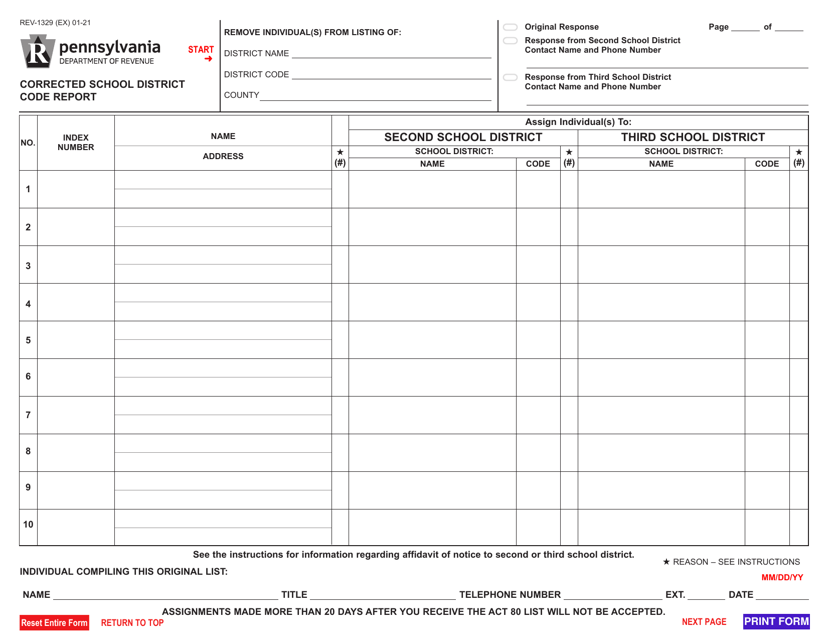

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

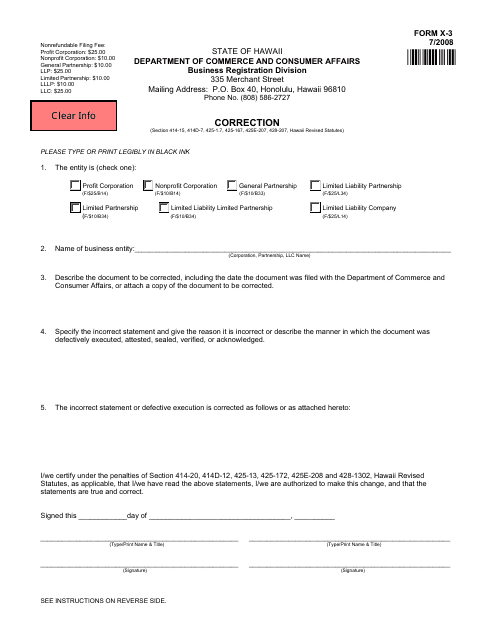

This Form is used for correcting errors on a previously filed Hawaii state tax return.

This Form is used for correcting local use tax information on vehicle licensing in Washington state.

This form is used for correcting revenue or transfers in the state of Arkansas.

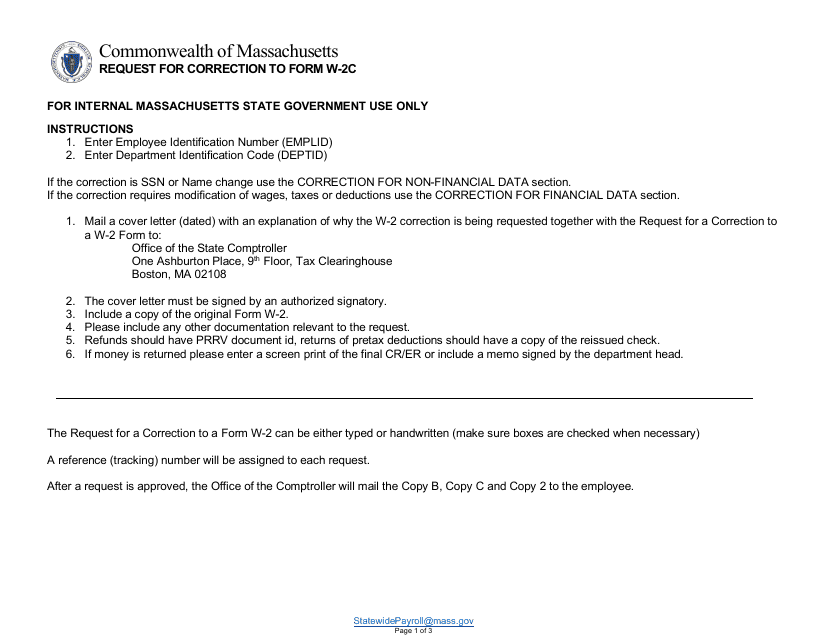

This form is used to request a correction to a Form W-2c in Massachusetts.