Wage Execution Templates

Wage Execution: Ensuring Fair Compensation for Employees

When it comes to fair and equitable compensation, wage execution plays a crucial role in upholding employees' rights. Also known as executive wages or the wage execution form, this group of documents aims to protect workers by providing a legal framework for collecting unpaid wages or enforcing court-ordered wage payments.

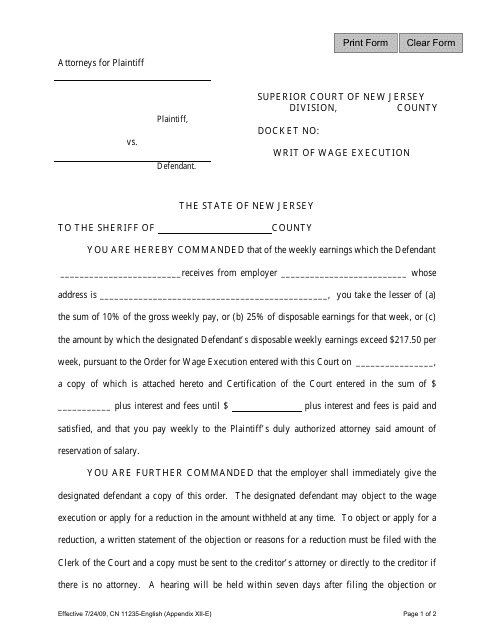

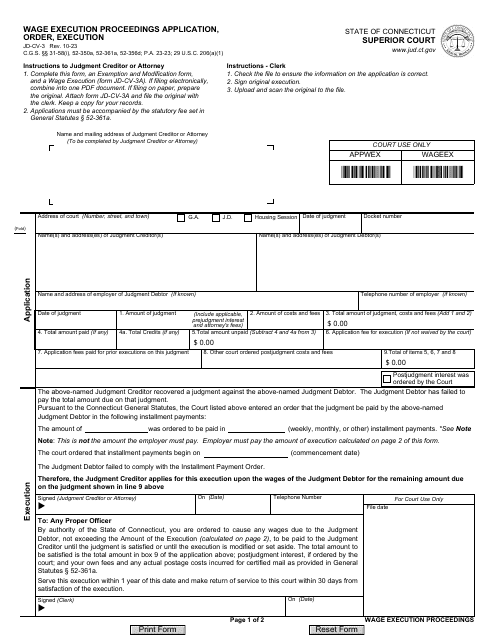

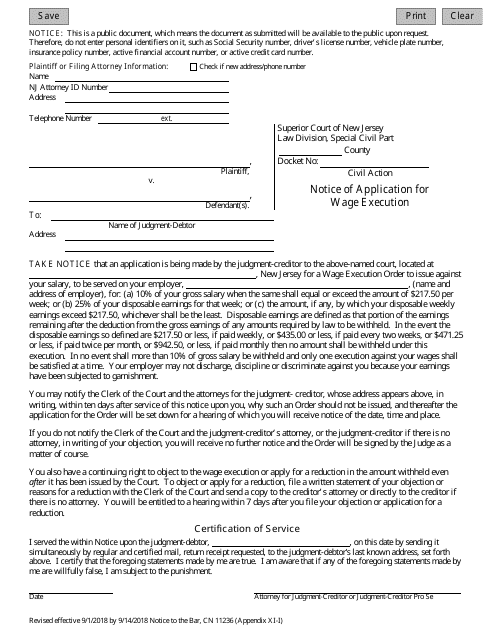

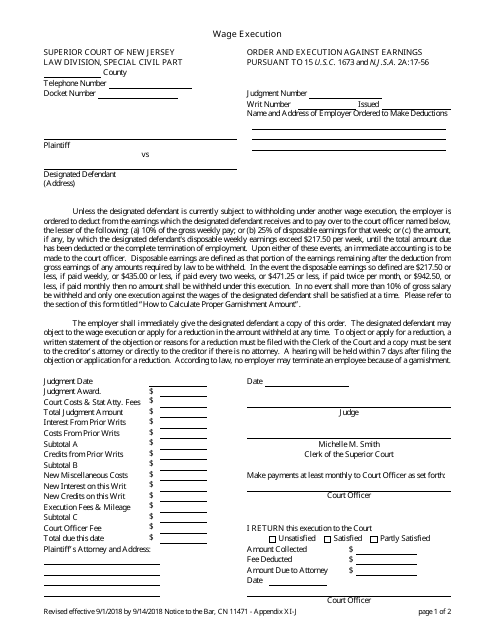

Employers are legally obligated to pay their employees in a timely manner, and wage execution acts as a safeguard to ensure compliance. Whether it is the Form 11235 Appendix XII-E Writ of Wage Execution in New Jersey or the Form JD-CV-3 Wage Execution Proceedings Application, Order, Execution in Connecticut, these documents serve as valuable tools in the pursuit of justice for workers.

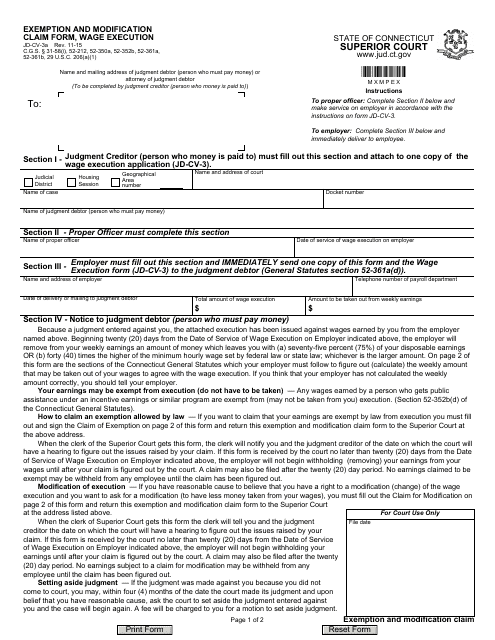

In cases of wage disputes or nonpayment, employees have the right to file for wage execution. This legal action empowers individuals to seek the wages owed to them through a court-issued order, often in the form of garnishing the employer's assets or wages. The wage execution process may include additional forms like the Form JD-CV-3A Exemption and Modification Claim Form, which allows employees to request exemptions or modifications based on their unique circumstances.

Wage execution not only protects individual workers but also promotes fair labor practices within the broader employment landscape. By holding employers accountable for any wage-related violations, this system ensures that employees receive the compensation they deserve while discouraging unscrupulous employers from exploiting their workforce.

If you believe you are owed wages, it is essential to familiarize yourself with the wage execution process and the specific forms and procedures in your jurisdiction. These documents provide the necessary structure and legal foundation to seek justice and reclaim what is rightfully yours.

Documents:

7

This form is used for issuing a writ of wage execution in New Jersey. It allows a creditor to collect unpaid debts by directing the debtor's employer to withhold a portion of their wages.

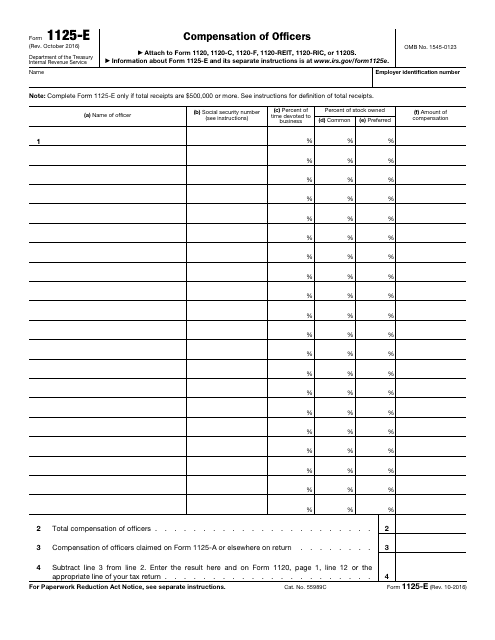

This IRS form is used to provide a detailed report in regards to the deduction for compensation of officers when an entity has $500,000 or more in total receipts.

This form is used for claiming exemption and requesting modification for wage execution in Connecticut.

This Form is used for notifying the court about an application for wage execution in the state of New Jersey.

This form is used for wage execution in the state of New Jersey. It is an appendix to form 11471 and is used to enforce payment of outstanding debts by deducting wages.