Limited Liability Partnership Templates

A limited liability partnership (LLP) is a popular business structure that combines the limited liability protection of a corporation with the flexibility and tax advantages of a partnership. LLPs are often the ideal choice for professional service firms such as law firms, accounting firms, and consulting companies.

With a limited liability partnership, the partners are not personally liable for the debts and liabilities of the business. This means that their personal assets are protected in the event of a lawsuit or financial hardship. This level of protection is a major advantage over general partnerships or sole proprietorships.

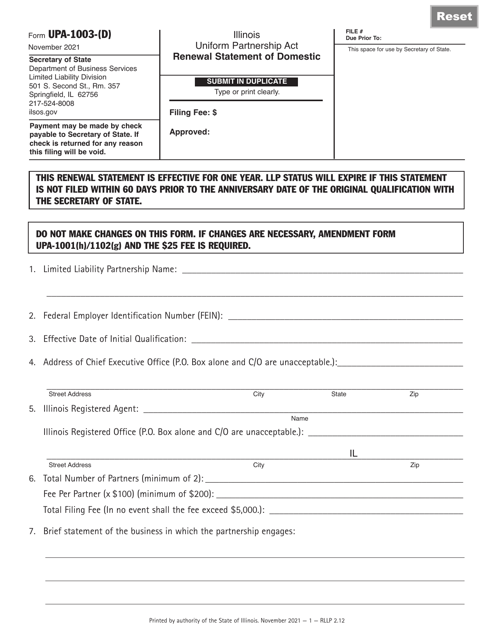

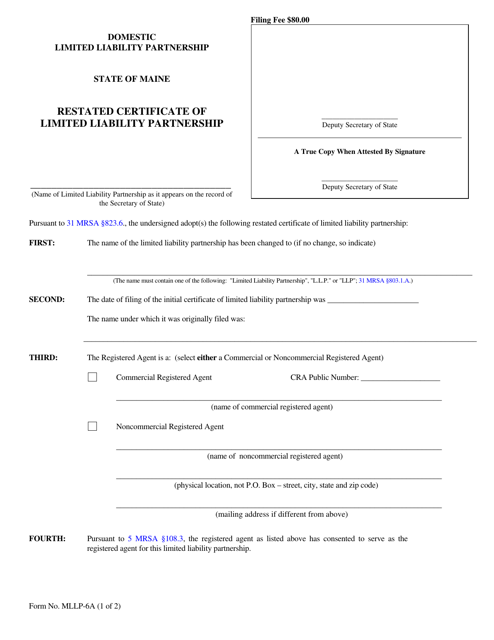

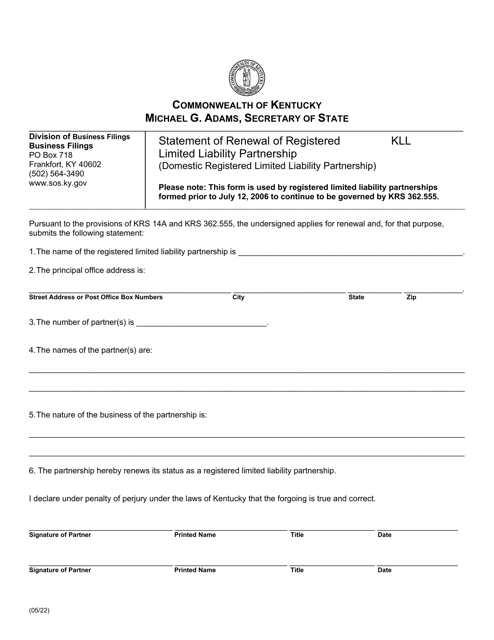

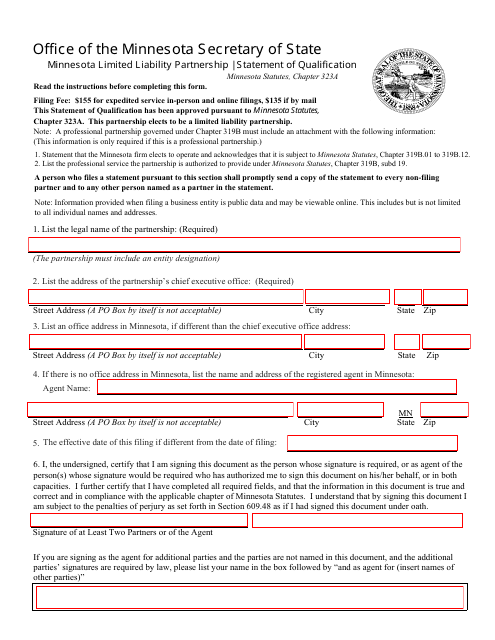

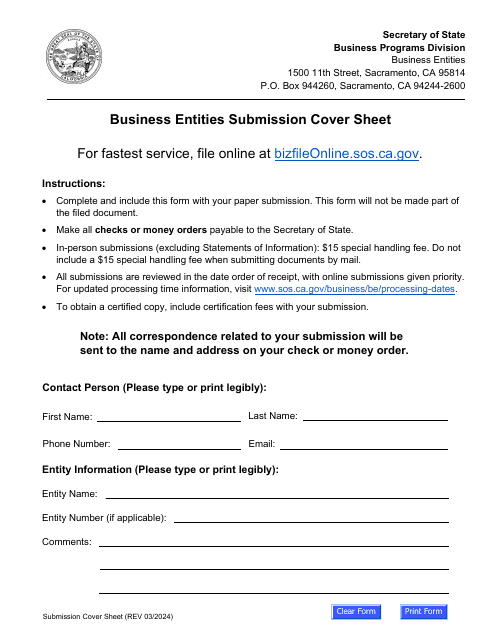

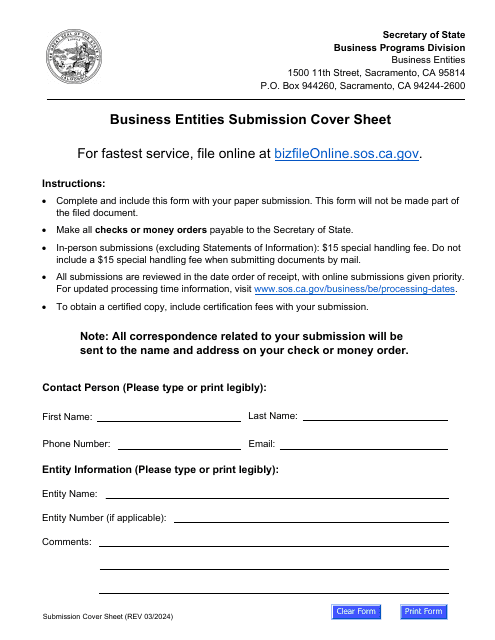

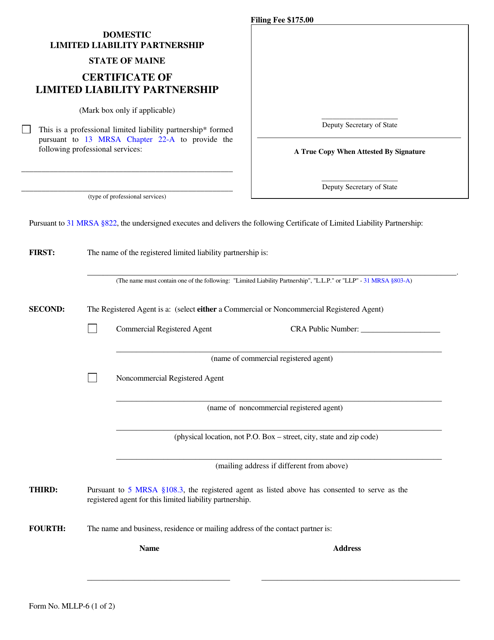

Setting up an LLP typically involves filing the necessary documents with the state government, such as a Certificate of Formation or a Statement of Organization. These documents establish the existence of the partnership and provide key information about the business, such as the names of the partners and the business address.

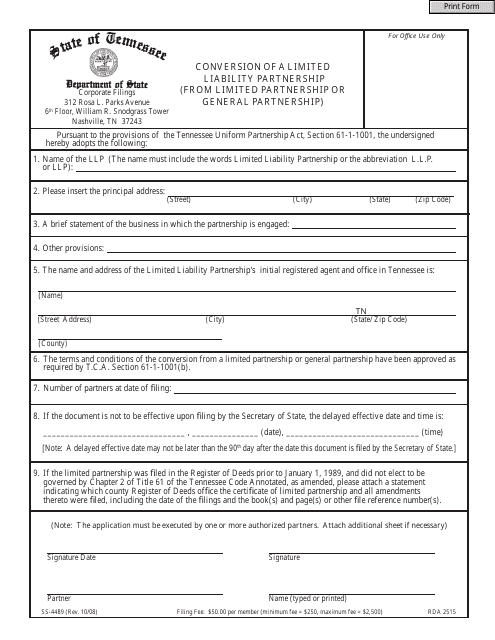

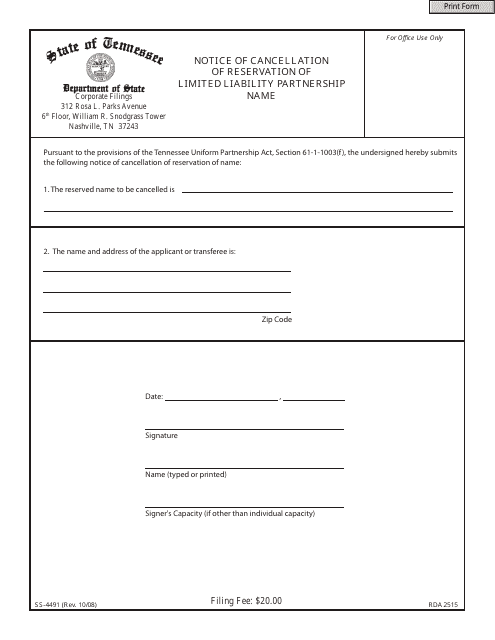

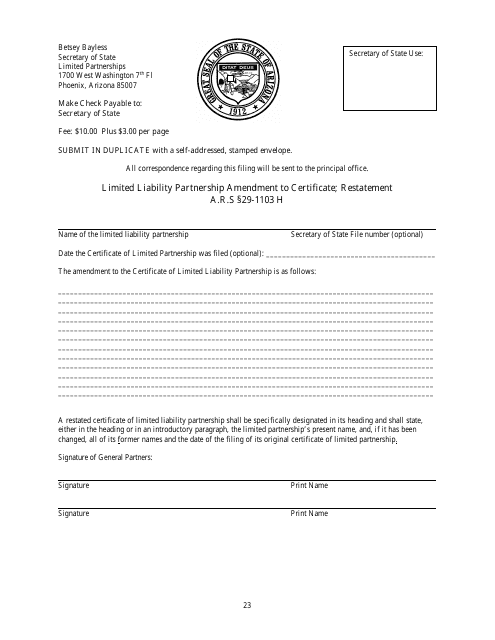

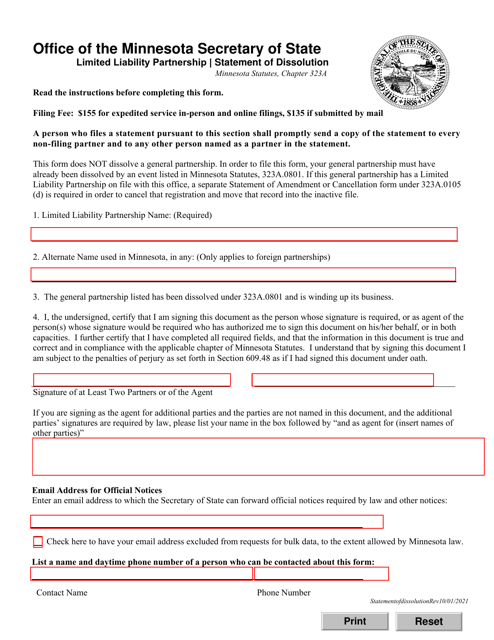

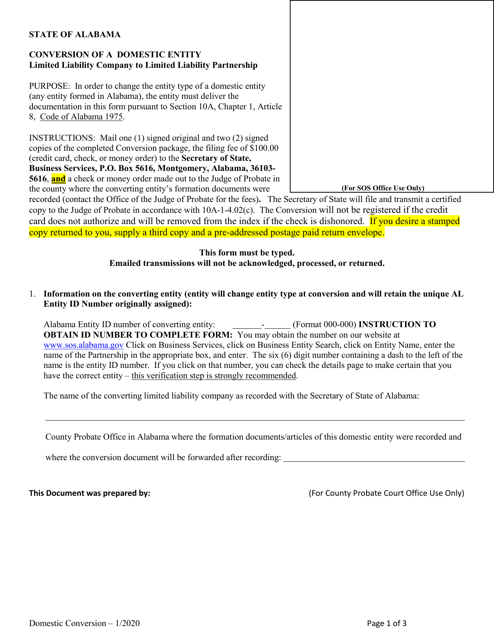

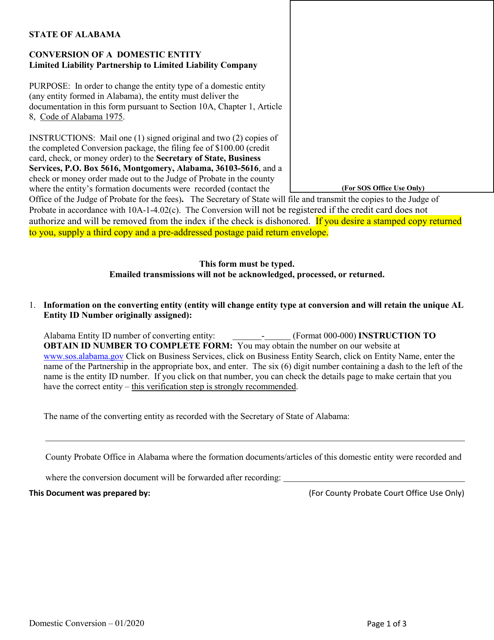

LLPs often need to file additional documents throughout their existence, such as amendments, cancellations, or restatements. For example, if there are changes to the partners or business address, an amendment may need to be filed to update the LLP's records. Similarly, if the LLP decides to dissolve or cancel its registration, a statement of cancellation would need to be submitted.

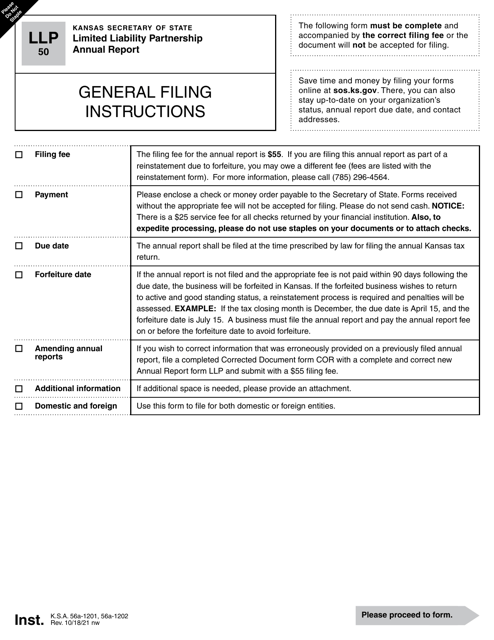

Each state may have its own specific requirements and forms for LLP filings. Some common alternate names for LLP-related documents include LLP forms or limited liability partnership forms. Regardless of the name, it is important to ensure that the necessary paperwork is filed accurately and in a timely manner to maintain compliance with state regulations.

If you are thinking about starting a limited liability partnership or need assistance with LLP filings, consult with a qualified business attorney or use an online legal services provider to ensure that you have the proper documentation and guidance throughout the process. By taking the necessary steps to establish and maintain your limited liability partnership, you can enjoy the benefits of limited liability protection and the flexibility to manage your business effectively.

Documents:

249

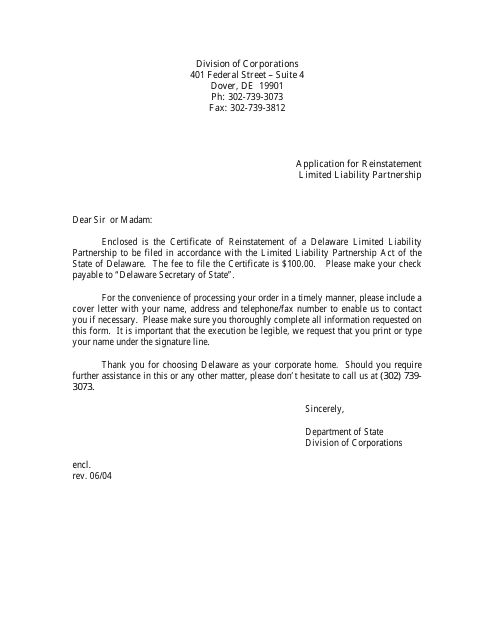

This document is used for applying for reinstatement of a limited liability partnership in Delaware.

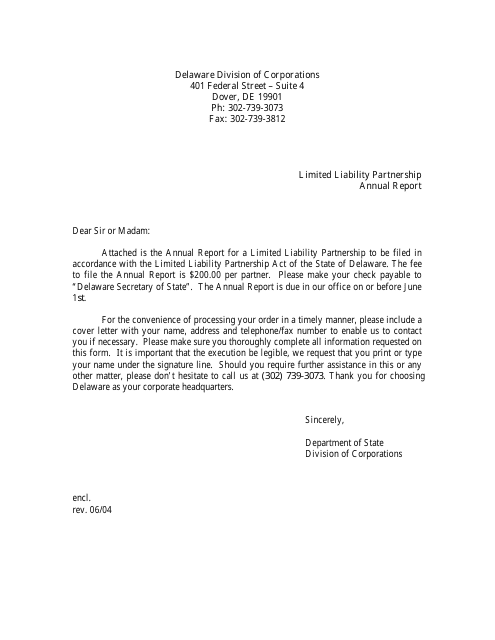

This document is used for filing the annual report for a limited liability partnership in the state of Delaware.

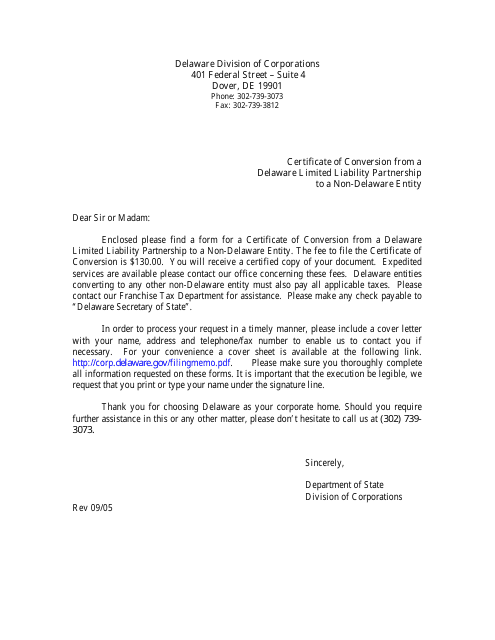

This document is used for converting a Delaware limited liability partnership to a non-Delaware entity.

This form is used for converting a limited liability partnership in Tennessee from either a limited partnership or a general partnership.

Form SS-4491 Notice of Cancellation of Reservation of Limited Liability Partnership Name - Tennessee

This form is used for notifying the cancellation of a reservation of a limited liability partnership name in Tennessee.

This form is used for making amendments or restatements to the Certificate of Limited Liability Partnership in the state of Arizona.

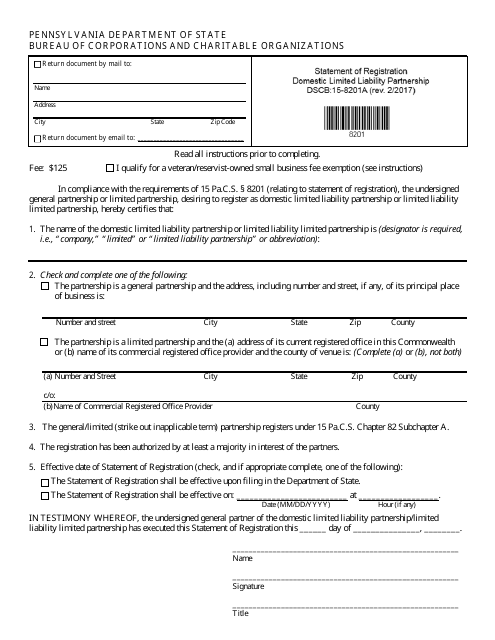

This form is used for registering a domestic registered limited liability partnership in Pennsylvania.

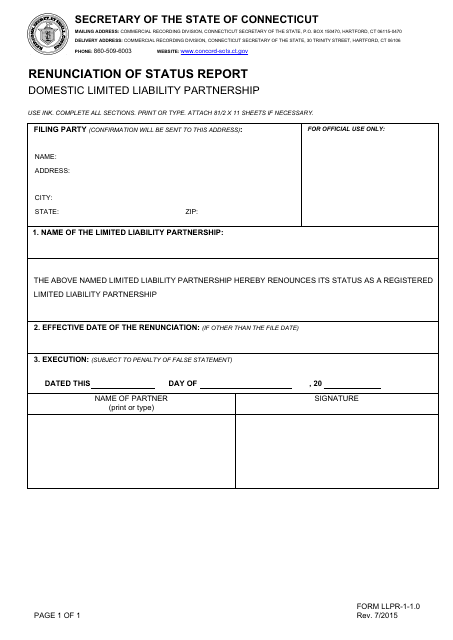

Form LLPR-1-1.0 Renunciation of Status Report - Domestic Limited Liability Partnership - Connecticut

This form is used for renouncing the status report of a domestic limited liability partnership in Connecticut.

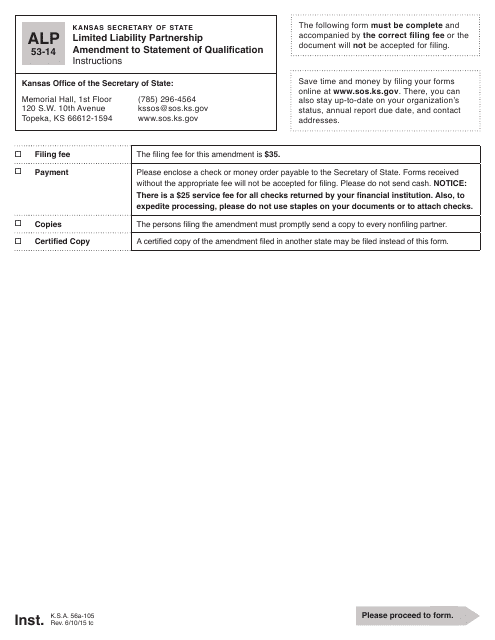

This form is used for making amendments to the statement of qualification of a limited liability partnership in the state of Kansas.

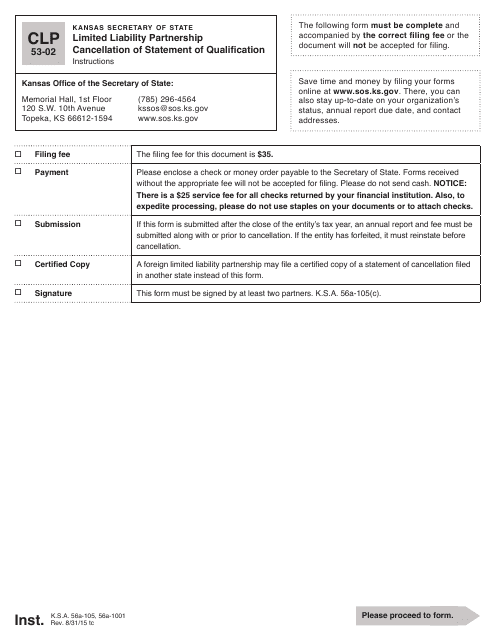

This form is used for canceling the statement of qualification for a limited liability partnership in the state of Kansas.

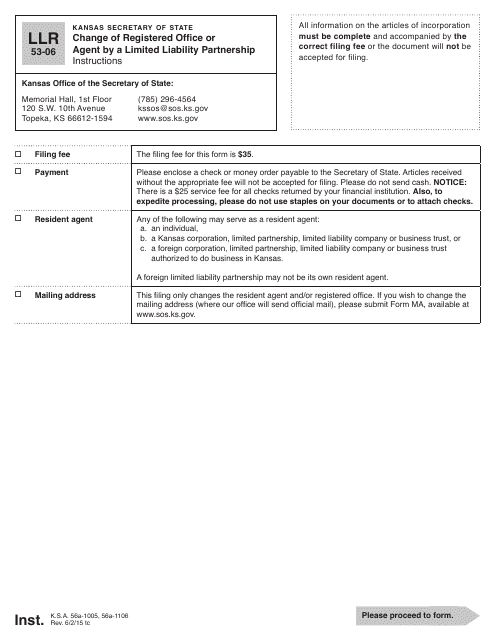

This form is used for changing the registered office or agent of a Limited Liability Partnership (LLP) in the state of Kansas.

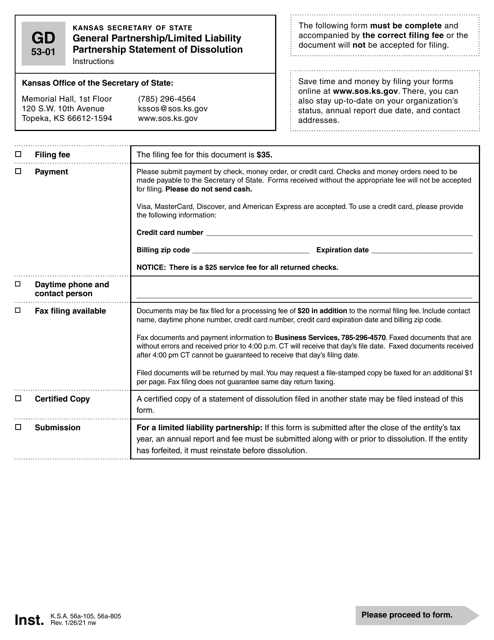

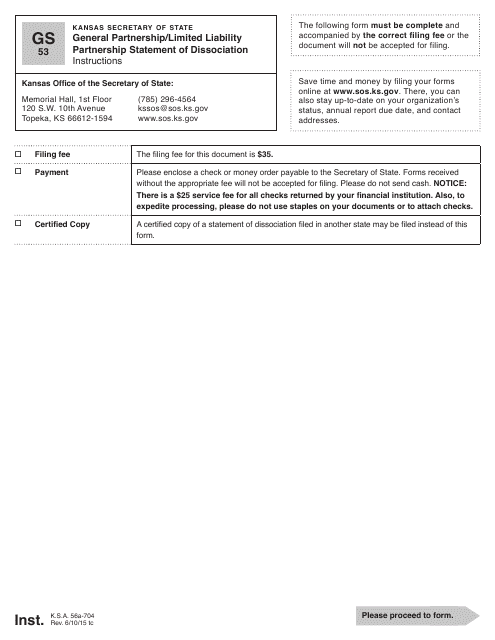

This form is used for submitting a statement of dissociation for a general partnership or limited liability partnership in the state of Kansas.

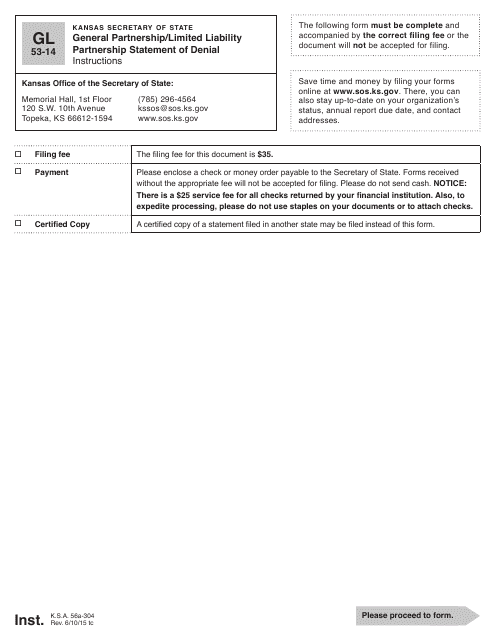

This form is used for making a statement of denial for a general partnership or limited liability partnership in Kansas.

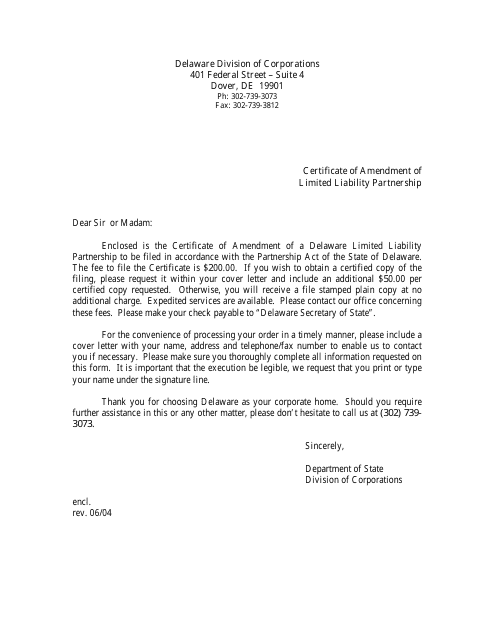

This document is used for making changes to the business structure and details of a Limited Liability Partnership (LLP) in the state of Delaware. It allows the LLP to amend its original formation documents and update information such as the name, address, or membership of the partnership.

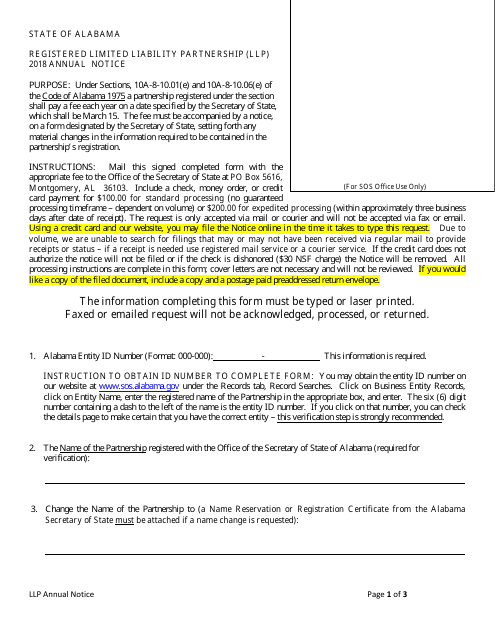

This document is used to file the annual notice for a Registered Limited Liability Partnership (LLP) in the state of Alabama.

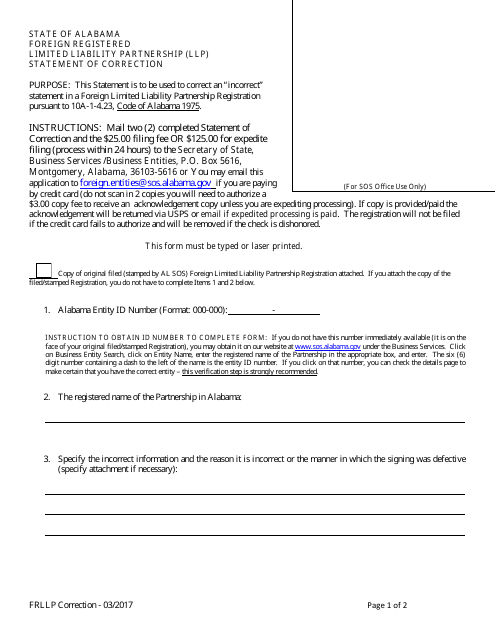

This document is for making corrections to the information of a foreign registered Limited Liability Partnership (LLP) in Alabama.

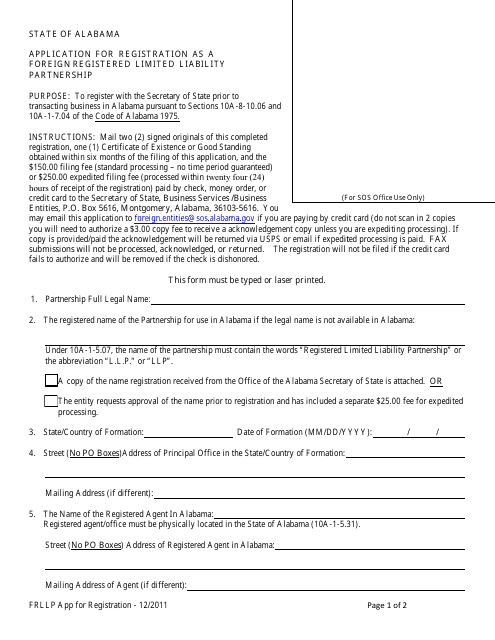

This document is used for individuals or companies wishing to register as a foreign registered limited liability partnership in the state of Alabama.

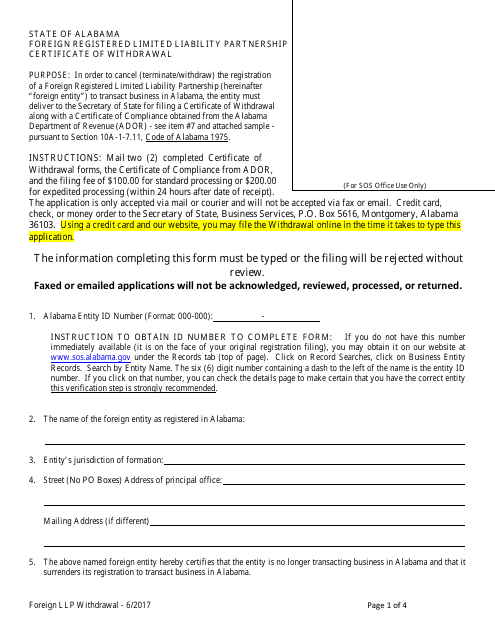

This document is used for withdrawing a foreign registered limited liability partnership in the state of Alabama. It provides certification for the withdrawal process.

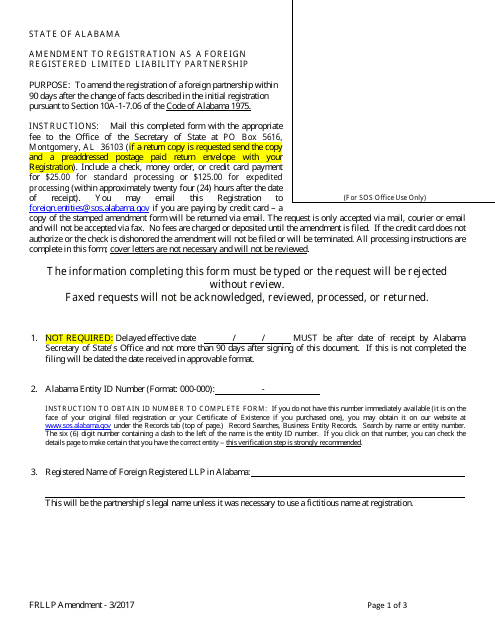

This document is used for making changes to the registration of a foreign limited liability partnership in Alabama.

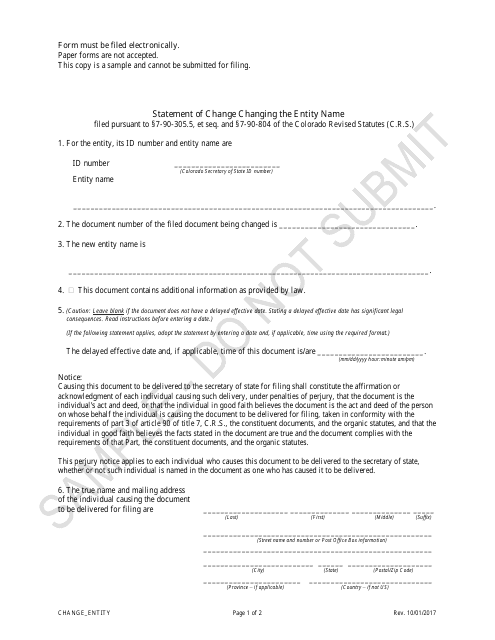

This document is for changing the name of a Limited Liability Partnership or Limited Liability Limited Partnership in the state of Colorado. It provides a sample template for submitting the required Statement of Change.

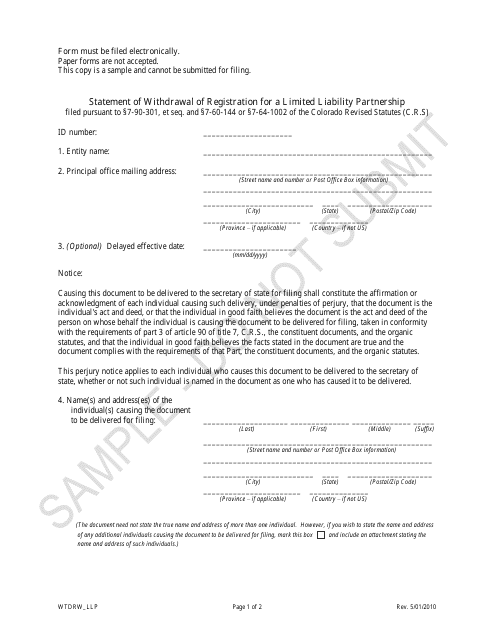

This document is used to officially withdraw the registration of a Limited Liability Partnership in the state of Colorado.

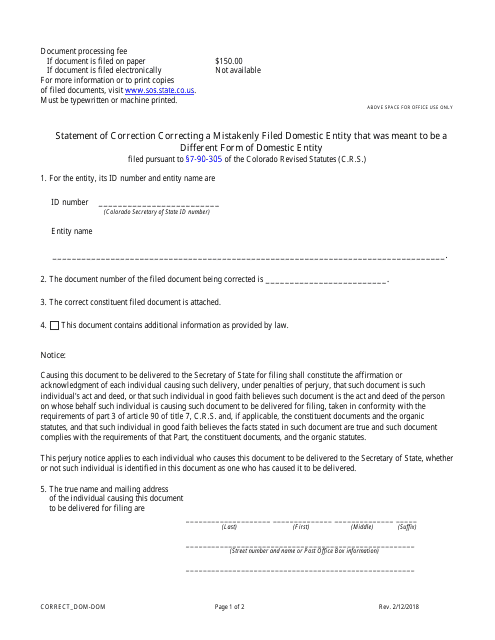

This document is used for correcting a mistakenly filed domestic entity in Colorado that was meant to be a limited liability partnership.

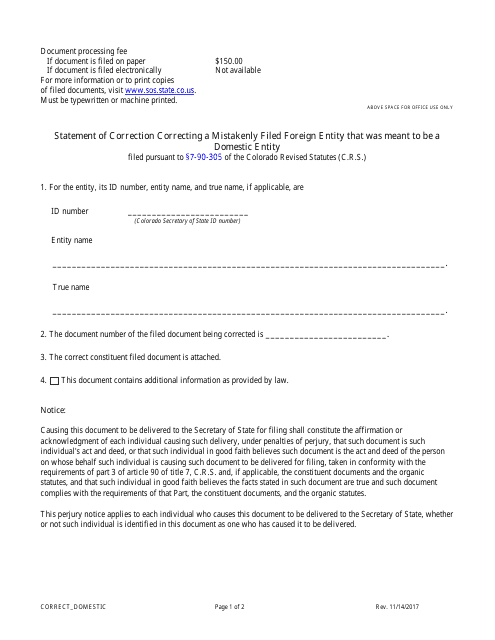

This Form is used for correcting a mistakenly filed foreign entity that was meant to be a domestic entity for Limited Liability Partnerships in Colorado.

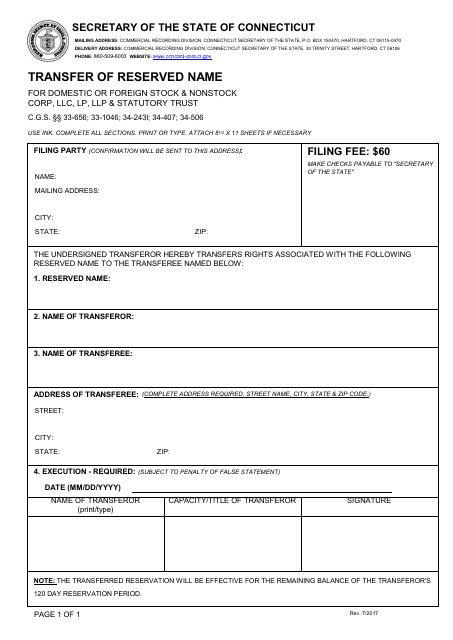

This form is used for transferring the reserved name of a domestic or foreign stock or nonstock corporation, LLC, LP, LLP, or statutory trust in the state of Connecticut.

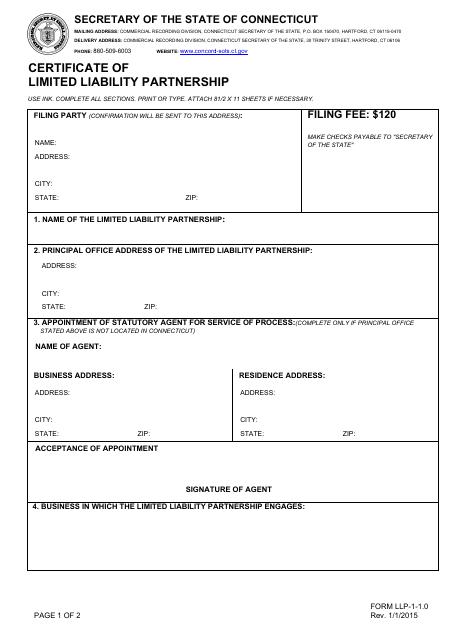

This document is used for filing a Certificate of Limited Liability Partnership (LLP) in the state of Connecticut.

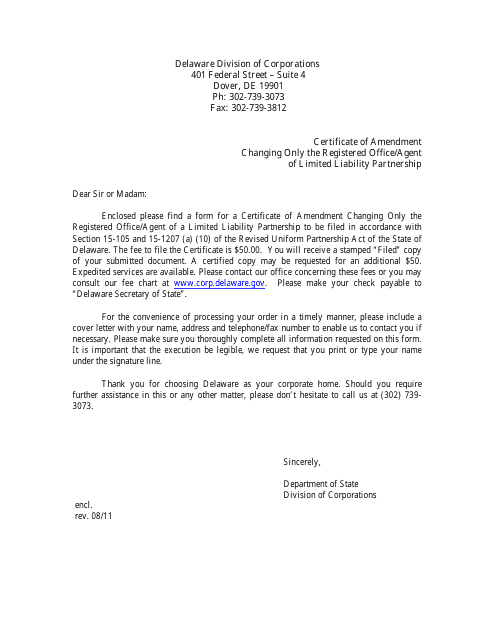

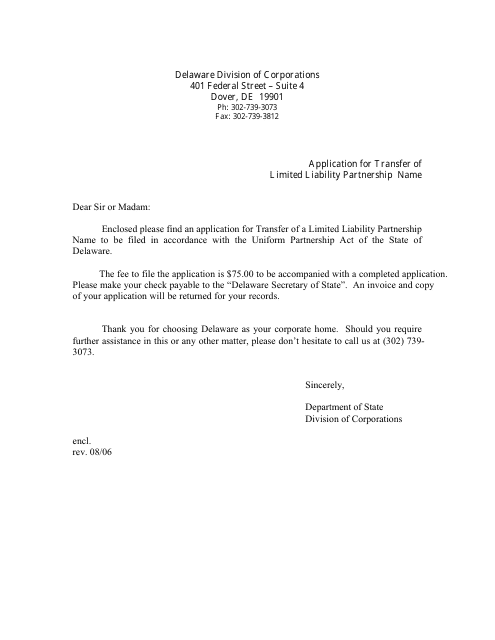

This document is used to amend the registered office or agent of a Limited Liability Partnership (LLP) in the state of Delaware.

This document is used for transferring the name of a Limited Liability Partnership in the state of Delaware.

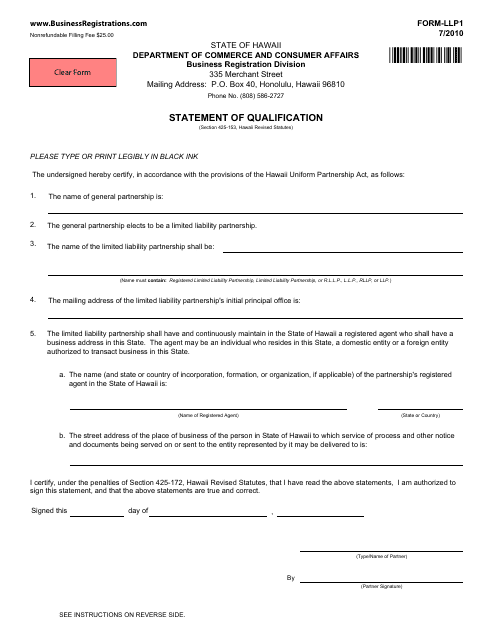

This Form is used for filing a Statement of Qualification for a Limited Liability Partnership (LLP) in the state of Hawaii.