Severance Tax Templates

Severance Tax Documents and Forms

Looking for a comprehensive collection of documents and forms related to severance tax? Look no further! Our severance tax documents and forms include a wide range of resources that will help you understand and comply with severance tax requirements in various jurisdictions.

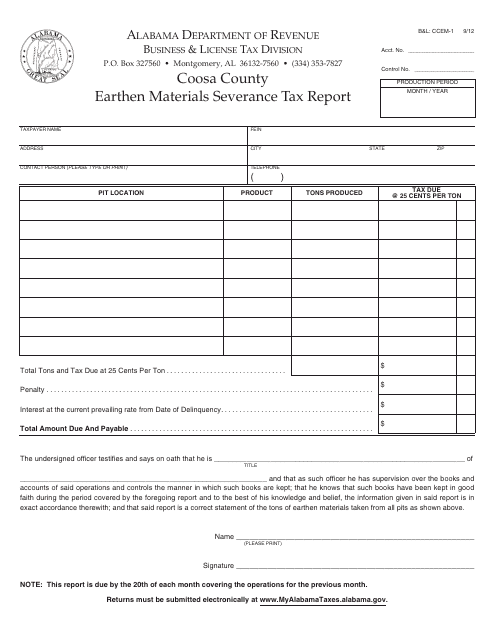

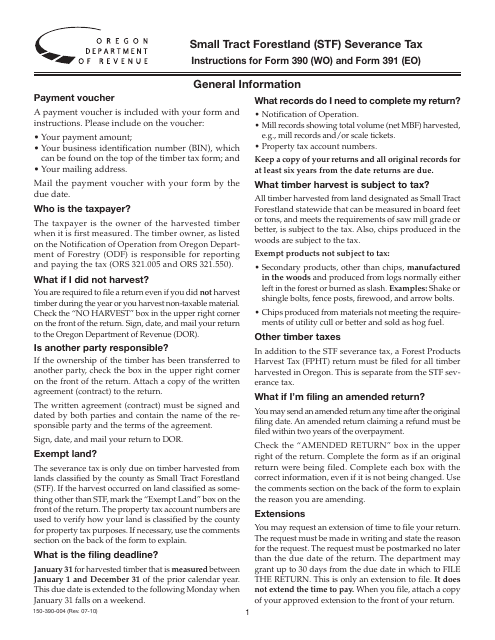

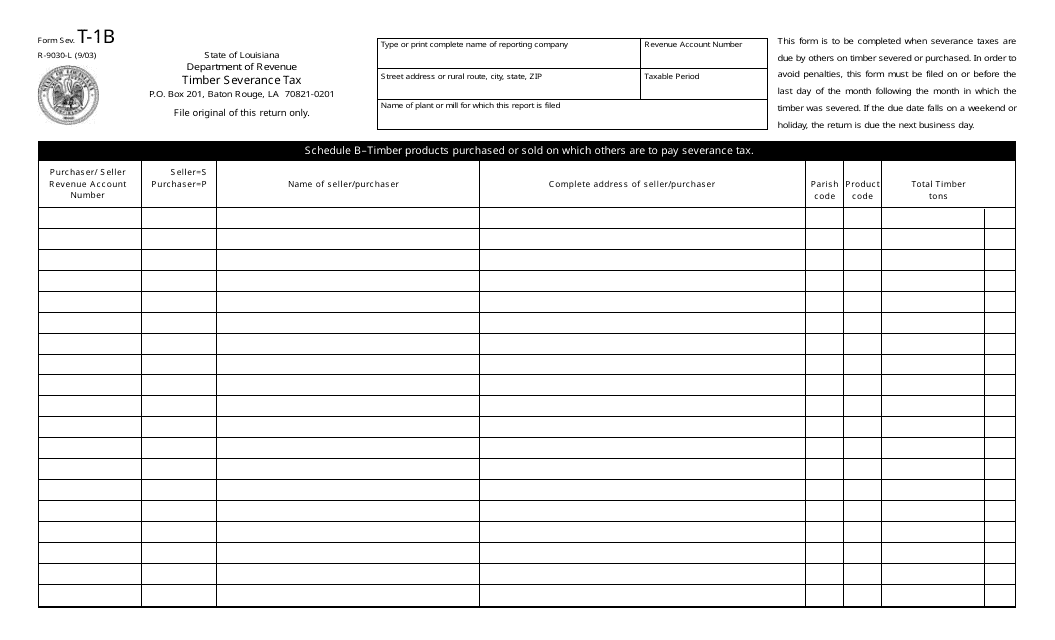

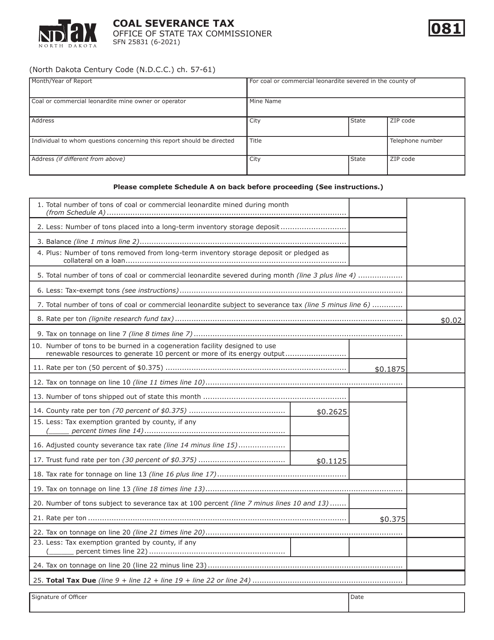

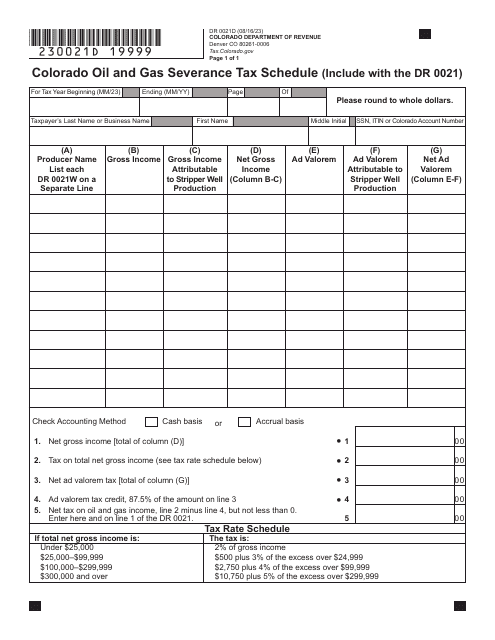

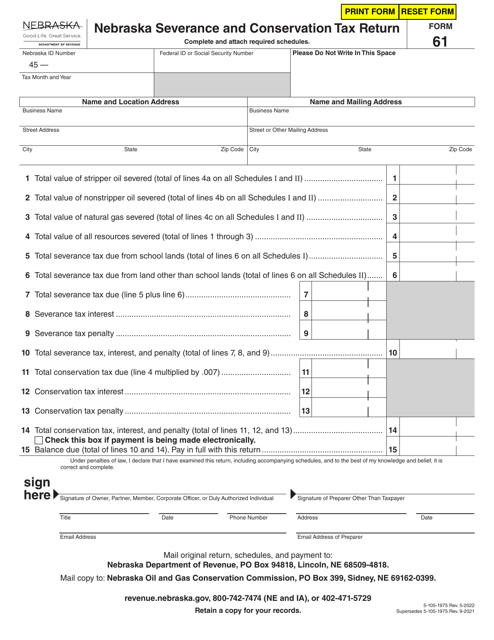

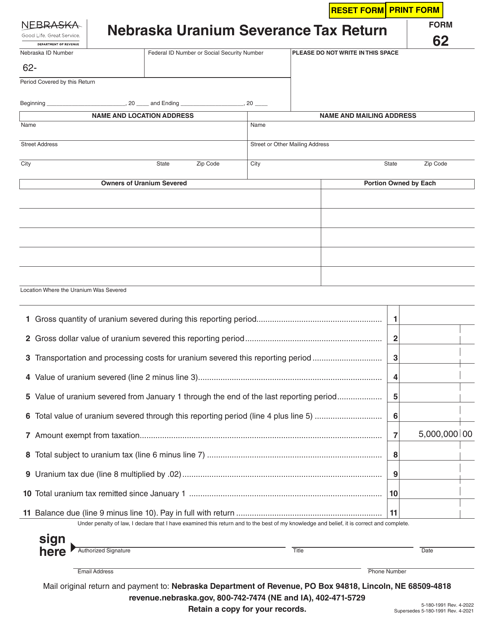

Also known as the severance tax form collection, this resource provides you with easy access to the necessary documents needed to complete and submit severance tax reports accurately. Our collection includes forms such as Form B&L: CCEM-1 Earthen Materials Severance Tax Report for Coosa County, Alabama, Form R-9030-L (SEV. T-1B) Timber Severance Tax for Louisiana, Form DR0021X Amended Colorado Oil and Gas Severance Tax Return, and Form DR0021D Colorado Oil and Gas Severance Tax Schedule.

Whether you are an individual or a business entity involved in the extraction of natural resources, these documents are essential for reporting and paying the appropriate severance tax to the relevant authorities. By using our collection, you can ensure compliance with state-specific regulations and avoid penalties or legal complications.

Our severance tax documents are designed to be user-friendly, providing clear instructions and guidelines for accurate completion. We understand the importance of accuracy and timeliness when it comes to filing these reports, and our collection aims to simplify the process and save you valuable time.

So, if you need access to a comprehensive collection of severance tax documents and forms, look no further! Our resource is your one-stop-shop for all your severance tax reporting needs. Start exploring our collection today and streamline your reporting process.

Documents:

79

This form is used for reporting the severance tax on earthen materials in Coosa County, Alabama.

This form is used for reporting and paying the small tract forestland severance tax in Oregon. It provides instructions on how to fill out forms 390 (WO) and 391 (EO) for reporting the tax on forest product removals from small tracts of forestland.

This form is used for calculating and paying the timber severance tax in the state of Louisiana.

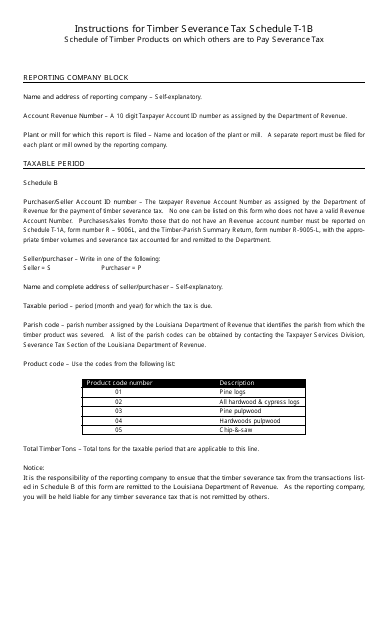

This Form is used for reporting the schedule of timber products on which others are liable to pay severance tax in the state of Louisiana.

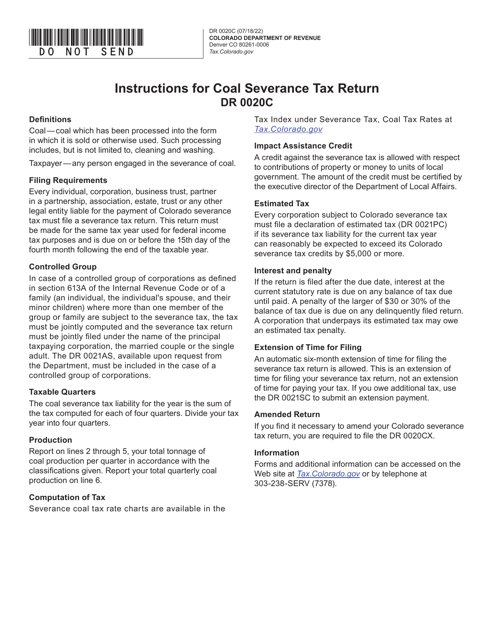

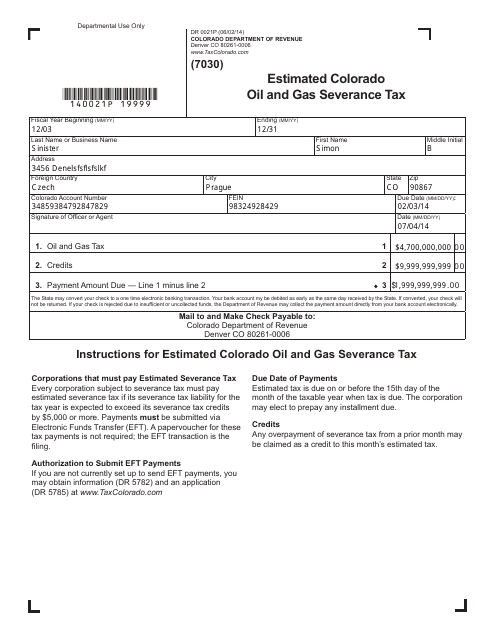

This Form is used for estimating the Colorado Oil and Gas Severance Tax for the state of Colorado.

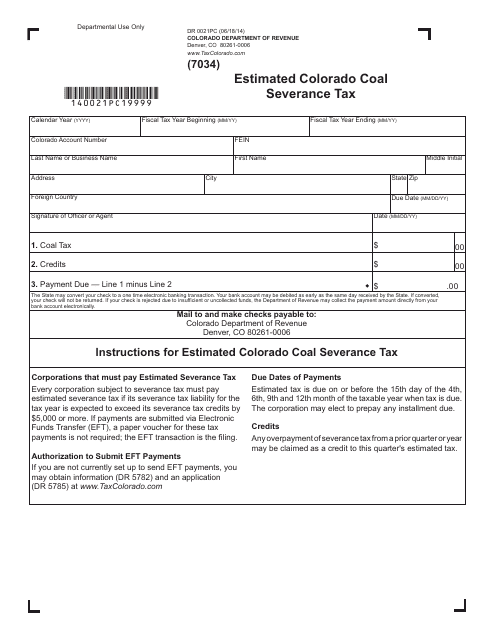

This form is used for reporting and estimating the amount of coal severance tax owed by coal producers in the state of Colorado.

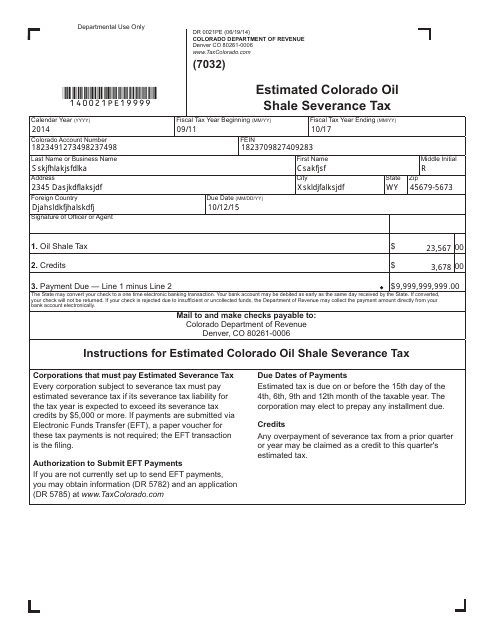

This form is used for estimating the severance tax on oil shale in the state of Colorado.

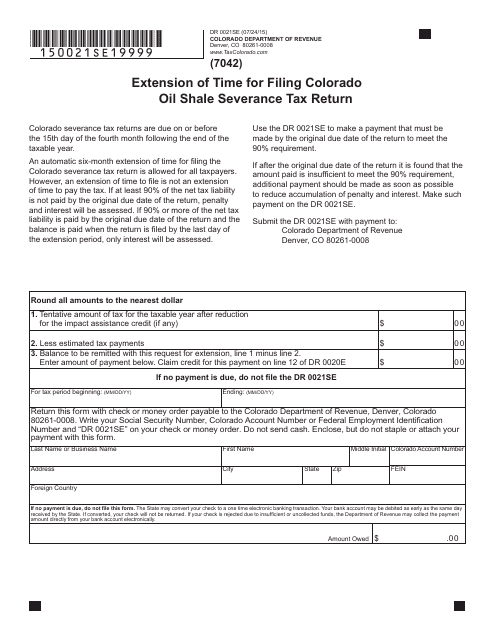

This form is used for requesting an extension of time to file the Colorado Oil Shale Severance Tax Return.

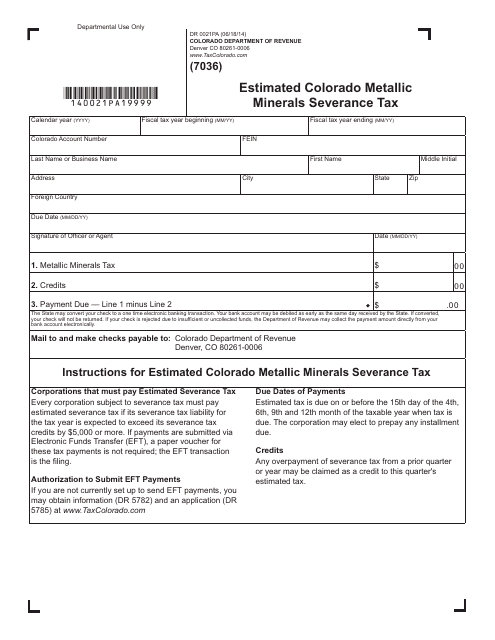

This form is used for estimating the severance tax on metallic minerals in Colorado.

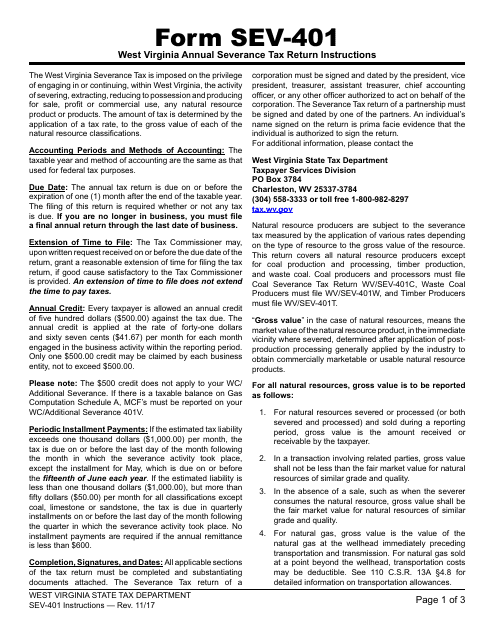

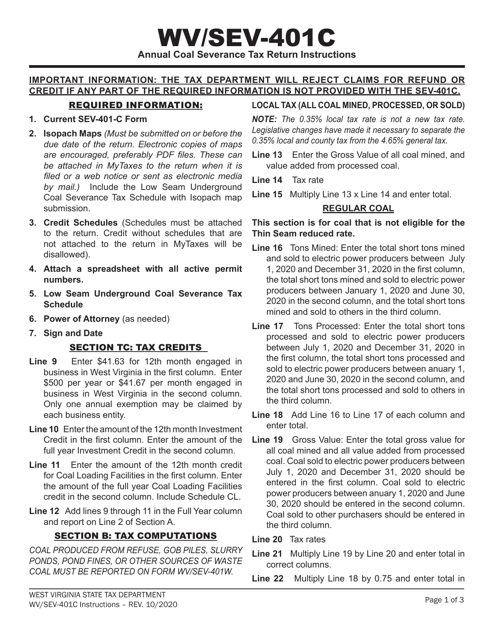

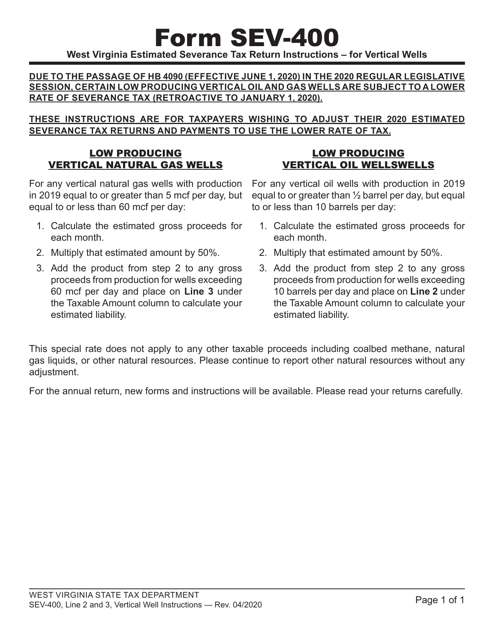

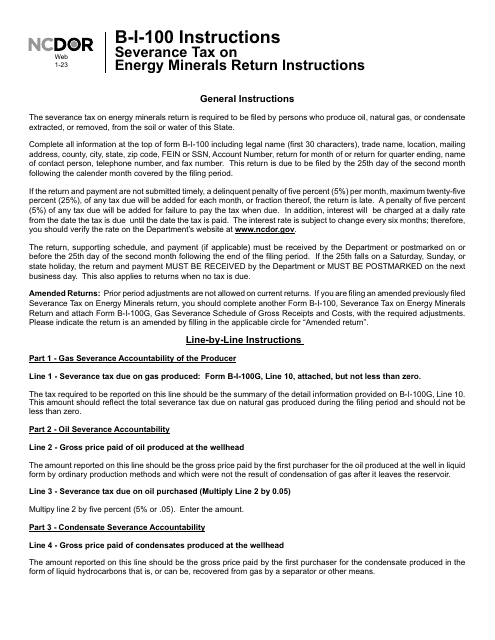

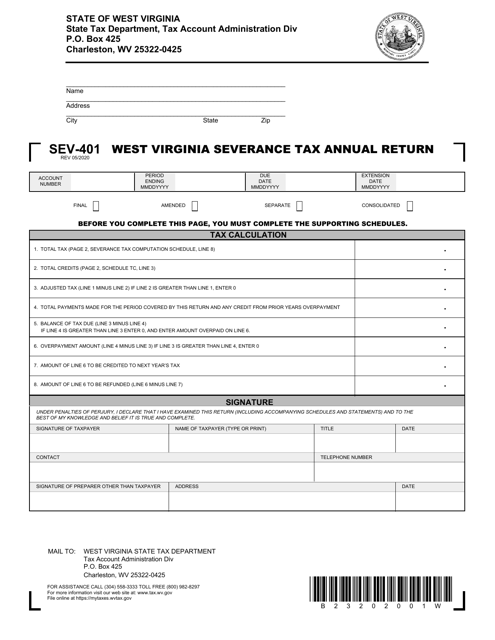

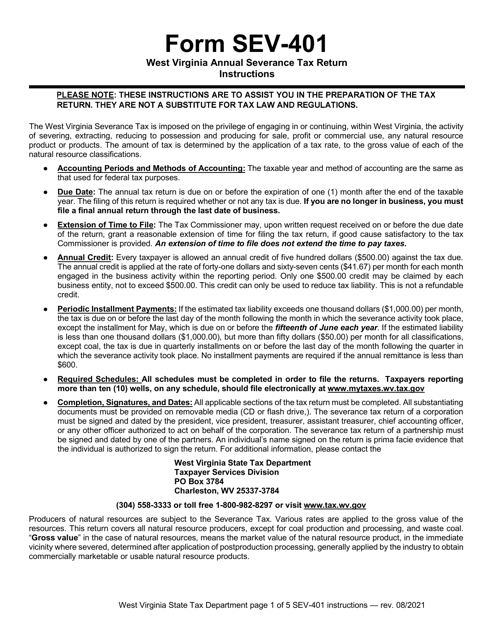

This document is used for filing the West Virginia Annual Severance Tax Return. It provides instructions on how to fill out the form correctly.

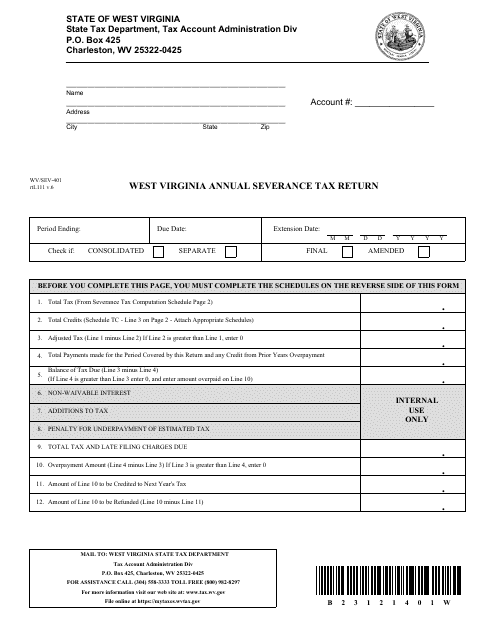

This form is used for filing the annual severance tax return in West Virginia.

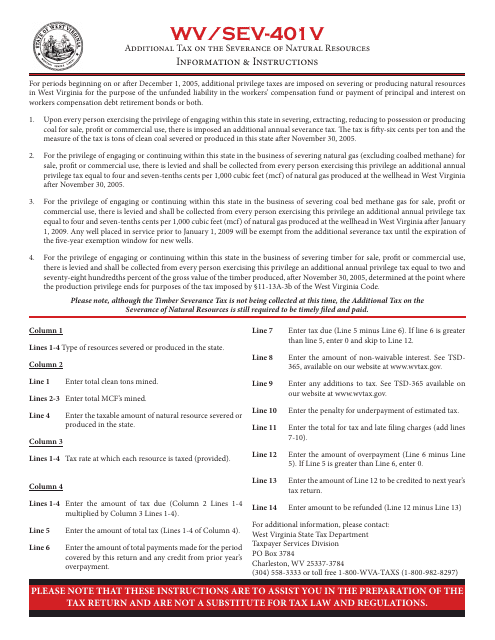

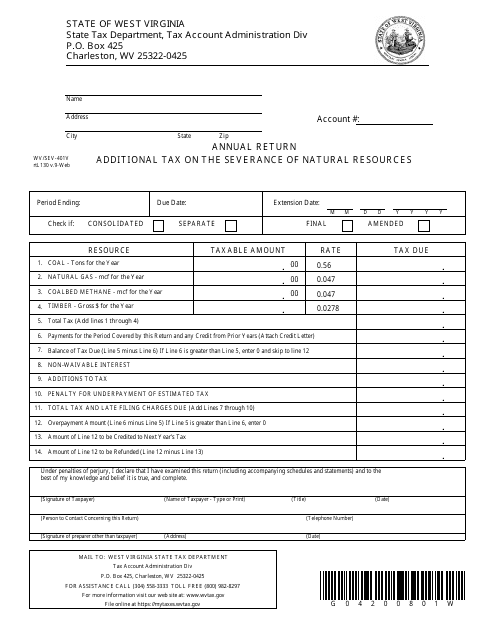

This Form is used for calculating and reporting additional tax on the severance of natural resources in the state of West Virginia. It provides instructions on how to properly fill out and file the form.

This Form is used for reporting and paying additional tax on the severance of natural resources in the state of West Virginia.

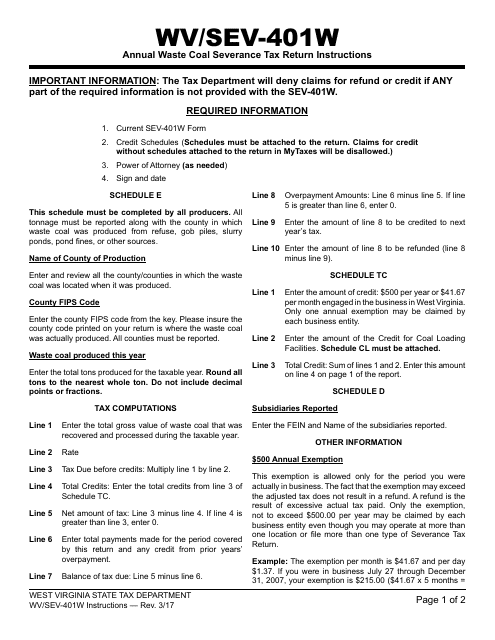

This form is used for filing the Annual Waste Coal Severance Tax Return in West Virginia. It provides instructions on how to properly complete and submit the form.

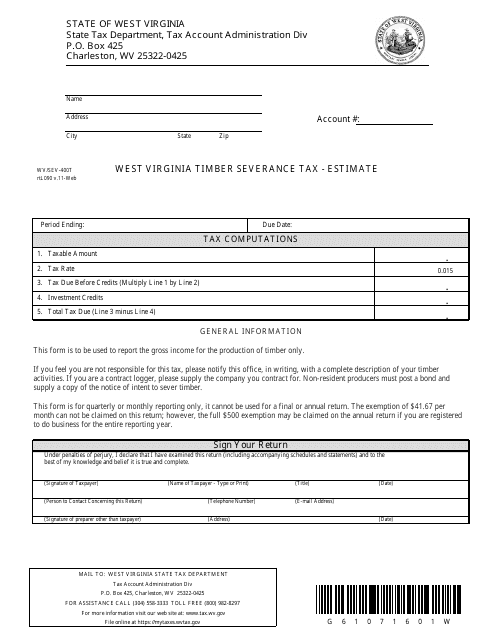

This Form is used for estimating the timber severance tax in West Virginia.

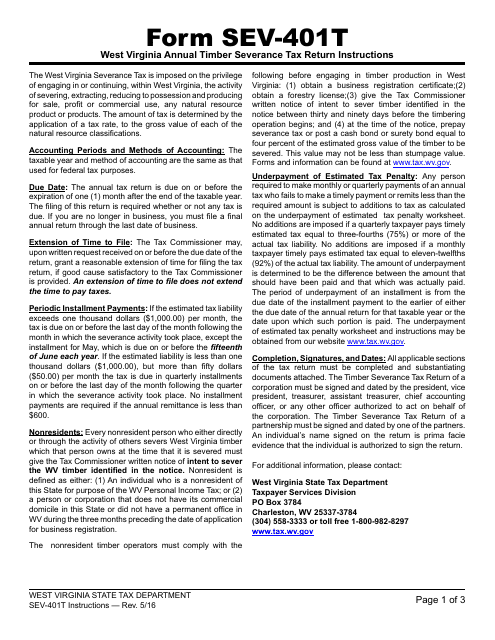

This document is for individuals or businesses in West Virginia who need to file an annual timber severance tax return. It provides instructions on how to complete and submit the form WV/SEV-401T.

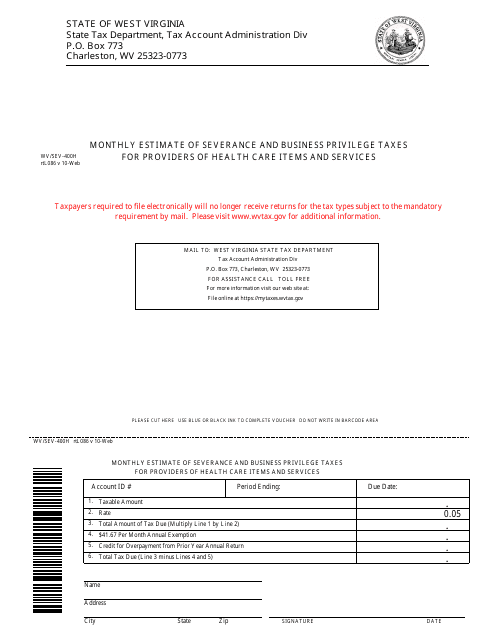

This form is used for monthly estimate of severance and business privilege taxes for providers of health care items and services in West Virginia.

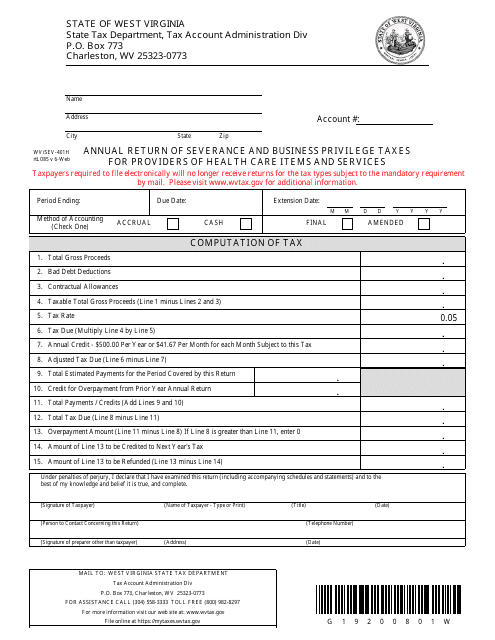

This form is used for the annual return of severance and business privilege taxes for providers of health care items and services in West Virginia.

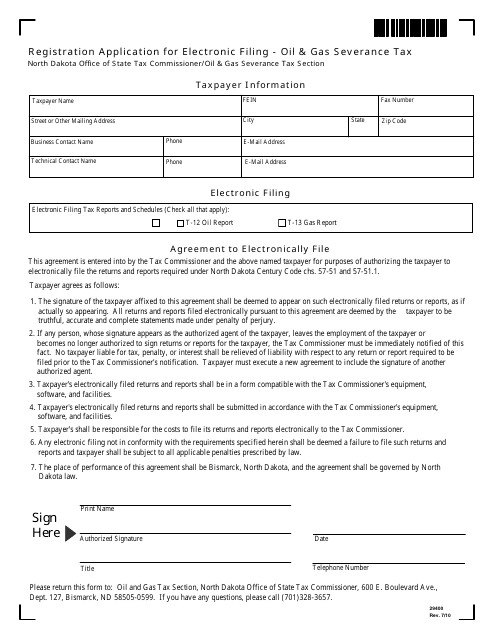

This Form is used for registering electronic filing of oil & gas severance tax in North Dakota.

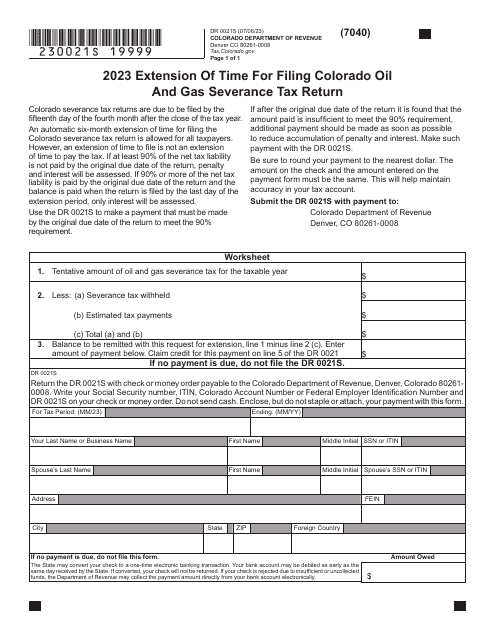

Form DR0021S Extension of Time for Filing Colorado Oil and Gas Severance Tax Return - Colorado, 2023

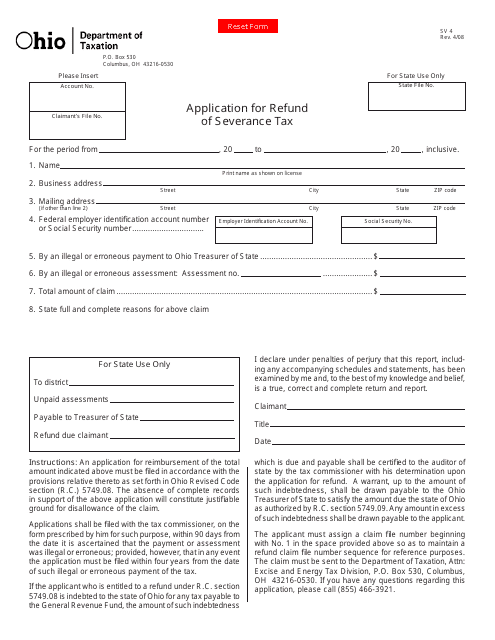

This Form is used for applying for a refund of severance tax in the state of Ohio.

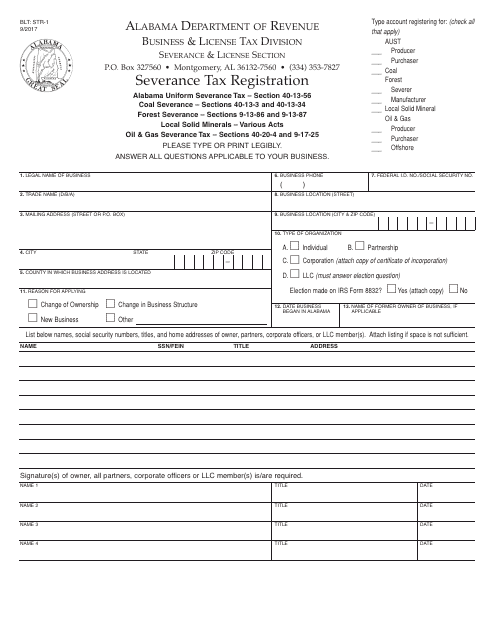

This Form is used for registering for severance tax in the state of Alabama. It is required for individuals and businesses engaged in extracting natural resources such as oil, gas, and minerals.

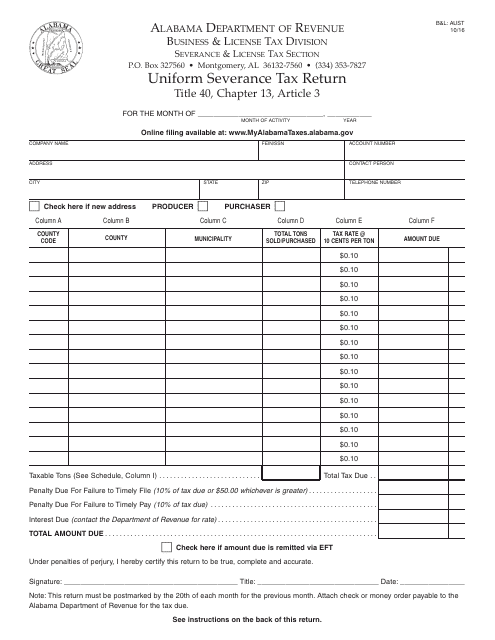

This form is used for filing the uniform severance tax return in the state of Alabama. It is necessary for businesses operating in the state to report and pay their severance taxes using this form.

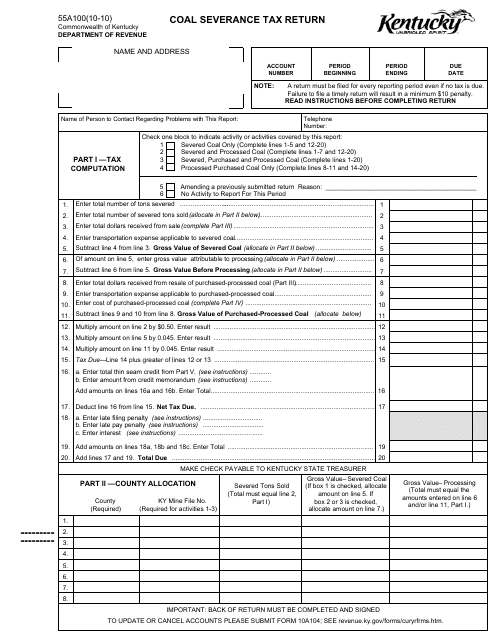

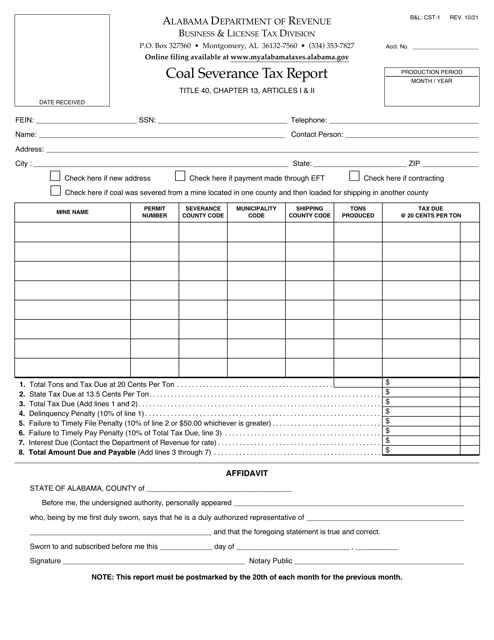

This form is used for filing the Coal Severance Tax Return in the state of Kentucky. It is required for individuals or businesses that generate income from coal severance activities.

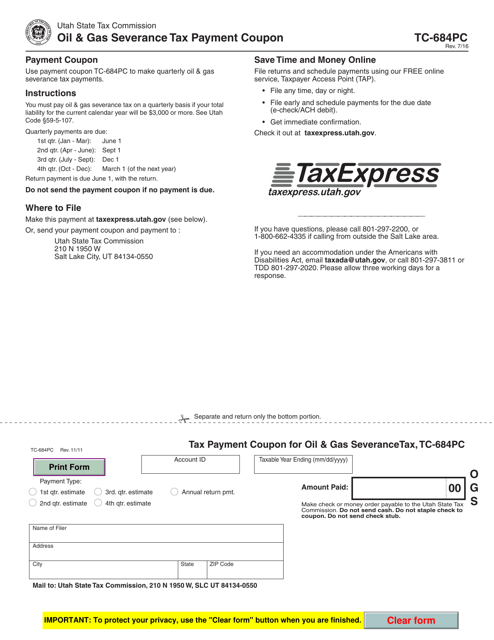

This form is used for making oil and gas severance tax payments in Utah.

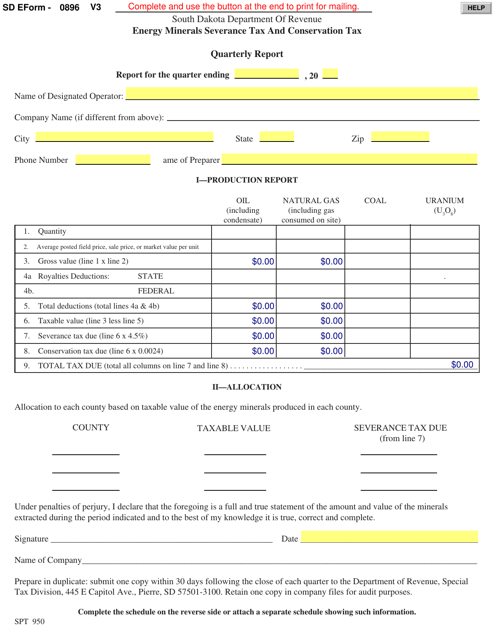

This Form is used for reporting and paying the Energy Minerals Severance Tax and Conservation Tax on a quarterly basis in South Dakota.

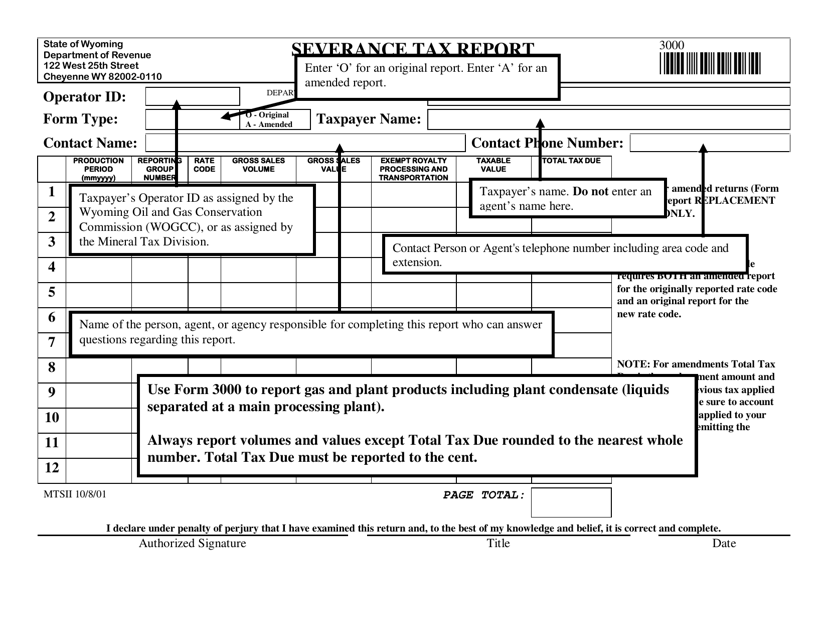

This Form is used for reporting the severance tax in the state of Wyoming. It is used by companies or individuals who are engaged in the extraction of natural resources such as oil, gas, coal, or minerals in Wyoming. The report helps the state government track and collect the appropriate severance tax revenue.

This Form is used for filing the West Virginia Severance Tax Annual Return in West Virginia.