Local Option Templates

Are you looking to understand the various local regulations and options that are available in your area? Our website is dedicated to providing you with all the information you need regarding the local option. Sometimes referred to as the local optional, this collection of documents touches on a wide range of topics.

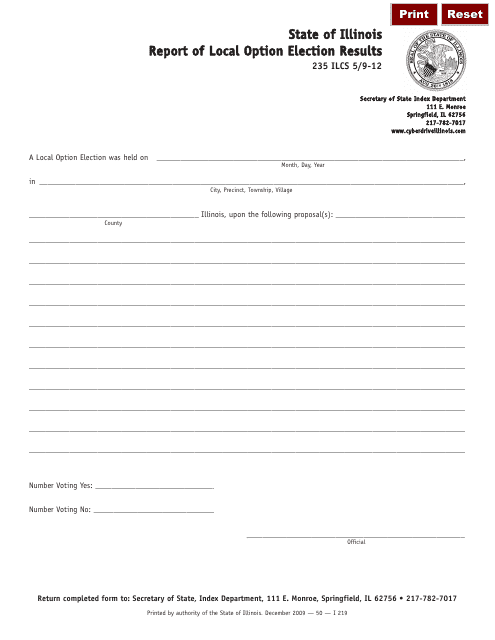

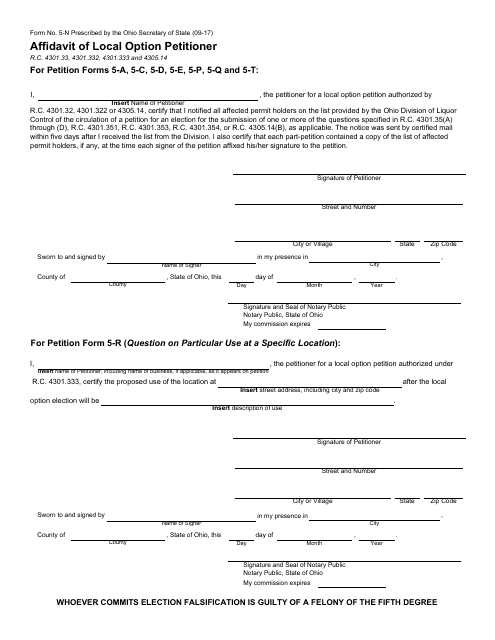

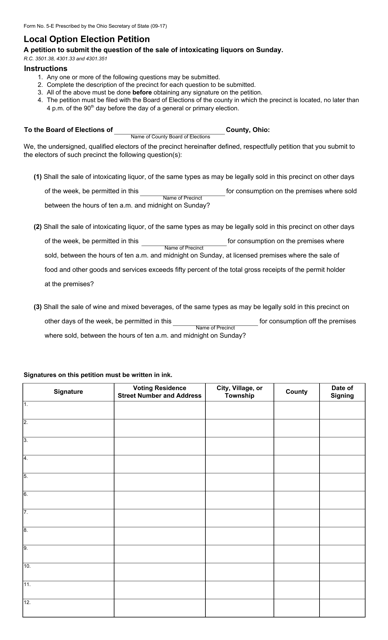

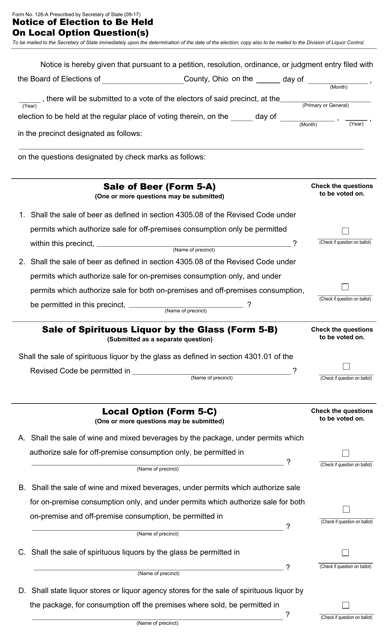

From reports of local option election results, such as the Form I219 in Illinois, to affidavits of local option petitioners like the Form 5-N in Ohio, our documents cover it all. Additionally, we provide resources like the Form 126-A, which notifies residents of an upcoming local option question in Ohio.

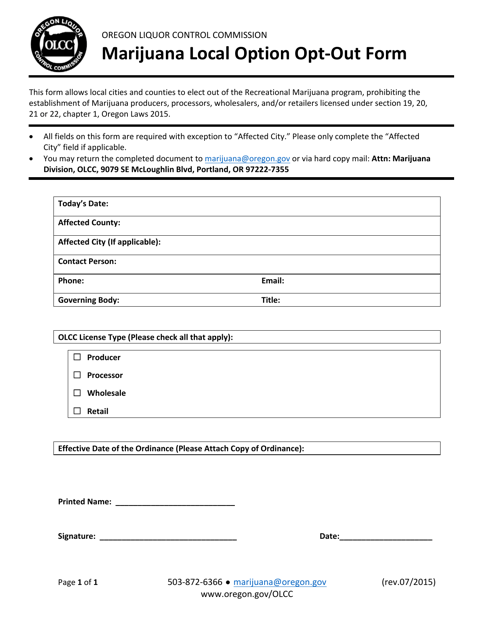

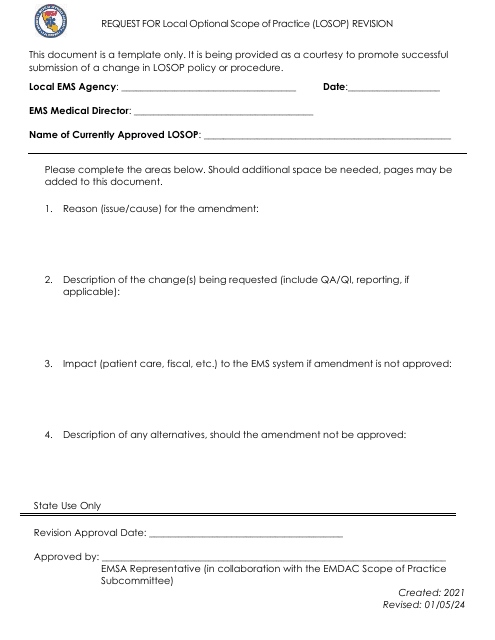

Furthermore, our collection extends beyond the scope of traditional local options. For instance, if you're interested in marijuana regulations, we have the Marijuana Local Option Opt-Out Form specific to Oregon. Alternatively, if you want to explore changes in the local optional scope of practice, we offer resources like the Request for Local Optional Scope of Practice (Losop) Revision in California.

Whether you're a resident or a business owner, understanding the local option is vital. With our comprehensive and easily accessible documents, you can navigate the local regulations and options with ease.

Documents:

7

This form is used for reporting the results of local option elections in Illinois. It helps track the outcome of elections conducted by local jurisdictions and provides a record of the votes cast on specific measures or issues.

This form is used for Ohio residents who are requesting a local option petition. It is an affidavit that must be completed by the petitioner.

This form is used for filing a local option election petition in the state of Ohio. It allows individuals to petition for the inclusion of an issue on the ballot for a local election.

This Form is used for giving notice of an election to be held in Ohio on a local option question or questions.

This Form is used for opting out of local marijuana regulations in Oregon.

This form is used for determining the local option transient rental tax rates, also known as the tourist development tax rates, in the state of Florida. It provides the necessary information to calculate the tax rates applicable to transient rentals.