Local Sales Tax Templates

Are you a business owner looking for information on local sales tax? Understanding and complying with local sales tax regulations is crucial for businesses operating in various jurisdictions. Whether you're in North Dakota, Nebraska, Washington, or other states, our collection of documents will provide you with the necessary resources to navigate local sales tax requirements.

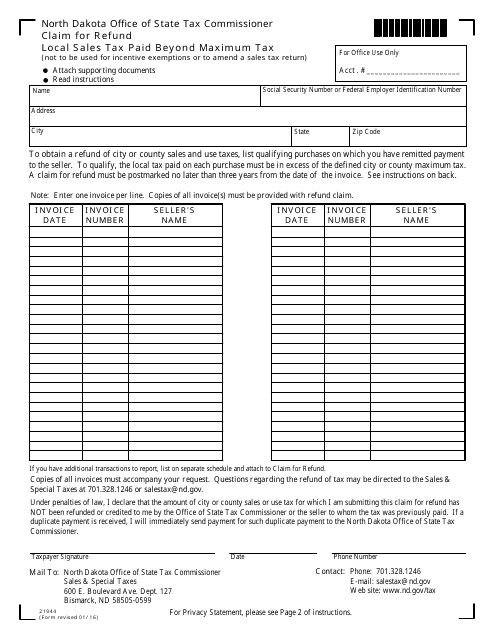

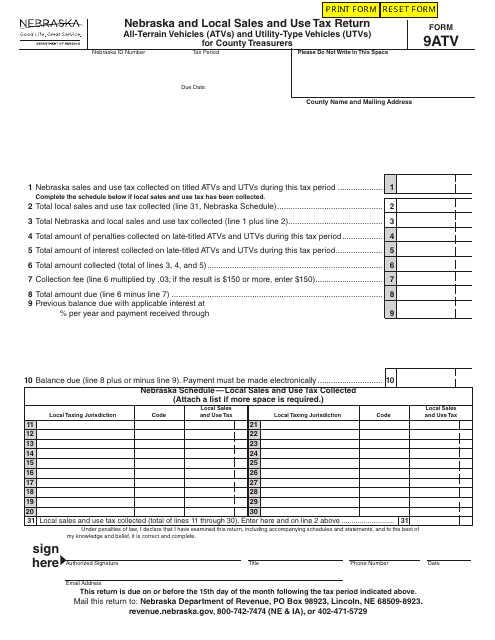

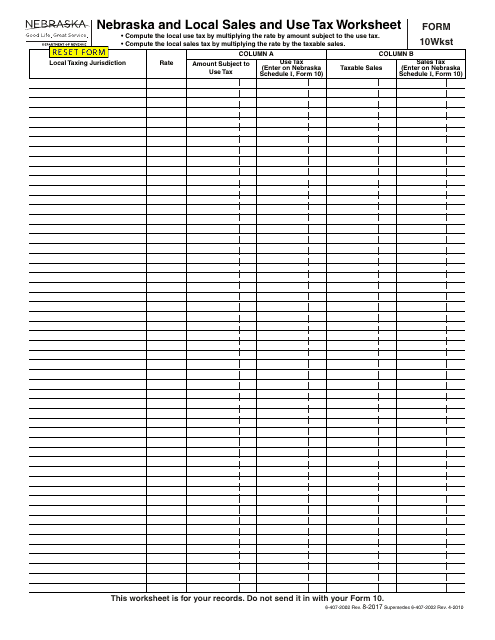

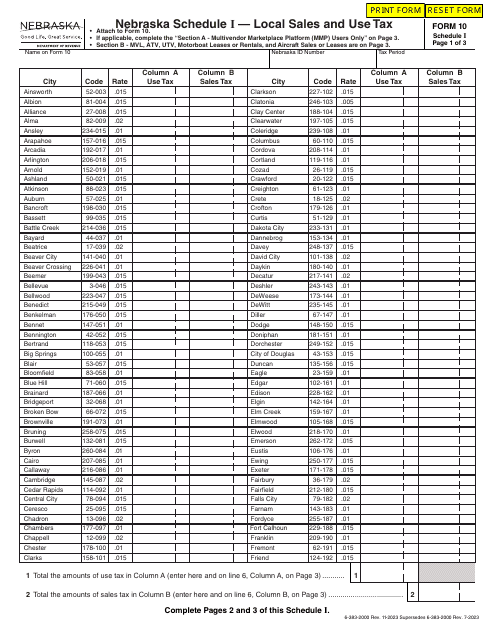

Our comprehensive collection of local sales tax documents ensures that you have access to the specific forms and guidelines relevant to your location. For example, if you're in North Dakota, you'll find Form 21944 Claim for Refund - Local Sales Tax Paid Beyond Maximum Tax - North Dakota. Similarly, businesses in Nebraska can utilize Form 9ATV Nebraska and Local Sales and Use Tax Return All-terrain Vehicles (ATVs) and Utility-type Vehicles (UTVs) - Nebraska, Form 10WKST Nebraska and Local Sales and Use Tax Worksheet - Nebraska, or Form 9ATV Nebraska and Local Sales and Use Tax Return All-terrain Vehicles (ATVs) and Utility-type Vehicles (UTVs) for County Treasurers (For 10/2022 and After) - Nebraska.

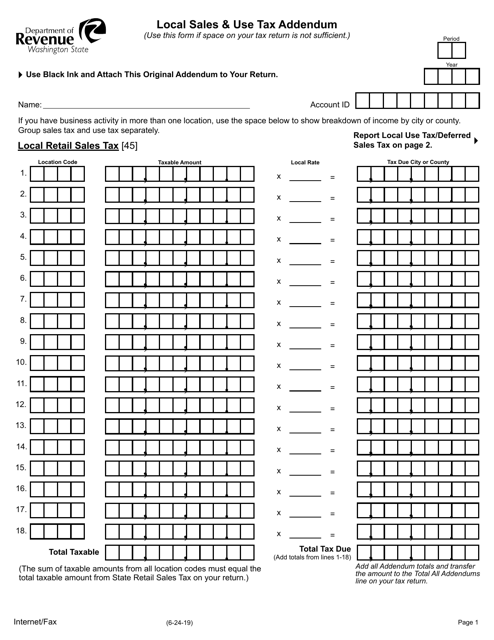

Our collection also includes additional resources such as the Local Sales & Use Tax Addendum - Washington, providing valuable insights into local sales tax regulations in Washington state. With our diverse range of documents, you can easily navigate the complexities of local sales tax requirements specific to your location.

Don't let local sales tax become a burden on your business. Stay compliant and ensure accurate reporting with our collection of local sales tax documents. Streamline your tax processes and focus on growing your business, knowing that you have the necessary resources at your disposal.

Documents:

8

This Form is used for claiming a refund on local sales tax paid beyond the maximum tax amount in North Dakota.

This form is used for calculating and reporting Nebraska and Local Sales and Use Tax in Nebraska.

This document is an addendum to the Local Sales & Use Tax form in the state of Washington. It provides additional information or instructions related to calculating and reporting local sales and use taxes.