Head of Household Filing Status Templates

Are you confused about how to file your taxes as a head of household? Don't worry, we've got you covered. Our comprehensive collection of documents on head of householdfiling status is here to help you navigate the tax filing process with ease.

Our alternate name for this collection, "Head of Household Filing Status," reflects the specific focus of these documents. Whether you're looking for step-by-step instructions or specific forms related to head of household filing status, we have what you need.

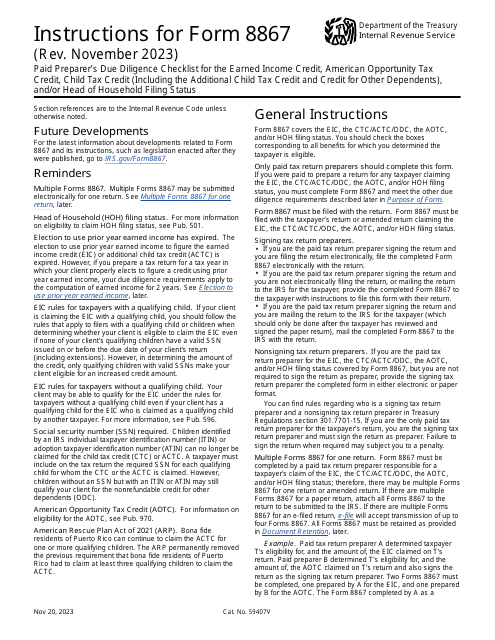

For example, our Instructions for IRS Form 8867 Paid Preparer's Due Diligence Checklist for the Earned Income Credit, American Opportunity Tax Credit, Child Tax Credit (Including the Additional Child Tax Credit and Credit for Other Dependents), and/or Head of Household Filing Status provide detailed guidance on how to properly claim these credits and file as head of household. This document ensures that you meet all the necessary requirements and maximize your tax benefits.

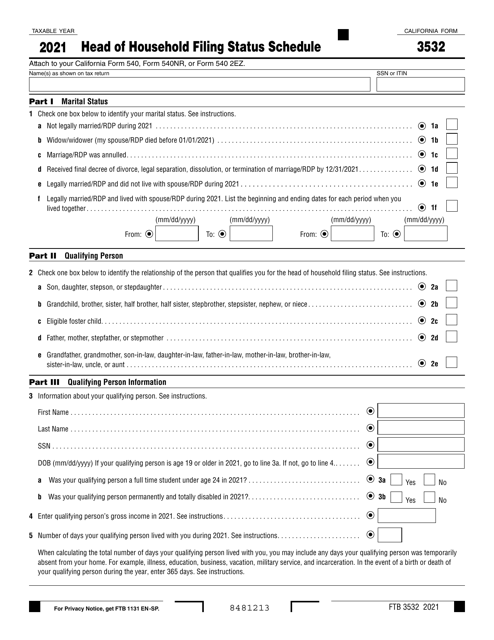

We also offer the Form 3532 Head of Household Filing Status Schedule - California, which is specifically designed for residents of California. This form allows you to accurately report your head of household filing status in accordance with state tax laws.

By accessing our collection of head of household filing status documents, you can feel confident in your ability to file your taxes correctly and take advantage of the tax benefits available to you. Don't let the complexity of tax filing overwhelm you – let our documents be your guide.

Documents:

5

This form is used for individuals in California who qualify for the head of household filing status. It is used to calculate the correct amount of tax owed based on this status.