Tax License Templates

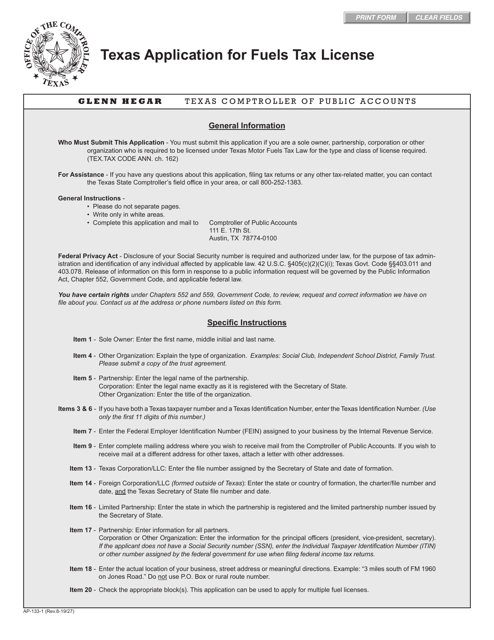

A tax license, also known as a license tax or tax license form, is a document that is required by various jurisdictions for individuals or businesses to engage in certain activities or provide specific services. This form serves as an application to obtain the necessary licensing to operate legally in a given jurisdiction.

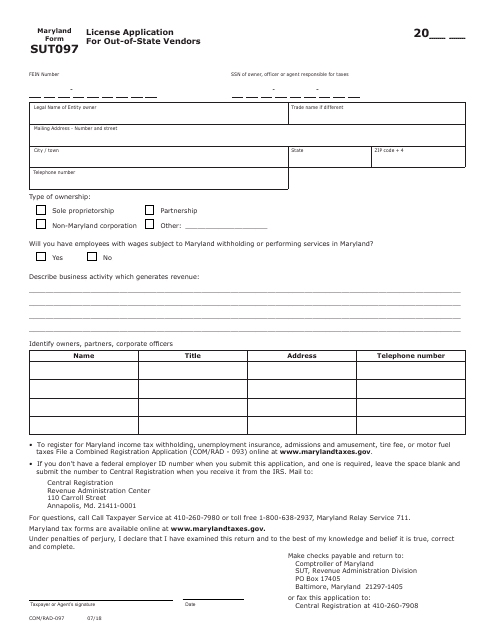

For example, in Maryland, the Form COM/RAD-097 (also referred to as the Maryland Form SUT097) License Application for Out-of-State Vendors is a tax license application specifically designed for vendors located outside of Maryland. This form allows vendors to apply for the required tax license to conduct business in the state.

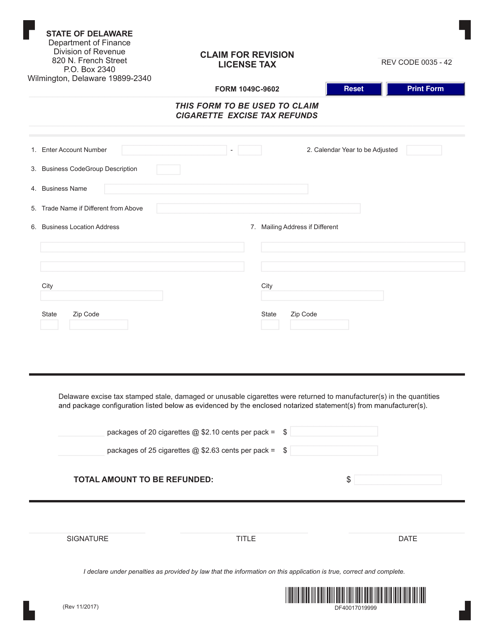

In Delaware, the Form 1049C-9602 Claim for Revision License Tax is used for individuals or businesses to request a revision to their license tax assessment. This form provides a means for taxpayers to dispute the amount of license tax they have been charged.

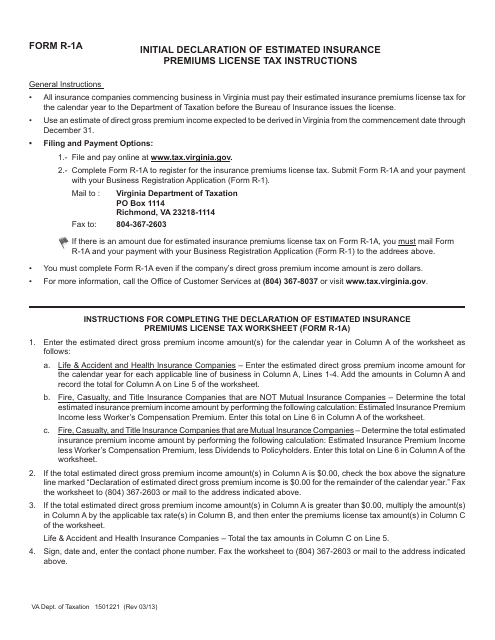

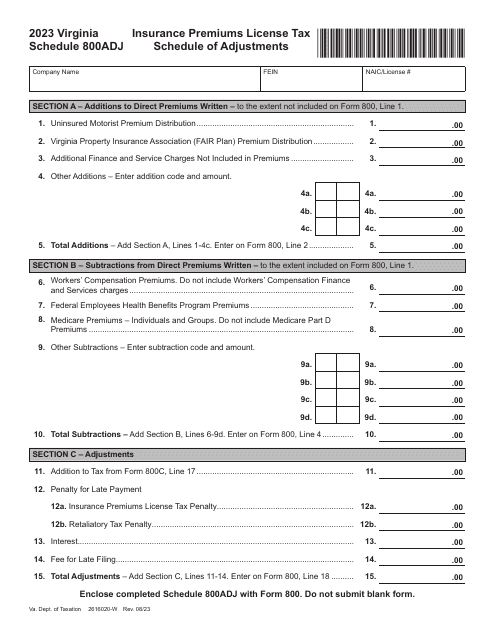

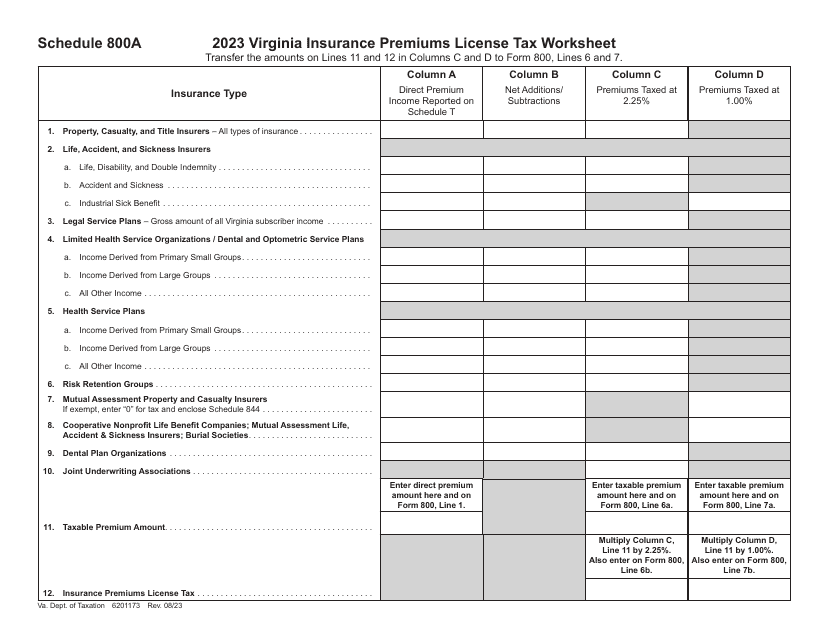

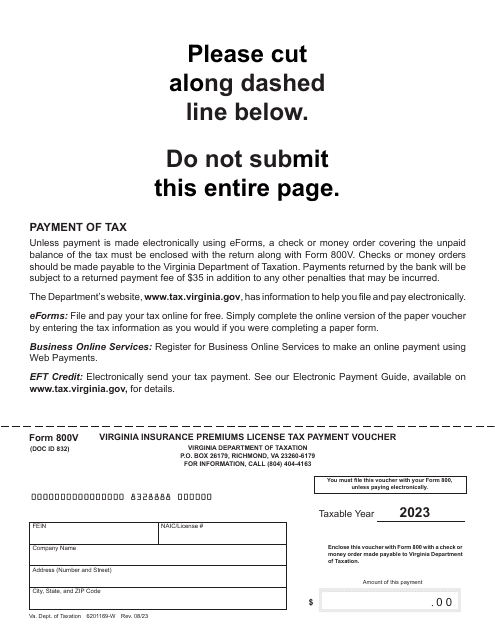

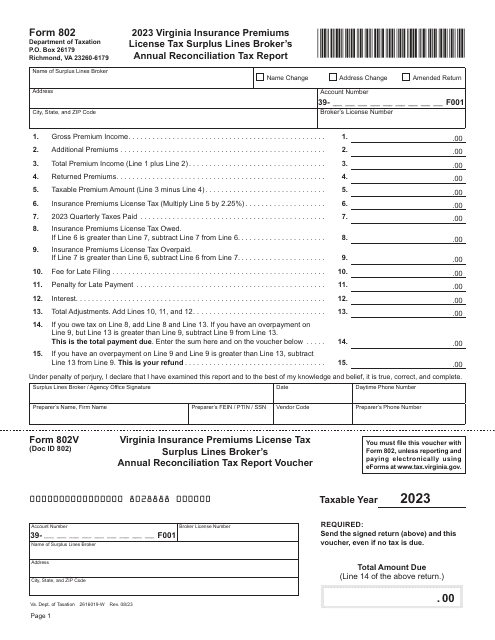

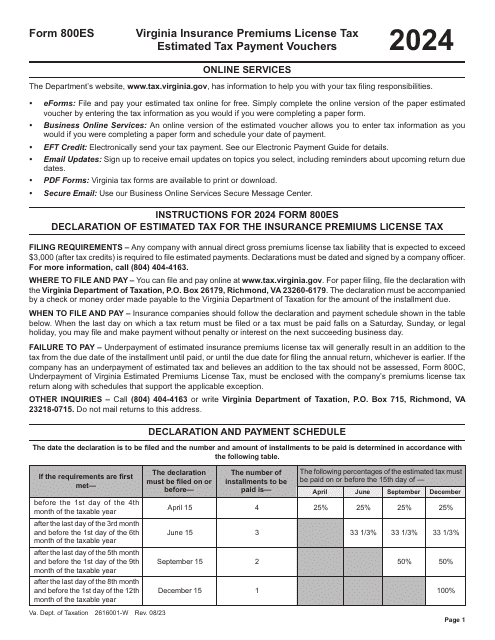

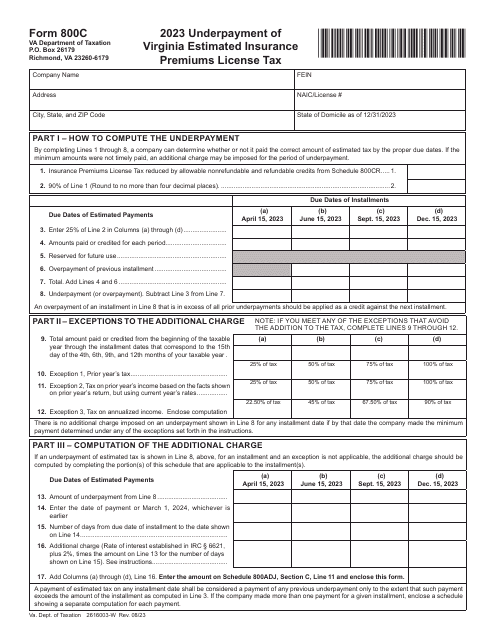

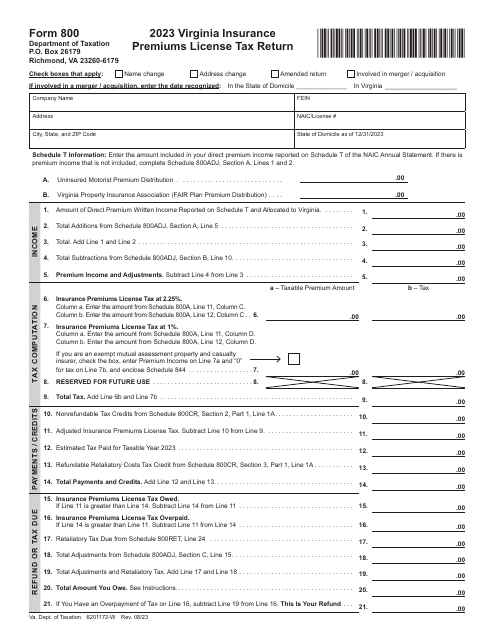

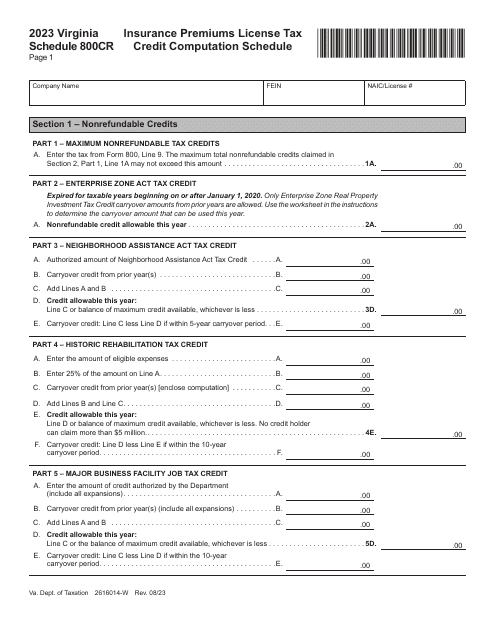

Similarly, in Virginia, the Schedule 800A Insurance Premiums License Tax Worksheet and the Form 800C Underpayment of Virginia Estimated Insurance Premiums License Tax are examples of tax license forms specifically tailored to the insurance industry. These forms help insurers calculate and report their insurance premiums license tax liability accurately.

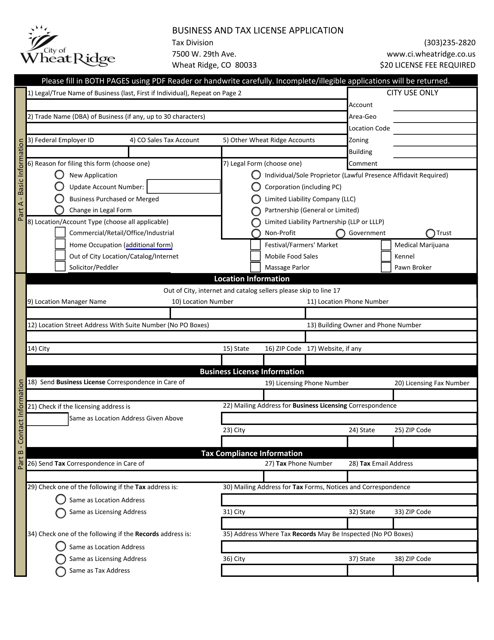

For individuals or businesses wanting to operate in the City of Wheat Ridge, Colorado, the Business and Tax License Application is the document necessary to obtain both the required business license and the associated tax license.

Whether you refer to it as a tax license, license tax, tax license form, or tax licensing, these documents are essential in meeting legal requirements and ensuring compliance with tax regulations. Obtaining the appropriate tax license is essential for any individual or business engaging in taxable activities in a specific jurisdiction.

Documents:

54

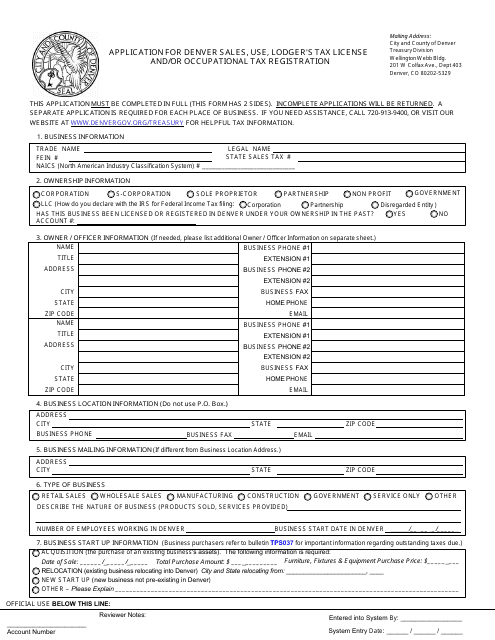

This form is used for applying for a sales, use, lodger's tax license, and/or occupational tax registration in the City and County of Denver, Colorado.

This form is used for the initial declaration of estimated insurance premiums license tax in the state of Virginia.

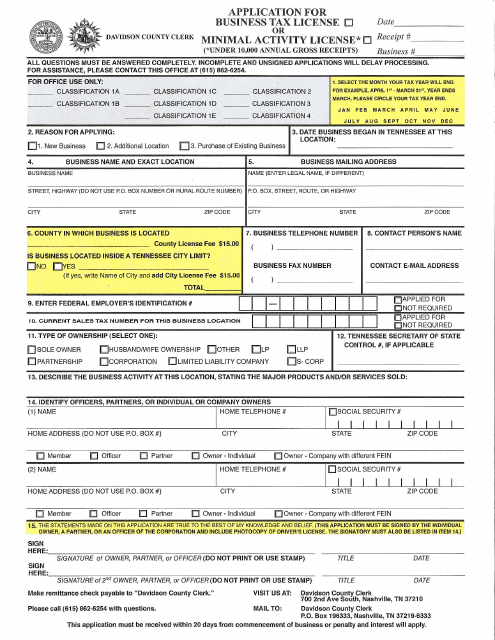

This document is used for applying for a business tax license or a minimal activity license in Davidson County, Tennessee.

This form is used for applying for a license as an out-of-state vendor in Maryland.

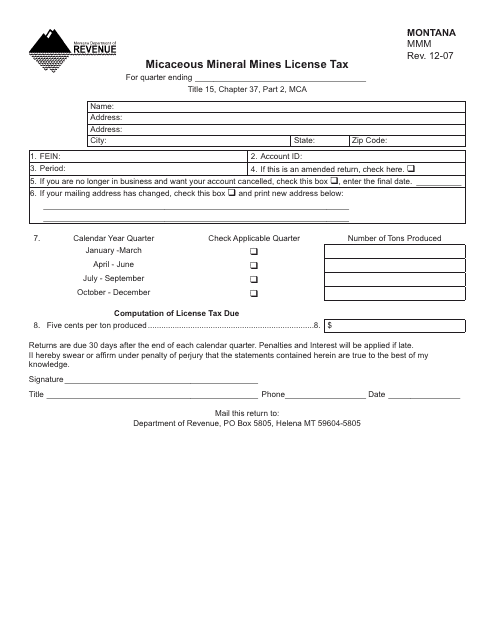

This form is used for applying and paying taxes for licenses related to micaceous mineral mines in Montana.

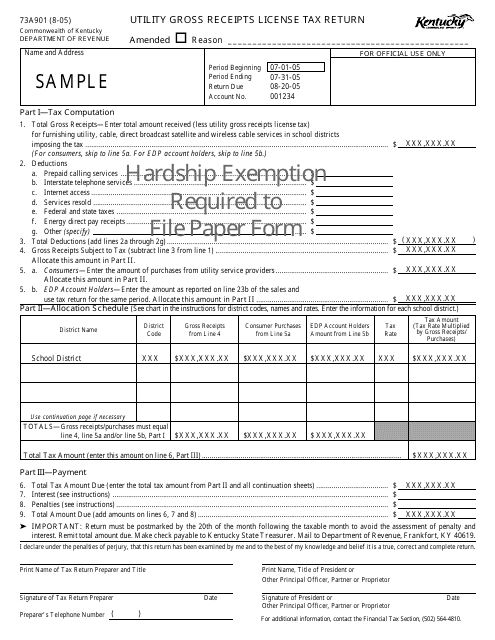

This form is used for filing the Utility Gross Receipts License Tax Return in Kentucky.

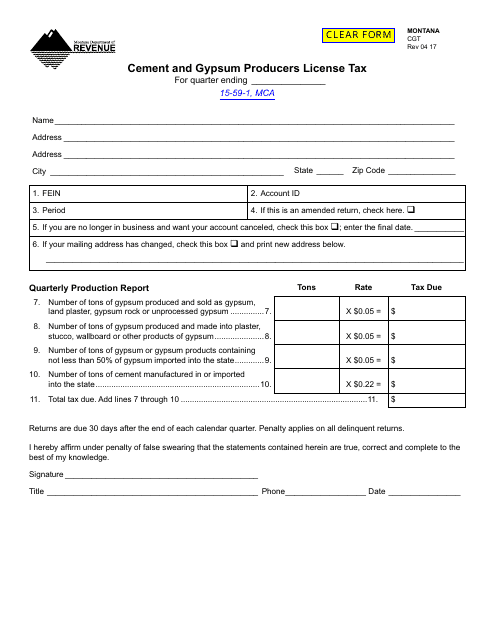

This form is used for obtaining a license tax for cement and gypsum producers in the state of Montana.

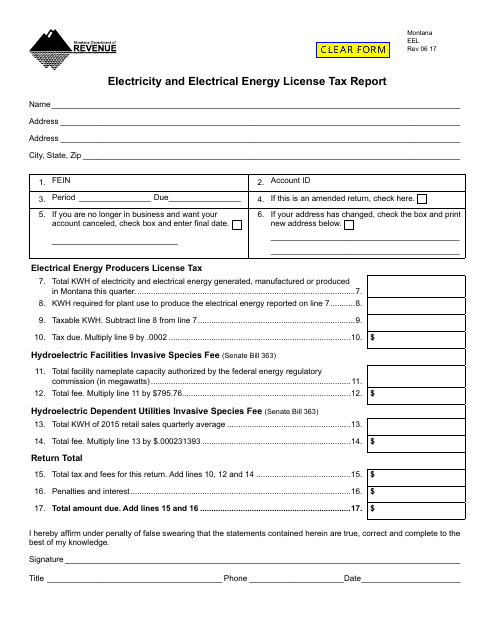

This Form is used for reporting electricity and electrical energy license tax in the state of Montana.

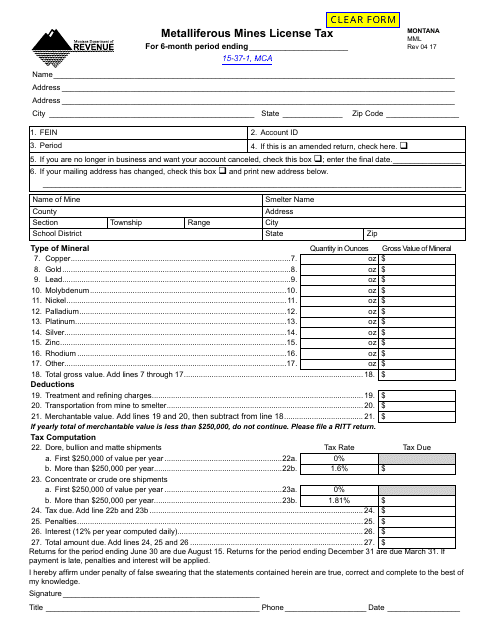

This form is used for submitting a tax payment for a Metalliferous Mines License in the state of Montana.

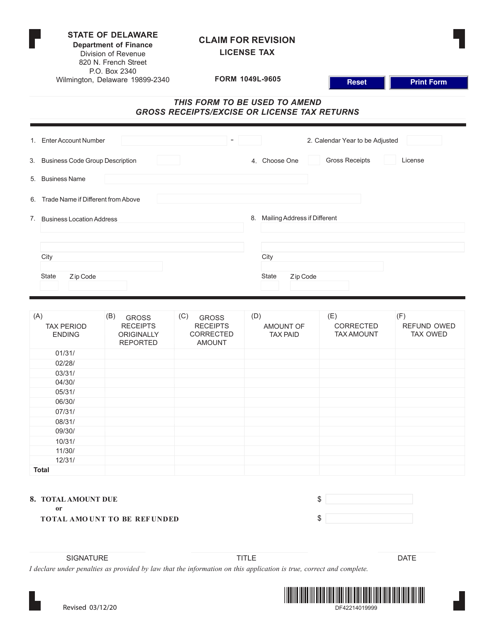

This form is used for claiming a revision of a license tax in the state of Delaware.

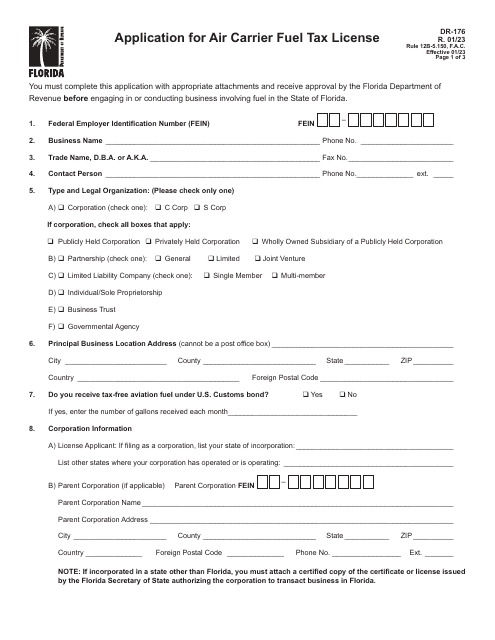

This document is used for individuals and partnerships in California to apply for a diesel fuel tax license for interstate use.

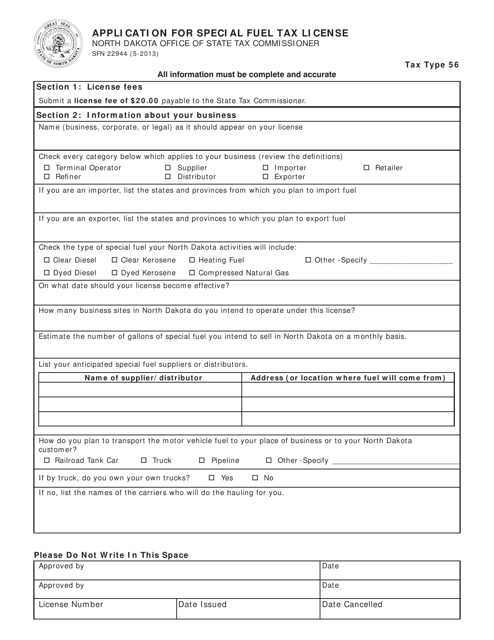

This form is used for applying for a special fuel tax license in North Dakota.

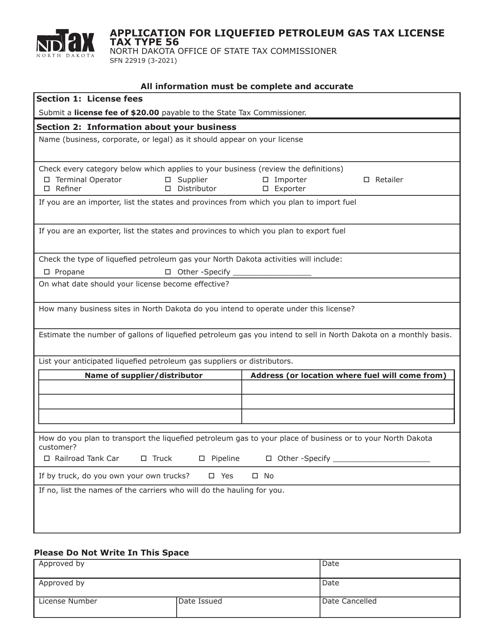

This form is used for applying for a tax license for the sale of Liquefied Petroleum Gas in North Dakota.

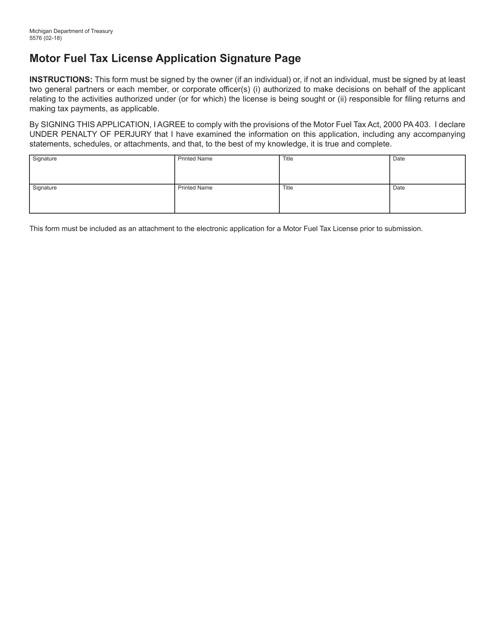

This Form is used for the Motor Fuel Tax License Application Signature Page in the state of Michigan.

This form is used for applying for a business and tax license in the City of Wheat Ridge, Colorado.