Salary Deduction Templates

Are you looking for information about salary deduction? Look no further, as we provide comprehensive resources on this topic. Whether you need information on garnishee calculation sheets, monthly transit payroll deduction enrollment, or payroll deduction authorization forms, we have got you covered.

Salary deduction, also known as payroll deduction, refers to the process of withholding a specified amount of an employee's salary to cover various expenses. This includes but is not limited to taxes, healthcare premiums, retirement contributions, and loan repayments. By deducting these amounts directly from an employee's paycheck, it streamlines the payment process and ensures accuracy.

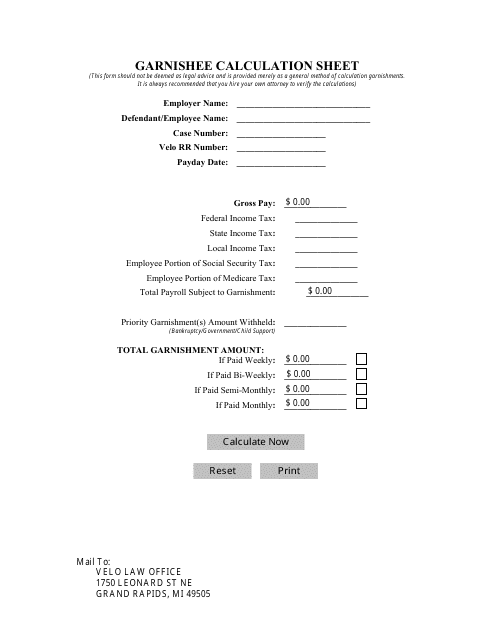

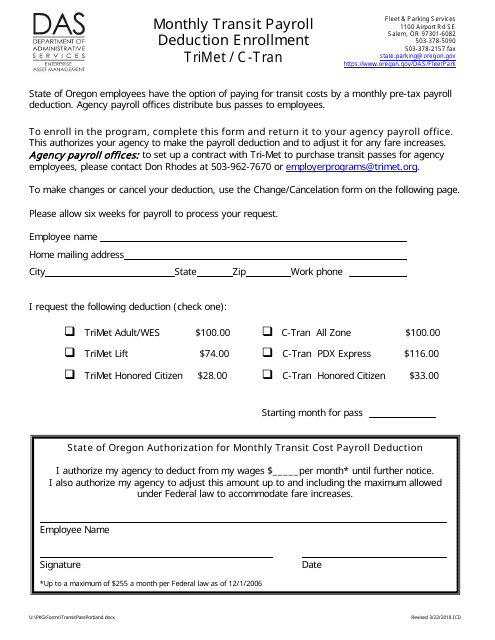

Understanding the various documents related to salary deduction is essential for both employers and employees. For instance, the Garnishee Calculation Sheet helps law offices determine the proper amount to withhold from an employee's salary to satisfy a debt. On the other hand, the Monthly Transit Payroll Deduction Enrollment form, used in Oregon, facilitates the deduction of transit expenses directly from an employee's salary.

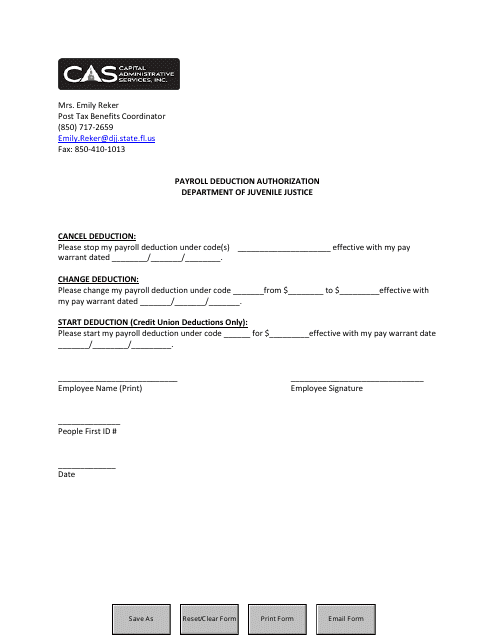

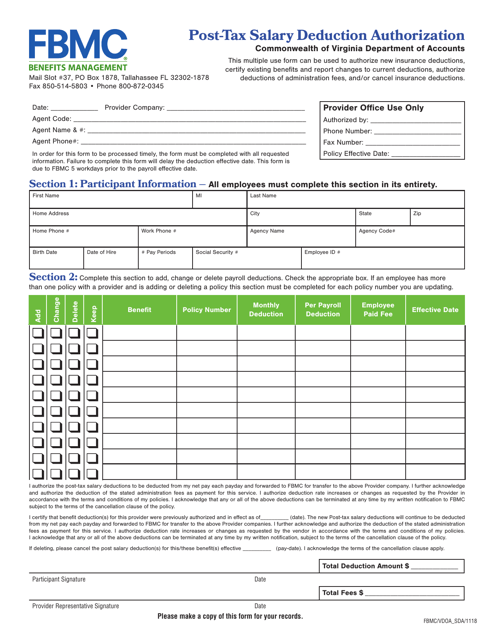

If you're an employer in Florida, you will want to familiarize yourself with the Payroll Deduction Authorization Form. This document enables employees to authorize deductions from their salary for various purposes such as charitable contributions or health insurance premiums. Similarly, the Post-tax Salary Deduction Authorization, common in Virginia, allows employees to opt for voluntary deductions after taxes have been deducted.

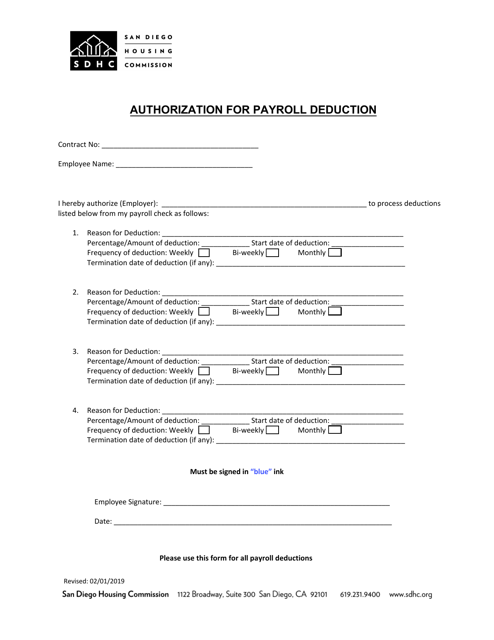

Furthermore, government entities like the City of San Diego in California may have their own Authorization for Payroll Deduction forms. These forms enable employees to authorize specific deductions, such as union dues or parking fees, directly from their salary.

Navigating the world of salary deduction can be complex, but having the right information and documents at hand can simplify the process. Whether you are an employee looking for information on authorizing payroll deductions or an employer seeking guidance on various salary deduction forms, our website is your go-to resource.

Note: The text provided is a sample and can be adjusted as needed.

Documents:

5

This document is used for calculating garnishment amounts by Velo Law Office.

This document is for enrolling in monthly transit payroll deductions for the Trimet or C-Tran transit systems in Oregon. It allows employees to have their transit fares automatically deducted from their paychecks.

This form is used for authorizing payroll deductions in the state of Florida. It allows employees to specify the amount of money to be deducted from their paycheck for various purposes such as retirement contributions, insurance premiums, or charitable donations.

This document authorizes the deduction of specified amounts from an employee's post-tax salary in the state of Virginia.

This document is used by employees of the City of San Diego, California to authorize payroll deductions for various purposes such as taxes, retirement contributions, or other authorized deductions.